What is the 2024 standard deduction for single filers? This question is on the minds of many individuals as they prepare to file their taxes. The standard deduction is a valuable tax benefit that can reduce your taxable income and ultimately your tax liability.

Understanding how the standard deduction works and how it applies to single filers is crucial for navigating the tax system effectively.

The standard deduction is a fixed amount that taxpayers can choose to subtract from their adjusted gross income (AGI) instead of itemizing their deductions. This deduction is designed to simplify the tax filing process for many individuals, particularly those who do not have significant itemized deductions such as mortgage interest, charitable contributions, or medical expenses.

The amount of the standard deduction varies depending on your filing status, which for this case is single. The standard deduction for single filers is subject to change each year, and 2024 is no exception.

Standard Deduction Basics

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) when calculating your federal income tax liability. It’s a way to reduce your taxable income, ultimately lowering the amount of taxes you owe.

Planning to contribute to your IRA in 2024? The contribution limits vary based on your age, so it’s essential to know what you can put in. You can find the IRA contribution limits for 2024 by age to ensure you maximize your savings and avoid any penalties.

It’s a valuable benefit for many taxpayers, especially those who don’t itemize their deductions.The standard deduction is designed to simplify the tax filing process for many individuals. It provides a basic deduction for common expenses, such as medical expenses, charitable contributions, and state and local taxes.

If you’re looking to maximize your retirement savings in 2024, you’ll want to understand the contribution limits for 401(k) plans. You can contribute a significant amount each year, and if you’re over 50, you can take advantage of catch-up contributions.

Find out the maximum 401k contribution 2024 with catch-up to ensure you’re taking full advantage of your retirement savings.

This means that taxpayers who choose the standard deduction don’t need to itemize their deductions and can simply subtract the standard deduction amount from their AGI.

If you’re married filing jointly, you might be eligible for a higher standard deduction. The IRS provides specific guidance for different filing statuses, and it’s important to understand your options. Find out the standard deduction for married filing jointly in 2024 to make sure you’re claiming all the deductions you’re eligible for.

History of the Standard Deduction

The standard deduction has been a part of the U.S. tax code for decades. It was introduced in the 1940s to simplify tax filing for individuals with lower incomes. Over the years, the standard deduction has been adjusted for inflation and has been increased to reflect changes in living expenses.

Want to know how much you can contribute to your 401(k) in 2024? The limit for 401(k) contributions is set each year, and it’s a good idea to stay informed. You can find out how much you can contribute to your 401(k) in 2024 and plan your retirement savings accordingly.

It has also been expanded to include various deductions, such as those for certain medical expenses, charitable contributions, and state and local taxes. The standard deduction is adjusted annually to reflect changes in inflation and the cost of living. This ensures that the deduction keeps pace with the rising cost of living and continues to provide a valuable tax benefit for taxpayers.

2024 Standard Deduction Amount

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income. This reduces the amount of income subject to taxation, resulting in lower tax liability. For single filers in 2024, the standard deduction is a significant amount that can help lower your tax bill.

Driving to work in October 2024? You might be able to deduct some of your expenses. The IRS sets a mileage rate for commuting expenses, and you can use it to calculate your deductions. Find out the October 2024 mileage rate for driving to work to make sure you’re claiming all the deductions you’re eligible for.

Standard Deduction Amount for Single Filers in 2024

The standard deduction for single filers in 2024 is $13,850. This amount is subject to change based on inflation adjustments.

Potential Changes to the Standard Deduction for 2024

The standard deduction amount is adjusted annually to account for inflation. The Internal Revenue Service (IRS) uses the Consumer Price Index (CPI) to determine the adjustment. For 2024, the standard deduction amount is expected to increase slightly due to inflation.

However, it is important to consult official IRS guidance for the most up-to-date information.

If you have a disability, you might be eligible for a higher standard deduction. The IRS provides specific guidance for individuals with disabilities, and it’s important to understand your options. Find out the standard deduction for people with disabilities in 2024 to make sure you’re claiming all the deductions you’re eligible for.

Comparison of the 2024 Standard Deduction to Previous Years

The standard deduction has increased steadily over the past few years. Here’s a comparison of the standard deduction amount for single filers from 2020 to 2024:

| Year | Standard Deduction Amount |

|---|---|

| 2020 | $12,400 |

| 2021 | $12,550 |

| 2022 | $12,950 |

| 2023 | $13,850 |

| 2024 | $13,850 (estimated) |

The standard deduction amount is subject to change based on inflation adjustments. The IRS uses the Consumer Price Index (CPI) to determine the adjustment.

The standard deduction amount can significantly impact your tax liability, and it’s updated each year. Knowing the standard deduction amount can help you determine your tax strategy. Find out the standard deduction amount for the 2024 tax year to get a better understanding of your tax situation.

Who Qualifies for the Standard Deduction: What Is The 2024 Standard Deduction For Single Filers

The standard deduction is available to most taxpayers, but there are certain eligibility requirements. Whether you can claim the standard deduction depends on your filing status and other factors.The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income.

Tax brackets can impact your income significantly, and it’s crucial to understand how they’ll affect you in 2024. The tax brackets are adjusted each year, so it’s worth checking how these changes might affect your finances. Learn more about how tax brackets will affect your 2024 income and plan accordingly.

It is an alternative to itemizing deductions, which allow you to deduct certain expenses, such as medical expenses, state and local taxes, and charitable contributions.

Curious about how much you can contribute to your 401(k) in 2024? The limit for 401(k) contributions is set each year, and it’s a good idea to stay informed. You can find the 401(k) contribution limit for 2024 and plan your retirement savings accordingly.

Filing Status

Your filing status is the most important factor in determining your eligibility for the standard deduction. There are five filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er) with Dependent Child

Each filing status has its own standard deduction amount. For example, the standard deduction for single filers is lower than the standard deduction for married couples filing jointly.

Other Factors Affecting Eligibility

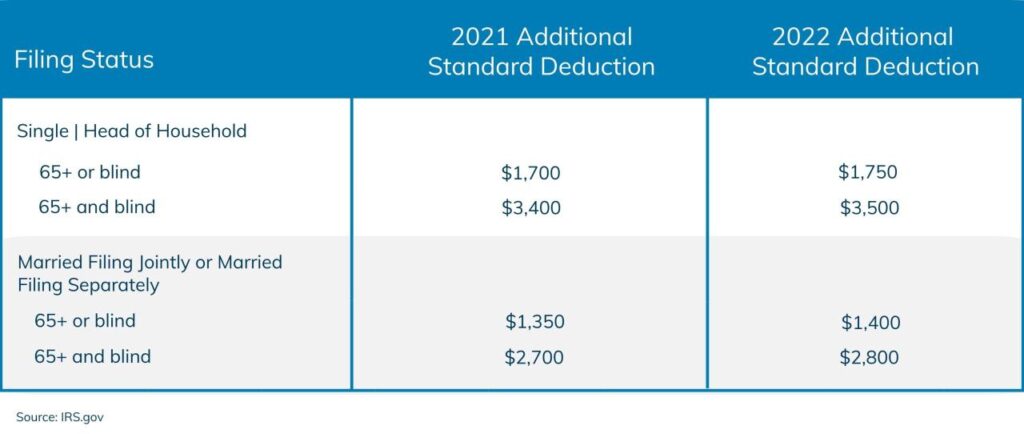

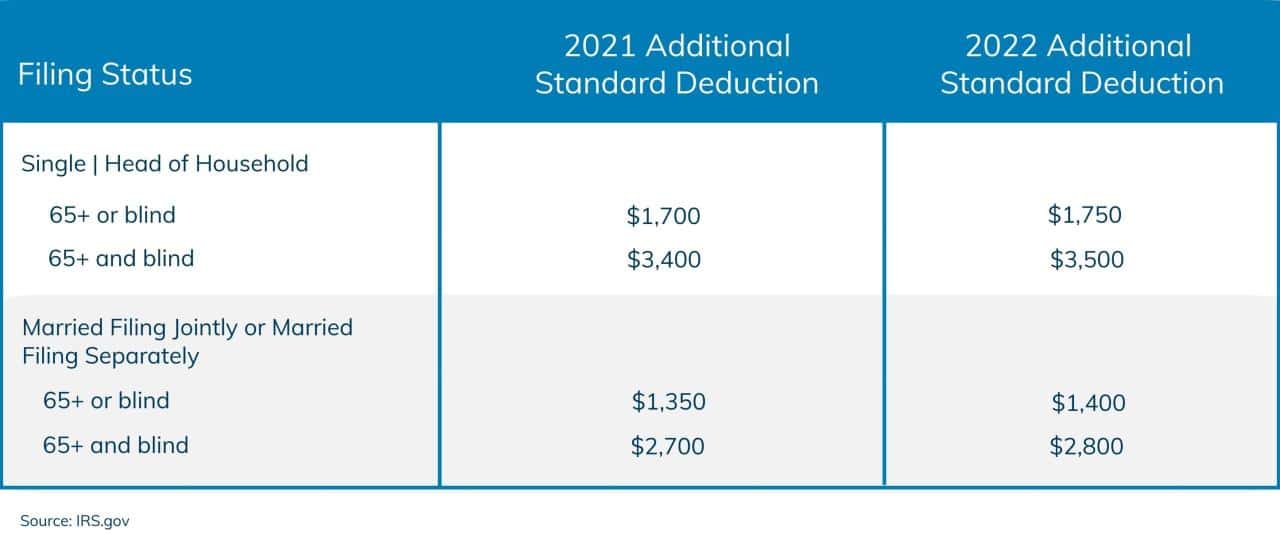

- Age:Taxpayers who are 65 years old or older or blind can claim an additional standard deduction amount. This additional amount is added to the regular standard deduction amount.

- Dependency Status:If you are claimed as a dependent on someone else’s tax return, you generally cannot claim the standard deduction. This rule applies even if you are over 19 years old and have earned income. However, there are some exceptions, such as if you are a student or are disabled.

- Dependence Exemptions:If you are claiming dependents on your tax return, you may be able to claim a standard deduction for each dependent. This is different from the additional standard deduction for age and blindness.

Benefits of Using the Standard Deduction

Choosing the standard deduction can be a smart move for many taxpayers, especially if you don’t have significant itemized deductions. The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income.

The contribution limits for 401(k) plans vary based on your age, so it’s essential to understand the rules. If you’re unsure how much you can contribute in 2024, you can find the 401(k) contribution limits for 2024 for different ages to maximize your retirement savings.

This means you’ll owe less in taxes.

Retirement planning is crucial, and understanding your tax obligations is essential. There are online calculators that can help you estimate your tax liability and plan for your future. Find a tax calculator for retirees in October 2024 to help you make informed decisions about your retirement finances.

Advantages of the Standard Deduction

The standard deduction offers several advantages over itemizing your deductions. Here are some key benefits:

- Simplicity:The standard deduction is a straightforward calculation, eliminating the need to gather receipts and documentation for itemized deductions. You simply use the predetermined amount for your filing status.

- Predictability:The standard deduction amount is set annually by the IRS, making it easy to estimate your tax liability in advance.

- Time-Saving:By choosing the standard deduction, you avoid the time-consuming process of itemizing, freeing up your time for other tasks.

Scenarios Where the Standard Deduction is Beneficial

The standard deduction is often the most advantageous option in these scenarios:

- Lower Itemized Deductions:If your itemized deductions are less than the standard deduction amount, using the standard deduction will result in a lower taxable income and lower tax liability. For example, if your standard deduction is $13,850 and your itemized deductions total $10,000, you would save $3,850 in taxes by taking the standard deduction.

Tax changes can impact deadlines, so it’s important to stay informed about any updates. The October 2024 deadline for certain tax-related activities might be affected by recent changes. Learn about tax changes impacting the October 2024 deadline to avoid any penalties or missed opportunities.

- Limited Homeownership Expenses:If you don’t have significant mortgage interest or property taxes, the standard deduction might be more beneficial than itemizing.

- No Significant Medical Expenses:Medical expenses are only deductible to the extent they exceed 7.5% of your AGI. If your medical expenses are below this threshold, you’re likely better off taking the standard deduction.

- No Charitable Contributions:If you don’t make significant charitable contributions, the standard deduction will likely result in a lower tax liability.

Impact of the Standard Deduction on Taxable Income

The standard deduction directly reduces your taxable income, resulting in lower tax liability.

If you’re working with government agencies, you might need to complete a W9 form. The IRS provides a W9 form for tax purposes, and it’s essential to have the correct information. Find the W9 form for October 2024 for government agencies to ensure you’re providing the necessary details.

The formula for calculating taxable income is: Adjusted Gross Income (AGI)

Standard Deduction = Taxable Income.

For example, if your AGI is $50,000 and the standard deduction for single filers is $13,850, your taxable income would be $36,150 ($50,000

$13,850 = $36,150).

If you’re over 50, you can take advantage of catch-up contributions to your 401(k) plan. These contributions allow you to save more for retirement and reach your financial goals. Learn more about how much you can contribute to your 401(k) in 2024 with catch-up contributions to maximize your retirement savings.

Factors Affecting the Standard Deduction

While the standard deduction is a straightforward concept, certain factors can influence its amount for individual taxpayers. These factors include age, dependency status, and other specific circumstances. Understanding these factors is crucial for accurately calculating your standard deduction and maximizing your tax benefits.

Age

Your age can affect the standard deduction if you are 65 or older. If you are 65 or older, you receive an additional standard deduction amount. The amount of this additional deduction varies depending on your filing status. For example, in 2024, a single filer aged 65 or older will receive an additional $1,850 standard deduction.

Moving in October 2024? If you’re planning a move, you might be able to deduct some of your expenses. The IRS sets a mileage rate for moving expenses, and you can use it to calculate your deductions. Find out the October 2024 mileage rate for moving expenses to make sure you’re claiming all the deductions you’re eligible for.

This additional deduction applies to each individual who is 65 or older in the household.

Dependency Status, What is the 2024 standard deduction for single filers

The number of dependents you claim on your tax return can also impact your standard deduction. If you are claiming a dependent who is blind or aged 65 or older, you will receive an additional standard deduction amount. This additional deduction is similar to the age-related deduction, and the amount varies depending on your filing status.

For instance, in 2024, a single filer claiming a dependent who is blind or aged 65 or older will receive an additional $1,850 standard deduction.

Other Factors

Several other factors can affect the standard deduction amount, including:

- Blindness:If you are blind, you receive an additional standard deduction amount. This additional deduction is similar to the age-related deduction and the dependent-related deduction, and the amount varies depending on your filing status. In 2024, a single filer who is blind will receive an additional $1,850 standard deduction.

- Filing Status:The standard deduction amount varies depending on your filing status. The standard deduction is higher for married couples filing jointly than for single filers. The following table Artikels the standard deduction amounts for different filing statuses in 2024:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Head of Household | $20,800 |

| Qualifying Widow(er) | $27,700 |

Note:These amounts are subject to change based on future legislation.

Resources for Further Information

It’s important to have access to reliable resources for the most up-to-date information on the standard deduction. The Internal Revenue Service (IRS) provides comprehensive guidance and resources on various tax-related matters, including the standard deduction.

Official Government Websites and Resources

The IRS website is the primary source for accurate and comprehensive information about the standard deduction. It provides detailed explanations, examples, and publications related to the standard deduction.

- IRS.gov:The official website of the IRS offers a wealth of information on the standard deduction, including eligibility criteria, calculation methods, and relevant publications. You can find detailed explanations, examples, and FAQs to help you understand the standard deduction.

- IRS Publication 17 (Your Federal Income Tax):This publication is a comprehensive guide to federal income tax, including detailed information about the standard deduction. It covers various aspects, such as eligibility, calculation, and potential adjustments to the standard deduction.

- IRS Publication 501 (Exemptions, Standard Deduction, and Itemized Deductions):This publication provides specific guidance on the standard deduction, including detailed explanations of the different types of deductions and how they are calculated. It also covers eligibility requirements and potential adjustments to the standard deduction.

Helpful Resources and Contact Information

Here is a table summarizing some helpful resources and their contact information:

| Resource | Contact Information |

|---|---|

| IRS.gov | https://www.irs.gov |

| IRS Publication 17 | https://www.irs.gov/pub/irs-pdf/p17.pdf |

| IRS Publication 501 | https://www.irs.gov/pub/irs-pdf/p501.pdf |

| IRS Taxpayer Advocate Service | https://www.taxpayeradvocate.irs.gov |

| Tax Counseling for the Elderly (TCE) | https://www.irs.gov/individuals/tax-counseling-for-the-elderly-tce |

Last Word

In conclusion, the standard deduction for single filers in 2024 offers a significant tax benefit, potentially reducing your taxable income and tax liability. Understanding the eligibility criteria, benefits, and factors that affect the standard deduction is essential for maximizing your tax savings.

If you have any questions or need further guidance, consulting a tax professional is always a wise decision.

Essential Questionnaire

Can I claim the standard deduction if I am married filing separately?

Yes, you can claim the standard deduction if you are married filing separately. The standard deduction amount for married filing separately is generally half of the standard deduction amount for married filing jointly.

What if my income is below the standard deduction amount?

If your income is below the standard deduction amount, you will not owe any federal income tax. This is because the standard deduction will reduce your taxable income to zero.

How do I know if I should claim the standard deduction or itemize my deductions?

It is generally beneficial to claim the standard deduction if your itemized deductions are less than the standard deduction amount. You can use tax software or consult a tax professional to determine which option is best for you.

What happens if I make a mistake on my tax return regarding the standard deduction?

If you make a mistake on your tax return, you can file an amended return to correct it. The IRS has a form for this purpose, Form 1040-X. It’s important to act promptly if you discover an error to avoid potential penalties.