What Influences the Size of Your Capital One Payout? This question is at the heart of understanding how to maximize your rewards from Capital One’s credit card programs. Whether you’re looking to redeem points for travel, merchandise, or cash back, knowing what factors influence your payout is key to making the most of your rewards.

Capital One offers a variety of credit cards with different rewards programs, each with its own set of rules and earning structures. Understanding how your spending habits impact your rewards is crucial, as are the different types of purchases you make.

Additionally, Capital One offers various bonus categories and promotions that can significantly boost your rewards potential.

Understanding Capital One Rewards

Capital One is known for its diverse range of credit cards, each offering unique rewards programs designed to cater to different spending habits and preferences. Understanding how these programs work is crucial for maximizing your benefits and making informed financial decisions.

This article delves into the intricacies of Capital One rewards, exploring factors that influence the size of your payout, the redemption options available, and the terms and conditions that govern these programs.

In this topic, you find that Who Can Claim Capital One Payout? is very useful.

Capital One Credit Card Rewards Programs

Capital One offers a variety of credit cards with different rewards programs, each designed to appeal to specific cardholders. These programs typically revolve around earning rewards points for everyday purchases, which can then be redeemed for travel, merchandise, or cash back.

You also can understand valuable knowledge by exploring Eligibility Guidelines for Capital One Compensation.

- Capital One Venture X Rewards Credit Card:This card is ideal for frequent travelers, offering 2 miles per dollar spent on all purchases, including travel, dining, and groceries. These miles can be redeemed for flights, hotels, and other travel expenses at a value of 1 cent per mile.

You also can investigate more thoroughly about Are You Eligible for the Capital One Settlement Payout? to enhance your awareness in the field of Are You Eligible for the Capital One Settlement Payout?.

- Capital One Venture Rewards Credit Card:Similar to the Venture X, this card offers 2 miles per dollar spent on all purchases, but with a slightly lower redemption value of 0.8 cents per mile. However, it comes with a lower annual fee, making it more accessible to budget-conscious travelers.

- Capital One SavorOne Rewards Credit Card:This card is designed for foodies, offering 3 points per dollar spent at restaurants and entertainment venues, and 1 point per dollar on all other purchases. These points can be redeemed for travel, merchandise, or cash back at a value of 1 cent per point.

Obtain recommendations related to How to Find Out If You Qualify for the Settlement that can assist you today.

- Capital One Quicksilver Rewards Credit Card:This card is a straightforward option for everyday spending, offering 1.5 miles per dollar spent on all purchases. These miles can be redeemed for travel, merchandise, or cash back at a value of 1 cent per mile.

Examples of Reward Redemption

Here are some examples of how Capital One rewards points can be redeemed:

- Travel:A flight from New York to Los Angeles, costing $500, could be redeemed for 50,000 miles with the Capital One Venture X or Venture Rewards Credit Cards.

- Merchandise:A $100 gift card to Amazon could be redeemed for 10,000 points with the Capital One SavorOne Rewards Credit Card.

- Cash Back:$100 in cash back could be redeemed for 10,000 points with the Capital One Quicksilver Rewards Credit Card.

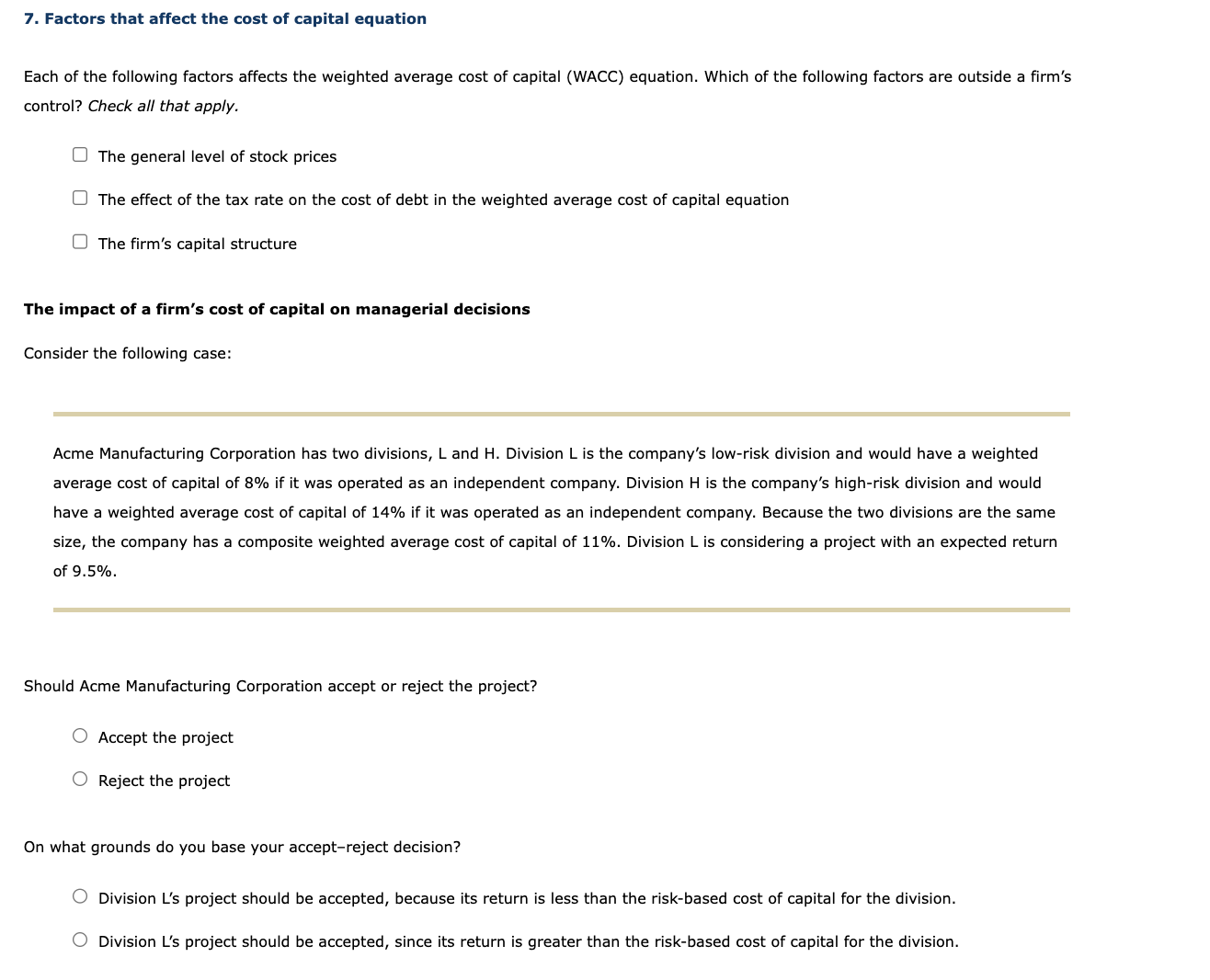

Factors Influencing Payout Size: What Influences The Size Of Your Capital One Payout?

The size of your Capital One rewards payout is influenced by several factors, including your spending activity, credit card usage patterns, and the specific rewards program associated with your card. Understanding these factors can help you optimize your rewards earning potential.

Spending Activity and Rewards Accumulation

The more you spend using your Capital One credit card, the more rewards points you accumulate. However, the rate at which you earn points varies depending on the type of purchases you make and the specific rewards program you’re enrolled in.

Credit Card Usage Patterns and Rewards

Your credit card usage patterns also play a role in your rewards earnings. For instance, if you frequently use your card for travel-related expenses, you’ll earn more rewards with a travel-focused credit card like the Capital One Venture X or Venture Rewards Credit Card.

You also can understand valuable knowledge by exploring How the Payout Amount Is Calculated.

Conversely, if you primarily use your card for dining and entertainment, the Capital One SavorOne Rewards Credit Card would be a more rewarding option.

Check what professionals state about Why Some People Are Not Eligible for the Capital One Payout and its benefits for the industry.

Rewards Earned on Different Purchases

Capital One rewards programs typically offer different earning rates for various categories of purchases. For example, travel cards often offer bonus points for travel-related expenses, while dining cards offer higher rewards for restaurant purchases. It’s essential to analyze your spending habits and choose a credit card that aligns with your typical spending patterns to maximize your rewards potential.

Capital One’s Reward Structure

Capital One calculates reward points based on the specific credit card you use and the type of purchase you make. The reward structure varies depending on the card’s rewards program, offering different earning rates and bonus categories.

You also can understand valuable knowledge by exploring Capital One Settlement: What You Need to Know About Eligibility.

Reward Point Calculation

Most Capital One credit cards offer a base earning rate of 1 to 2 points per dollar spent on all purchases. However, certain cards offer bonus categories that increase the earning rate for specific purchases, such as dining, travel, or groceries.

For example, the Capital One SavorOne Rewards Credit Card offers 3 points per dollar spent at restaurants and entertainment venues, while the Capital One Venture X Rewards Credit Card offers 2 miles per dollar spent on all purchases, including travel, dining, and groceries.

Reward Tiers and Benefits

Capital One may offer different reward tiers based on your spending activity or account status. Higher tiers often come with enhanced benefits, such as increased earning rates, bonus points, or exclusive travel perks. These tiers can provide additional incentives for spending more and maximizing your rewards.

Obtain recommendations related to What Affects Your Eligibility for the Capital One Settlement? that can assist you today.

Bonus Categories and Promotions

Capital One often introduces bonus categories and promotions to encourage specific spending habits and enhance the value of its rewards programs. These promotions may offer increased earning rates for certain categories, such as dining, travel, or online shopping. Staying informed about these promotions can help you maximize your rewards earning potential.

Do not overlook the opportunity to discover more about the subject of How to Determine Your Eligibility for Capital One Compensation.

Redemption Options and Value

Capital One offers various ways to redeem your accumulated rewards points, each with its own value and redemption options. Choosing the best redemption method depends on your individual needs and preferences.

Redemption Options

- Travel:Capital One rewards points can be redeemed for flights, hotels, car rentals, and other travel expenses through the Capital One Travel portal. This portal offers a wide selection of travel options, allowing you to book flights, hotels, and vacation packages directly with your rewards points.

Obtain recommendations related to Capital One Data Breach Victim Eligibility that can assist you today.

- Merchandise:Rewards points can also be redeemed for merchandise through the Capital One Shopping portal. This portal offers a wide variety of products from popular retailers, including electronics, home goods, and clothing.

- Cash Back:You can also redeem your rewards points for cash back, either deposited into your bank account or used as a statement credit. However, the value of your points may be lower when redeemed for cash back compared to other redemption options.

- Gift Cards:Capital One rewards points can also be redeemed for gift cards to popular retailers, such as Amazon, Target, and Walmart. This option can be convenient for those who prefer to use their rewards for specific purchases.

Value of Redeemed Rewards

The value of your redeemed rewards depends on the redemption option you choose. Travel redemptions typically offer the highest value, with points often valued at 1 cent or more per point. Merchandise redemptions generally offer a lower value, while cash back redemptions often have the lowest value.

It’s essential to compare the value of different redemption options to maximize your rewards potential.

Maximizing Redemption Value, What Influences the Size of Your Capital One Payout?

Here are some strategies for maximizing the value of your redeemed rewards:

- Redeem for Travel:Travel redemptions often offer the highest value, especially when booking flights and hotels through the Capital One Travel portal.

- Take Advantage of Promotions:Capital One frequently offers promotions that enhance the value of your rewards points. For example, they may offer bonus miles or points for travel bookings or merchandise purchases.

- Redeem for High-Value Items:When redeeming for merchandise, consider choosing high-value items to maximize the value of your points.

- Avoid Cash Back Unless Necessary:Cash back redemptions generally offer the lowest value, so avoid them unless you need cash immediately.

Capital One’s Terms and Conditions

Capital One’s rewards programs are subject to terms and conditions that govern the earning and redemption of rewards points. Understanding these terms is crucial for maximizing your rewards potential and avoiding any surprises or disappointments.

Earning and Redeeming Rewards

Capital One’s terms and conditions Artikel the specific rules for earning and redeeming rewards points. These rules may vary depending on the credit card and rewards program you’re enrolled in. For example, some cards may have limitations on the types of purchases that qualify for rewards points, while others may have minimum redemption thresholds for certain rewards options.

Limitations and Restrictions

Capital One’s rewards programs may have limitations or restrictions on the earning and redemption of rewards points. For instance, some cards may have annual spending limits that restrict the number of rewards points you can earn. Additionally, there may be blackout dates or other restrictions on travel redemptions.

Further details about Eligibility Checklist for Capital One Payout Claims is accessible to provide you additional insights.

It’s essential to carefully review the terms and conditions to understand any limitations or restrictions that may apply to your rewards program.

Account Status and Rewards

Your account status with Capital One can impact your rewards eligibility. If you have a good standing account with a positive payment history, you’ll typically have full access to your rewards program. However, if you have a history of late payments or other account issues, your rewards eligibility may be affected.

It’s important to maintain a good payment history to ensure you can fully utilize your rewards program.

Closing Summary

Ultimately, maximizing your Capital One payout involves a combination of understanding the intricacies of their rewards programs, choosing the right credit card for your needs, and taking advantage of opportunities to earn bonus rewards. By carefully considering the factors that influence your payout size, you can ensure you’re getting the most out of your Capital One rewards.

Helpful Answers

How do I track my Capital One rewards points?

You can track your rewards points through your online Capital One account or the Capital One mobile app.

Can I transfer my Capital One rewards points to other programs?

Capital One does not currently offer the ability to transfer rewards points to other programs.

What happens to my rewards points if my Capital One account is closed?

Your rewards points will typically expire if your account is closed, though there may be exceptions depending on the specific terms and conditions of your card.