What Is Immediate Annuity Plan? It’s a financial product that can provide a guaranteed stream of income for life, starting immediately after purchase. Immediate annuities, often called “single premium immediate annuities” (SPIAs), are a popular choice for retirees looking for reliable income and protection against outliving their savings.

Variable annuities offer potential growth, but they also carry risks. Variable Annuity Has Which Of The Following Characteristics 2024 explains some key characteristics of these annuities, helping you decide if they’re right for you.

Unlike traditional investments, immediate annuities offer a fixed payment schedule, providing financial certainty and peace of mind.

The Annuity Exclusion Ratio 2024 helps determine the taxable portion of your annuity payments. It’s important to understand this ratio when planning your retirement income.

The process of purchasing an immediate annuity involves exchanging a lump sum of money for a series of regular payments. The amount of the payment is determined by factors such as the individual’s age, the interest rate at the time of purchase, and the chosen payout option.

The Formula Annuity Certain 2024 is a specific type of annuity that guarantees payments for a set period. To calculate the exact amount of your annuity payments, you can explore our article on How To Calculate Annuity Using Financial Calculator 2024.

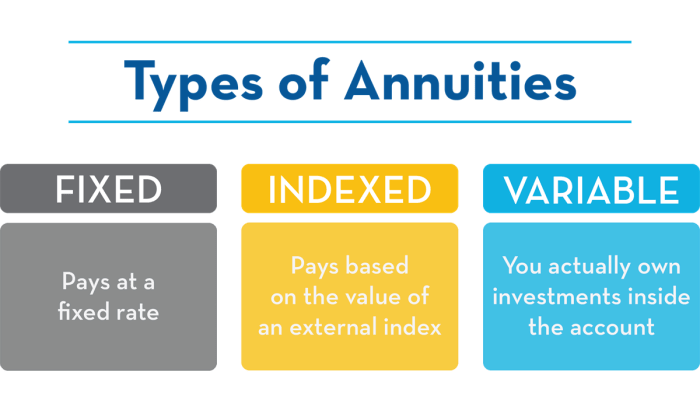

Immediate annuities come with various payout options, including fixed, variable, and indexed annuities, allowing individuals to tailor their income stream to their specific needs and risk tolerance.

What Is an Immediate Annuity Plan?

An immediate annuity plan, often simply referred to as an immediate annuity, is a type of insurance contract that provides a guaranteed stream of income payments for life, starting immediately upon purchase. It’s a popular choice for individuals seeking a reliable source of income in retirement, especially those looking for financial security and protection against outliving their savings.

Core Features of Immediate Annuities

Immediate annuities are characterized by their key features:

- Guaranteed Lifetime Income:The most defining feature of immediate annuities is the guarantee of regular income payments for the rest of the annuitant’s life, regardless of how long they live. This eliminates the risk of outliving one’s savings, a common concern in retirement planning.

Annuity products can be complex, and their suitability depends on individual circumstances. Annuity Is Good Or Bad 2024 explores the pros and cons of annuities, helping you determine if they’re a good fit for your retirement planning.

- Single Premium Payment:Immediate annuities are purchased with a single lump sum payment, which is then used to fund the future income stream. This upfront payment creates a fixed pool of money dedicated to generating income.

- Immediate Payment Commencement:As the name suggests, income payments begin immediately after the annuity is purchased. This contrasts with deferred annuities, where payments are delayed until a future date.

Annuitization: The Core Concept

Annuitization is the process of exchanging a lump sum of money for a guaranteed stream of income payments. When you purchase an immediate annuity, you essentially annuitize your savings. This means you’re trading the potential for investment growth in exchange for the certainty of regular income.

Immediate vs. Deferred Annuities

The primary difference between immediate and deferred annuities lies in the timing of income payments. In an immediate annuity, payments start immediately, while in a deferred annuity, payments are delayed until a specified future date. Deferred annuities allow for a period of growth before income payments begin, making them suitable for individuals with a longer time horizon.

Variable annuities are complex financial products, so it’s essential to understand their workings. Variable Annuity Insurance 2024 explains how these annuities work and the risks involved. To better understand how these annuities function, you can explore our guide on Variable Annuity Meaning 2024.

Suitable Situations for Immediate Annuities

Immediate annuities can be a suitable option in several situations:

- Retirement Income:For individuals entering retirement who need a reliable source of income, immediate annuities can provide a guaranteed stream of payments to cover essential expenses.

- Longevity Risk Mitigation:Immediate annuities offer protection against outliving one’s savings, a significant concern for individuals with a long life expectancy. The guaranteed lifetime income ensures a steady stream of funds regardless of how long they live.

- Legacy Planning:Immediate annuities can be used to provide a stream of income for a surviving spouse or other beneficiaries, ensuring their financial security even after the annuitant’s death.

How Immediate Annuities Work

Purchasing an immediate annuity involves a straightforward process:

Purchasing an Immediate Annuity

- Contact an Insurance Company:You begin by contacting an insurance company that offers immediate annuities. They will provide you with information about their available plans and terms.

- Choose a Payout Option:You’ll need to select a payout option that aligns with your income needs and preferences. Options include fixed, variable, and indexed annuities, each offering different levels of income and potential for growth.

- Determine the Annuity Payment Amount:The insurance company will calculate the monthly or annual income payments based on factors such as your age, the amount of your lump sum payment, the chosen payout option, and prevailing interest rates.

- Fund the Annuity:You’ll make a single lump sum payment to the insurance company to purchase the annuity. This payment becomes the principal that funds the future income stream.

- Receive Income Payments:Once the annuity is purchased, you’ll begin receiving regular income payments, typically monthly, for the rest of your life.

Factors Influencing Annuity Payments

Several factors influence the amount of income payments you’ll receive from an immediate annuity:

- Age:Younger individuals generally receive lower annuity payments than older individuals because they have a longer life expectancy. The insurance company needs to spread the same principal over a longer period.

- Interest Rates:Higher interest rates generally lead to higher annuity payments. This is because the insurance company can earn more on the principal, allowing them to provide larger income payments.

- Payout Option:The chosen payout option significantly impacts the amount of income payments. Fixed annuities provide a guaranteed, fixed income stream, while variable annuities offer the potential for growth but with greater risk.

Payout Options for Immediate Annuities

Immediate annuities offer various payout options to suit different income needs and risk tolerances:

- Fixed Annuities:These provide a guaranteed, fixed income stream for life. The payments remain the same regardless of market fluctuations, offering stability and predictability.

- Variable Annuities:These offer the potential for higher income payments, but they also come with greater risk. The payments are tied to the performance of underlying investments, which can fluctuate in value.

- Indexed Annuities:These offer a combination of guaranteed income and potential for growth. The payments are linked to the performance of a specific index, such as the S&P 500, but with a guaranteed minimum return.

Guaranteed Lifetime Income

The concept of guaranteed lifetime income is central to immediate annuities. It means that the insurance company guarantees to make regular income payments to the annuitant for the rest of their life, regardless of how long they live. This provides peace of mind, knowing that a reliable stream of income is secured for the long term.

Many financial calculators can help you calculate annuity payments. Calculating Annuities On Ba Ii Plus 2024 explains how to use a popular calculator model for these calculations. If you’re considering an annuity in the UK, you can also find helpful information on Annuity Quotes Uk 2024.

Advantages of Immediate Annuities: What Is Immediate Annuity Plan

Immediate annuities offer several advantages, making them an attractive option for retirement income planning:

Benefits of Immediate Annuities

- Guaranteed Income for Life:Immediate annuities provide a guaranteed stream of income payments for the rest of the annuitant’s life, eliminating the risk of outliving their savings.

- Protection Against Outliving Savings:This feature is particularly important for individuals with a long life expectancy, as it ensures they have a steady source of income throughout their retirement years.

- Potential Tax Advantages:Depending on the specific annuity contract and the annuitant’s tax situation, a portion of the income payments may be tax-free.

- Simplicity and Predictability:Immediate annuities offer simplicity and predictability in retirement income planning. The guaranteed income stream provides a reliable budget and eliminates the need for complex investment management.

Comparison with Other Retirement Income Options

Immediate annuities offer a distinct advantage compared to other retirement income options:

| Option | Advantages | Disadvantages |

|---|---|---|

| Traditional Pensions | Guaranteed income for life, often with cost-of-living adjustments. | Becoming increasingly rare, may be subject to employer solvency risks. |

| Investment Accounts | Potential for higher returns, control over investments. | Risk of market fluctuations, potential for outliving savings. |

| Immediate Annuities | Guaranteed income for life, protection against outliving savings. | Limited access to principal, potential for lower returns compared to investments. |

Supplementing Other Income Sources

Immediate annuities can be used to supplement other income sources, such as Social Security or retirement savings withdrawals. They can provide a steady stream of income to cover essential expenses, allowing individuals to draw down their savings at a slower pace.

Looking for a retirement income strategy? Leaders 2 Variable Annuity 2024 might be worth exploring. This type of annuity offers the potential for growth, but it’s important to understand the risks involved. You can learn more about the pros and cons of different annuity options in our article on Variable Annuity Vs Fixed Annuity 2024.

Disadvantages of Immediate Annuities

While immediate annuities offer several advantages, it’s important to consider their potential drawbacks:

Potential Drawbacks of Immediate Annuities

- Limited Access to Principal:Once you purchase an immediate annuity, you typically lose access to the principal. The insurance company uses the principal to fund the income payments, and you can’t withdraw it.

- Potential for Lower Returns Compared to Investments:The guaranteed income stream of an immediate annuity comes at the cost of potential investment growth. Investments, while riskier, could potentially generate higher returns over time.

- Risk of Inflation Eroding Purchasing Power:The fixed income payments of an immediate annuity may not keep pace with inflation, eroding their purchasing power over time.

- Annuitization Trade-off:Annuitization involves a trade-off between guaranteed income and the potential for growth. By annuitizing your savings, you’re giving up the potential for higher returns in exchange for the certainty of regular income.

Investment Goals and Risk Tolerance

Before purchasing an immediate annuity, it’s crucial to carefully consider your investment goals and risk tolerance. If you’re highly risk-averse and prioritize guaranteed income, an immediate annuity may be a suitable option. However, if you’re comfortable with risk and seeking potential for growth, other investment options may be more appropriate.

If you’re considering an annuity in Hong Kong, Immediate Annuity Hong Kong can help you navigate the options available. It’s important to carefully consider the different types of annuities and their features before making a decision.

Choosing an Immediate Annuity Plan

Selecting the right immediate annuity plan requires careful consideration of several factors:

Key Factors to Consider

- Issuing Company’s Financial Stability:Choose an annuity plan issued by a financially sound insurance company with a strong track record. This ensures the reliability of your income payments.

- Annuity Terms and Conditions:Thoroughly review the annuity contract’s terms and conditions, including the payout options, surrender charges, and death benefits.

- Payout Options Offered:Choose a payout option that aligns with your income needs and risk tolerance. Consider factors such as fixed income, potential for growth, and the duration of payments.

- Fees and Expenses:Compare the fees and expenses associated with different annuity plans to ensure you’re getting a competitive product.

Comparing Annuity Plans

When comparing different annuity plans, consider the following:

- Guaranteed Income Amount:Compare the guaranteed income payments offered by different plans, taking into account your age, the lump sum payment, and the chosen payout option.

- Payout Options:Compare the payout options available, including fixed, variable, and indexed annuities. Consider the potential for growth and the level of risk involved.

- Fees and Expenses:Compare the fees and expenses associated with each plan, such as surrender charges, administrative fees, and mortality and expense charges.

- Death Benefits:Compare the death benefits offered, which may include a lump sum payment to beneficiaries or a continuation of income payments to a surviving spouse.

Seeking Professional Financial Advice

It’s highly recommended to seek professional financial advice from a qualified financial advisor before purchasing an immediate annuity. They can help you assess your individual needs, goals, and risk tolerance and recommend an annuity plan that aligns with your circumstances.

For those working in the Federal government, understanding annuity calculations is crucial. Calculating A Federal Annuity – Fers 2024 provides insights into how these annuities are calculated, helping you plan for your future.

Immediate Annuities in Retirement Planning

Immediate annuities can play a valuable role in a comprehensive retirement plan:

Integrating Immediate Annuities into Retirement Plans

- Reliable Income Stream:Immediate annuities provide a reliable stream of income during retirement, ensuring financial security and covering essential expenses.

- Longevity Risk Mitigation:They offer protection against outliving one’s savings, a critical concern for individuals with a long life expectancy.

- Income Diversification:Immediate annuities can diversify retirement income sources, reducing reliance on other investments or savings withdrawals.

Ensuring Financial Security in Retirement, What Is Immediate Annuity Plan

By providing a guaranteed stream of income, immediate annuities can help mitigate longevity risk and ensure financial security in retirement. They can provide peace of mind, knowing that a reliable source of income is secured for the long term.

When it comes to inherited annuities, understanding the tax implications is crucial. How Is Inherited Annuity Taxed 2024 provides information on the tax treatment of inherited annuities, helping you make informed financial decisions.

Final Wrap-Up

Immediate annuities offer a compelling solution for retirees seeking guaranteed income and protection against longevity risk. However, it’s crucial to carefully consider the potential drawbacks, such as limited access to principal and potential for lower returns compared to investments.

Retirement planning often involves understanding specific rules and regulations. The Annuity 59.5 Rule 2024 allows you to withdraw funds from your annuity without penalty before age 59 1/2 under certain circumstances. This rule can be particularly relevant if you’re planning to access your retirement savings early.

Ultimately, the decision of whether an immediate annuity is right for you depends on your individual circumstances, financial goals, and risk tolerance. Consulting with a qualified financial advisor can help you determine if an immediate annuity fits within your overall retirement plan.

Common Queries

What are the tax implications of immediate annuities?

The tax treatment of immediate annuity payments depends on the type of annuity and the individual’s tax situation. Generally, a portion of each payment is considered a return of principal, which is not taxed, while the remaining portion is considered taxable income.

It’s essential to consult with a tax advisor to understand the specific tax implications for your situation.

Can I withdraw my principal from an immediate annuity?

Immediate annuities are designed to provide a stream of income for life. Once you purchase an immediate annuity, you typically cannot access the principal. However, some annuity contracts may offer limited withdrawal options or death benefits for beneficiaries.

How can I compare different immediate annuity plans?

When comparing immediate annuity plans, consider factors such as the issuing company’s financial stability, the annuity’s terms and conditions, the payout options offered, and the interest rate guarantee. You can also use online annuity calculators to compare different plans and their projected payments.