What are the income tax brackets for October 2024? This question is on the minds of many Americans as they prepare for the upcoming tax season. Understanding how the tax system works and how income tax brackets are determined is crucial for making informed financial decisions.

This guide will provide a comprehensive overview of the income tax brackets for October 2024, including anticipated changes, calculating tax liability, and the impact on financial planning.

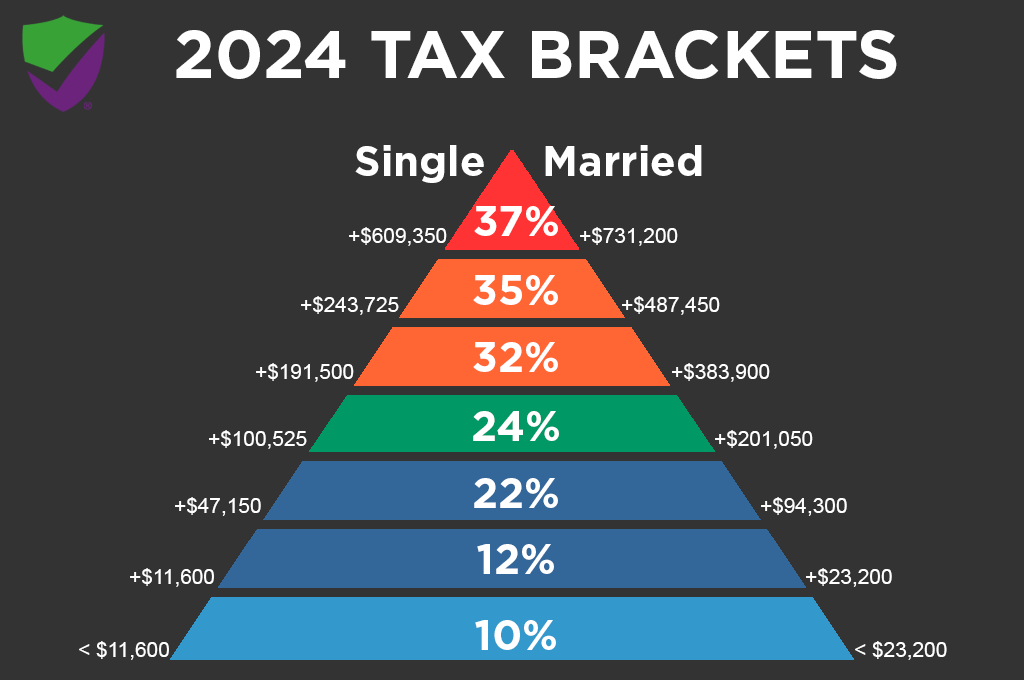

The United States has a progressive tax system, meaning that higher earners pay a larger percentage of their income in taxes. This system is divided into different tax brackets, each with its own corresponding tax rate. The amount of income that falls within each bracket determines the overall tax liability for individuals and families.

As we move closer to October 2024, it’s important to stay informed about any potential adjustments to these brackets, which could affect your tax burden.

Understanding Income Tax Brackets: What Are The Income Tax Brackets For October 2024

The US income tax system uses a progressive tax structure, meaning that the more you earn, the higher percentage of your income you pay in taxes. This system is based on income tax brackets, which are ranges of income subject to different tax rates.

Tax Brackets and How They Work

Income tax brackets divide taxable income into ranges, each with a corresponding tax rate. As your income increases, it moves into higher tax brackets, and the percentage of your income subject to tax also increases. It’s important to note that you don’t pay the highest tax rate on your entire income; you only pay the higher rate on the portion of your income that falls within that specific bracket.

Looking for the best credit card for students? We’ve got you covered with our list of the best credit cards for students in October 2024. Find the perfect card with student-friendly perks and rewards.

Overview of the US Tax System

The US tax system is a complex system with various taxes, including federal income tax, state income tax, and property tax. The federal income tax system is based on a progressive tax structure, meaning that those with higher incomes pay a larger percentage of their income in taxes.

Did you know that there are catch-up contributions for those over 50? Check out the 401k contribution limit 2024 and catch-up contributions to see if you qualify. This can be a great way to boost your retirement savings in the later years.

The federal government uses this revenue to fund various programs and services, such as social security, Medicare, and national defense.

Tax Brackets for Individuals and Married Couples

The Internal Revenue Service (IRS) publishes annual tax brackets for individuals and married couples filing jointly. These brackets can vary depending on factors such as filing status, age, and dependents.

For example, in 2023, the tax brackets for single filers ranged from 10% for incomes up to $10,950 to 37% for incomes over $578,125.

Running a small business and wondering about your IRA contribution limits? The IRA contribution limits for small business owners in 2024 might be different than you expect. Make sure you’re maximizing your retirement savings potential.

Individual Tax Brackets

- Income up to $10,950: 10%

- Income between $10,951 and $46,275: 12%

- Income between $46,276 and $101,750: 22%

- Income between $101,751 and $192,150: 24%

- Income between $192,151 and $578,125: 32%

- Income over $578,125: 37%

Married Filing Jointly Tax Brackets

- Income up to $21,900: 10%

- Income between $21,901 and $82,550: 12%

- Income between $82,551 and $172,750: 22%

- Income between $172,751 and $344,300: 24%

- Income between $344,301 and $628,300: 32%

- Income over $628,300: 37%

2024 Tax Brackets

It’s impossible to predict the exact income tax brackets for October 2024 with certainty. Tax legislation is subject to change based on various economic and political factors. However, we can examine potential adjustments and trends based on historical data and current economic conditions.

Potential Changes in Income Tax Brackets

The income tax brackets for 2024 are likely to be influenced by several factors, including inflation, economic growth, and the political climate. Here’s a breakdown of potential scenarios:* Inflation:If inflation remains high, the government may consider adjusting the tax brackets to account for the erosion of purchasing power.

Planning for retirement? Wondering how much you can contribute to your 401k in 2024? The 401k contribution limits 2024 vs 2023 might surprise you! The limits have increased, so you can save even more for your future.

This could involve raising the income thresholds for each bracket, effectively lowering the tax burden for some taxpayers.

Economic Growth

Are you filing as married filing separately? Knowing the tax brackets for married filing separately in 2024 can help you estimate your tax liability and plan accordingly.

A robust economy could lead to increased tax revenue, potentially providing the government with more flexibility to make changes to the tax code. This might include lowering tax rates or expanding tax credits, benefiting taxpayers across different income levels.

Political Climate

Political ideologies and priorities play a significant role in tax policy. For instance, if a particular party prioritizes tax cuts, we might see adjustments to the tax brackets that reduce the tax burden for specific income groups.

Potential Adjustments to the Standard Deduction or Personal Exemptions

The standard deduction and personal exemptions are essential components of the tax code that can impact taxpayers’ overall tax liability. * Standard Deduction:The standard deduction is a fixed amount that taxpayers can deduct from their taxable income. It is adjusted annually for inflation.

If inflation remains high, the standard deduction might be increased in 2024 to reflect the rising cost of living.

Personal Exemptions

Personal exemptions are deductions for individuals and dependents. These exemptions have been suspended since 2018, but their potential reinstatement remains a topic of discussion. If they are reinstated, it could provide significant tax relief for families and individuals.

Comparison with Previous Years

Comparing the 2024 tax brackets with previous years is crucial to understand the potential impact of any changes. Here’s a brief overview:* 2023 Tax Brackets:The 2023 tax brackets reflect the adjustments made in the Tax Cuts and Jobs Act of 2017. The act lowered tax rates for most income levels and expanded the standard deduction.

2024 Tax Brackets

The 2024 tax brackets are yet to be determined. As mentioned earlier, factors like inflation and economic growth will likely influence their structure.

Are you a self-employed individual with a solo 401k? It’s important to know the IRA contribution limits for solo 401k in 2024 to ensure you’re taking full advantage of your retirement savings options.

It’s important to note that these are just potential scenarios, and the actual changes to the income tax brackets, standard deduction, and personal exemptions for 2024 will depend on various factors. Staying informed about tax legislation updates is essential for individuals and businesses alike.

Students, are you wondering how to calculate your taxes? We’ve got you covered with a handy tax calculator for students in October 2024. It’s easy to use and can help you stay on top of your tax obligations.

Calculating Tax Liability

Understanding how your income is taxed is crucial for effective financial planning. This section will guide you through the process of calculating your individual tax liability based on your income and the applicable tax brackets for 2024. We will explore the steps involved in determining your tax rate and provide a clear breakdown of the tax brackets and their corresponding rates.

Tax Rate Determination

Your tax liability is determined by the applicable tax rate for your income level. The tax rate is not a single percentage; instead, it varies based on your taxable income. The higher your income, the higher the tax rate you will pay on a portion of your income.

To calculate your tax liability, you need to determine the applicable tax rate for each portion of your income that falls within a specific tax bracket.

Wondering how much you can contribute to your 401k this year? The how much can I contribute to my 401k in 2024 information can help you make informed decisions about your retirement savings.

Calculating Tax Liability: A Step-by-Step Guide, What are the income tax brackets for October 2024

Here’s a step-by-step guide to calculating your tax liability:

- Determine your taxable income:This is your gross income minus deductions and exemptions.

- Identify the applicable tax brackets:Consult the 2024 tax brackets table to identify the tax bracket your taxable income falls into. Each bracket has a specific range of income and a corresponding tax rate.

- Calculate the tax owed for each bracket:For each tax bracket, multiply the income within that bracket by the corresponding tax rate.

- Sum up the tax owed from each bracket:Add up the tax amounts calculated for each bracket to determine your total tax liability.

2024 Tax Brackets and Rates

The following table displays the tax brackets and corresponding tax rates for 2024. These brackets are based on single filers, and the rates are subject to change. It’s important to consult the latest IRS guidelines for accurate information.

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | $0

Want to know how much you can contribute to your 401k after taxes? Our guide on how much can I contribute to my 401k in 2024 after taxes provides the answers you need to make informed financial decisions.

|

|

| 12% | $10,276

|

|

| 22% | $41,776

If you’re filing as head of household, you’ll want to know the tax brackets for head of household in 2024 to understand how much you’ll owe in taxes. This information can help you plan your finances and avoid any surprises at tax time.

|

|

| 24% | $89,076

Saving for retirement can be a balancing act. Find out how the 401k contribution limit 2024 and Roth IRA limit can help you reach your financial goals.

|

|

| 32% | $170,051

Tax changes can happen, so stay informed about the tax changes impacting the October 2024 deadline. This information can help you avoid any unexpected tax bills.

|

|

| 35% | $215,951

|

|

| 37% | $539,901+ |

Impact of Income Tax Brackets

Income tax brackets play a significant role in shaping financial planning and decision-making. Understanding how these brackets work is crucial for maximizing your financial well-being.Tax brackets influence various aspects of your financial life, from investment strategies to retirement planning.

They also affect your overall tax liability.

Are you curious about the specifics for traditional 401k contributions in 2024? You can find the exact 401k contribution limits for 2024 for traditional 401k on our website. Knowing these limits can help you plan your retirement savings strategy.

Impact on Investment Strategies

The tax brackets you fall into can influence your investment choices. For example, if you’re in a higher tax bracket, you might prefer investments that generate tax-efficient returns. This could include:

- Tax-advantaged accounts:These accounts, such as 401(k)s and IRAs, allow you to defer paying taxes on your investment earnings until retirement. This can be particularly beneficial for those in higher tax brackets.

- Municipal bonds:Interest earned on municipal bonds is typically exempt from federal income tax. This can be advantageous for investors in higher tax brackets.

- Dividend-paying stocks:Dividends are taxed at a lower rate than capital gains, making them a more attractive option for those in higher tax brackets.

Impact on Retirement Planning

Tax brackets can also affect your retirement planning decisions. For instance, if you expect to be in a lower tax bracket in retirement, you might prefer to defer taxes on your retirement savings until you withdraw them. However, if you expect to be in a higher tax bracket in retirement, you might prefer to pay taxes on your retirement savings now while you’re in a lower tax bracket.

Even if you work part-time, you can still contribute to your retirement. The IRA contribution limits for 2024 for part-time workers can help you build a secure financial future.

Minimizing Tax Liability

There are several strategies you can use to minimize your tax liability:

- Maximize deductions and credits:Tax deductions and credits can reduce your taxable income, ultimately lowering your tax liability. Examples include deductions for mortgage interest, charitable donations, and medical expenses.

- Take advantage of tax-advantaged accounts:Utilizing tax-advantaged accounts, like 401(k)s and IRAs, allows you to defer paying taxes on your investment earnings until retirement, potentially saving you money on taxes.

- Consider tax-loss harvesting:Selling losing investments to offset capital gains can help reduce your tax liability. This strategy can be particularly beneficial in years when you have significant capital gains.

- Consult with a tax professional:A qualified tax professional can provide personalized advice and help you develop a tax plan that minimizes your tax liability.

Resources and Further Information

Understanding your tax obligations and utilizing available resources can significantly simplify the tax filing process. This section will provide you with valuable links and information to aid in your tax preparation and planning.

It’s always good to have a plan for the future. Check out our information on the 401k contribution limits for 2024 and 2025 to see how much you can contribute in the coming years.

Official Government Websites

The Internal Revenue Service (IRS) is the primary source for all tax-related information in the United States. Their website offers a comprehensive range of resources, including:

- Tax forms and publications

- Tax rates and brackets

- Tax filing instructions

- Information on deductions and credits

- Tools and calculators for tax planning

- Contact information for IRS assistance

The IRS website is the most reliable source for up-to-date tax information and guidance. You can find it at https://www.irs.gov/ .

Tax Preparation and Planning Resources

There are numerous resources available to help you prepare and plan your taxes effectively:

- Tax Software:Popular tax software programs, such as TurboTax, H&R Block, and TaxAct, provide user-friendly interfaces and step-by-step guidance for preparing your tax return. They often include features like tax calculators, deductions and credits finders, and audit support.

- Professional Tax Services:Enlisting the services of a certified public accountant (CPA) or an enrolled agent (EA) can be beneficial for complex tax situations or individuals seeking professional guidance. They can help with tax planning, preparing your return, and representing you in case of an audit.

- Financial Advisors:Financial advisors can offer personalized advice on tax planning strategies, investment decisions, and retirement planning, incorporating tax considerations into your overall financial goals.

Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability. It’s crucial to understand the different types available and how they apply to your specific circumstances.

- Deductions:Deductions reduce your taxable income, thereby lowering your tax bill. Some common deductions include:

- Standard Deduction:A fixed amount that you can deduct instead of itemizing. The standard deduction amount varies based on your filing status.

- Itemized Deductions:Specific expenses that you can deduct, such as medical expenses, charitable contributions, mortgage interest, and state and local taxes.

- Credits:Credits directly reduce your tax liability, dollar for dollar. Some common credits include:

- Earned Income Tax Credit (EITC):A refundable credit for low-to-moderate-income working individuals and families.

- Child Tax Credit:A credit for each qualifying child under 17 years old.

- American Opportunity Tax Credit:A credit for qualified education expenses for the first four years of higher education.

Epilogue

Navigating the complexities of the US tax system can be daunting, but understanding the income tax brackets is a fundamental step in managing your finances effectively. By staying informed about potential changes and utilizing available resources, you can make informed decisions that optimize your tax liability and ensure financial well-being.

Remember to consult with a tax professional for personalized advice and guidance tailored to your specific circumstances.

Essential Questionnaire

What are the implications of a change in income tax brackets?

Changes in income tax brackets can impact your tax liability, potentially leading to higher or lower taxes. It’s crucial to stay informed about any adjustments and adjust your financial planning accordingly.

How often are income tax brackets adjusted?

Income tax brackets are typically adjusted annually based on inflation and other economic factors. However, significant changes to the tax system may occur less frequently.

Where can I find the most up-to-date information on income tax brackets?

The Internal Revenue Service (IRS) website is the most reliable source for official tax information, including current tax brackets and any proposed changes.