Weighting and Aggregation in the November 2024 CPI Calculation play a pivotal role in understanding the economic landscape, as they underpin the measurement of inflation, a key indicator for policymakers and consumers alike. The Consumer Price Index (CPI) provides a comprehensive snapshot of price changes in a basket of goods and services, reflecting the purchasing power of consumers.

Discover the crucial elements that make The CPI and the Environment in November 2024 the top choice.

This article delves into the intricacies of weighting and aggregation, exploring their impact on the CPI calculation and its implications for economic policy decisions.

The CPI is calculated by assigning weights to different categories of goods and services based on their relative importance in consumer spending. These weights are meticulously determined through surveys and data analysis, ensuring that the CPI accurately reflects the changing consumption patterns of the population.

Understand how the union of Common Misconceptions about the CPI in November 2024 can improve efficiency and productivity.

The process of aggregation involves combining the price data for individual items within each category, resulting in a single CPI measure that represents the overall price level.

Introduction to the Consumer Price Index (CPI)

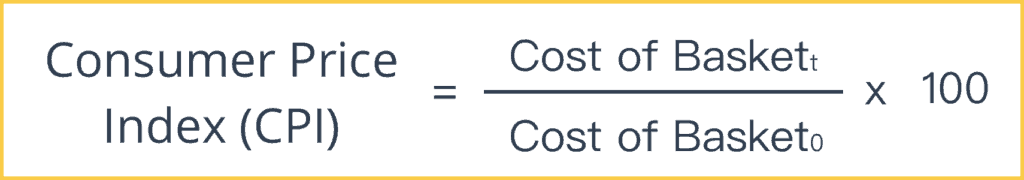

The Consumer Price Index (CPI) is a vital economic indicator that measures changes in the average prices paid by urban consumers for a basket of consumer goods and services. It serves as a key gauge of inflation, reflecting the purchasing power of consumers over time.

The CPI’s significance lies in its ability to track the cost of living and provide valuable insights into the broader economic landscape.

The Importance of the CPI in Measuring Inflation

Inflation, defined as a sustained increase in the general price level of goods and services, can significantly impact economic stability and individual purchasing power. The CPI plays a crucial role in measuring inflation by providing a standardized measure of price changes across a wide range of consumer goods and services.

By tracking these price fluctuations, the CPI helps policymakers and economists understand the extent of inflation and its potential impact on the economy.

The Significance of Accurate CPI Calculations for Economic Policy Decisions

Accurate CPI calculations are essential for informed economic policy decisions. The CPI serves as a benchmark for various economic policies, including:

- Monetary Policy:Central banks use the CPI to guide their monetary policy decisions, such as setting interest rates. By understanding inflation trends, central banks can adjust interest rates to maintain price stability and support economic growth.

- Social Welfare Programs:The CPI is used to adjust the value of social welfare programs, such as Social Security and Medicare, to ensure that benefits keep pace with inflation. This helps maintain the purchasing power of recipients and ensures their ability to meet basic needs.

- Wage Negotiations:The CPI serves as a reference point for wage negotiations, as workers often seek compensation increases that align with inflation to maintain their real purchasing power.

- Government Spending:The CPI is used to adjust government spending on various programs, such as defense and education, to account for inflation and ensure that funding levels remain consistent in real terms.

Inaccurate CPI calculations can lead to distorted economic policies, potentially resulting in suboptimal outcomes for individuals, businesses, and the economy as a whole.

Weighting in the CPI Calculation

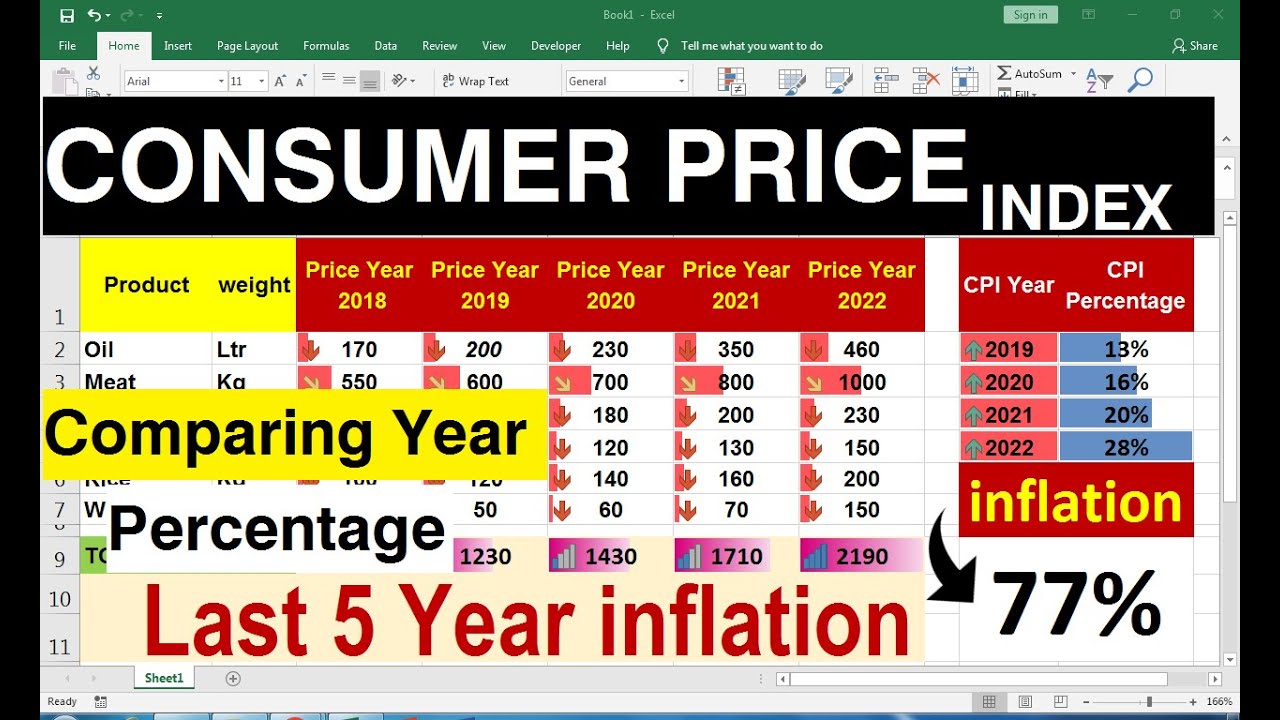

Weighting is a fundamental aspect of the CPI calculation, reflecting the relative importance of different goods and services in the overall consumption basket of urban consumers. It ensures that the CPI accurately reflects changes in the cost of living by giving greater weight to items that consumers spend more on.

Examples of Different Categories of Goods and Services and Their Respective Weights

The CPI basket comprises various categories of goods and services, each assigned a specific weight based on consumer spending patterns. For instance, the weight assigned to food is higher than the weight assigned to clothing, reflecting the greater proportion of household budgets allocated to food expenses.

| Category | Weight (Approximate) |

|---|---|

| Food and Beverages | 14% |

| Housing | 42% |

| Transportation | 17% |

| Medical Care | 8% |

| Recreation | 6% |

| Education and Communication | 6% |

| Apparel | 3% |

| Other Goods and Services | 4% |

These weights are subject to change over time as consumer spending patterns evolve. For example, the weight assigned to technology goods may increase as their adoption becomes more widespread.

How Weights are Determined and Updated

Weights are determined based on extensive data collection and analysis of consumer spending patterns. The Bureau of Labor Statistics (BLS) conducts regular surveys of households to gather information on their expenditure on various goods and services. This data is then used to calculate the weights assigned to each category in the CPI basket.

Notice CPI and Housing Affordability in November 2024 for recommendations and other broad suggestions.

Weights are updated periodically to reflect changes in consumer spending patterns. This ensures that the CPI remains relevant and accurately reflects the cost of living for urban consumers. Accurate data collection and analysis are crucial for maintaining the integrity of the CPI and its effectiveness as a measure of inflation.

Aggregation in the CPI Calculation: Weighting And Aggregation In The November 2024 CPI Calculation

The CPI calculation involves aggregating price data for different categories of goods and services into a single measure. This aggregation process combines the price changes of individual items within each category, taking into account their respective weights, to arrive at an overall CPI index.

Various Aggregation Methods Used

The BLS uses different aggregation methods, including arithmetic and geometric means, to calculate the CPI. The choice of aggregation method depends on the specific characteristics of the goods and services being considered.

- Arithmetic Mean:This method is used when the price changes for different items within a category are relatively similar. It involves simply averaging the price changes of all items in the category, weighted by their respective importance in consumer spending.

- Geometric Mean:This method is used when the price changes for different items within a category vary significantly. It takes into account the multiplicative effect of price changes, providing a more accurate representation of overall price changes in the category.

Impact of Different Aggregation Methods on the Overall CPI Calculation

The choice of aggregation method can impact the overall CPI calculation. For instance, using a geometric mean might result in a slightly lower CPI than using an arithmetic mean, particularly when there are significant price changes for certain items within a category.

Notice CPI and Consumer Confidence in November 2024 for recommendations and other broad suggestions.

The BLS carefully considers the characteristics of each category and the potential impact of different aggregation methods on the overall CPI calculation. This ensures that the CPI accurately reflects the changes in the cost of living for urban consumers.

Browse the implementation of CPI and the Global Economy in November 2024 in real-world situations to understand its applications.

Specific Considerations for the November 2024 CPI Calculation

The November 2024 CPI calculation may involve specific considerations due to potential changes in the economic landscape, consumer spending patterns, and the availability of data. The BLS continuously monitors economic conditions and adjusts the CPI calculation methodology as needed to ensure its accuracy and relevance.

Potential Changes or Updates to the CPI Calculation Methodology

The BLS may introduce changes to the CPI calculation methodology to reflect evolving consumer spending patterns or address data availability challenges. These changes could include:

- Updating Weights:The weights assigned to different categories of goods and services may be updated to reflect changes in consumer spending patterns. This ensures that the CPI accurately reflects the relative importance of different items in the overall consumption basket.

- Adding or Removing Items:The CPI basket may be updated to include new goods and services that have become more prevalent in consumer spending or to remove items that are no longer widely consumed.

- Adjusting Price Collection Methods:The BLS may adjust its price collection methods to account for changes in the availability of data or to improve the accuracy of price measurements.

Potential Impact of Any Changes on the Overall CPI Measure

Changes to the CPI calculation methodology can impact the overall CPI measure. For example, updating weights to reflect increased spending on technology goods could lead to a higher CPI, as these goods may experience faster price increases than other categories.

Remember to click The Impact of Technology on the November 2024 CPI to understand more comprehensive aspects of the The Impact of Technology on the November 2024 CPI topic.

Specific Challenges or Uncertainties Related to the CPI Calculation

The CPI calculation for November 2024 may face specific challenges or uncertainties related to:

- Economic Volatility:Economic volatility can make it challenging to accurately track price changes for certain goods and services, particularly those with highly fluctuating prices.

- Data Availability:Data availability can be a challenge, especially for newly emerging goods and services or for items with limited price information.

- Technological Advancements:Rapid technological advancements can make it difficult to accurately measure price changes for goods and services that are constantly evolving, such as electronic devices and software.

The BLS will need to carefully consider these challenges and uncertainties to ensure that the November 2024 CPI calculation remains accurate and reliable.

Find out further about the benefits of CPI and Transportation Costs in November 2024 that can provide significant benefits.

Implications of the CPI Calculation for Economic Policy

The CPI calculation has significant implications for economic policy decisions, influencing monetary policy, inflation expectations, consumer behavior, and government spending programs.

Potential Implications of the CPI Calculation for Monetary Policy Decisions

The CPI is a key input for central banks in setting interest rates. When inflation is high, as measured by the CPI, central banks typically raise interest rates to slow down economic growth and curb inflation. Conversely, when inflation is low, central banks may lower interest rates to stimulate economic activity.

Finish your research with information from CPI and Education Expenses in November 2024.

Impact of the CPI on Inflation Expectations and Consumer Behavior

The CPI influences inflation expectations, which in turn can impact consumer behavior. When consumers expect high inflation, they may accelerate their purchases to avoid paying higher prices later, potentially leading to increased demand and further price increases. Conversely, low inflation expectations can lead to reduced consumer spending, potentially slowing economic growth.

Role of the CPI in Informing Government Policies Related to Social Welfare Programs and Wage Adjustments, Weighting and Aggregation in the November 2024 CPI Calculation

The CPI plays a vital role in informing government policies related to social welfare programs and wage adjustments. Social Security and Medicare benefits are adjusted annually based on the CPI to ensure that their value keeps pace with inflation. Similarly, many labor contracts include cost-of-living adjustments (COLAs) tied to the CPI, ensuring that workers’ wages keep pace with inflation.

The CPI’s accuracy and relevance are crucial for maintaining the purchasing power of individuals and ensuring the effectiveness of government programs.

Conclusive Thoughts

The November 2024 CPI calculation is a crucial exercise, as it provides insights into the prevailing inflationary pressures and their impact on the economy. Understanding the intricacies of weighting and aggregation is paramount for policymakers to make informed decisions about monetary policy, social welfare programs, and wage adjustments.

Obtain access to How the November 2024 CPI Affects Your Daily Life to private resources that are additional.

By meticulously analyzing the CPI data, we gain valuable insights into consumer behavior, inflation expectations, and the overall health of the economy.

Discover more by delving into How to Use November 2024 CPI Data for Personal Finance Decisions further.

Essential FAQs

How often is the CPI updated?

The CPI is typically updated monthly, reflecting changes in prices and consumer spending patterns.

What are the major categories of goods and services included in the CPI?

The CPI includes a wide range of categories, such as food, housing, transportation, healthcare, education, and entertainment.

How does the CPI affect interest rates?

Central banks often use the CPI to gauge inflation and adjust interest rates accordingly. High inflation typically leads to higher interest rates to curb spending and control price increases.