Wells Fargo Mortgage Rates are a crucial factor for anyone looking to buy or refinance a home. Understanding the various rates, factors that influence them, and the processes involved can make a significant difference in your financial journey.

Owning a home is a major milestone, and a home loan can make that dream a reality. There are various loan programs available, so it’s important to explore your options and find the best fit for your situation.

This guide delves into the intricacies of Wells Fargo mortgage rates, covering everything from current rates and available promotions to factors that impact your eligibility and the steps involved in securing a mortgage. We’ll also explore the nuances of refinancing and provide helpful tips for minimizing closing costs.

Discover offers a range of financial products, including loans. From personal loans to home equity lines of credit, they can help you achieve your financial goals.

Final Review: Wells Fargo Mortgage Rates

Navigating the world of mortgage rates can feel daunting, but with a thorough understanding of Wells Fargo’s offerings and the factors at play, you can make informed decisions and secure a mortgage that aligns with your financial goals. Remember, researching and comparing options is key to finding the best deal.

Staying informed about current mortgage rates is crucial when considering a home purchase. Rates fluctuate, so understanding the market can help you secure the best deal.

FAQ

What is the difference between an interest rate and an APR?

Discover’s personal loans offer a convenient and flexible way to consolidate debt or fund a major purchase. Discover Personal Loans are known for their competitive rates and transparent terms.

An interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. APR (Annual Percentage Rate) includes the interest rate plus other fees associated with the loan, such as closing costs and origination fees.

Financing your education can be a significant hurdle, but there are options available. College loans can help bridge the gap, allowing you to pursue your academic goals without financial constraints.

How can I improve my credit score to qualify for better mortgage rates?

Federal employees have access to specialized loan programs designed to meet their unique needs. Loans for federal employees often come with competitive rates and terms.

Pay bills on time, keep credit utilization low, avoid opening new credit accounts frequently, and consider disputing any errors on your credit report.

Whether you’re buying a new or used car, auto loans offer flexible financing options to fit your budget and needs.

What is a pre-approval and why is it important?

Before you commit to a new vehicle, it’s wise to get pre-qualified for an auto loan. Pre-qualifying gives you an idea of your borrowing power and helps you make informed decisions when negotiating with dealerships.

A pre-approval is a preliminary estimate of how much you can borrow based on your financial information. It helps you understand your borrowing power and makes you a more attractive buyer to sellers.

What are some common closing costs?

Common closing costs include loan origination fees, appraisal fees, title insurance, and property taxes.

Fixed-rate home loans offer peace of mind with predictable monthly payments. Fixed-rate home loans protect you from fluctuating interest rates, ensuring your payments remain stable over the life of the loan.

Wells Fargo is a well-known financial institution that offers personal loans. Wells Fargo Personal Loan Rates can vary, so it’s essential to compare them to other lenders to find the best option for you.

The government offers programs to help borrowers manage student loan debt. Studentaid.gov debt relief programs can provide options for forgiveness, consolidation, or repayment plans.

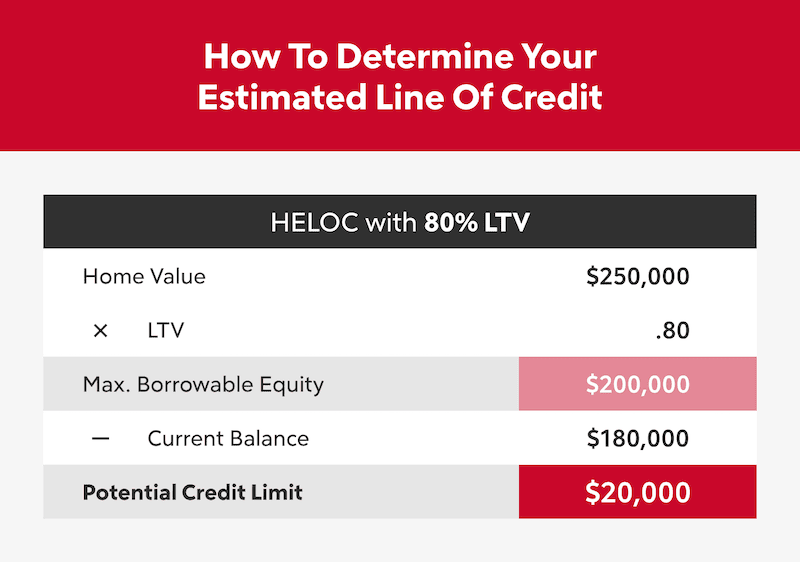

A home equity line of credit (HELOC) allows you to borrow against the equity you’ve built in your home. HELOCs can be used for various purposes, such as home improvements or debt consolidation.

For eligible veterans, the VA offers specialized home loan programs. VA home loans often come with competitive terms and require no down payment.

When seeking a loan, it’s beneficial to compare offers from different loan companies. This allows you to find the best rates and terms for your specific needs.

River Valley Loans is a reputable lender that provides a variety of financial products. River Valley Loans can help you secure the financing you need, whether it’s for a home purchase, auto loan, or personal loan.