What Is An Immediate Annuity? Imagine receiving a guaranteed stream of income for life, starting immediately. That’s the promise of an immediate annuity, a financial product designed to provide a steady income stream during retirement. Unlike deferred annuities, which begin payouts at a later date, immediate annuities start providing income as soon as you purchase them.

Variable annuities allow you to withdraw funds, but there are specific rules and limitations to be aware of. You can find more information about Variable Annuity Withdrawals 2024 to ensure you understand the process.

This type of annuity allows you to convert a lump sum of money into a regular income stream, eliminating the need to worry about investment risk and market fluctuations. Whether you’re seeking a reliable source of income, looking to protect against outliving your savings, or simply desire financial peace of mind, immediate annuities can be a valuable tool in your retirement planning toolbox.

Schwab offers immediate annuities as part of their financial products. You can find more information about their offerings on Immediate Annuity Schwab.

What Is an Immediate Annuity?

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income for life, starting immediately after you purchase it. Think of it as a financial product that allows you to trade a lump sum of money for a regular, predictable income stream.

An annuity is a financial product that provides a stream of payments for a set period of time. If you’re curious about the details, you can find more information on Annuity What Is The Meaning 2024.

It’s designed to provide financial security during retirement, ensuring you have a steady source of income even if you live longer than expected.

Variable annuities can offer some tax benefits, but these benefits can vary depending on the specific annuity and your individual circumstances. You can find more information about Variable Annuity Tax Benefits 2024 to make informed decisions.

Defining Immediate Annuities

In simple terms, an immediate annuity is like a pension plan you buy for yourself. You give the insurance company a lump sum of money, and in return, they promise to pay you a fixed amount of money each month for the rest of your life.

A 5% annuity is a type of annuity that provides a guaranteed return of 5% per year. If you’re interested in learning more about this specific type of annuity, you can find more information on 5 Percent Annuity 2024.

The amount of income you receive depends on several factors, including the amount of money you invest, your age, and the type of annuity you choose.

How Immediate Annuities Differ From Deferred Annuities

Immediate annuities differ from deferred annuities in terms of when the income payments begin. While immediate annuities start paying out right away, deferred annuities have a delay period. You purchase a deferred annuity and let it grow for a certain number of years before starting to receive payments.

This makes deferred annuities a better option for those who are still working and saving for retirement, while immediate annuities are more suitable for those who are already retired or planning to retire soon.

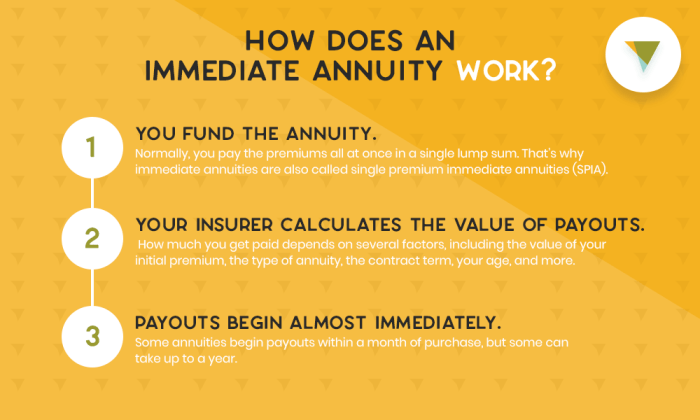

How Immediate Annuities Work

Here’s a breakdown of how immediate annuities work:

- You purchase an immediate annuity with a lump sum of money. This could be from savings, retirement accounts, or other investments.

- The insurance company uses your money to invest in a variety of assets, such as bonds, stocks, and real estate.

- The insurance company guarantees to pay you a fixed amount of income each month for the rest of your life, regardless of how long you live.

- The payments can be structured in various ways, such as a single life annuity (payments end upon your death) or a joint life annuity (payments continue for the lifetime of both you and your spouse).

Benefits of Immediate Annuities

Immediate annuities offer several advantages for retirement planning, making them a valuable tool for those seeking financial security and income stability.

Variable annuities are a complex investment product with unique characteristics. You can learn more about the specific characteristics of variable annuities on A Variable Annuity Has Which Of The Following Characteristics 2024.

Guaranteed Income Stream

Immediate annuities provide a guaranteed income stream for life, eliminating the uncertainty of market fluctuations and investment risk. This is especially important for retirees who need a reliable source of income to cover their living expenses.

An immediate annuity is a type of annuity that begins making payments immediately after you purchase it. If you’re interested in getting a quote for this type of annuity, you can find more information on Immediate Annuity Quote.

Protection Against Longevity Risk

Longevity risk refers to the risk of outliving your savings. Immediate annuities help mitigate this risk by providing a guaranteed income stream for as long as you live, regardless of how long you live. This ensures you have a steady source of income even if you live longer than expected.

Calculating the return on your annuity investment is important for understanding its performance. You can find resources to help you Calculate Annuity Return 2024 and track your progress.

Advantages for Retirement Planning

Immediate annuities can play a crucial role in retirement planning, offering several advantages:

- Income stability:Immediate annuities provide a reliable and predictable source of income, helping you budget for expenses and maintain a comfortable lifestyle in retirement.

- Investment protection:By converting your savings into a guaranteed income stream, you protect your principal from market fluctuations and potential losses.

- Peace of mind:Knowing you have a guaranteed income stream for life can provide peace of mind and reduce financial stress during retirement.

- Flexibility:Immediate annuities offer various payment options and features to suit your individual needs and circumstances.

Types of Immediate Annuities

Immediate annuities come in various types, each with its own features, benefits, and risks. Understanding the different types of annuities can help you choose the one that best aligns with your financial goals and risk tolerance.

When considering an annuity, it’s crucial to understand how your investment will grow over time. This is where calculating the annuity rate of return comes into play. You can learn how to Calculating Annuity Rate Of Return 2024 to make sure it aligns with your financial goals.

Fixed Immediate Annuities

Fixed immediate annuities provide a guaranteed fixed income stream for life. The payment amount is determined at the time of purchase and remains the same throughout the duration of the annuity. This type of annuity offers predictability and stability, but it may not keep pace with inflation.

An immediate needs annuity is a type of annuity designed to provide income for immediate needs. If you’re interested in learning more about this type of annuity, you can find a questionnaire on Immediate Needs Annuity Questionnaire.

Variable Immediate Annuities

Variable immediate annuities offer a variable income stream that fluctuates based on the performance of the underlying investment portfolio. The payment amount can go up or down depending on market conditions. Variable annuities offer the potential for higher returns but also come with greater risk.

There are online tools available that allow you to calculate annuity returns without providing personal details. You can find a helpful calculator on Annuity Calculator No Personal Details 2024.

This type of annuity is best suited for those who are comfortable with market volatility and have a higher risk tolerance.

Indexed Immediate Annuities, What Is An Immediate Annuity

Indexed immediate annuities offer a fixed income stream with the potential for growth tied to a specific index, such as the S&P 500. The payment amount is adjusted periodically based on the performance of the index, offering a balance between stability and potential growth.

Annuity yields are an important factor to consider when evaluating different annuity options. You can find a useful tool to calculate annuity yields on Annuity Yields Calculator 2024.

Indexed annuities provide some protection against inflation while offering the potential for higher returns compared to fixed annuities. However, they may not keep pace with inflation or market returns as much as variable annuities.

Considerations When Choosing an Immediate Annuity

Choosing the right immediate annuity is crucial for ensuring you get the most out of your retirement savings. Several factors should be considered when making this decision.

If you’re looking for an annuity calculator specifically designed for use in the United States, you can find one on Annuity Calculator Usa 2024.

Key Factors to Consider

When selecting an immediate annuity, it’s essential to consider these key factors:

- Your financial goals:What are your retirement income needs? How much income do you require to maintain your desired lifestyle?

- Your risk tolerance:How comfortable are you with market volatility? Do you prefer a guaranteed income stream or are you willing to accept some risk for the potential of higher returns?

- Your age and health:Your age and health status can influence the annuity’s payout amount and duration.

- Your life expectancy:Consider your life expectancy and the length of time you need the income stream.

- Your investment horizon:How long do you plan to use the annuity? Short-term or long-term needs can influence the type of annuity you choose.

Understanding the Annuity Contract

It’s crucial to thoroughly understand the terms and conditions of the annuity contract before purchasing. This includes:

- Payment amount:How much will you receive each month?

- Payment frequency:Will you receive monthly, quarterly, or annually?

- Duration of payments:How long will the payments continue?

- Fees and expenses:What are the fees and expenses associated with the annuity?

- Death benefits:What happens to the annuity payments if you die before the end of the payout period?

- Withdrawal options:Are you allowed to withdraw a portion of your principal?

Selecting an Annuity Provider

Choosing the right annuity provider is just as important as selecting the right annuity. Here are some tips for selecting an annuity provider:

- Financial stability:Choose a reputable insurance company with a strong financial track record.

- Customer service:Look for a provider with excellent customer service and a responsive support team.

- Transparency:Choose a provider that is transparent about its fees and expenses.

- Product offerings:Ensure the provider offers a variety of annuity products to meet your specific needs.

Final Review

In conclusion, immediate annuities offer a unique and potentially valuable approach to retirement income planning. They provide guaranteed income, protection against longevity risk, and a sense of financial security. However, it’s crucial to carefully consider the different types of annuities, their features, and your individual circumstances before making a decision.

Variable annuities are a type of investment that can offer both growth potential and income security. However, they also carry some risks, so it’s important to understand the potential downsides before investing. You can learn more about the Variable Annuity Risk 2024 and make informed decisions about whether this investment is right for you.

Consulting with a financial advisor can help you determine if an immediate annuity is the right fit for your retirement goals.

FAQ Summary

How much money do I need to purchase an immediate annuity?

Variable annuities are a type of investment that offers potential growth but doesn’t provide a guaranteed rate of return. It’s essential to remember that A Variable Annuity Does Not Provide 2024 a guaranteed return, so understand the risks involved.

The amount you need to purchase an immediate annuity depends on factors such as your age, the type of annuity you choose, and the desired income stream. It’s best to consult with an insurance agent or financial advisor to determine the appropriate amount for your specific needs.

Can I withdraw my money from an immediate annuity?

Generally, you can’t withdraw the principal amount you invested in an immediate annuity. However, some annuities may offer limited withdrawal options or death benefits for beneficiaries.

What happens if I die before I receive all my annuity payments?

Depending on the type of annuity you purchase, your beneficiary may receive a lump sum payment or continued income payments. This is a crucial aspect to consider when choosing an annuity.

How do I find a reputable annuity provider?

Look for reputable insurance companies with a strong financial rating. You can check ratings from organizations like A.M. Best or Standard & Poor’s. It’s also wise to seek recommendations from trusted financial advisors.