What is the 2024 standard deduction for married filing jointly? This question is crucial for married couples looking to navigate the complexities of federal income tax. The standard deduction is a valuable tool that allows taxpayers to reduce their taxable income, ultimately leading to lower tax bills.

Understanding this deduction, how it works, and how much it applies to married couples filing jointly in 2024 is essential for maximizing tax savings.

The standard deduction is a fixed amount that taxpayers can choose to subtract from their adjusted gross income, reducing their taxable income. It is a simplified alternative to itemizing deductions, which involves claiming specific expenses. For married couples filing jointly in 2024, the standard deduction provides a significant benefit, allowing them to lower their tax liability without the need for detailed documentation.

Understanding the Standard Deduction: What Is The 2024 Standard Deduction For Married Filing Jointly

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) when calculating your federal income tax liability. It’s a way to reduce your taxable income and, consequently, the amount of taxes you owe.The standard deduction is designed to benefit taxpayers by offering a simplified way to reduce their tax burden.

The tax brackets for 2024 have changed slightly from 2023. You can find a breakdown of the tax bracket changes for 2024 vs 2023 on the IRS website.

It’s a convenient alternative to itemizing deductions, which involves listing specific expenses, such as medical costs or charitable donations.

The IRS resources for the October 2024 tax deadline are available online and can help you file your taxes on time.

The Importance of Filing Status, What is the 2024 standard deduction for married filing jointly

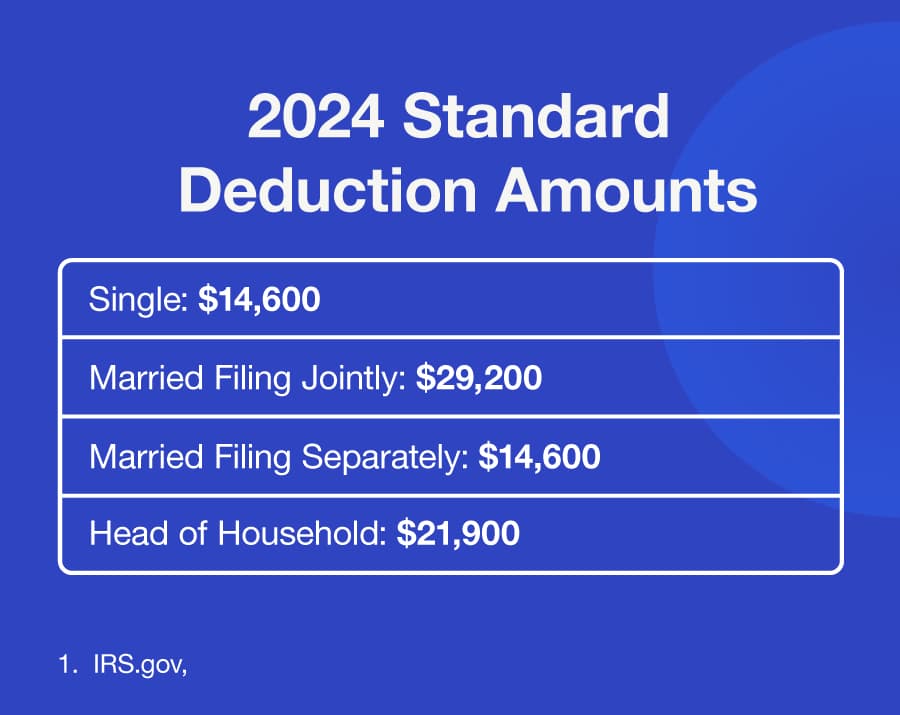

Your filing status plays a crucial role in determining the standard deduction amount. The IRS offers different standard deduction amounts for various filing statuses, reflecting the different financial circumstances of individuals and families.

It’s helpful to know what the 2024 federal tax brackets for single filers are, so you can plan accordingly.

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) when calculating your federal income tax liability.

If you’re a freelancer, it’s important to stay on top of your taxes. You can use a tax calculator for freelancers to get an estimate of what you’ll owe.

Here’s a table showing the standard deduction amounts for 2024, based on filing status:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Qualifying Widow(er) | $27,700 |

| Head of Household | $20,800 |

| Married Filing Separately | $13,850 |

2024 Standard Deduction for Married Filing Jointly

The standard deduction for married couples filing jointly in 2024 is a significant amount that can reduce your tax liability. Understanding this deduction is crucial for accurate tax filing and maximizing your potential tax savings.

Students may be eligible for a standard deduction. The standard deduction for students in 2024 can help reduce their tax liability.

Standard Deduction Amount for Married Filing Jointly

The standard deduction for married couples filing jointly in 2024 is $28,700. This amount represents the total expenses that taxpayers can deduct without itemizing their deductions.

If you’re over 50, you can contribute more to your 401k. The 401k limits for 2024 for over 50 are higher than for younger workers.

Comparison with Other Filing Statuses

The standard deduction amount varies depending on the filing status. Here’s a comparison of the standard deductions for different filing statuses in 2024:

- Single: $13,850

- Married Filing Separately: $13,850

- Head of Household: $20,800

- Qualifying Widow(er): $28,700

As you can see, the standard deduction for married filing jointly is the highest among all filing statuses. This reflects the higher expenses typically associated with married couples.

The 401k contribution limits for 2024 for different employers can vary, so it’s important to check with your employer.

Potential Changes or Updates to the Standard Deduction

The standard deduction is subject to adjustments based on inflation and other economic factors. While the 2024 standard deduction remains unchanged from 2023, it’s essential to stay updated on any potential changes or updates announced by the IRS.

The standard mileage rate for October 2024 is used to calculate deductions for business and charitable driving.

Factors Affecting the Standard Deduction

The standard deduction amount for married couples filing jointly can be influenced by several factors, including age, blindness, and certain qualifying expenses. These factors can either increase or decrease the standard deduction amount, impacting the couple’s overall tax liability.

The IRA limits for October 2024 are a good way to save for retirement.

Age

Age plays a role in determining the standard deduction amount for married couples filing jointly. For individuals aged 65 or older, the standard deduction is increased. The amount of this increase varies depending on the filing status. For example, in 2024, the standard deduction for married couples filing jointly is $27,000.

The standard deduction amount for the 2024 tax year has been adjusted for inflation.

However, if one or both spouses are 65 or older, the standard deduction increases to $28,700. If both spouses are 65 or older, the standard deduction increases to $30,400.

Families can use a tax calculator for families to see how the new tax laws might affect their bottom line.

Blindness

Similar to age, blindness also affects the standard deduction amount. For individuals who are legally blind, the standard deduction is increased. In 2024, the standard deduction for married couples filing jointly is $27,000. If one spouse is legally blind, the standard deduction increases to $28,700.

The standard deduction for head of household in 2024 is a helpful way to reduce your tax liability.

If both spouses are legally blind, the standard deduction increases to $30,400.

Small business owners can contribute to an IRA. The IRA contribution limits for small business owners in 2024 are the same as for other individuals.

Other Qualifying Factors

There are other factors that can affect the standard deduction amount, such as certain qualifying expenses. These expenses can be deducted from the couple’s adjusted gross income, reducing their taxable income and ultimately their tax liability. Some examples of these qualifying expenses include:

- Medical Expenses:Married couples filing jointly can deduct medical expenses exceeding 7.5% of their adjusted gross income.

- State and Local Taxes (SALT):The Tax Cuts and Jobs Act of 2017 limited the deductibility of state and local taxes to $10,000 per household. This limit applies to the combined total of state and local income taxes, property taxes, and sales taxes paid.

- Home Mortgage Interest:Married couples filing jointly can deduct interest paid on up to $750,000 of mortgage debt incurred to acquire, construct, or substantially improve their primary residence. This limit applies to mortgages acquired after December 15, 2017.

- Charitable Contributions:Married couples filing jointly can deduct charitable contributions up to 60% of their adjusted gross income. This limit applies to cash contributions, but it is subject to different limitations for non-cash contributions.

Standard Deduction vs. Itemized Deductions

When filing your taxes, you have the option of taking the standard deduction or itemizing your deductions. Both options reduce your taxable income, ultimately lowering your tax liability. Understanding the differences between these two methods is crucial for maximizing your tax savings.

Choosing Between Standard Deduction and Itemized Deductions

The choice between the standard deduction and itemized deductions depends on your individual circumstances and the specific deductions you qualify for. For married couples filing jointly, the standard deduction amount is typically higher than for single filers. To determine which option is more beneficial, you need to compare the total value of your itemized deductions to the standard deduction amount for your filing status.

If you’re donating to charity, you can use the October 2024 mileage rate for charitable donations to calculate your deduction.

If your itemized deductions exceed the standard deduction, itemizing is generally more advantageous. However, if the standard deduction is higher, you’ll likely save more by taking the standard deduction.

The 401k contribution limits for 2024 have been increased, which is good news for those saving for retirement.

Benefits and Drawbacks of Standard Deduction and Itemized Deductions

Standard Deduction

- Benefits:

- Simplicity: The standard deduction is straightforward and easy to calculate. You don’t need to gather receipts or documentation for specific expenses.

- Guaranteed Savings: The standard deduction ensures a minimum tax reduction, even if you don’t have significant itemized deductions.

- Drawbacks:

- Limited Savings: You might miss out on potential tax savings if your itemized deductions exceed the standard deduction.

Itemized Deductions

- Benefits:

- Potential for Greater Savings: If your itemized deductions are substantial, you can significantly reduce your taxable income and potentially save more on taxes compared to the standard deduction.

- Flexibility: You have the option to choose the deductions that best suit your financial situation, allowing for greater customization.

- Drawbacks:

- Complexity: Itemizing requires more paperwork and documentation. You need to gather receipts and evidence for each deductible expense.

- Potential for Errors: The process of itemizing can be more complex, increasing the risk of making mistakes that could lead to penalties or audits.

Tax Filing and the Standard Deduction

The standard deduction is a valuable tool for simplifying your tax filing process. When you choose to take the standard deduction, you don’t have to itemize your deductions, making your tax return easier to complete. Here’s a breakdown of how the standard deduction works during tax filing.

Claiming the Standard Deduction

To claim the standard deduction, you’ll need to follow these steps:

- Determine your filing status:Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)) determines your standard deduction amount.

- Gather your tax documents:You’ll need your Form W-2, 1099s, and other relevant tax documents to complete your return.

- Choose the standard deduction on your tax form:When you file your taxes, you’ll have the option to choose either the standard deduction or itemized deductions. On your tax form, simply select the standard deduction option.

- Double-check your information:Before submitting your tax return, ensure all your information is accurate, especially your filing status and any dependents you claim.

Standard Deduction Amounts for 2024

The standard deduction amounts for 2024 are as follows:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Married Filing Separately | $13,850 |

| Head of Household | $20,800 |

| Qualifying Widow(er) | $27,700 |

Resources for More Information

For more detailed information on the standard deduction, you can consult the following resources:

- Internal Revenue Service (IRS) website: https://www.irs.gov/

- Tax preparation software:Programs like TurboTax and H&R Block provide detailed information on the standard deduction and other tax topics.

- Tax professionals:Certified Public Accountants (CPAs) and Enrolled Agents (EAs) can provide expert advice on claiming the standard deduction.

Conclusion

The standard deduction for married couples filing jointly in 2024 is a valuable tool for reducing tax burdens. Understanding this deduction, its implications, and the factors that influence its amount is essential for couples seeking to optimize their tax strategies.

By taking advantage of this deduction, couples can ensure they are maximizing their tax savings and navigating the complexities of federal income tax with greater ease.

Top FAQs

How do I know if I should take the standard deduction or itemize my deductions?

The decision to take the standard deduction or itemize depends on your individual circumstances. If your itemized deductions exceed the standard deduction amount, it’s generally more beneficial to itemize. However, if the standard deduction is higher, it’s typically more advantageous to take that option.

What if I’m not sure what my filing status should be?

It’s important to determine your correct filing status as it impacts the standard deduction amount. Consult the IRS website or a tax professional for guidance on determining your appropriate filing status.

Are there any penalties for claiming the wrong standard deduction amount?

While there are no specific penalties for claiming the wrong standard deduction amount, it’s crucial to ensure accuracy. Review your tax return carefully and consult with a tax professional if you have any questions.