What Is The Meaning Of Immediate Annuity? It’s a retirement planning tool that provides a guaranteed stream of income starting right away. Imagine receiving regular payments throughout your golden years, no matter what the market does. Immediate annuities are like a personal pension, offering peace of mind and financial security in retirement.

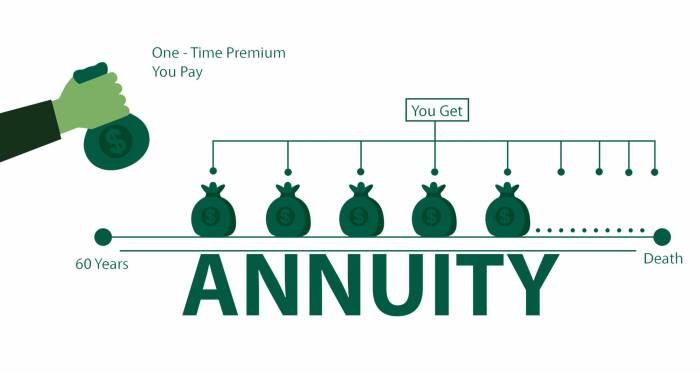

An immediate annuity is a financial product that converts a lump sum of money into a series of regular payments, beginning immediately. These payments can be fixed or variable, depending on the type of annuity you choose. Immediate annuities are often used as a way to supplement retirement income, provide a steady stream of cash flow, or protect against outliving your savings.

Excel can be a powerful tool for calculating annuity values. Calculate Annuity On Excel 2024 provides a guide to using Excel for annuity calculations, enabling you to perform these calculations with greater efficiency and accuracy.

What Is The Meaning Of Immediate Annuity?

An immediate annuity is a financial product that provides a stream of guaranteed income payments for life, starting immediately after the purchase. It is a popular option for retirees who are looking for a reliable source of income to supplement their retirement savings.

Calculating the annuity exclusion ratio is a key step in understanding the tax implications of your annuity payments. Calculate Annuity Exclusion Ratio 2024 offers a guide to this calculation, empowering you to make informed decisions about your annuity investments.

Immediate annuities are also known as “single premium immediate annuities” (SPIAs) or “fixed immediate annuities”.

Variable annuities offer potential growth but come with risks. Before making a decision, it’s essential to weigh the pros and cons. Read Variable Annuity Good Or Bad 2024 to gain insights into the potential benefits and drawbacks of this investment option.

Introduction to Immediate Annuities

Immediate annuities are a type of annuity contract that provides a guaranteed stream of income payments to the annuitant for life, starting immediately after the purchase. The annuitant makes a lump-sum payment to the insurance company, and in return, the company agrees to make regular payments to the annuitant for the rest of their life.

Immediate annuities can be a valuable tool for retirement planning, as they provide a predictable and guaranteed source of income that can help to supplement other retirement savings.

When you inherit an annuity, the tax treatment can be different from the original owner. How Is Inherited Annuity Taxed 2024 clarifies the tax rules for inherited annuities, ensuring you understand the tax implications and make informed financial decisions.

Key Features of Immediate Annuities

Immediate annuities have several key features that make them attractive to retirees. These features include:

- Guaranteed Income Payments:Immediate annuities provide a guaranteed stream of income payments for life, regardless of how long the annuitant lives. This means that the annuitant can be sure that they will receive a regular income stream, even if they live longer than expected.

When considering variable annuities, it’s crucial to be aware of the associated expenses. Variable Annuity Expenses 2024 delves into the various fees and charges you might encounter, providing a clear understanding of the costs involved.

- Fixed or Variable Payments:Immediate annuities can be either fixed or variable. Fixed annuities provide a guaranteed stream of income payments that do not fluctuate with market conditions. Variable annuities, on the other hand, provide payments that are linked to the performance of a specific investment portfolio.

If you’re looking for a variable annuity provider, there are many reputable companies to choose from. Variable Annuity Companies 2024 provides a list of companies known for their expertise in this area, helping you find the right fit for your needs.

- Lump-Sum Payment:Immediate annuities are typically purchased with a lump-sum payment. This payment is used to purchase the annuity contract, and the income payments are based on the amount of the initial investment.

- Payment Options:Annuity payments can be made in a variety of ways, including monthly installments, lump-sum payments, or a combination of both. The annuitant can choose the payment option that best meets their needs.

Examples of How Immediate Annuities Can Be Used to Supplement Retirement Income

- Covering Essential Expenses:Immediate annuities can be used to cover essential expenses, such as housing, food, and healthcare. This can help to ensure that retirees have enough income to meet their basic needs.

- Generating Income for Discretionary Spending:Immediate annuities can also be used to generate income for discretionary spending, such as travel, hobbies, or entertainment. This can help to enhance retirees’ quality of life.

- Providing a Safety Net:Immediate annuities can provide a safety net for retirees who are concerned about outliving their retirement savings. This can help to ensure that retirees have a source of income even if their other savings run out.

How Immediate Annuities Work, What Is The Meaning Of Immediate Annuity

Purchasing an immediate annuity is a straightforward process. The annuitant simply needs to contact an insurance company and provide information about their age, health, and desired payment options. The insurance company will then calculate the amount of the annuity payment based on the annuitant’s individual circumstances.

The Process of Purchasing an Immediate Annuity

Here are the steps involved in purchasing an immediate annuity:

- Choose an Insurance Company:The first step is to choose an insurance company that offers immediate annuities. It is important to compare different companies and their rates before making a decision.

- Determine Your Payment Options:Once you have chosen an insurance company, you need to determine your desired payment options. This includes the amount of the monthly payment, the frequency of the payments, and the duration of the payments.

- Provide Personal Information:You will need to provide the insurance company with personal information, such as your age, health, and financial situation. This information will be used to calculate the amount of the annuity payment.

- Make a Lump-Sum Payment:You will need to make a lump-sum payment to the insurance company to purchase the annuity contract. The amount of the payment will depend on your chosen payment options and the insurance company’s rates.

- Receive Annuity Payments:Once the annuity contract is purchased, you will start to receive regular income payments. The payments will continue for the rest of your life, regardless of how long you live.

Types of Annuity Payments

Annuity payments can be made in a variety of ways, including:

- Lump-Sum Payments:The annuitant can receive a single lump-sum payment at the beginning of the annuity period. This option is typically chosen by individuals who need a large sum of money for a specific purpose, such as paying off debt or making a major purchase.

Sarasota is a popular destination for retirees, and annuities can play a significant role in their financial planning. To learn more about the services offered in Sarasota, check out Annuity King Sarasota 2024. This article provides valuable information about annuity providers and their offerings in the area.

- Monthly Installments:The annuitant can receive regular monthly payments for the rest of their life. This option is typically chosen by individuals who need a steady stream of income to cover their living expenses.

- Combination of Lump-Sum and Monthly Payments:The annuitant can receive a combination of lump-sum and monthly payments. This option is typically chosen by individuals who need a combination of immediate cash and a regular income stream.

Factors That Affect Annuity Payouts

Several factors can affect the amount of the annuity payout, including:

- Interest Rates:Interest rates play a significant role in determining annuity payouts. Higher interest rates generally result in higher annuity payments.

- Life Expectancy:Life expectancy is another important factor. Individuals with a longer life expectancy will generally receive lower annuity payments than individuals with a shorter life expectancy.

- Payment Option:The chosen payment option will also affect the amount of the annuity payout. Lump-sum payments will generally result in lower payouts than monthly installments.

Benefits of Immediate Annuities

Immediate annuities offer several benefits that can make them an attractive option for retirees. These benefits include:

Advantages of Immediate Annuities

Immediate annuities offer a number of advantages over other retirement savings options, including:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income payments for life, regardless of how long the annuitant lives. This can help to ensure that retirees have a reliable source of income to meet their living expenses.

- Protection Against Inflation:Some immediate annuities offer protection against inflation, which means that the annuity payments will increase over time to keep pace with rising prices. This can help to ensure that retirees have enough income to maintain their standard of living in retirement.

Tax qualifications for variable annuities can be complex. Variable Annuity Tax Qualification 2024 explores the tax implications of these annuities, providing valuable insights for understanding your potential tax liabilities.

- Tax Benefits:The income payments from an immediate annuity are generally taxed as ordinary income, but the principal amount is not taxed until it is withdrawn. This can provide tax benefits for retirees, especially those in lower tax brackets.

- Simplicity:Immediate annuities are relatively simple to understand and manage. Once the annuity contract is purchased, the annuitant does not need to worry about investing or managing their money.

Comparison of Immediate Annuities to Other Retirement Savings Options

Immediate annuities can be a valuable addition to a retirement savings plan, but they are not the right choice for everyone. It is important to compare immediate annuities to other retirement savings options, such as traditional IRAs or 401(k)s, before making a decision.

To understand how variable annuities work in practice, it’s helpful to examine a real-world example. Variable Annuity Example 2024 provides a step-by-step illustration, making it easier to grasp the key concepts and how they apply in different scenarios.

Here is a table that summarizes the pros and cons of immediate annuities versus other retirement savings options:

| Feature | Immediate Annuities | Traditional IRAs | 401(k)s |

|---|---|---|---|

| Guaranteed Income | Yes | No | No |

| Protection Against Inflation | May be available | No | No |

| Tax Benefits | Yes | Yes | Yes |

| Flexibility | Limited | High | High |

| Investment Control | None | High | High |

| Risk | Low | Medium | Medium |

Considerations for Immediate Annuities

When considering an immediate annuity, it is important to weigh the benefits and drawbacks carefully. Here are some factors to consider:

- Your Age and Health:Younger individuals with a longer life expectancy may not be good candidates for immediate annuities, as they may not receive as much in annuity payments.

- Your Financial Situation:Immediate annuities require a lump-sum payment, so it is important to ensure that you have enough money available to purchase the annuity contract.

- Your Retirement Goals:Immediate annuities can be a valuable tool for retirement planning, but they are not the right choice for everyone. It is important to consider your retirement goals and whether an immediate annuity will help you achieve them.

Risks and Considerations

Immediate annuities are not without their risks. It is important to understand the potential drawbacks before making a decision.

Potential Drawbacks of Immediate Annuities

- Risk of Outliving Your Annuity Payments:If you live longer than expected, you may run out of annuity payments before you die. This is a risk that is inherent in all annuities, but it is more likely to occur with immediate annuities because the payments are guaranteed for life.

While annuities and life insurance share some similarities, they are distinct financial products. Is Annuity The Same As Life Insurance 2024 provides a clear explanation of the differences, helping you understand the unique features and benefits of each.

- Loss of Principal:If you purchase an immediate annuity with a lump-sum payment, you will lose access to that money. This means that you will not be able to withdraw the principal amount or invest it in other ways.

- Limited Flexibility:Immediate annuities offer limited flexibility. Once you purchase an annuity contract, you cannot change the payment options or withdraw the principal amount.

- Interest Rate Risk:If interest rates rise after you purchase an immediate annuity, the value of your annuity may decline. This is because the annuity payments are based on the interest rate at the time of purchase.

Consulting with a Financial Advisor

It is important to consult with a financial advisor before purchasing an immediate annuity. A financial advisor can help you determine if an immediate annuity is right for your individual circumstances. They can also help you choose the right type of annuity and payment options.

Annuity calculations can be simplified using Excel templates. Annuity Calculator Excel Template 2024 offers a downloadable template that can help you quickly and easily calculate annuity values.

Questions to Ask a Financial Advisor

Here are some questions to ask a financial advisor before purchasing an immediate annuity:

- What are the different types of immediate annuities available?

- What are the current interest rates for immediate annuities?

- What are the payment options available for immediate annuities?

- What are the risks and benefits of immediate annuities?

- Are there any other retirement savings options that might be a better fit for me?

Examples and Case Studies

Immediate annuities can be a valuable tool for retirement planning, but it is important to understand how they work and the potential risks and benefits before making a decision. Here are some real-world examples of how individuals have used immediate annuities to achieve their retirement goals.

Real-World Examples

- John, a 65-year-old retiree, purchased an immediate annuity with a lump-sum payment of $100,000.John chose to receive monthly payments for the rest of his life. The annuity payments provided him with a guaranteed stream of income that he could use to cover his essential expenses.

- Mary, a 70-year-old retiree, purchased an immediate annuity with a lump-sum payment of $50,000.Mary chose to receive a combination of lump-sum and monthly payments. She used the lump-sum payment to pay off her mortgage, and she used the monthly payments to supplement her other retirement income.

Hypothetical Scenario

Imagine that you are a 60-year-old retiree with $200,000 in savings. You are looking for a way to generate a guaranteed stream of income to supplement your retirement savings. You are considering purchasing an immediate annuity with a lump-sum payment of $100,000.

Knowing how to calculate your annuity income is essential for financial planning. Calculating Annuity Income 2024 provides step-by-step guidance, allowing you to project your future income streams and make informed financial decisions.

The annuity would provide you with monthly payments of $5,000 for the rest of your life.

Variable annuities can be complex, especially when it comes to taxation. Qualified Variable Annuity Taxation 2024 breaks down the tax rules specific to qualified variable annuities, helping you navigate the intricacies of this type of investment.

The benefits of this scenario include:

- Guaranteed Income:You would receive a guaranteed stream of income of $5,000 per month for the rest of your life.

- Protection Against Inflation:The annuity payments may increase over time to keep pace with rising prices.

- Simplicity:You would not need to worry about investing or managing your money.

The risks of this scenario include:

- Risk of Outliving Your Annuity Payments:If you live longer than expected, you may run out of annuity payments before you die.

- Loss of Principal:You would lose access to the $100,000 lump-sum payment.

- Limited Flexibility:You would not be able to change the payment options or withdraw the principal amount.

Case Studies

- Case Study 1:A 72-year-old retiree purchased an immediate annuity with a lump-sum payment of $250,000. The annuity provided him with monthly payments of $1,500 for the rest of his life. He was happy with the annuity payments, as they provided him with a reliable source of income to cover his living expenses.

However, he died at age 80, and his wife received no further payments.

- Case Study 2:A 68-year-old retiree purchased an immediate annuity with a lump-sum payment of $100,000. The annuity provided her with monthly payments of $500 for the rest of her life. She was disappointed with the low payments, as she had hoped to receive more income from the annuity.

One common question about annuities is whether the payments are taxable. Is Annuity Payments Taxable 2024 provides a comprehensive explanation of the tax implications of annuity payments. It’s essential to understand these rules to ensure you’re prepared for potential tax liabilities.

However, she lived to be 95 years old, and the annuity payments continued throughout her life.

Final Thoughts

Understanding the meaning of immediate annuities is crucial for making informed decisions about your retirement savings. By carefully considering the benefits, risks, and your individual circumstances, you can determine if an immediate annuity is the right fit for your retirement plan.

Remember to consult with a financial advisor to get personalized guidance and explore all your options.

Question Bank: What Is The Meaning Of Immediate Annuity

What are the different types of immediate annuities?

Immediate annuities can be fixed or variable. Fixed annuities offer a guaranteed rate of return, while variable annuities provide a rate of return that fluctuates based on the performance of the underlying investment portfolio.

How much money do I need to purchase an immediate annuity?

If you’re planning to invest in an annuity, understanding how its future value is calculated is crucial. You can find a helpful guide on Calculating Annuity Future Value Compounded Monthly 2024 , which explains the process in detail. This knowledge will empower you to make informed decisions about your investment strategy.

The amount of money you need to purchase an immediate annuity depends on factors such as your age, life expectancy, the payment amount you desire, and the interest rate offered by the annuity provider. Consult with a financial advisor to determine the appropriate amount for your individual circumstances.

What are the tax implications of immediate annuities?

The tax implications of immediate annuities can vary depending on the type of annuity and your individual circumstances. It’s important to consult with a tax professional to understand the tax implications of your specific annuity.