What are the 2024 federal tax brackets for single filers? This question is on the minds of many individuals as they prepare for the upcoming tax season. Understanding how the federal tax system works is crucial for maximizing your financial well-being.

The US tax system utilizes a progressive tax structure, meaning that higher earners pay a larger percentage of their income in taxes. This system is designed to ensure fairness and equity, but it can also be complex to navigate.

This article provides a comprehensive guide to the 2024 federal tax brackets for single filers, covering key aspects such as tax rates, standard deductions, and common tax credits and deductions. We’ll explore how these factors impact your tax liability and offer tips for optimizing your tax planning strategies.

Whether you’re a seasoned tax professional or just starting to understand the intricacies of the system, this information will be valuable as you prepare for the year ahead.

Introduction to Federal Tax Brackets: What Are The 2024 Federal Tax Brackets For Single Filers

The US federal income tax system uses a progressive tax structure, which means that individuals with higher incomes pay a larger percentage of their income in taxes. This system relies on tax brackets, which are ranges of income that are taxed at different rates.

Understanding how these brackets work is essential for accurately calculating your tax liability.Tax brackets serve as a way to ensure fairness and progressivity in the tax system. They ensure that individuals with higher incomes contribute a greater share to support government services and programs.

If you’re over 50, you can contribute more to your 401(k) than younger workers. The catch-up contribution limit for 2024 is $7,500. This means you can contribute up to $30,000 in total for the year. This can be a great way to boost your retirement savings and catch up on any contributions you may have missed in the past.

The US tax code is designed to be progressive, meaning that higher earners pay a higher percentage of their income in taxes.

Factors Influencing Tax Bracket Assignment

Tax bracket assignments for single filers are influenced by several key factors, including:

- Taxable Income:The most significant factor determining your tax bracket is your taxable income. This is your gross income (wages, salaries, investments, etc.) minus deductions and exemptions.

- Filing Status:Your filing status (single, married filing jointly, head of household, etc.) affects the tax brackets you fall into and the standard deduction you can claim.

- Tax Credits:Certain tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, can reduce your tax liability and potentially move you into a lower tax bracket.

2024 Federal Tax Brackets for Single Filers

The 2024 federal tax brackets for single filers are determined by the amount of taxable income you earn. Taxable income is your gross income minus deductions and exemptions. The tax brackets are progressive, meaning that the more you earn, the higher the tax rate you pay on a portion of your income.

The October 2024 tax deadline for businesses is approaching quickly. If you’re a business owner, it’s important to stay organized and file your taxes on time to avoid any penalties. The IRS offers a variety of resources to help businesses meet their tax obligations.

You can find more information on the IRS website, or you can contact the IRS directly with any questions. For more information, you can check out the IRS website here.

2024 Federal Tax Brackets for Single Filers

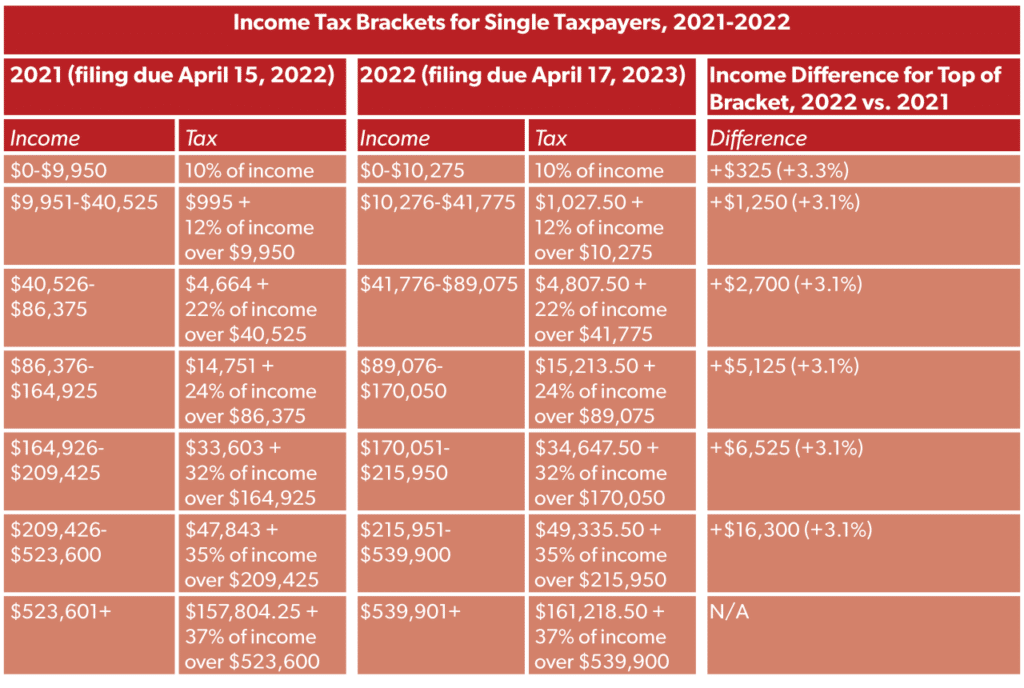

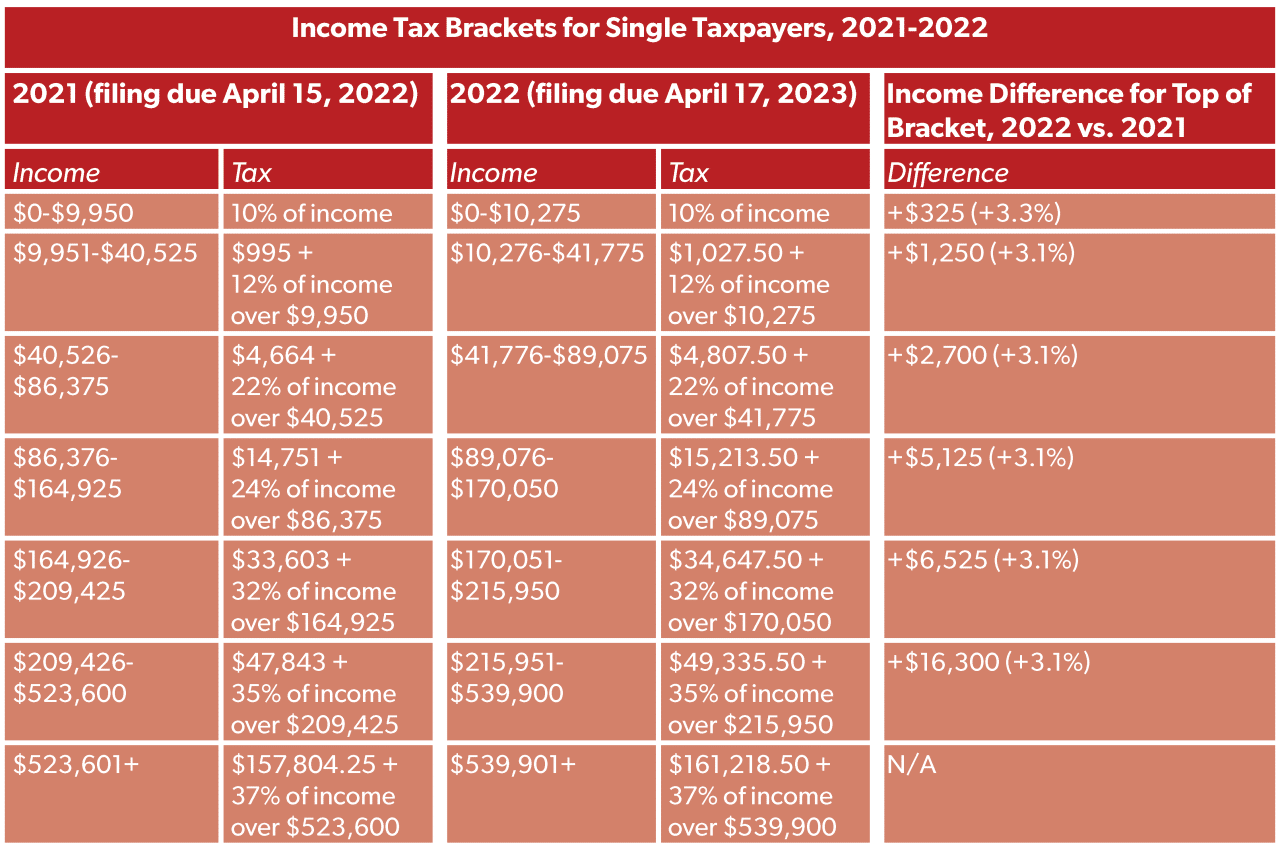

The following table shows the 2024 federal tax brackets for single filers:

| Tax Bracket | Income Range | Tax Rate | Total Tax Liability |

|---|---|---|---|

| 10% | $0

The tax brackets for married filing separately in 2024 are different from the brackets for other filing statuses. This means that you’ll pay a different amount of taxes if you’re married filing separately. The tax brackets for married filing separately are generally higher than the brackets for other filing statuses. This is because the tax burden is divided between two people. You can find the specific tax brackets for each income level on the IRS website, or you can use a tax calculator to estimate your tax liability. You can find the tax brackets for married filing separately in 2024 here.

|

10% | $0

Planning for retirement? It’s important to know the contribution limits for your 401(k) plan. For 2024, the maximum amount you can contribute is $22,500. This limit applies to traditional and Roth 401(k) plans. If you’re 50 or older, you can contribute an additional $7,500 as a catch-up contribution.

|

| 12% | $10,951

If you’re looking to save for retirement, a Roth IRA can be a great option. For 2024, the contribution limit for a Roth IRA is $6,500. If you’re 50 or older, you can contribute an additional $1,000 as a catch-up contribution. This means you can contribute up to $7,500 in total for the year.

|

12% | $1,095

|

| 22% | $46,276

The maximum amount you can contribute to a 401(k) in 2024 is $22,500. This limit applies to both traditional and Roth 401(k) plans. It’s important to note that this limit is subject to change in future years. If you’re unsure about your contribution limit, you can always consult with a financial advisor.

|

22% | $5,553

The contribution limits for IRAs are set to increase in 2024 and beyond. For 2024, the contribution limit for a traditional IRA is $6,500 , and the limit for a Roth IRA is also $6,500. If you’re 50 or older, you can contribute an additional $1,000 as a catch-up contribution to either type of IRA.

|

| 24% | $101,751

The maximum 401(k) contribution for 2024 for those over 50 is $30,000. This includes the regular contribution limit of $22,500 plus the catch-up contribution limit of $7,500. It’s important to note that this limit is subject to change in future years.

|

24% | $18,951

|

| 32% | $192,151

|

32% | $37,557

The October 2024 tax deadline for businesses is October 15th. This deadline applies to businesses that operate on a fiscal year ending in September. If you’re a business owner, it’s important to stay organized and file your taxes on time to avoid any penalties.

|

| 35% | $578,126

The tax brackets for qualifying widow(er)s in 2024 are the same as for married filing jointly. This means that you’ll pay the same amount of taxes as a married couple if you’re a qualifying widow(er). You can find the specific tax brackets for each income level on the IRS website, or you can use a tax calculator to estimate your tax liability. You can find the tax brackets for qualifying widow(er)s in 2024 here.

|

35% | $161,765

|

| 37% | $1,000,001+ | 37% | $331,765+ |

Calculating Tax Liability, What are the 2024 federal tax brackets for single filers

The tax liability for each bracket is calculated by multiplying the taxable income in that bracket by the corresponding tax rate. For example, if your taxable income is $50,000, you would pay 10% on the first $10,950, 12% on the income between $10,951 and $46,275, and 22% on the income between $46,276 and $50,000.

Tax Liability = (Taxable Income in Bracket

Tax Rate)

The total tax liability is the sum of the tax liability for each bracket.

Standard Deduction and Personal Exemption

The standard deduction is a fixed amount that taxpayers can deduct from their taxable income, reducing the amount of taxes they owe. It’s a simplified way to account for certain common expenses, such as medical expenses, charitable contributions, and state and local taxes.

The standard deduction is meant to benefit taxpayers who don’t itemize their deductions, which involves listing specific expenses to reduce their taxable income.

Standard Deduction for Single Filers in 2024

The standard deduction for single filers in 2024 is $13,850. This means that single filers can reduce their taxable income by $13,850 before calculating their federal income tax liability.

Impact of Standard Deduction on Taxable Income

The standard deduction directly reduces a taxpayer’s taxable income. This means that a single filer with $50,000 in taxable income would only owe taxes on $36,150 ($50,000$13,850). This reduction in taxable income leads to a lower tax liability.

Changes to the Standard Deduction in 2024

The standard deduction for 2024 has been adjusted for inflation. The standard deduction for single filers increased from $13,200 in 2023 to $13,850 in 2024.

The standard deduction for seniors in 2024 is $20,800 for those who are single, $27,200 for those who are married filing jointly, and $13,600 for those who are married filing separately. This deduction can help reduce your tax liability and save you money.

Additional Tax Credits and Deductions

In addition to the standard deduction and personal exemption, single filers can further reduce their tax liability by claiming various tax credits and deductions. These benefits are designed to provide financial relief to individuals in specific circumstances or for certain activities.

Tax Credits

Tax credits directly reduce the amount of taxes owed, dollar for dollar. They are often more beneficial than deductions because they provide a larger tax savings.

The catch-up contribution limit for 401(k) plans in 2024 is $7,500. This limit applies to those who are 50 or older. It’s a great way to boost your retirement savings and make up for any contributions you may have missed in the past.

The catch-up contribution limit can be added to the regular contribution limit, allowing you to contribute up to $30,000 for the year.

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on the filer’s income, filing status, and number of qualifying children. For example, a single filer with no children and an adjusted gross income (AGI) of $23,430 in 2024 could receive a maximum EITC of $1,004.

The 401(k) contribution limits for 2024 vary depending on your age. For those under 50, the limit is $22,500. If you’re 50 or older, you can contribute an additional $7,500 as a catch-up contribution. These limits are designed to help you save for retirement, regardless of your age.

- Child Tax Credit:This credit provides a tax break for families with qualifying children under the age of 17. The credit amount is $2,000 per child, with a portion of the credit potentially refundable. For example, a single filer with one qualifying child could receive a $2,000 credit.

However, the amount of the credit is phased out for higher-income families.

- American Opportunity Tax Credit (AOTC):This credit is available for the first four years of post-secondary education. The credit is worth up to $2,500 per student, with a maximum of $1,000 being refundable. The credit is phased out for higher-income families.

- Premium Tax Credit (PTC):This credit helps individuals and families afford health insurance purchased through the Health Insurance Marketplace. The credit is calculated based on income and family size. For example, a single filer with an income of $40,000 in 2024 could receive a PTC of up to $1,000, depending on the cost of their health insurance plan.

Deductions

Deductions reduce taxable income, which in turn lowers the amount of taxes owed.

- Medical Expenses:Individuals can deduct medical expenses exceeding 7.5% of their AGI. This deduction is often used for out-of-pocket medical costs, such as doctor’s visits, prescription drugs, and dental care. For example, a single filer with an AGI of $50,000 in 2024 could deduct medical expenses exceeding $3,750.

- State and Local Taxes (SALT):The 2017 Tax Cuts and Jobs Act limited the deduction for state and local taxes to $10,000 per household. This deduction can be claimed for property taxes, income taxes, and sales taxes. For example, a single filer who paid $12,000 in state and local taxes in 2024 could deduct $10,000.

- Homeownership Expenses:Individuals who own their homes can deduct mortgage interest and property taxes. These deductions can significantly reduce taxable income, particularly for those with large mortgages. For example, a single filer with a mortgage of $300,000 could deduct the interest paid on that mortgage, depending on the interest rate and the loan term.

The contribution limits for traditional 401(k) plans in 2024 are the same as for Roth 401(k) plans. You can contribute up to $22,500 for the year. If you’re 50 or older, you can contribute an additional $7,500 as a catch-up contribution.

This means you can contribute up to $30,000 in total for the year.

- Charitable Contributions:Individuals can deduct cash contributions to qualified charities up to 60% of their AGI. For example, a single filer with an AGI of $100,000 in 2024 could deduct up to $60,000 in charitable contributions. The deduction for non-cash contributions, such as donated clothing or furniture, is subject to different rules.

Tax Planning Considerations for Single Filers

As a single filer, understanding tax planning strategies is crucial for maximizing your income and minimizing your tax liability. By proactively planning your finances, you can potentially reduce your tax burden and ensure that you are taking advantage of all available deductions and credits.

Tax Planning Strategies for Single Filers

- Maximize Deductions and Credits:Single filers can benefit from a variety of deductions and credits, such as the standard deduction, the earned income tax credit, and the child tax credit (if applicable). Carefully review your tax situation and identify all eligible deductions and credits to maximize your tax savings.

- Contribute to Retirement Accounts:Contributions to traditional and Roth IRAs can lower your taxable income, potentially placing you in a lower tax bracket. Consider contributing to a 401(k) or other employer-sponsored retirement plan if available.

- Optimize Your Tax Withholding:Review your W-4 form to ensure you are withholding the correct amount of taxes. Adjusting your withholdings can help avoid a large tax bill or a refund at the end of the year.

- Consider Tax-Advantaged Investments:Explore investments that offer tax advantages, such as municipal bonds, which often have tax-free interest income. These investments can help reduce your overall tax liability.

- Keep Detailed Records:Maintaining accurate and detailed records of all your income, expenses, and tax-related documents is essential for accurate tax preparation and potential audits. It also helps you identify potential deductions and credits you might have missed.

Potential Tax Bracket Changes

Tax brackets can shift based on factors such as income level, deductions, and credits. For example, a single filer’s income might increase due to a raise or bonus, potentially pushing them into a higher tax bracket. Conversely, a significant deduction or credit could move a filer into a lower bracket.

It’s important to be aware of these potential shifts and adjust your financial strategies accordingly.

Seeking Professional Tax Advice

Navigating tax laws can be complex, and it’s always advisable to seek professional advice from a qualified tax advisor. A tax professional can help you understand your individual tax situation, identify potential tax savings opportunities, and ensure compliance with all applicable tax regulations.

They can also provide guidance on strategies for minimizing your tax liability, especially in situations involving significant income changes, complex financial arrangements, or unique tax circumstances.

Ultimate Conclusion

Navigating the federal tax system can be daunting, but understanding the 2024 tax brackets for single filers is a crucial first step. By familiarizing yourself with the various tax rates, deductions, and credits available, you can make informed decisions that optimize your tax planning and minimize your tax liability.

Remember, seeking professional advice from a qualified tax advisor is essential to ensure you are taking advantage of all eligible deductions and credits and complying with all applicable tax laws. With a clear understanding of the system and proper planning, you can confidently navigate the tax season and maximize your financial well-being.

Q&A

What is the difference between a tax bracket and a tax rate?

A tax bracket defines the income range for which a specific tax rate applies. The tax rate, on the other hand, is the percentage of your income that is taxed at that particular bracket.

How do I know which tax bracket I fall into?

Your tax bracket is determined by your taxable income, which is your gross income minus deductions and exemptions. Refer to the table provided in this article to identify your corresponding tax bracket based on your income level.

Are there any circumstances where my tax bracket might change during the year?

Yes, your tax bracket can change if your income fluctuates significantly throughout the year, such as due to a job change, a bonus, or a large investment gain. It’s important to monitor your income and adjust your tax planning accordingly.

What are some common tax credits available to single filers?

Common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit. Eligibility criteria and potential benefits vary, so it’s crucial to research and understand the specific requirements for each credit.