What Is A Variable Annuity 2024? This question is on the minds of many investors seeking a path to retirement security. Variable annuities offer a unique approach to savings, combining the potential for growth with the security of guaranteed payments.

Annuity payments can vary, with some individuals receiving a annuity of $2,000 per month in 2024. This amount can depend on factors like the initial investment and the chosen annuity type.

But with any investment, understanding the intricacies is crucial. This guide delves into the world of variable annuities, explaining their workings, benefits, and risks to help you make informed decisions about your financial future.

Staying informed about the latest developments in the annuity market is crucial. You can find updates on variable annuity news in 2024 through financial news sources and industry publications.

Variable annuities, unlike their fixed counterparts, are tied to the performance of underlying investments. Think of them as a hybrid of insurance and investment, offering the potential for growth in line with the market while providing certain guarantees. This duality is what makes variable annuities a complex, yet potentially rewarding, investment option.

Annuity contracts often have specific terms and conditions, including the duration of payments. Some annuities may have a duration that is expressed in a specific number of years, like the 9-letter annuity in 2024.

What Is a Variable Annuity?

A variable annuity is a type of retirement savings product that offers the potential for growth based on the performance of underlying investments. It’s designed to help individuals accumulate wealth for retirement and provide a stream of income during their golden years.

Defining a Variable Annuity

A variable annuity is a contract between an individual and an insurance company. The individual invests a lump sum or makes regular payments into the annuity, and the insurance company manages the funds in a variety of investment options. The value of the annuity fluctuates based on the performance of the underlying investments.

How a Variable Annuity Works

The core components of a variable annuity include:

- Premium Payments:You contribute funds to the annuity, either as a lump sum or through regular installments.

- Sub-Accounts:The premium payments are allocated to different sub-accounts, each representing a specific investment option.

- Investment Options:These sub-accounts typically offer a range of mutual funds, including stock funds, bond funds, and money market funds. You choose how to allocate your premium payments among these sub-accounts based on your risk tolerance and investment goals.

- Growth Potential:The value of your annuity grows based on the performance of the chosen sub-accounts. If the investments perform well, your annuity value will increase. Conversely, if the investments perform poorly, your annuity value may decrease.

- Annuitization:When you reach retirement, you can choose to annuitize your annuity. This means you convert the accumulated value of your annuity into a guaranteed stream of income for life. The amount of income you receive depends on the value of your annuity at the time of annuitization and the chosen annuitization option.

Variable annuities involve various financial terms and concepts. Familiarizing yourself with the variable annuity terminology in 2024 will help you understand the intricacies of this investment option.

Variable Annuity vs. Fixed Annuity

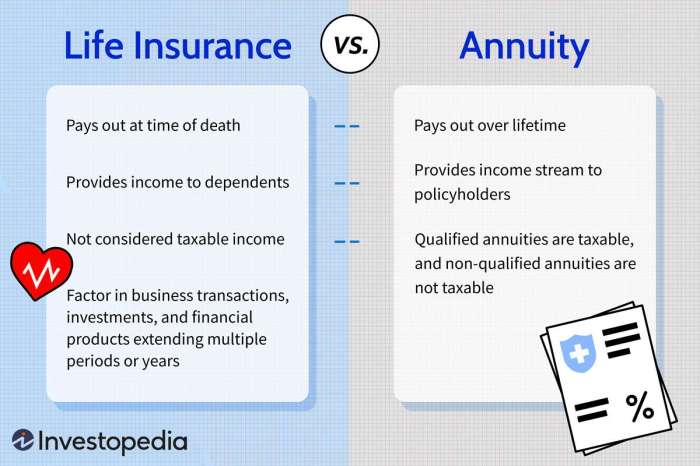

A fixed annuity provides a guaranteed rate of return, typically a fixed interest rate, for a specified period. The value of a fixed annuity does not fluctuate with market conditions. On the other hand, a variable annuity offers the potential for higher returns but also carries the risk of losing money.

Annuities can be categorized as fixed or variable, offering different levels of risk and potential returns. A fixed variable annuity in 2024 might combine elements of both types, providing a balanced approach.

Benefits of Variable Annuities

Variable annuities often have surrender charges, which can vary depending on the share class. For instance, variable annuity share class C surrender charges in 2024 might be higher than those for other share classes.

- Growth Potential:Variable annuities offer the potential for higher returns compared to fixed annuities, as the value of the annuity is linked to the performance of the underlying investments.

- Tax-Deferred Growth:Earnings from a variable annuity are not taxed until they are withdrawn in retirement, providing tax-deferred growth.

- Death Benefit:Some variable annuities include a death benefit feature that guarantees a minimum payout to your beneficiaries in the event of your death. This can provide financial protection for your loved ones.

- Investment Flexibility:You have the flexibility to choose from a range of investment options within a variable annuity, allowing you to tailor your investment strategy to your risk tolerance and goals.

Risks of Variable Annuities

Annuities are available in various countries, including the United Kingdom. If you’re considering an annuity in the UK, research the annuity landscape in the UK in 2024 to understand the specific regulations and options available.

- Market Risk:The value of a variable annuity is subject to market fluctuations, meaning you could lose money if the investments in your sub-accounts perform poorly.

- Annuitization Risk:When you annuitize your variable annuity, you receive a guaranteed stream of income for life, but the amount of income is based on the value of your annuity at the time of annuitization. If the market has declined, your income stream may be lower than expected.

- Fees and Expenses:Variable annuities often have higher fees and expenses compared to other investment options, which can impact your overall returns.

- Complexity:Variable annuities can be complex products, requiring careful consideration and understanding of the risks involved.

Sub-Accounts

Sub-accounts are the core of a variable annuity. They represent individual investment portfolios within the annuity. Each sub-account is linked to a specific mutual fund, allowing you to diversify your investments across different asset classes.

Investment Options

Variable annuities typically offer a wide range of investment options, including:

- Stock Funds:These funds invest in stocks, providing the potential for high returns but also carrying higher risk.

- Bond Funds:These funds invest in bonds, offering lower risk and potentially lower returns than stock funds.

- Money Market Funds:These funds invest in short-term debt securities, providing a relatively safe and liquid investment option.

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as you approach retirement.

Fees and Expenses

Variable annuities typically come with a variety of fees and expenses, including:

- Mortality and Expense Risk Charges:These charges cover the insurance company’s costs of providing the death benefit and other features of the annuity.

- Administrative Fees:These fees cover the costs of managing the annuity, such as account maintenance and record-keeping.

- Investment Management Fees:These fees are charged by the mutual funds within the sub-accounts.

Death Benefit Feature

The death benefit feature of a variable annuity guarantees a minimum payout to your beneficiaries in the event of your death. This benefit can be a valuable safety net for your loved ones.

Variable Annuities in Retirement Planning

Variable annuities can be a valuable tool for retirement planning, offering the potential for growth and income generation. They can be used to:

- Accumulate Retirement Savings:Variable annuities provide a tax-deferred environment for accumulating wealth for retirement.

- Generate Retirement Income:When you annuitize your variable annuity, you receive a guaranteed stream of income for life.

- Protect Against Inflation:The potential for growth in a variable annuity can help protect your retirement savings from inflation.

Advantages and Disadvantages Table

| Advantages | Disadvantages |

|---|---|

| Potential for higher returns | Market risk |

| Tax-deferred growth | Annuitization risk |

| Death benefit feature | Fees and expenses |

| Investment flexibility | Complexity |

Tax Benefits, What Is A Variable Annuity 2024

Variable annuities offer tax-deferred growth, meaning earnings are not taxed until they are withdrawn in retirement. This can provide significant tax savings over time.

Variable annuities offer flexibility, but they also come with fees. Understanding the variable annuity fees in 2024 is essential before investing, as these can impact your overall returns.

Guaranteed Minimum Death Benefits

Some variable annuities offer a guaranteed minimum death benefit, which ensures that your beneficiaries will receive a minimum payout even if the value of your annuity has declined.

Suitable Investment Option

Variable annuities can be a suitable investment option for individuals who:

- Have a long investment horizon.

- Are comfortable with market risk.

- Are seeking potential for higher returns.

- Want a tax-deferred investment vehicle.

- Value the death benefit feature.

Drawbacks and Risks

- Market Risk:As mentioned earlier, the value of a variable annuity is subject to market fluctuations, meaning you could lose money if the investments in your sub-accounts perform poorly.

- Fees and Expenses:Variable annuities often have higher fees and expenses compared to other investment options, which can impact your overall returns.

- Complexity:Variable annuities can be complex products, requiring careful consideration and understanding of the risks involved.

Market Conditions and Impact

The current market conditions are volatile, with inflation, rising interest rates, and geopolitical uncertainty impacting investment returns. These factors can influence the performance of variable annuities, as the value of the underlying investments fluctuates.

Calculating the rate of return on an annuity can be complex, but it’s essential for evaluating its performance. Tools and methods exist to help you calculate the annuity rate of return in 2024.

Regulatory Changes

The regulatory landscape for variable annuities is constantly evolving. Recent changes have focused on increasing transparency and consumer protection, including requirements for clearer disclosures of fees and expenses.

The UK government provides resources and tools for individuals seeking financial planning assistance, including an annuity calculator on the UK government website in 2024. This calculator can help estimate potential annuity payments.

Interest Rate Environment

Rising interest rates can impact the performance of variable annuities, particularly those with sub-accounts that invest in bonds. Higher interest rates can lead to lower bond prices, potentially affecting the value of the annuity.

The amount of annuity payments can be substantial, with some individuals receiving annuities exceeding $600,000 in 2024. This depends on the initial investment and the chosen annuity type.

Trends and Innovations

The variable annuity market is evolving, with new trends and innovations emerging. These include:

- Increased Focus on Income Annuities:Variable annuities are increasingly incorporating features that provide guaranteed income streams in retirement.

- Greater Use of Technology:Variable annuity providers are leveraging technology to improve the customer experience, offering online platforms for account management and investment tracking.

Outlook for Variable Annuities

The outlook for variable annuities in the coming years is uncertain, influenced by factors such as market conditions, interest rates, and regulatory changes. However, variable annuities can continue to play a role in retirement planning for individuals who are comfortable with the risks involved.

Index annuities are a specific type of annuity linked to a particular market index. Understanding the what an index annuity is in 2024 is crucial before investing in this type of product.

Final Wrap-Up: What Is A Variable Annuity 2024

Navigating the variable annuity landscape requires careful consideration. While they offer potential growth and protection, understanding the risks and fees is paramount. Consulting with a financial advisor can provide personalized guidance, helping you determine if a variable annuity aligns with your investment goals and risk tolerance.

The number of annuities an individual holds can vary. Some may have multiple annuities, such as a 3-annuity portfolio in 2024. This can be a strategic approach to diversifying income streams.

Remember, informed decisions are the cornerstone of a secure financial future.

FAQ Section

What is the difference between a variable annuity and a fixed annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments. Fixed annuities are less risky, but their returns are capped, while variable annuities have the potential for higher returns but also carry greater risk.

How do I choose the right variable annuity for my needs?

Consider your risk tolerance, investment goals, and time horizon. Consult with a financial advisor to discuss your specific circumstances and find a variable annuity that aligns with your financial plan.

What are the tax implications of variable annuities?

Learning about annuities can be facilitated through resources like Khan Academy. Their comprehensive materials provide insights into the concept, including the annuity topic on Khan Academy in 2024.

Withdrawals from a variable annuity before age 59 1/2 are typically subject to a 10% penalty, plus your ordinary income tax rate. However, withdrawals after age 59 1/2 are taxed as ordinary income.

Are variable annuities right for everyone?

Understanding the different types of annuities is crucial, especially when considering a single payment annuity in 2024. This type involves a lump sum payment upfront, which then generates regular income streams for a set period.

Variable annuities are not a one-size-fits-all solution. They can be suitable for individuals with a long-term investment horizon and a moderate to high risk tolerance. It’s essential to carefully assess your financial situation and goals before making a decision.