Where to Find Official Information on Stimulus Check Eligibility is a crucial question for many individuals seeking to understand their potential benefits. Navigating the complexities of government programs can be daunting, especially when it comes to financial assistance. This guide aims to provide clear and concise information on how to access official resources and verify your eligibility for stimulus checks.

The Internal Revenue Service (IRS) plays a central role in administering stimulus checks, making their website a primary source of information. The IRS provides comprehensive guidelines on eligibility criteria, payment schedules, and methods for verifying your status. Additionally, other government agencies may offer relevant information, such as the U.S.

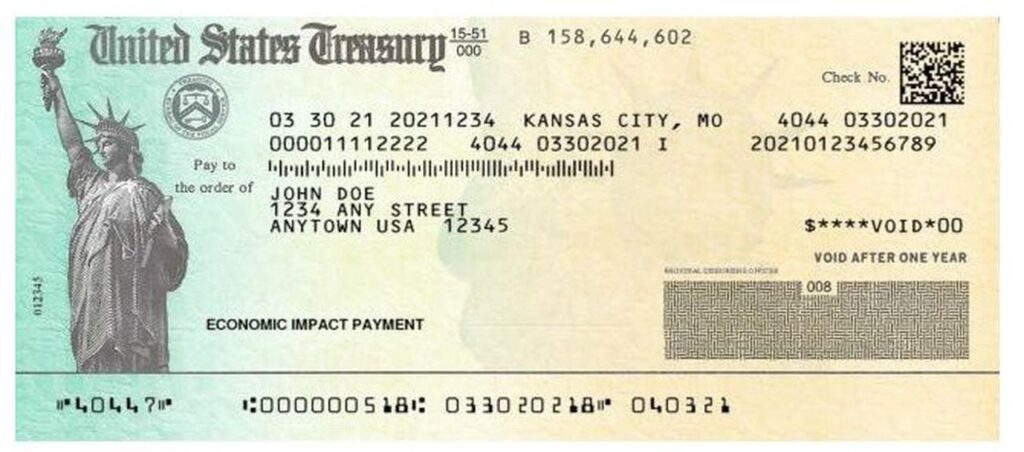

Department of the Treasury, which oversees the overall disbursement of stimulus funds.

Official Sources for Stimulus Check Information

Navigating the complex world of government benefits, especially stimulus checks, can be overwhelming. It’s crucial to rely on official sources for accurate and up-to-date information to avoid misinformation and ensure you receive the benefits you’re eligible for.

Government Websites

The most reliable sources for information on stimulus checks are official government websites. These websites provide comprehensive information about eligibility criteria, application processes, and payment schedules.

- Internal Revenue Service (IRS):The IRS is responsible for administering stimulus checks. Their website, irs.gov , provides detailed information about eligibility, payment amounts, and how to claim missing payments.

- U.S. Department of the Treasury:The Treasury Department oversees the distribution of stimulus checks. Their website, treasury.gov , provides updates on the status of stimulus check programs and related policies.

- Federal Register:The Federal Register is the official daily publication for rules and regulations issued by the U.S. government. You can find official announcements and updates on stimulus check programs here: federalregister.gov .

Importance of Official Sources

Relying on official sources is essential for several reasons:

- Accuracy:Official government websites provide verified information based on official regulations and policies.

- Up-to-date Information:Government websites are regularly updated with the latest information on stimulus check programs and eligibility requirements.

- Avoid Misinformation:Misinformation can spread quickly, especially online. Official sources help ensure you receive accurate and reliable information.

Eligibility Criteria for Stimulus Checks

Stimulus checks are designed to provide financial assistance to eligible individuals and families during economic hardship. Eligibility criteria vary depending on the specific stimulus check program.

Discover more by delving into How Age Affects Stimulus Check Eligibility in New York & California further.

Key Eligibility Requirements

Generally, the following are key eligibility requirements for stimulus checks:

- Income Level:Income thresholds are set for each stimulus check program. Individuals exceeding these thresholds may not be eligible.

- Residency Status:You must be a U.S. resident or citizen to be eligible for stimulus checks.

- Filing Status:Your filing status, such as single, married filing jointly, or head of household, can impact your eligibility.

Dependents and Eligibility

The number and type of dependents you claim on your tax return can affect your eligibility for stimulus checks. Each qualifying dependent can increase the amount of your stimulus check.

- Children:Children under a certain age are typically qualifying dependents.

- Other Qualifying Individuals:Other qualifying individuals, such as elderly parents or disabled relatives, may also be considered dependents.

Different Stimulus Check Programs, Where to Find Official Information on Stimulus Check Eligibility

Several stimulus check programs have been enacted since the start of the COVID-19 pandemic. Each program has its specific eligibility criteria:

- Economic Impact Payments (EIP):The EIP programs were part of the CARES Act and subsequent relief packages. Eligibility for EIP payments was based on income levels, residency status, and other factors.

- Advanced Child Tax Credit Payments:The Advanced Child Tax Credit Payments were part of the American Rescue Plan Act. This program provided monthly payments to eligible families with children.

How to Verify Eligibility

To verify your eligibility for stimulus checks, you can take the following steps:

IRS Online Tools

The IRS offers online tools to help you determine your eligibility and track the status of your payments.

Check Do Dependents Count Towards Stimulus Check Eligibility? to inspect complete evaluations and testimonials from users.

- IRS’s Get My Payment Tool:This tool allows you to check the status of your stimulus check payment. You’ll need your Social Security number, date of birth, and filing status to use this tool.

- IRS’s Tax Withholding Estimator:This tool helps you estimate your tax withholding and potential eligibility for stimulus checks based on your income and other factors.

Contacting the IRS

If you have questions or need assistance verifying your eligibility, you can contact the IRS directly.

Obtain access to Residency Requirements for Stimulus Checks in NY & CA to private resources that are additional.

- IRS Phone Number:You can call the IRS at 1-800-829-1040 for assistance.

- IRS Website:The IRS website provides contact information and resources for getting help with stimulus check eligibility.

Providing Accurate Information

It’s crucial to provide accurate information and documentation when verifying your eligibility. This helps ensure you receive the correct amount of stimulus check payments.

Potential Scenarios for Missing Payments

There are situations where you may be eligible for a stimulus check but haven’t received it yet. Here are some possible scenarios:

- Incorrect or Missing Information:If the IRS has incorrect or missing information about your address or bank account, your payment may be delayed or not received.

- Recent Changes in Circumstances:If your income or filing status changed significantly after the stimulus check program was enacted, you may not be eligible.

Frequently Asked Questions (FAQ)

Here are some frequently asked questions about stimulus check eligibility:

| Question | Answer |

|---|---|

| What are the income thresholds for stimulus check eligibility? | Income thresholds vary depending on the specific stimulus check program. You can find this information on the IRS website or in the official program guidelines. |

| Do I need to file a tax return to receive a stimulus check? | In most cases, you need to file a tax return to receive a stimulus check. However, there may be exceptions for certain individuals, such as those who are not required to file a tax return. |

| How do dependents affect my eligibility for stimulus checks? | Each qualifying dependent can increase the amount of your stimulus check. The specific rules for dependents vary by program. |

| What if I haven’t received my stimulus check payment yet? | If you haven’t received your stimulus check payment, you can use the IRS’s Get My Payment tool to check the status of your payment. You can also contact the IRS for assistance. |

Closure

Understanding stimulus check eligibility is essential for maximizing your potential benefits. By relying on official sources and utilizing the resources provided by the IRS and other government agencies, you can navigate the process with confidence. Remember to keep your information accurate and up-to-date to ensure a smooth and timely disbursement of your stimulus payments.

Expand your understanding about How Previous Stimulus Payments Affect Eligibility with the sources we offer.

Answers to Common Questions: Where To Find Official Information On Stimulus Check Eligibility

What if I haven’t received my stimulus check yet?

If you believe you are eligible for a stimulus check but haven’t received it, you can check the IRS’s online tool or contact them directly for assistance.

What documents do I need to verify my eligibility?

You also can understand valuable knowledge by exploring Who Qualifies for a Stimulus Check in New York?.

You will need to provide your Social Security number, income information, and details about your dependents. It’s essential to have accurate and up-to-date documentation readily available.

Are there any deadlines for claiming my stimulus check?

While there may be deadlines for claiming certain tax credits or deductions, there is typically no specific deadline for claiming stimulus checks. However, it’s advisable to contact the IRS for the most up-to-date information.