What are the income limits for Roth IRA contributions in 2024? This question is crucial for individuals considering this popular retirement savings option. The Roth IRA allows contributions to grow tax-free, but eligibility is determined by your income. Understanding the income limits for 2024 is essential to ensure you can maximize your retirement savings potential.

The Roth IRA is a retirement savings plan that offers tax advantages. While it’s known for its potential for tax-free growth, it’s important to remember that the Roth IRA has income limits for eligibility. This means that if your income is too high, you may not be able to contribute to a Roth IRA or may only be able to contribute a reduced amount.

Roth IRA Contribution Limits for 2024

The Roth IRA is a popular retirement savings plan that offers tax-free withdrawals in retirement. However, there are income limits that determine your eligibility to contribute to a Roth IRA. These limits change annually, so it’s essential to stay informed about the current contribution limits and how they might affect your savings strategy.

Contribution Limit

The maximum amount you can contribute to a Roth IRA in 2024 is $7,000. This limit applies to all individuals, regardless of age. If you are 50 or older, you can make an additional “catch-up” contribution of $1,000, bringing your total contribution limit to $8,000.

Consequences of Exceeding the Contribution Limit

Exceeding the Roth IRA contribution limit can result in penalties. The IRS considers excess contributions as a taxable distribution, and you may also be subject to a 6% penalty on the excess amount.

Small business owners have a variety of retirement savings options, including IRAs. You can find out about the IRA contribution limits for small business owners in 2024 and start planning your retirement savings strategy!

Contribution Limits for Different Income Levels

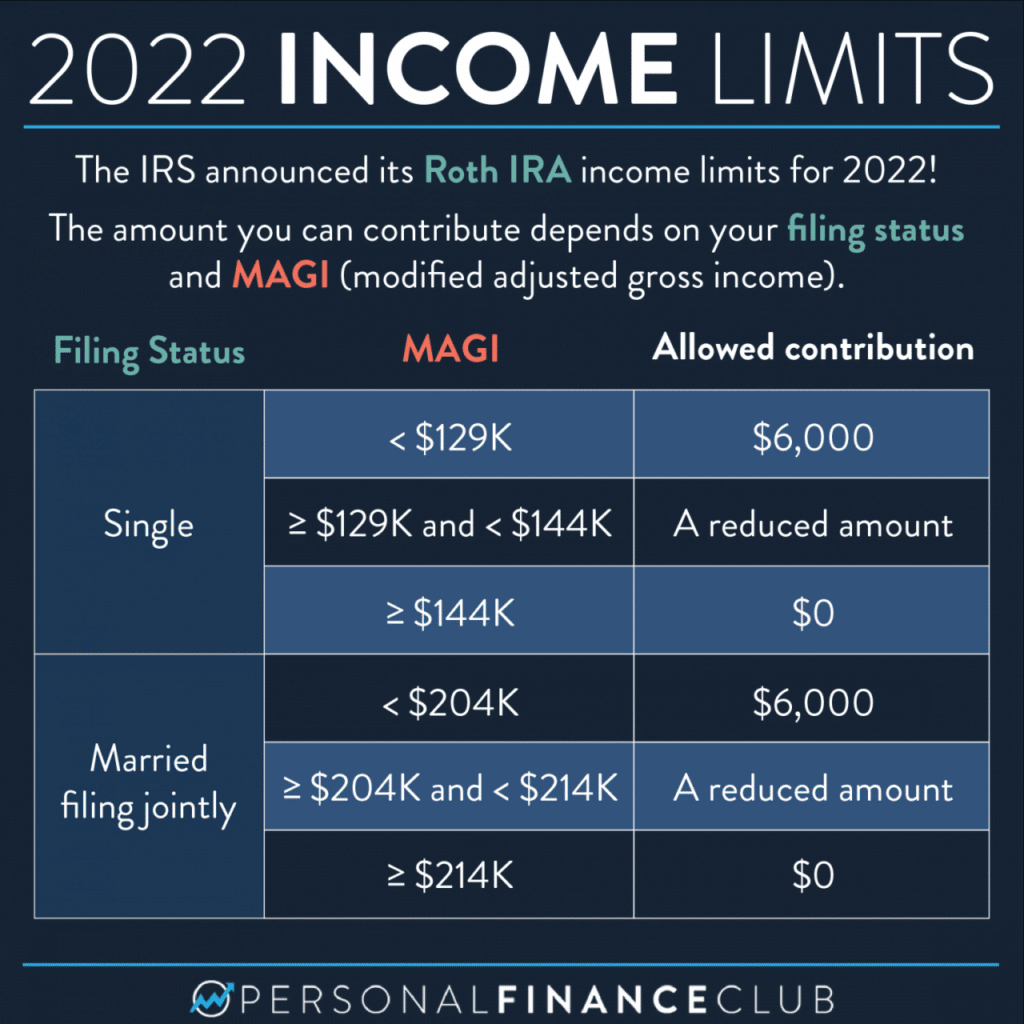

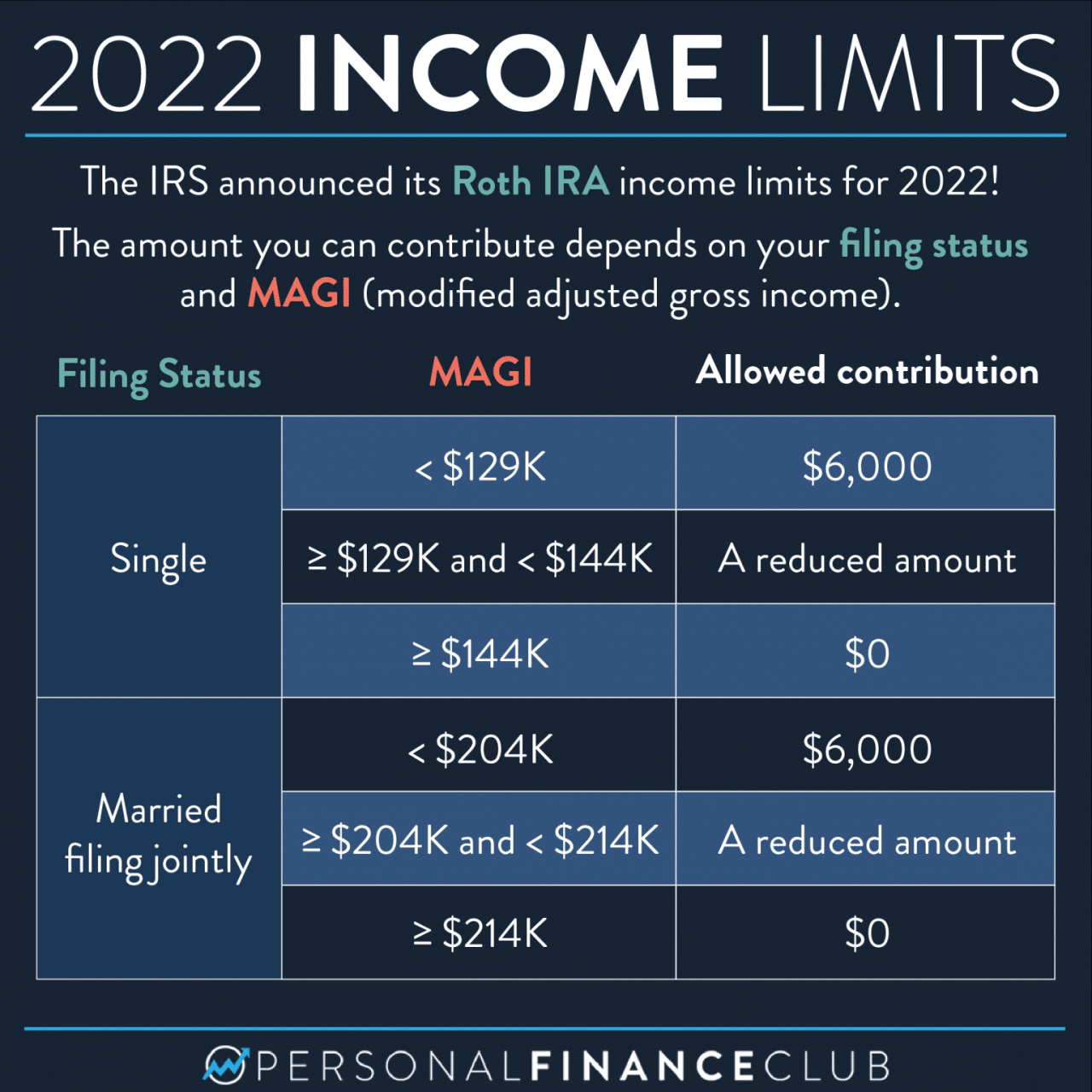

The income limits for Roth IRA contributions are based on your modified adjusted gross income (MAGI). If your MAGI exceeds certain thresholds, you may not be able to contribute to a Roth IRA, or your contributions may be phased out.

Here is a table summarizing the contribution limits for different income levels in 2024:

| Income Level | Contribution Limit |

|---|---|

| Single Filers | $153,000 |

| Married Filing Jointly | $228,000 |

| Head of Household | $189,000 |

| Qualifying Widow(er) | $228,000 |

If your MAGI exceeds these limits, you may not be able to contribute to a Roth IRA. If your MAGI falls within the phase-out range, you may be able to contribute a reduced amount.

Important Note:The contribution limits and income thresholds are subject to change each year. It’s crucial to check with the IRS for the most up-to-date information.

Income Limits for Roth IRA Contributions

The Roth IRA is a popular retirement savings plan that offers tax-free withdrawals in retirement. However, eligibility for Roth IRA contributions is based on your Modified Adjusted Gross Income (MAGI).

The tax deadline can be a stressful time, especially if you’re self-employed. It’s important to stay organized and on top of your finances. Find out about the October 2024 tax deadline for self-employed individuals and make sure you’re prepared!

Modified Adjusted Gross Income (MAGI)

MAGI is a specific income calculation used for determining eligibility for certain tax benefits, including Roth IRA contributions. It is a variation of your Adjusted Gross Income (AGI) that takes into account specific additions and subtractions.

Tax credits can be a real lifesaver, especially if you’re eligible for any! Make sure you’re taking advantage of all the available credits by checking out tax credits for the October 2024 deadline. You might be surprised at what you qualify for!

How MAGI is Calculated

To calculate your MAGI, start with your Adjusted Gross Income (AGI) from your tax return. Then, add back certain deductions that were previously subtracted from your AGI, such as:

- Student loan interest deduction

- Deduction for tuition and fees

- IRA contributions

- Moving expenses

Next, subtract certain income items that were previously included in your AGI, such as:

- Foreign earned income exclusion

- Certain income from U.S. possessions

The resulting figure is your MAGI.

Income Limits for Roth IRA Contributions in 2024

The income limits for Roth IRA contributions in 2024 are based on your filing status. If your MAGI exceeds these limits, you may not be able to contribute to a Roth IRA.

- Single Filers:If your MAGI is $153,000 or greater, you cannot contribute to a Roth IRA.

- Married Filing Jointly:If your MAGI is $228,000 or greater, you cannot contribute to a Roth IRA.

- Head of Household:If your MAGI is $189,000 or greater, you cannot contribute to a Roth IRA.

- Qualifying Widow(er):If your MAGI is $228,000 or greater, you cannot contribute to a Roth IRA.

- Married Filing Separately:If your MAGI is $114,000 or greater, you cannot contribute to a Roth IRA.

Phase-Out of Roth IRA Contributions

The Roth IRA contribution limit for 2024 is $7,500 for individuals and $15,000 for couples filing jointly. However, the ability to contribute to a Roth IRA is not available to everyone. The IRS sets income limits for those who can make full contributions or any contributions at all.

If your modified adjusted gross income (MAGI) exceeds certain thresholds, your ability to contribute to a Roth IRA is gradually phased out. This means that you may not be able to contribute the full $7,500 (or $15,000 for joint filers) or may not be able to contribute anything at all.

The mileage rate is a big deal for anyone who drives for business purposes. You’ll want to keep an eye out for the updated rate, and you can find all the information you need on when the mileage rate will be updated for October 2024.

Make sure you’re using the correct rate for accurate deductions!

Phase-Out Ranges for Different Income Levels

The phase-out range for Roth IRA contributions in 2024 is as follows:

| Filing Status | Lower Limit | Upper Limit |

|---|---|---|

| Single Filers | $153,000 | $168,000 |

| Married Filing Jointly | $228,000 | $243,000 |

| Head of Household | $153,000 | $168,000 |

Implications of Exceeding the Phase-Out Limit

If your MAGI exceeds the upper limit of the phase-out range, you are not eligible to contribute to a Roth IRA. For example, if you are single and your MAGI is $170,000, you cannot contribute to a Roth IRA.If your MAGI falls within the phase-out range, you may be able to contribute a reduced amount.

The October 2024 tax deadline is fast approaching, and it’s important to be prepared. You can find a helpful guide on how to file taxes by the October 2024 deadline to make sure you’re ready to file your taxes accurately and on time.

For example, if you are single and your MAGI is $160,000, you can only contribute a portion of the full contribution limit. The exact amount you can contribute will depend on your MAGI and the phase-out range.

Government agencies have specific requirements when it comes to the W9 Form. Make sure you’re in compliance by checking out the W9 Form October 2024 for government agencies information. It’s important to stay organized and accurate with your paperwork.

Alternative Retirement Savings Options

If you find yourself exceeding the income limits for Roth IRA contributions in 2024, don’t despair! There are still other retirement savings options available to you. These options may offer different contribution limits, tax implications, and eligibility requirements, so it’s important to carefully consider which one is right for your individual circumstances.

If you’re self-employed, you have some unique retirement savings options, including 401k contributions. You can find out about the 401k contribution limits for 2024 for self-employed and start planning your retirement savings strategy!

Traditional IRA

Traditional IRAs allow pre-tax contributions to grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them in retirement. This can be a great option if you expect to be in a lower tax bracket in retirement than you are now.

The contribution limit for traditional IRAs in 2024 is the same as for Roth IRAs: $6,500 for individuals and $13,000 for those aged 50 and over. There are no income limits for contributing to a traditional IRA, though you may be subject to income limitations if you wish to deduct your contributions on your tax return.

Life happens, and sometimes you need a little extra time to file your taxes. If you’re in a bind, you can always file for an extension. Check out how to file for an extension on your taxes in October 2024 for all the details.

Just remember, the extension is for filing, not paying, so don’t delay on that!

If you are covered by a retirement plan at work, your ability to deduct contributions may be limited.

Figuring out how much you can contribute to your 401k after taxes can be a bit confusing, but don’t worry, it’s not rocket science! You can find all the details you need on how much you can contribute to your 401k in 2024 after taxes , and remember, the sooner you start saving for retirement, the better!

If your adjusted gross income (AGI) is above certain thresholds, you may not be able to deduct your traditional IRA contributions.

Life gets busy, and sometimes you need a little extra time to file your taxes. You can find out all about tax filing extensions for October 2024 and see if you qualify for an extension. Just remember, you still need to pay any taxes owed by the original deadline!

401(k)

A 401(k) is a retirement savings plan offered by employers. These plans allow pre-tax contributions to grow tax-deferred. Your employer may also offer a matching contribution, which is free money that can significantly boost your retirement savings.The contribution limit for 401(k) plans in 2024 is $22,500.

If you are aged 50 or over, you can contribute an additional $7,500, for a total of $30,000.

Freelancers need to be familiar with the W9 Form to provide their tax information to clients. Check out the W9 Form October 2024 for freelancers to ensure you’re following the correct procedures and providing the necessary information.

Non-profit organizations have specific deadlines for filing their taxes. Make sure you’re aware of the tax extension deadline October 2024 for non-profit organizations to avoid any penalties. It’s crucial to stay organized and meet all deadlines.

403(b)

A 403(b) is a retirement savings plan similar to a 401(k) but is offered to employees of public schools, certain tax-exempt organizations, and religious organizations. These plans also allow pre-tax contributions to grow tax-deferred.The contribution limit for 403(b) plans in 2024 is the same as for 401(k) plans: $22,500.

If you are aged 50 or over, you can contribute an additional $7,500, for a total of $30,000.

Solo 401(k)

A Solo 401(k) is a retirement savings plan designed for self-employed individuals and small business owners. This plan allows both employee and employer contributions to grow tax-deferred.The contribution limit for Solo 401(k) plans in 2024 is $66,000 for those aged 50 and over.

The maximum contribution limit for Solo 401(k) plans is the lesser of 25% of your net adjusted self-employed income or $66,000.

Tax brackets can be tricky, especially for those with unique situations like qualifying widow(er) status. If you’re in this category, you’ll want to familiarize yourself with the tax brackets for qualifying widow(er)s in 2024 to make sure you’re paying the correct amount.

Simplified Employee Pension (SEP) IRA

A SEP IRA is a retirement savings plan designed for self-employed individuals and small business owners. This plan allows contributions to grow tax-deferred.The contribution limit for SEP IRA plans in 2024 is 25% of your net adjusted self-employed income, up to $66,000.

Students often have unique tax situations, including the standard deduction. Find out about the standard deduction for students in 2024 and make sure you’re taking advantage of any applicable deductions to minimize your tax burden.

Table of Retirement Savings Options

| Retirement Savings Option | Contribution Limit (2024) | Tax Implications | Eligibility Requirements |

|---|---|---|---|

| Traditional IRA | $6,500 (Individuals) $13,000 (Age 50+) | Pre-tax contributions, tax-deferred growth, taxed at withdrawal | Anyone |

| Roth IRA | $6,500 (Individuals) $13,000 (Age 50+) | After-tax contributions, tax-free growth and withdrawals | Income limits apply |

| 401(k) | $22,500 ($30,000 Age 50+) | Pre-tax contributions, tax-deferred growth, taxed at withdrawal | Offered by employers |

| 403(b) | $22,500 ($30,000 Age 50+) | Pre-tax contributions, tax-deferred growth, taxed at withdrawal | Offered to employees of public schools, certain tax-exempt organizations, and religious organizations |

| Solo 401(k) | 25% of net adjusted self-employed income, up to $66,000 | Pre-tax contributions, tax-deferred growth, taxed at withdrawal | Self-employed individuals and small business owners |

| SEP IRA | 25% of net adjusted self-employed income, up to $66,000 | Pre-tax contributions, tax-deferred growth, taxed at withdrawal | Self-employed individuals and small business owners |

Future Projections for Roth IRA Income Limits

Predicting future Roth IRA income limits is inherently challenging, as these limits are subject to changes based on various economic and political factors. However, understanding the potential drivers of change can help us anticipate future trends.

Factors Influencing Future Income Limits, What are the income limits for Roth IRA contributions in 2024

Several factors could influence future Roth IRA income limits, including:

- Inflation:The Consumer Price Index (CPI) is a key factor considered when adjusting income limits. As inflation rises, income limits are typically adjusted upward to maintain the real value of contributions.

- Economic Growth:Strong economic growth can lead to increased tax revenues, potentially providing more resources for government programs, including retirement savings plans. This could result in higher income limits for Roth IRAs.

- Political Climate:Political priorities and ideologies can significantly impact retirement savings policies. For example, a government focused on expanding access to retirement savings might consider increasing income limits to encourage participation.

- Budgetary Constraints:Government budget deficits and spending priorities can also influence Roth IRA income limits. In times of fiscal constraints, there might be pressure to limit or freeze income limits to reduce spending.

Potential Scenarios for Future Income Limits

While predicting the future is impossible, we can explore potential scenarios for Roth IRA income limits based on various factors:

| Scenario | Description | Potential Income Limits (Single Filers) |

|---|---|---|

| Scenario 1: Moderate Inflation and Economic Growth | Inflation remains at a moderate level, and the economy continues to grow at a steady pace. | $150,000

|

| Scenario 2: High Inflation and Stagnant Economic Growth | Inflation accelerates, and economic growth slows down. | $140,000

|

| Scenario 3: Strong Economic Growth and Tax Revenue Increase | The economy experiences robust growth, leading to increased tax revenue. | $160,000

|

| Scenario 4: Fiscal Constraints and Budgetary Pressure | The government faces budgetary constraints and prioritizes spending cuts. | $130,000

|

It’s important to note that these are just potential scenarios and actual income limits may differ. Staying informed about economic and political developments can help individuals better understand the potential changes to Roth IRA income limits.

If you’re a business owner, you’ll need to be familiar with the W9 Form, which is used to report your taxpayer identification number. The W9 Form October 2024 requirements for businesses are pretty straightforward, so make sure you’re up-to-date on the latest regulations.

Outcome Summary

Navigating the income limits for Roth IRA contributions in 2024 can seem complex, but understanding the basics can empower you to make informed decisions about your retirement savings. By considering your income, exploring alternative options if needed, and staying informed about potential future changes, you can make the most of this valuable retirement savings tool.

Query Resolution: What Are The Income Limits For Roth IRA Contributions In 2024

Can I contribute to a Roth IRA if I’m over the income limit?

You can still contribute to a Roth IRA, but you may not be able to contribute the full amount. There is a phase-out range where you can contribute a reduced amount based on your income.

What happens if I exceed the income limit and contribute to a Roth IRA?

If you exceed the income limit and contribute to a Roth IRA, the contributions may be considered non-deductible. This means that you may not be able to claim a tax deduction for the contributions, and you may have to pay taxes on the withdrawals in retirement.

Are there other retirement savings options if I can’t contribute to a Roth IRA?

Yes, there are other retirement savings options available, such as a traditional IRA, 401(k), or 403(b). These plans may have different contribution limits and tax implications.