What are the 401k contribution limits for 2024 for different ages – What are the 2024 401k contribution limits for different ages? This question is on the minds of many Americans as they plan for their financial future. Understanding these limits is crucial for maximizing retirement savings and ensuring a comfortable lifestyle in later years.

The 401(k) plan, a popular retirement savings vehicle, allows employees to contribute pre-tax income, reducing their current tax burden and building a nest egg for the future. In 2024, there are specific contribution limits based on age, designed to encourage individuals to save more as they approach retirement.

This article will delve into the nuances of these limits, shedding light on the factors that influence them and providing strategies for maximizing contributions.

The 2024 contribution limits are a significant consideration for individuals seeking to maximize their retirement savings. The limits, which are adjusted annually, dictate the maximum amount an individual can contribute to their 401(k) plan. The limits vary depending on age, with older individuals often having higher limits to encourage them to save more in the years leading up to retirement.

Understanding these limits is crucial for making informed financial decisions and ensuring that you are taking full advantage of your retirement savings opportunities.

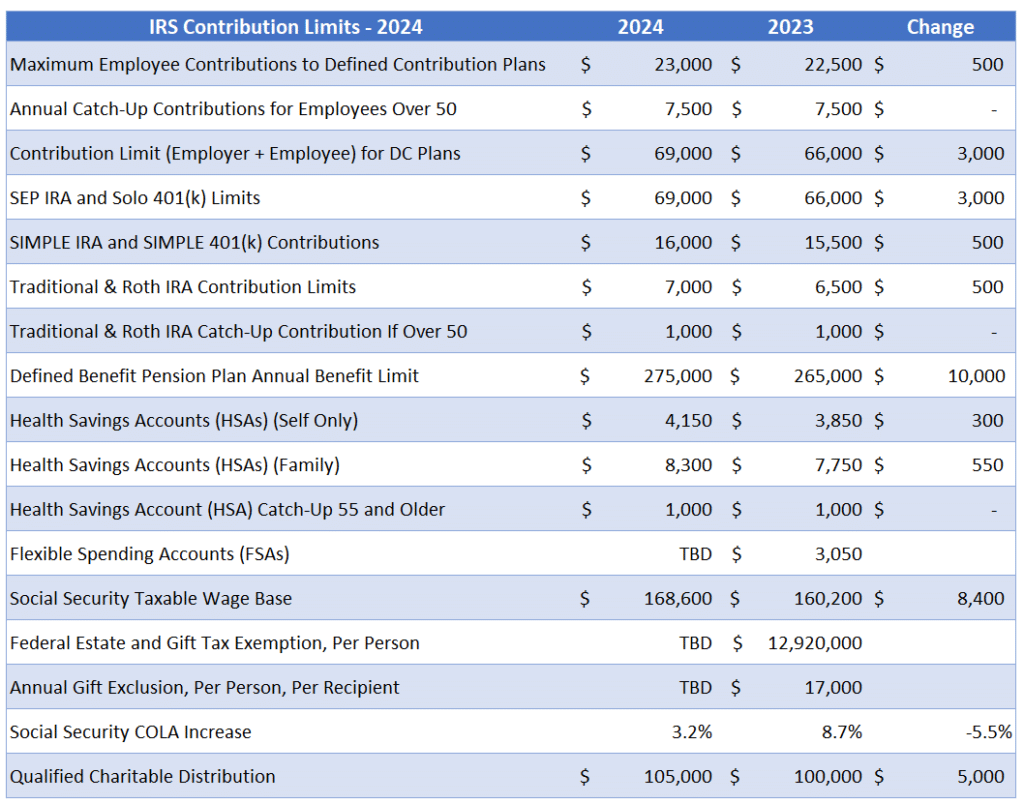

2024 401(k) Contribution Limits Overview

The 2024 401(k) contribution limits are designed to help individuals save for retirement. These limits represent the maximum amount of money you can contribute to your 401(k) plan in a given year. The contribution limits are divided into two categories: employee contributions and employer matching contributions.

The deadline for filing taxes is usually April 15th, but you can request an extension until October 15th. Check out this link for more details on tax filing extensions for October 2024.

Employee contributions refer to the amount of money you personally contribute to your 401(k) plan, while employer matching contributions represent the amount your employer contributes to your plan based on your own contributions.

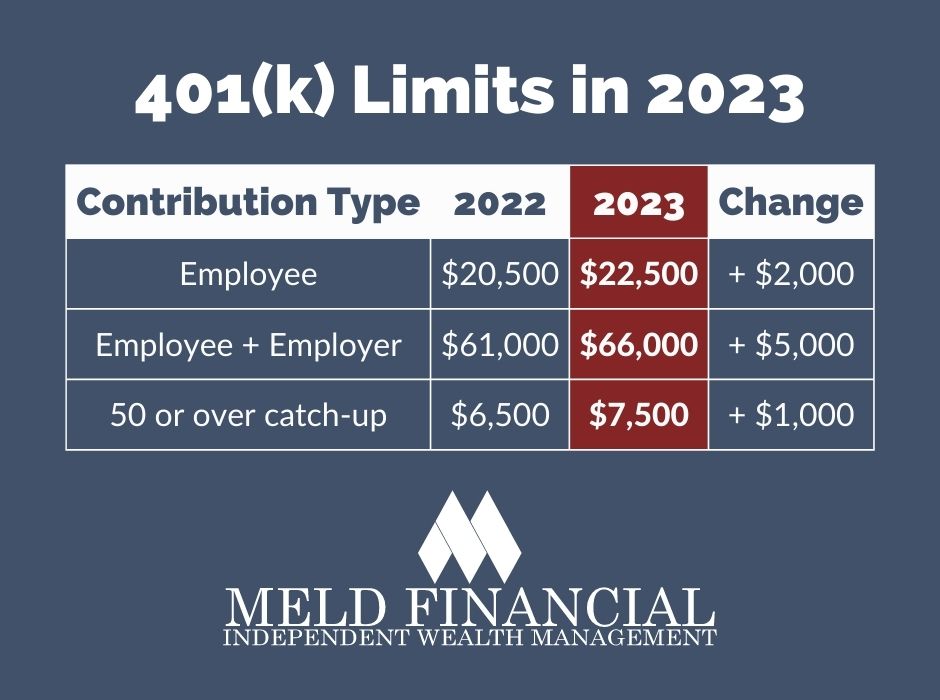

Employee Contributions

The maximum amount you can contribute to your 401(k) plan in 2024 is $22,500. This limit applies to all individuals, regardless of age.

Employer Matching Contributions

Employer matching contributions are an additional benefit offered by some employers. They are essentially free money that your employer contributes to your 401(k) plan based on your own contributions. The amount of the employer match varies depending on the employer’s plan.

Catch-Up Contributions

Individuals aged 50 and older are eligible for “catch-up” contributions. This allows them to contribute an additional $7,500 to their 401(k) plan in 2024, increasing the total maximum contribution to $30,000.

Age-Based Contribution Limits

The 2024 401(k) contribution limits are influenced by your age. The IRS sets these limits to encourage individuals to save more for retirement as they get closer to retirement age. This ensures you have enough time to build a sizable nest egg.

The tax brackets for qualifying widow(er)s can be different than for other individuals. You can find more information on this topic here.

Age-Based Contribution Limits

The following table summarizes the 2024 401(k) contribution limits based on age:

| Age | Employee Contribution Limit | Employer Match Limit | Total Maximum Contribution Limit |

|---|---|---|---|

| Under 50 | $22,500 | Varies by employer | $66,000 |

| 50 and older | $30,000 | Varies by employer | $73,500 |

The catch-up contribution limit is the extra amount individuals 50 and older can contribute to their 401(k) plans beyond the regular limit. This is intended to help older workers make up for lost time in saving for retirement.

Impact of Contribution Limits on Retirement Savings

The annual contribution limits for 401(k) plans are designed to help individuals save for retirement. These limits encourage regular savings and help ensure that individuals have enough money to support themselves in their later years. However, the limits can also impact the amount of money individuals can save for retirement.The impact of 401(k) contribution limits on retirement savings can be significant, particularly for individuals who are able to contribute more than the limit.

By maximizing contributions within the established limits, individuals can potentially accelerate their retirement savings and achieve their financial goals sooner.

You’ll want to know how much you can contribute to your 401k for 2024. Find the information on the 401k contribution limits for 2024 here.

Impact of Contribution Limits on Retirement Savings

The contribution limits for 401(k) plans can impact retirement savings in several ways. Here are some key considerations:* Reduced Savings Potential:The contribution limits set a ceiling on how much individuals can contribute to their 401(k) plans each year. For individuals who can afford to save more, the limits can restrict their ability to maximize their retirement savings.

If you’re over 50, you can contribute more to your 401k than someone younger. Find out more about the contribution limits for those over 50 here.

Impact on Long-Term Growth

Seniors can often take advantage of a higher standard deduction. You can find the details on the standard deduction for seniors in 2024 here.

The contribution limits can affect the long-term growth of retirement savings. The earlier individuals start saving and the more they contribute, the greater the potential for compound interest to work its magic. The power of compound interest allows investments to grow exponentially over time.

If you’re over 50, you can contribute more to your 401k. Learn more about the catch-up contributions you can make here.

Missed Opportunities for Tax Advantages

401(k) contributions are tax-deferred, meaning individuals do not have to pay taxes on the contributions or the earnings until they withdraw the money in retirement. By maximizing contributions within the limits, individuals can take full advantage of these tax benefits.

Examples of Contribution Levels and Retirement Outcomes

To illustrate the impact of contribution limits on retirement savings, let’s consider a few examples:* Example 1: Maximum Contribution vs. Lower Contribution:Imagine two individuals, both starting their careers at age 25, with the same salary. One individual contributes the maximum amount allowed to their 401(k) plan each year, while the other contributes a lower amount.

If you’re a small business owner, you might be eligible for a different IRA contribution limit. Learn more about the IRA contribution limits for small business owners in 2024 here.

Assuming an average annual return of 7%, the individual who contributes the maximum amount could have significantly more money saved for retirement.

The 401k contribution limits can change each year. Check out this link for the latest information on the 401k contribution limit for 2024 here.

Example 2

Early vs. Late Contributions: The earlier individuals start saving for retirement, the greater the potential for their savings to grow. This is due to the power of compound interest. For example, an individual who starts contributing to their 401(k) at age 25 and contributes the maximum amount allowed each year will have significantly more saved for retirement than an individual who starts contributing at age 40.

Importance of Maximizing Contributions Within Limits

Maximizing contributions within the established 401(k) contribution limits is crucial for building a strong retirement nest egg. Here are some key benefits:* Accelerated Savings:By contributing the maximum amount allowed, individuals can accelerate their retirement savings and reach their financial goals sooner.

Tax Advantages

401(k) contributions are tax-deferred, meaning individuals do not have to pay taxes on the contributions or the earnings until they withdraw the money in retirement.

If you’re working with government agencies, you’ll need to fill out a W9 form. Learn more about the W9 form for government agencies in October 2024 here.

Increased Retirement Security

If you’re driving for business, you can use the IRS mileage rate to deduct your expenses. Find the current IRS mileage rate for October 2024 here.

Maximizing contributions can help individuals achieve greater financial security in retirement, allowing them to live comfortably and pursue their desired lifestyle.

If you’re curious about the top tax bracket for 2024, you can find the information here. It’s essential to know this, especially if you’re anticipating a higher income this year.

Compounding Power

You can contribute more to your 401k if you’re over 50. Learn more about the catch-up contributions you can make here.

The earlier individuals start saving and the more they contribute, the greater the potential for compound interest to work its magic. The power of compound interest allows investments to grow exponentially over time.

If you’re a freelancer, you’ll want to make sure you’re aware of the October 2024 tax deadline. You can find more information on this deadline here.

The earlier you start saving for retirement, the more time your money has to grow through compound interest. Even small contributions can make a big difference over time.

Strategies for Maximizing 401(k) Contributions

Maximizing your 401(k) contributions is a crucial step towards securing a comfortable retirement. By strategically allocating your savings, you can take advantage of tax benefits and compound growth to reach your financial goals.

There are a number of tax deductions you can claim. Check out this link for a list of tax deductions for the October 2024 deadline here.

Evaluating Your Current Contribution Levels

It’s essential to start by assessing your current contribution level and identifying areas for improvement. This step involves analyzing your income, expenses, and existing savings to determine the optimal contribution amount.

- Review your current contribution percentage:Determine the percentage of your pre-tax income you’re currently contributing to your 401(k). This percentage can be found on your pay stubs or your 401(k) account statement.

- Calculate your maximum contribution limit:The IRS sets annual contribution limits for 401(k) plans. For 2024, the limit is $22,500 for individuals under age 50. If you’re 50 or older, you can contribute an additional $7,500, bringing the total to $30,000. You can find the most up-to-date information on the IRS website.

Trusts also need to file a W9 form. You can find the specific details on the W9 form for trusts in October 2024 here.

- Analyze your income and expenses:Consider your annual income and your monthly expenses. Identify areas where you can potentially reduce spending or increase income to allocate more towards your 401(k) contributions.

- Review your retirement goals:Determine how much you need to save for retirement based on your desired lifestyle and retirement age. This can be a helpful benchmark to assess your current contribution levels and make adjustments if needed.

Increasing Contributions Over Time, What are the 401k contribution limits for 2024 for different ages

Once you’ve evaluated your current contribution levels, you can start planning for gradual increases. This approach allows you to adjust your budget gradually and maximize your savings potential.

- Implement a gradual increase:Instead of making a significant jump in contributions, consider increasing them by a small percentage every year, such as 1% to 2%. This approach allows you to adapt to the change and minimizes the impact on your monthly budget.

- Take advantage of employer matches:If your employer offers a matching contribution program, be sure to contribute enough to receive the full match. This is essentially free money that can significantly boost your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, make sure you contribute at least 6% to get the full match.

- Maximize contributions during peak earning years:As your income increases, consider maximizing your contributions during your peak earning years. This can lead to significant growth over time due to compound interest.

“The sooner you start saving, the more time your money has to grow. Even small contributions can make a big difference over the long term.”

Summary: What Are The 401k Contribution Limits For 2024 For Different Ages

Navigating the 2024 401(k) contribution limits can seem daunting, but understanding the intricacies is key to maximizing your retirement savings potential. By staying informed about the age-based limits, factors influencing contributions, and strategies for maximizing contributions, you can make informed decisions that set you on a path toward a secure and comfortable retirement.

Remember, the journey to financial security starts with taking proactive steps to save for the future, and understanding these limits is a crucial part of that journey.

Commonly Asked Questions

What are the consequences of exceeding the 401(k) contribution limit?

If you exceed the 401(k) contribution limit, the excess contributions will be subject to a 10% penalty, plus the usual income tax rate. You will also have to pay interest on the excess contribution.

Can I contribute to a Roth IRA in addition to my 401(k)?

Yes, you can contribute to a Roth IRA in addition to your 401(k). However, the total amount you contribute to both accounts may be subject to income limitations.

How does the 401(k) contribution limit affect my Social Security benefits?

The 401(k) contribution limit does not directly affect your Social Security benefits. However, the amount you save in your 401(k) can indirectly impact your Social Security benefits by increasing your overall savings and reducing your reliance on Social Security in retirement.