What are the benefits of contributing to a Roth IRA in 2024? This question is on the minds of many individuals looking to secure their financial future. A Roth IRA offers a unique opportunity to save for retirement while enjoying tax advantages that can significantly impact your overall wealth.

This guide explores the key benefits of contributing to a Roth IRA, from tax-free withdrawals in retirement to estate planning advantages.

A Roth IRA is a retirement savings plan that allows you to contribute after-tax dollars, meaning you won’t owe taxes on your withdrawals in retirement. This is a significant advantage compared to traditional IRAs, where you pay taxes on withdrawals in retirement.

Additionally, Roth IRAs offer flexibility, allowing you to withdraw contributions without penalties, making them a valuable tool for both short-term and long-term financial planning.

Tax Advantages of a Roth IRA

The Roth IRA offers a unique tax advantage that sets it apart from traditional IRAs. It allows you to contribute after-tax dollars to your account, which then grow tax-free. This means that you can enjoy tax-free withdrawals in retirement, potentially saving you a significant amount of money.

Tax-Free Withdrawals in Retirement

The primary benefit of a Roth IRA is that your withdrawals in retirement are tax-free. This is a significant advantage, as you won’t have to pay any taxes on the money you withdraw, regardless of how much it has grown.

Planning for retirement in 2024? You’ll want to know the 401k contribution limit 2024 and Roth IRA limit to make sure you’re maximizing your contributions. These limits can vary by age, so it’s essential to understand how they apply to you.

For example, you might be curious about IRA contribution limits for 2024 by age to see if you qualify for a higher limit. And if you’re thinking about contributing more than the allowed amount, it’s important to be aware of the consequences.

Learn more about what happens if you exceed the Roth IRA contribution limit in 2024 to avoid any potential penalties.

For example, if you contribute $6,500 to a Roth IRA in 2024 and it grows to $50,000 by the time you retire, you can withdraw the entire $50,000 tax-free.

Avoiding Future Tax Liability on Investment Growth

Another major advantage of a Roth IRA is that you avoid future tax liability on investment growth. Since your contributions are made with after-tax dollars, the growth on your investments within the account is also tax-free. This means that you can watch your investments grow without worrying about paying taxes on those gains.

For example, if you contribute $6,500 to a Roth IRA in 2024 and it grows to $50,000 by the time you retire, you won’t have to pay taxes on the $43,500 in investment growth.

Whether you’re contributing to a traditional IRA or a Roth IRA, you’ll want to understand the limits. Find out how much you can contribute to a traditional IRA in 2024 and compare that to the limits for Roth IRAs.

While the 401k limit is generally set, you might be wondering if there’s a way to contribute more. Read about can you contribute more than the 401k limit in 2024 to see if there are any exceptions. And if you’re self-employed, remember that you have a different tax deadline.

Check out the October 2024 tax deadline for self-employed individuals to make sure you’re on track.

Retirement Savings Flexibility

The Roth IRA offers flexibility in accessing your retirement savings, providing you with peace of mind and control over your finances. Unlike traditional IRAs, where you pay taxes on withdrawals in retirement, the Roth IRA allows you to withdraw contributions tax-free and penalty-free at any time.

It’s important to stay up-to-date on tax requirements, including forms like the W9. Find out about the W9 Form October 2024 penalties for non-compliance to avoid any issues. You’ll also want to understand how your income affects your tax burden.

See the tax rates for each tax bracket in 2024 to plan your finances accordingly. While the IRA contribution limits are often adjusted annually, you might be curious about how they’ve changed from the previous year. Take a look at the Ira contribution limits for 2024 vs 2023 to see the differences.

And if you’re a married couple, you’ll want to know the specific limits for your situation. Check out the Roth IRA contribution limits for 2024 for married couples to make sure you’re taking advantage of all available contributions.

Withdraw Contributions Without Penalties

The Roth IRA allows you to withdraw contributions, not earnings, without penalty at any time. This flexibility is particularly beneficial if you face unexpected expenses or need access to your savings before retirement. For example, if you require funds for a down payment on a house, medical expenses, or a sudden job loss, you can access your Roth IRA contributions without worrying about tax penalties.

Building Wealth and Compound Growth

A Roth IRA can be a powerful tool for building wealth, especially when you consider the potential for tax-free compounding. By contributing to a Roth IRA, you’re essentially setting yourself up for long-term growth, allowing your investments to grow without being taxed on the gains.

It’s always a good idea to check if there are any special limits that apply to you. For example, you might be wondering is there a catch-up contribution limit for IRAs in 2024 if you’re over a certain age.

Understanding these rules can help you make informed decisions about your retirement savings.

Tax-Free Compounding

Tax-free compounding means that your earnings in the Roth IRA grow without being taxed each year. This allows your money to grow at a faster rate than if you were paying taxes on your gains annually. Think of it as your money working harder for you.

Imagine investing $5,000 in a Roth IRA that earns an average annual return of 7%. After 30 years, your investment could grow to over $38,000. Now, imagine that you had to pay taxes on those gains each year. Your final amount would be significantly lower.

Your ability to contribute to a Roth IRA can be affected by your income. Knowing what is the Roth IRA income limit for 2024 is crucial for making informed financial decisions. Understanding tax deductions can also save you money.

See the standard deduction amount for 2024 tax year to determine how much you can deduct from your taxable income. This amount can vary depending on your filing status. For example, if you’re filing jointly, you’ll want to look up the standard deduction for married filing jointly in 2024 to ensure you’re taking advantage of all available deductions.

The IRA contribution limits also vary based on your filing status. Check out the IRA contribution limits for 2024 for single filers to see what applies to you.

Potential for Higher Returns

Since your earnings in a Roth IRA are tax-free, you can potentially earn higher returns than with traditional investments. This is because you’re not paying taxes on your gains, which allows your money to compound at a faster rate. Imagine you invest $10,000 in a traditional IRA and another $10,000 in a Roth IRA.

Both investments earn an average annual return of 8%. After 20 years, your traditional IRA might be worth $46,609, but your Roth IRA could be worth $46,609 plus any additional gains from the tax-free compounding. This can make a significant difference in your overall wealth over time.

Impact of Compound Growth Over Time

Here’s a table illustrating the power of compound growth over time:

| Years | Initial Investment | Average Annual Return | Total Value (Taxable) | Total Value (Tax-Free) |

|---|---|---|---|---|

| 10 | $10,000 | 7% | $19,671 | $19,671 |

| 20 | $10,000 | 7% | $38,696 | $38,696 |

| 30 | $10,000 | 7% | $76,122 | $76,122 |

As you can see, the longer you leave your money invested, the more powerful compound growth becomes. In the table above, the “Taxable” column represents the potential value of your investment if you had to pay taxes on your earnings each year.

The “Tax-Free” column represents the potential value of your investment if your earnings were tax-free. The difference between these two columns shows the impact of tax-free compounding over time.

Estate Planning and Inheritance Benefits

A Roth IRA can be a valuable tool for estate planning, offering significant tax advantages for both you and your beneficiaries. This section explores the tax-free inheritance of Roth IRA assets and the potential savings from avoiding estate taxes.

Tax-Free Inheritance of Roth IRA Assets

The Roth IRA’s tax-free nature extends to your beneficiaries, allowing them to inherit the account’s assets without incurring any income tax liability. This contrasts with traditional IRAs, where beneficiaries may face income taxes on distributions.

The tax-free nature of Roth IRA distributions applies even after your death.

Avoiding Estate Taxes on Roth IRA Distributions

Roth IRA distributions are not subject to estate taxes, meaning your beneficiaries will receive the entire balance without any deductions for estate taxes. This can be a significant advantage, especially for high-net-worth individuals.

The estate tax exemption for Roth IRA distributions can be substantial, potentially saving your beneficiaries thousands of dollars.

Scenario Illustrating Potential Tax Savings

Imagine a scenario where an individual passes away with a Roth IRA balance of $1 million. If this individual had a traditional IRA instead, their beneficiaries would potentially owe income taxes on the distributions, depending on their tax bracket. However, with a Roth IRA, the beneficiaries inherit the full $1 million tax-free.

In addition, they avoid any estate taxes on the account balance.

In this scenario, the Roth IRA’s tax-free inheritance could save the beneficiaries a significant amount of money in income and estate taxes.

Eligibility and Contribution Limits: What Are The Benefits Of Contributing To A Roth IRA In 2024

While the Roth IRA offers significant advantages, it’s crucial to understand the eligibility requirements and contribution limits. These factors determine whether you can contribute to a Roth IRA and how much you can contribute annually.

Income Limitations

The Roth IRA has income limitations, meaning that you may not be eligible to contribute if your modified adjusted gross income (MAGI) exceeds a certain threshold. These limits are adjusted annually.

In 2024, if your MAGI is above the limit, you cannot contribute to a Roth IRA. However, you may still be eligible to contribute to a traditional IRA and convert it to a Roth IRA later.

Annual Contribution Limits

The annual contribution limit for Roth IRAs is the same for all eligible individuals, regardless of age.

For 2024, the maximum annual contribution limit for Roth IRAs is \$7,000. Individuals aged 50 and older can contribute an additional \$1,000, bringing their total contribution limit to \$8,000.

Strategies for Maximizing Contributions

You can utilize several strategies to maximize your Roth IRA contributions within the limits.

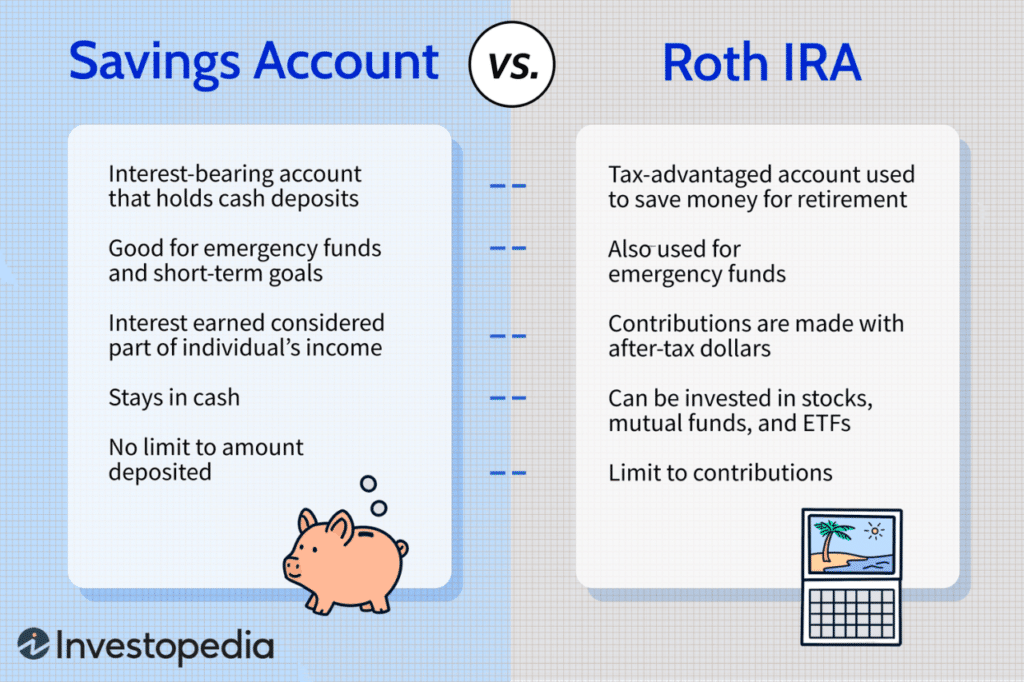

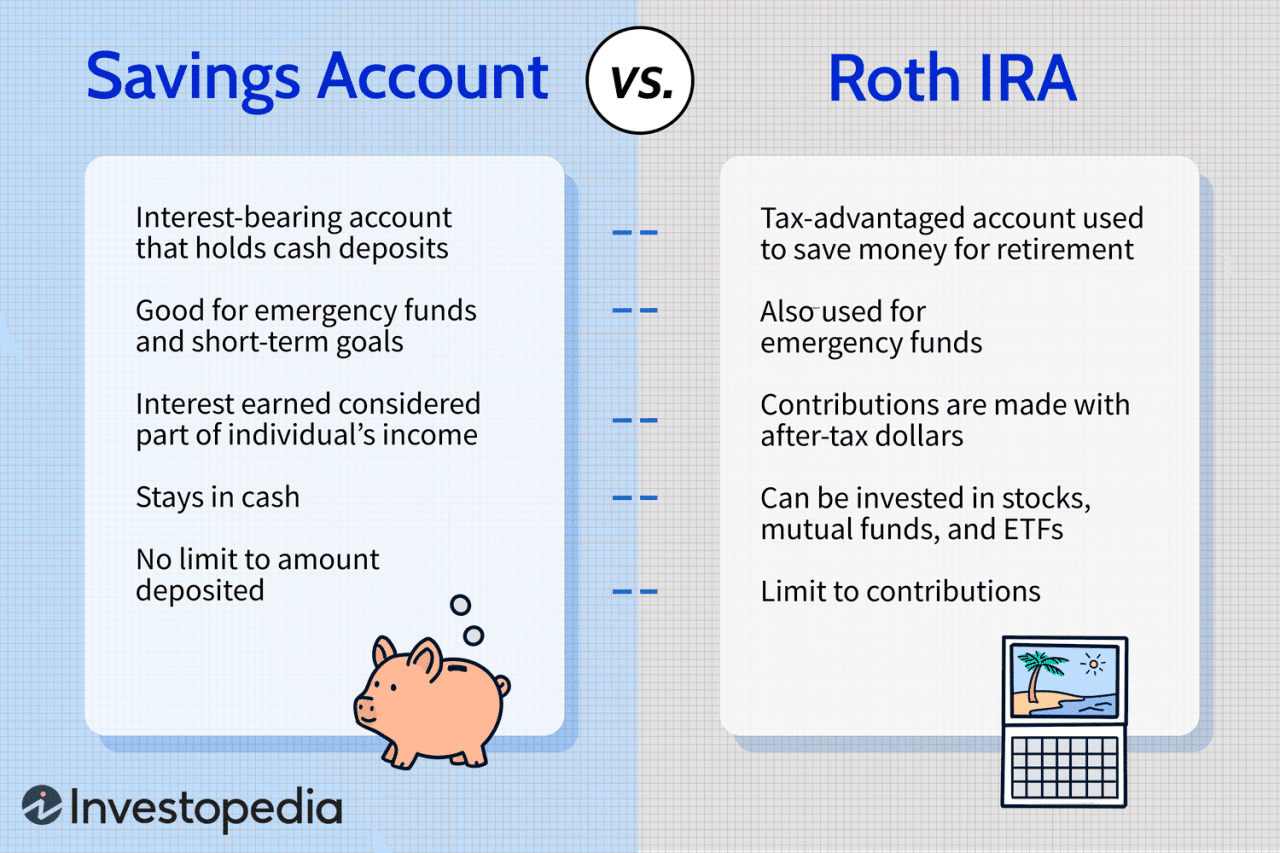

Roth IRA vs. Traditional IRA

Choosing between a Roth IRA and a Traditional IRA can be a significant decision for individuals seeking to maximize their retirement savings. Both offer tax advantages, but their structures and implications differ, impacting your financial strategy in various ways.

Tax Implications

The primary distinction between Roth and Traditional IRAs lies in their tax treatment.

- Roth IRA:Contributions are made with after-tax dollars, meaning you pay taxes on your earnings before contributing to the IRA. However, withdrawals in retirement are tax-free.

- Traditional IRA:Contributions are made with pre-tax dollars, reducing your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income.

Factors Influencing the Best Choice, What are the benefits of contributing to a Roth IRA in 2024

Several factors should be considered when determining the most suitable IRA type for your individual circumstances.

- Current Tax Bracket:If you are currently in a lower tax bracket and anticipate being in a higher tax bracket in retirement, a Traditional IRA may be more advantageous. You would benefit from the tax deduction now and pay taxes later when your income is higher.

Conversely, if you are in a higher tax bracket now and expect to be in a lower tax bracket in retirement, a Roth IRA could be preferable, as you would pay taxes at a lower rate now and enjoy tax-free withdrawals later.

- Expected Income in Retirement:If you anticipate having a higher income in retirement, a Roth IRA may be more beneficial. Your withdrawals will be tax-free, regardless of your income level at that time.

- Long-Term Investment Horizon:If you have a long-term investment horizon, a Roth IRA can be advantageous. The tax-free growth of your investments over time can lead to substantial tax savings in retirement.

- Risk Tolerance:A Roth IRA can be more appealing to individuals with a higher risk tolerance. The tax-free withdrawals in retirement can offset the potential for higher capital gains taxes on investment growth.

Determining the Most Advantageous Option

To make an informed decision, it’s essential to consider your individual circumstances and financial goals.

- Project your future income:Estimate your income in retirement to determine your likely tax bracket.

- Analyze your current financial situation:Consider your current tax bracket, investment goals, and risk tolerance.

- Seek professional advice:Consult with a financial advisor or tax professional to gain personalized guidance and explore the options that best align with your financial goals.

Closing Summary

Contributing to a Roth IRA can be a powerful strategy for building wealth and achieving your retirement goals. With tax-free withdrawals, flexibility, and potential for significant compound growth, a Roth IRA can provide a solid foundation for a comfortable retirement.

While income limitations exist, the benefits of tax-free growth and withdrawals make a Roth IRA a valuable consideration for individuals looking to maximize their retirement savings.

Top FAQs

How does a Roth IRA differ from a traditional IRA?

A Roth IRA allows for tax-free withdrawals in retirement, while a traditional IRA offers tax deductions on contributions but requires you to pay taxes on withdrawals in retirement. The best choice depends on your individual tax situation and financial goals.

What are the income limitations for contributing to a Roth IRA?

There are income limitations for contributing to a Roth IRA. For 2024, if your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA or your contributions may be limited. These limits are adjusted annually, so it’s essential to check the latest guidelines.

Can I withdraw my Roth IRA contributions before retirement?

Yes, you can withdraw contributions to a Roth IRA at any time without penalties. However, withdrawals of earnings before age 59 1/2 may be subject to taxes and penalties.