What Income is Included? Investment Income Sources and Exclusions is a critical topic for anyone seeking to understand and manage their finances. Whether you are a seasoned investor or just starting your investment journey, knowing which types of income are included and excluded from your investment portfolio is essential for making informed financial decisions.

This guide provides a comprehensive overview of investment income, its sources, and the tax implications associated with it.

From dividends and interest to capital gains and rental income, investment income comes in various forms. Understanding these sources and how they are taxed is crucial for maximizing returns and minimizing tax liabilities. This guide will delve into the intricacies of investment income, providing a clear understanding of its different facets and how it impacts your financial well-being.

Sources of Investment Income: What Income Is Included? Investment Income Sources And Exclusions

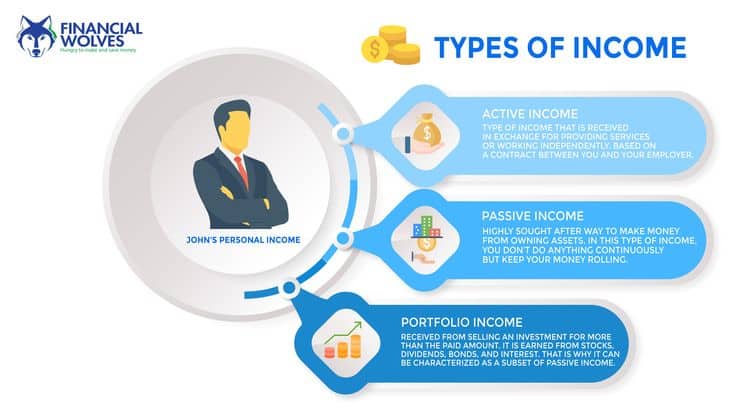

Investment income refers to the earnings generated from various investments, including stocks, bonds, real estate, and more. Understanding the different sources of investment income is crucial for investors to make informed decisions and manage their finances effectively.

If you’re looking for investments that make a difference, you need to check out this article on impact investing. It’s all about generating financial returns while doing good for the world. It’s a win-win, mate.

Types of Investment Income

Investment income can be categorized into different types, each with its unique characteristics and tax implications. Here’s a table summarizing some common investment income sources:

| Investment Type | Description | Examples | Taxation |

|---|---|---|---|

| Stocks | Shares of ownership in a company. | Apple Inc. (AAPL), Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN) | Capital gains tax on profits from selling stocks, dividends are taxed as ordinary income. |

| Bonds | Debt securities representing a loan to a borrower. | U.S. Treasury bonds, corporate bonds, municipal bonds | Interest income is taxed as ordinary income. |

| Real Estate | Land and any structures built on it. | Residential properties, commercial buildings, rental properties | Rental income is taxed as ordinary income, capital gains tax on profits from selling real estate. |

| Mutual Funds | A portfolio of securities managed by a professional. | Vanguard S&P 500 Index Fund (VOO), Fidelity Magellan Fund (FMAGX), Schwab Total Stock Market Index (SWTSX) | Dividends and capital gains distributions are taxed as ordinary income. |

| Exchange-Traded Funds (ETFs) | Similar to mutual funds, but traded on stock exchanges. | SPDR S&P 500 ETF (SPY), iShares Core US Aggregate Bond ETF (AGG), Vanguard Total Stock Market ETF (VTI) | Dividends and capital gains distributions are taxed as ordinary income. |

Tax Treatment of Investment Income, What Income is Included? Investment Income Sources and Exclusions

The tax treatment of investment income varies depending on the type of investment and the investor’s circumstances.

Now, you might be thinking, “Net investment income tax? What’s that all about?”. Well, if you’re into investing, you need to get your head around it. The Net Investment Income Tax is a real thing, and it can affect your bottom line.

Check out this guide to get the lowdown on how it works.

For example, dividends from stocks are taxed as ordinary income, while capital gains from selling stocks are taxed at different rates depending on the holding period.

Right, so you wanna know how businesses are tackling the climate crisis? Well, the DealBook Summit 2024 is all about that. It’s a real game-changer, with bigwigs from the business world discussing how to make a difference. From green finance to sustainable investing, they’re getting real about the future of the planet.

Pros and Cons of Different Investment Income Sources

Each investment income source comes with its own set of advantages and disadvantages.

The DealBook Summit 2024 is all about green finance and sustainable investing. They’re discussing how to invest in a way that’s good for the planet and good for your wallet. It’s a real game-changer for the future of finance.

For example, stocks offer the potential for high returns but also carry higher risk, while bonds are generally considered less risky but may provide lower returns.

It’s not just about profits anymore, you know. Businesses are starting to get serious about sustainability, and it’s not just a trend. They’re actually integrating it into their strategies. Check out this article to see how companies are making a real difference.

Investment Income and Retirement Planning

Investment income is an essential component of a robust retirement plan, providing a steady stream of funds to support your lifestyle during your golden years. By strategically allocating your assets, you can generate income from various sources, ensuring financial security and peace of mind.

Want to see how businesses are walking the talk? The DealBook Summit 2024 is showcasing some real-life examples of corporate social responsibility. It’s all about how businesses are giving back and making a positive impact on the world.

Maximizing Investment Income During Retirement

Maximizing investment income during retirement requires a well-defined strategy that balances risk and reward.

But it’s not just about the planet, mate. The DealBook Summit 2024 is also stressing the importance of getting everyone on board. From employees to customers, they’re talking about how to make sure everyone’s voices are heard. It’s all about collaboration and building a better future together.

- Diversification:A diversified portfolio spread across different asset classes, such as stocks, bonds, real estate, and commodities, can mitigate risk and enhance returns. By investing in a variety of assets, you can reduce the impact of any single investment’s underperformance.

- Income-Generating Assets:Include assets that generate regular income, such as dividend-paying stocks, bonds, and real estate rentals. These assets can provide a consistent cash flow to supplement your retirement income.

- Tax-Efficient Strategies:Consider tax-advantaged accounts like Roth IRAs and 401(k)s, where withdrawals are tax-free in retirement. These accounts can help preserve your investment income and maximize your after-tax returns.

- Withdrawal Strategies:Develop a systematic withdrawal plan that balances your income needs with the preservation of your principal. Consider a combination of strategies like the “bucket” approach, which involves allocating assets into different buckets based on their time horizon, or the “safe withdrawal rate,” which suggests withdrawing a specific percentage of your portfolio annually.

Hypothetical Retirement Portfolio

A hypothetical retirement portfolio might include the following asset allocation:

| Asset Class | Allocation | Income Generation |

|---|---|---|

| Large-Cap Stocks | 40% | Dividends, potential capital appreciation |

| Bonds | 30% | Interest payments |

| Real Estate | 15% | Rental income |

| Alternative Investments | 10% | Diversification, potential higher returns |

| Cash | 5% | Liquidity, emergency fund |

Note: This is just a hypothetical example and should be tailored to your specific circumstances and risk tolerance. It’s crucial to consult with a qualified financial advisor to develop a personalized retirement plan.

Last Word

Navigating the complexities of investment income can seem daunting, but armed with the knowledge of its sources, exclusions, and tax implications, you can make informed decisions that contribute to your financial goals. Whether you’re aiming for retirement security, funding a dream home, or achieving financial independence, understanding investment income is a vital step towards achieving your aspirations.

This guide has provided a comprehensive framework to help you navigate this intricate aspect of finance and empower you to make strategic choices that benefit your financial future.

Helpful Answers

How often is investment income taxed?

The frequency of investment income taxation depends on the specific type of income and the jurisdiction. Some investment income, like dividends, may be taxed annually, while others, like capital gains, may be taxed only when realized through a sale.

What are the tax implications of reinvesting investment income?

Reinvesting investment income, such as dividends or interest, can lead to compound growth, but it may also have tax implications. The tax treatment of reinvested income depends on the specific type of investment and the jurisdiction. In some cases, reinvesting income may delay the tax liability until the investment is ultimately sold or liquidated.

If you’re thinking about investing, you need to know about the Net Investment Income Tax. It’s a new tax that can affect your returns, so it’s important to understand how it works. This guide will give you all the info you need.