Will You Get a Illinois Stimulus Check if You Owe Taxes? This question is on the minds of many Illinois residents who are seeking financial relief. The Illinois stimulus check program, designed to provide economic support, has a set of eligibility requirements that can be impacted by outstanding tax obligations.

Navigating the complexities of tax debt and stimulus check eligibility can be confusing, but understanding the rules is crucial to ensure you receive the assistance you deserve.

This article will delve into the relationship between tax debt and Illinois stimulus check eligibility. We’ll explore the specific criteria for receiving the stimulus check, discuss the potential consequences of owing taxes, and provide information on resources that can help individuals facing tax debt.

Illinois Stimulus Check Eligibility

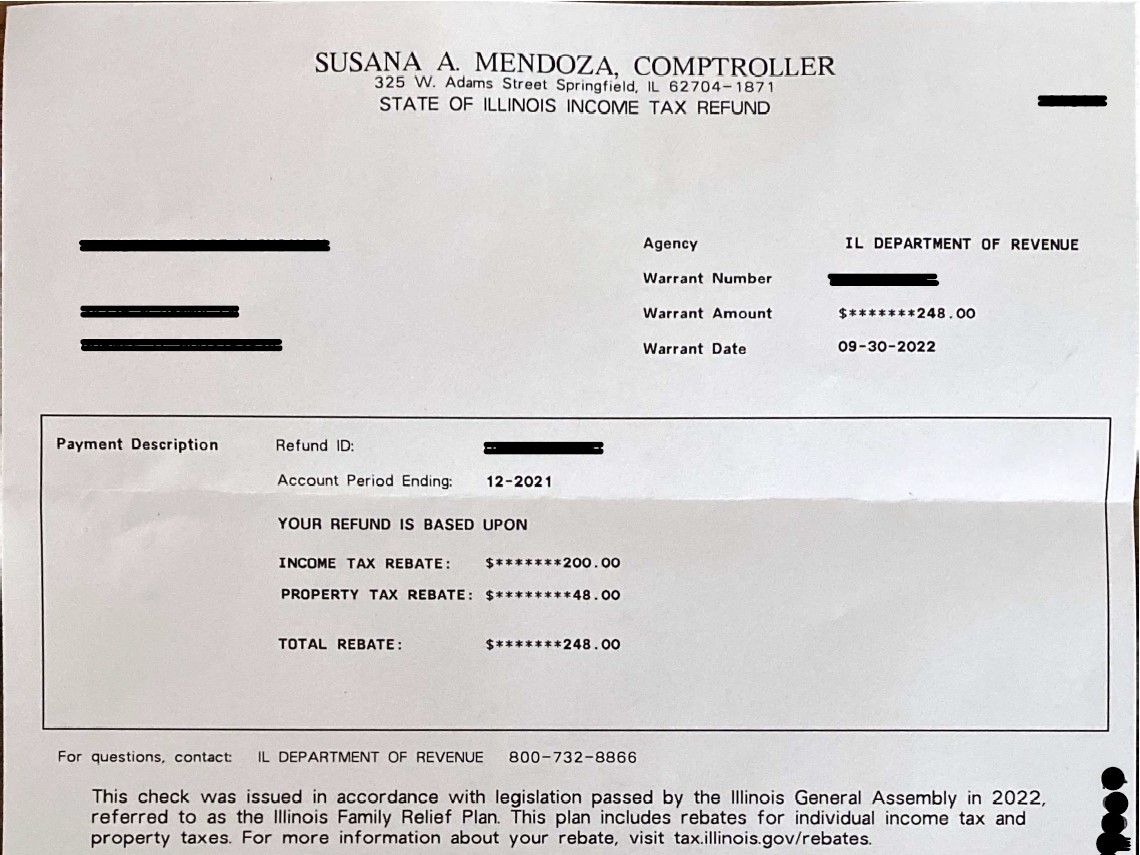

The Illinois stimulus check, officially known as the “Illinois Tax Relief Payment,” is a one-time payment designed to provide financial assistance to eligible residents. To be eligible for the stimulus check, individuals must meet specific criteria, including income thresholds and residency requirements.

These factors are crucial in determining who qualifies for the payment.

Income Thresholds

The eligibility for the Illinois stimulus check is based on adjusted gross income (AGI). AGI is the amount of income used to calculate your federal income tax liability. To be eligible, individuals must have an AGI below a certain threshold.

These thresholds vary based on filing status, such as single, married filing jointly, or head of household.

For descriptions on additional topics like Understanding the Stimulus Check Phase-Out in Illinois, please visit the available Understanding the Stimulus Check Phase-Out in Illinois.

- Single filers: $200,000 or less

- Married filing jointly: $400,000 or less

- Head of household: $250,000 or less

Residency Requirements

To be eligible for the stimulus check, individuals must have been a resident of Illinois for at least 12 months prior to the date of application. This residency requirement ensures that the benefits are directed towards individuals who have contributed to the state’s economy.

Dependents and Filing Status

The number of dependents an individual claims on their tax return can also impact their eligibility for the stimulus check. The presence of dependents may affect the income thresholds, and specific rules may apply to individuals with dependents. It’s essential to consult the official guidelines to determine the precise eligibility criteria based on your individual circumstances.

Tax Debt and Stimulus Check Eligibility

Owing taxes in Illinois does not automatically disqualify you from receiving the stimulus check. However, there are specific situations involving tax debt that could potentially affect your eligibility or the disbursement process.

Tax Liens and Unpaid Balances

If you have a tax lien or an unpaid balance with the Illinois Department of Revenue, it may affect your eligibility for the stimulus check. The state may prioritize using the stimulus check payment to offset your outstanding tax debt.

In such cases, you might not receive the full amount of the stimulus check or may receive it at a later date.

Potential Consequences of Owing Taxes

While owing taxes might not directly disqualify you from the stimulus check, it’s important to be aware of the potential consequences. The state may offset the stimulus payment against your tax debt, potentially delaying or reducing the amount you receive.

It’s crucial to address any outstanding tax liabilities to avoid complications with the stimulus check.

Discover more by delving into Understanding the Timeline for Stimulus Check Payments in Florida further.

Impact of Tax Debt on Stimulus Check Receipt

Tax debt can have a significant impact on the receipt of the Illinois stimulus check. The state may withhold or delay the payment to address outstanding tax obligations.

Delay or Prevention of Stimulus Check Receipt

If you have a tax lien or unpaid taxes, the state may prioritize using the stimulus check payment to offset your debt. This could result in a delay in receiving the payment or even prevent you from receiving it altogether.

Do not overlook the opportunity to discover more about the subject of Do Dependents Count Towards Stimulus Check Eligibility in Illinois?.

Scenarios Where Tax Debt Could Affect Disbursement

Consider the following scenarios where tax debt could affect the disbursement of the stimulus check:

- You have an unpaid tax balance from a previous year.

- You have a tax lien filed against you by the Illinois Department of Revenue.

- You are currently under an audit or investigation by the state.

Procedures to Address Tax Debt and Receive the Stimulus Check

If you have tax debt, you should take steps to address it to avoid potential delays or complications with receiving the stimulus check.

- Contact the Illinois Department of Revenue:Reach out to the department to discuss your tax debt and explore options for payment arrangements or resolving outstanding issues.

- File Your Tax Return:Ensure you file your tax return on time and accurately to avoid penalties or further tax debt.

- Explore Payment Options:The Illinois Department of Revenue offers various payment options, including payment plans, installment agreements, and offers in compromise.

Resources for Tax Assistance and Information

Several resources are available to provide assistance and information to individuals facing tax debt.

Tax Assistance Organizations, Will You Get a Illinois Stimulus Check if You Owe Taxes?

Organizations specializing in tax assistance can provide guidance and support in navigating tax issues and addressing tax debt.

- Tax Counseling for the Elderly (TCE):Provides free tax assistance to taxpayers aged 60 and older.

- Volunteer Income Tax Assistance (VITA):Offers free tax preparation assistance to low- and moderate-income taxpayers.

Government Agencies and Programs

Government agencies and programs can provide information and support related to tax debt and financial assistance.

Investigate the pros of accepting Will Stimulus Check Payments Be Garnished for Debts in Florida? in your business strategies.

| Agency/Program | Contact Information |

|---|---|

| Illinois Department of Revenue | (800) 732-8866 |

| Internal Revenue Service (IRS) | (800) 829-1040 |

| Illinois Taxpayer Assistance Program | (800) 732-8866 |

Alternative Options for Financial Assistance: Will You Get A Illinois Stimulus Check If You Owe Taxes?

Beyond the stimulus check, individuals facing tax debt may explore alternative sources of financial assistance.

Programs and Initiatives

Several programs and initiatives offer financial assistance to individuals facing financial challenges.

- Emergency Rental Assistance Program:Provides assistance with rent payments to eligible households impacted by the COVID-19 pandemic.

- Low-Income Home Energy Assistance Program (LIHEAP):Offers financial assistance to low-income households for heating and cooling costs.

- SNAP (Food Stamp) Program:Provides food assistance to low-income households.

The eligibility requirements and application processes for these programs vary, so it’s essential to research and contact the relevant agencies for specific details.

Final Thoughts

While owing taxes in Illinois can impact your eligibility for the stimulus check, it’s important to remember that there are resources available to help. Understanding your options, exploring available assistance programs, and staying informed about the rules governing both tax debt and stimulus checks can make a significant difference in your financial situation.

If you have questions or need guidance, don’t hesitate to reach out to the resources mentioned in this article.

FAQ Corner

What if I owe taxes but haven’t been contacted by the Illinois Department of Revenue?

Even if you haven’t been contacted, it’s important to be aware of any outstanding tax obligations. You can check your account status online or contact the Illinois Department of Revenue directly for information.

In this topic, you find that Stimulus Check Payments and Child Support Obligations in Florida is very useful.

Can I still receive the stimulus check if I’m making payments on a tax debt?

It’s possible, but the disbursement of your stimulus check might be delayed or adjusted depending on the terms of your payment plan. Contacting the Illinois Department of Revenue is recommended to understand how your payment plan might affect your stimulus check.

Are there any penalties for receiving the stimulus check if I owe taxes?

It’s best to consult with a tax professional or the Illinois Department of Revenue to determine if there are any potential penalties for receiving the stimulus check while owing taxes. Understanding the specific rules and regulations is crucial to avoid any unforeseen consequences.