What is the tax deadline for October 2024? This question might be on the minds of many taxpayers as the year draws to a close. While the standard tax filing deadline is typically April 15th, certain circumstances, like self-employment or extensions, can push the deadline to October.

In this article, we’ll delve into the intricacies of the October 2024 tax deadline, exploring any unique events, potential changes to tax laws, and the specific forms and requirements relevant to this period.

Understanding the tax deadline is crucial for avoiding penalties. We’ll examine the penalties associated with late filing and payment, including any exceptions or waivers. We’ll also provide practical tips and strategies for staying organized, keeping accurate records, and filing your taxes on time.

We’ll equip you with the knowledge and resources you need to navigate the tax filing process with confidence.

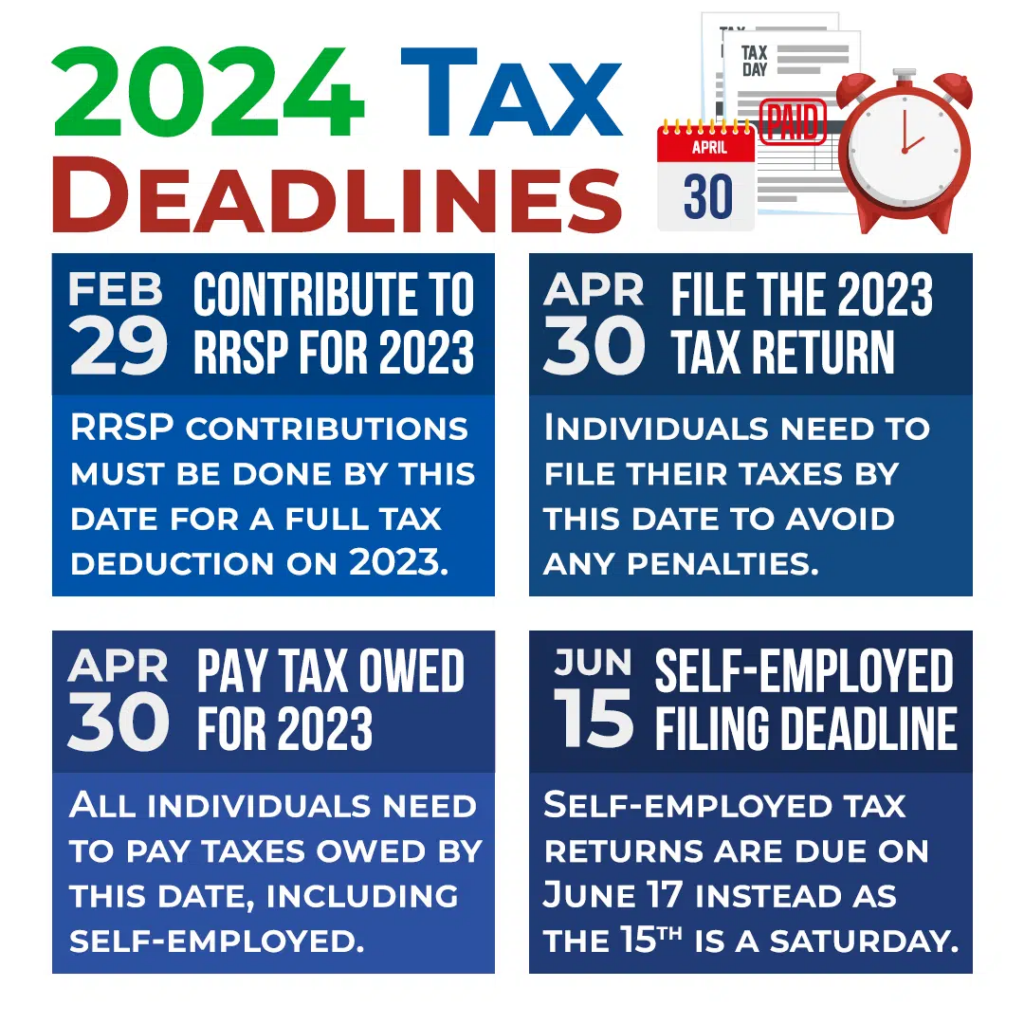

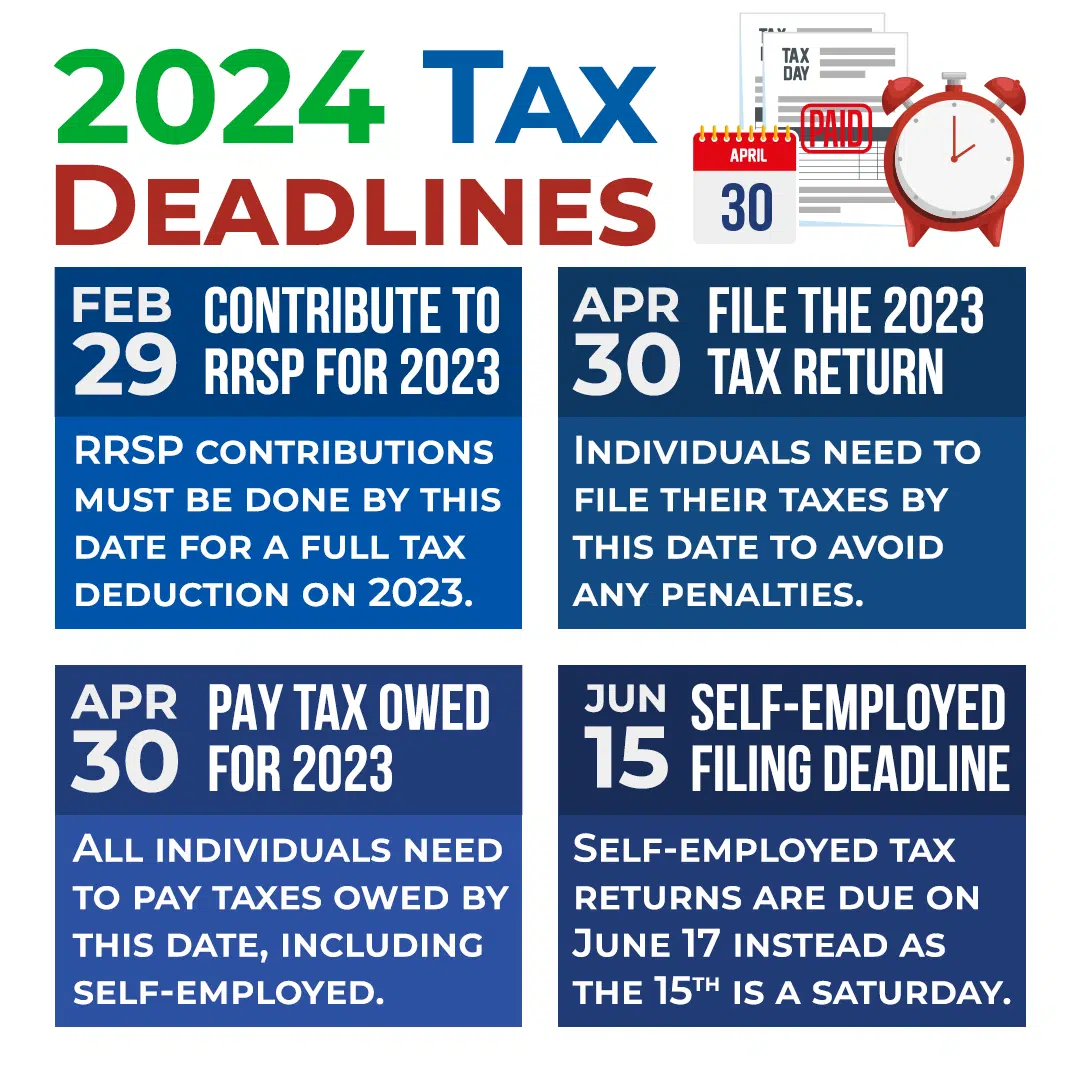

Tax Filing Deadlines

The standard tax filing deadline for individuals in the United States is April 15thof each year. This applies to most taxpayers, including those who are employed, self-employed, or receive other forms of income.

Wondering how the new tax brackets will impact your income in 2024? It’s a good question! You can find out more about how tax brackets will affect your income for the year here.

Tax Filing Deadlines for Self-Employed Individuals

Self-employed individuals have a slightly different deadline for filing their taxes. They are required to file their taxes by April 15th, but they also have to pay their estimated taxes quarterly. This means that they need to make four payments throughout the year to cover their tax liability.

The due dates for these quarterly payments are:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

Tax Filing Deadlines for Individuals with Extensions, What is the tax deadline for October 2024

If you are unable to file your taxes by the standard deadline, you can request an extension. This will give you an additional six months to file your return, but it will not give you extra time to pay your taxes.

The deadline for filing an extension is October 15th.

October 2024 Tax Filing Deadline

The October 2024 tax deadline is October 15th. This is because April 15th, 2024, falls on a Sunday, and the following day, April 16th, 2024, is a federal holiday (Emancipation Day). This means that the tax filing deadline is shifted to the next business day, which is April 17th, 2024.

The college football landscape is shifting! Alabama has slipped in the rankings, while Big Ten teams are making a strong showing. Check out the latest college football rankings and see how your team stacks up here.

Therefore, the deadline for filing an extension for the 2024 tax year is October 15th, 2024.

Note:This deadline applies to both individuals and self-employed individuals.

The Giants dominated the Seahawks in their recent game. Want to see a breakdown of what went down? Read this instant analysis of the game and get insights into the Giants’ victory.

October 2024 Tax Filing

The tax deadline for October 2024 is generally the same as the standard deadline, which is April 15th. However, there are some unique circumstances and potential changes that could affect the filing process.

Potential Changes to Tax Laws or Regulations

It’s important to be aware of potential changes to tax laws or regulations that could impact your tax obligations. The IRS regularly reviews and updates tax laws, and these changes may affect the forms you need to file, the deductions you can claim, or the amount of taxes you owe.

For example, in recent years, there have been significant changes to the tax code, such as the Tax Cuts and Jobs Act of 2017. These changes have impacted the standard deduction, the child tax credit, and the individual mandate penalty.

Want to get the latest scoop on Arkansas Football recruiting? Check out this video report with Otis Kirk for all the details. Watch the report and see who’s making waves in the recruiting world.

It’s crucial to stay informed about any changes to tax laws or regulations that could affect your tax filing. You can find information on the IRS website or consult with a tax professional.

Specific Tax Forms or Requirements

While the specific tax forms and requirements for October 2024 are not yet available, it’s likely that many of the forms used in previous years will still be relevant. For example, you’ll likely need to file Form 1040, the U.S.

Southern California experienced an early morning earthquake centered near Ontario. Get the latest details on the earthquake, including its magnitude and location, by reading this article.

Individual Income Tax Return, to report your income and taxes. You may also need to file other forms, such as Form W-2, Wage and Tax Statement, or Form 1099, Miscellaneous Income. It’s recommended to start gathering your tax documents early, including W-2s, 1099s, and any other relevant documentation, to ensure a smooth filing process.

Penalties for Late Filing

The IRS imposes penalties for late filing and late payment of taxes. These penalties can be significant, so it is important to file your taxes on time and pay any taxes owed.

Planning your taxes for 2024? It’s important to know the tax brackets for single filers. You can find the information on the different tax brackets for single filers in 2024 here.

Late Filing Penalty

The penalty for late filing is 0.5% of the unpaid taxes for each month or part of a month that your return is late, up to a maximum of 25%. The penalty is calculated on the amount of tax you owe, not the total income you report.

Are you filing as head of household in 2024? It’s important to understand the tax brackets that apply to this filing status. You can find more information about the tax brackets for head of household in 2024 here.

Late Payment Penalty

The penalty for late payment is 0.5% of the unpaid taxes for each month or part of a month that the payment is late, up to a maximum of 25%. The

The Packers secured a victory over the Rams, thanks in part to some crucial turnovers. Read this recap to see how the Packers pulled off the win and what key plays made the difference. Check out the recap and see how the Packers came out on top.

penalty is calculated on the amount of tax you owe, not the total income you report.

If you’re a qualifying widow(er) filing your taxes in 2024, you’ll need to understand the specific tax brackets that apply to your situation. You can find more information about the tax brackets for qualifying widow(er)s in 2024 here.

Exceptions and Waivers

There are some exceptions and waivers that may apply to late filing and late payment penalties. For example, if you have a reasonable cause for filing your return late, such as a serious illness or a natural disaster, the IRS may waive the penalty.

Robert Lewandowski had a great start to the season, scoring a hat trick in the first half of Barcelona’s game. Check out the details of his impressive performance in this article.

You will need to provide documentation to support your claim.

Looking for ways to watch the Raiders take on the Broncos this week? You’ve come to the right place. Find out how to watch the Las Vegas Raiders vs. Denver Broncos NFL game here.

Penalties for Late Filing and Payment

| Penalty | Calculation Method |

|---|---|

| Late Filing Penalty | 0.5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25% |

| Late Payment Penalty | 0.5% of the unpaid taxes for each month or part of a month that the payment is late, up to a maximum of 25% |

For example, if you owe $10,000 in taxes and file your return two months late, the late filing penalty would be $100 (0.5% x $10,000 x 2 months).

Tips for Avoiding Late Filing

Late filing can result in penalties and interest charges, which can significantly impact your finances. To avoid this, it’s crucial to plan ahead and stay organized throughout the year. Here are some tips for ensuring you file your taxes on time.

The new tax year is here! Are you curious about the updated tax brackets for 2024? You can find the latest information about the new tax brackets for 2024 here.

Staying Organized and Keeping Accurate Records

Staying organized is key to avoiding late filing. Maintaining accurate records throughout the year simplifies the tax filing process and reduces the risk of errors.

- Gather all your tax documents:This includes W-2 forms, 1099 forms, and any other income statements. It’s important to store these documents in a safe and accessible location.

- Track your deductions:Keep records of all eligible deductions, such as charitable donations, medical expenses, and home office expenses. This can help you minimize your tax liability.

- Use a tax organizer:A tax organizer can help you track your income, expenses, and deductions throughout the year. This makes it easier to compile the necessary information when it’s time to file your taxes.

Preparing and Filing Taxes on Time

Filing your taxes on time is crucial to avoid penalties. Here’s a step-by-step guide to help you prepare and file your taxes efficiently.

Filing your taxes separately as a married couple? It’s important to understand the tax brackets for this filing status. Check out the tax brackets for married filing separately in 2024 here.

- Gather all necessary documents:This includes your Social Security number, tax forms, and any other relevant documentation.

- Choose a filing method:You can file your taxes electronically, by mail, or through a tax professional. Electronic filing is generally the fastest and most convenient option.

- File your taxes before the deadline:The tax deadline for October 2024 is [Insert Date]. It’s best to file your taxes well before the deadline to avoid any last-minute rush.

Resources and Support: What Is The Tax Deadline For October 2024

Navigating tax filing can be overwhelming, but you don’t have to go it alone. Several resources are available to help you understand tax deadlines, requirements, and potential issues.The Internal Revenue Service (IRS) is the primary source of information for all things tax-related.

Curious about how the new tax brackets will affect your income in 2024? This handy tax bracket calculator can help you determine your tax liability. Use the calculator and see how your income falls within the brackets.

They provide a wealth of information on their website and through various communication channels.

The Jaguars pulled off a thrilling victory against the Colts in Week 5. See how the game unfolded and find out the key plays that led to Jacksonville’s win in this game report.

IRS Resources

- IRS Website:The IRS website is a comprehensive resource for tax information, including deadlines, forms, publications, and guidance on various tax topics. You can access it at [https://www.irs.gov/](https://www.irs.gov/).

- IRS Publications:The IRS offers a wide range of publications that cover specific tax topics in detail. These publications provide clear explanations and examples to help you understand your tax obligations. You can find them on the IRS website or by calling the IRS.

- IRS Tax Forms:The IRS website provides access to all the necessary tax forms, including instructions, that you need to file your taxes.

- IRS Phone Numbers:The IRS offers various phone numbers for specific tax-related inquiries. For general tax questions, you can call 1-800-829-1040. For tax-related issues, you can call 1-800-829-1040. For tax-related issues, you can call 1-800-829-1040. You can also find specific phone numbers for various departments on the IRS website.

- IRS Email:While the IRS does not offer email support for general inquiries, you can use their online forms and tools for various purposes, such as submitting tax payments, requesting transcripts, or accessing your tax account information.

Last Recap

Navigating the complexities of tax deadlines can be overwhelming, but with the right information and resources, you can confidently meet your tax obligations. By staying informed about the specific requirements for October 2024, you can avoid penalties and ensure a smooth tax filing experience.

Remember, it’s always best to seek professional advice if you have any questions or concerns regarding your tax situation.

Essential FAQs

What happens if I file my taxes late?

If you file your taxes late, you may face penalties for late filing and late payment. The penalty for late filing is typically 0.5% of the unpaid taxes for each month or part of a month that the taxes are late.

The penalty for late payment is 0.5% of the unpaid taxes for each month or part of a month that the payment is late, up to a maximum of 25%.

Can I get an extension to file my taxes?

Yes, you can request an extension to file your taxes. However, this extension only extends the time you have to file your return, not the time you have to pay your taxes. You must still pay your taxes by the original deadline, even if you have an extension to file.

Where can I find more information about tax deadlines?

You can find more information about tax deadlines on the IRS website (www.irs.gov) or by contacting the IRS directly.