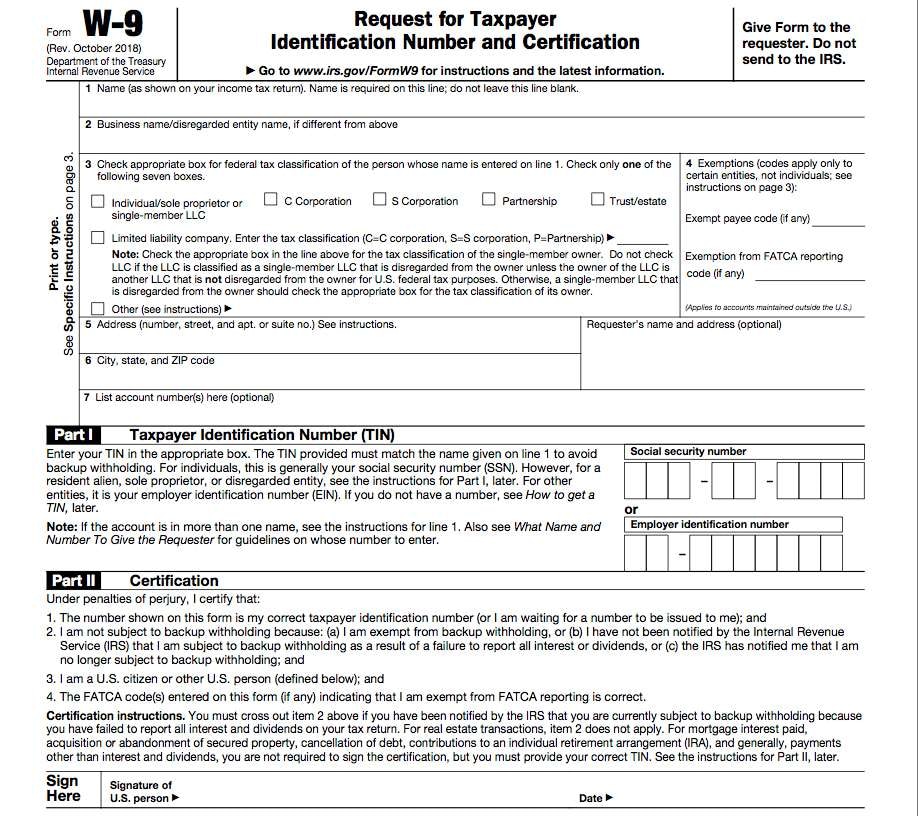

W9 Form October 2024 requirements for businesses are crucial for ensuring accurate tax reporting and compliance. The W9 Form serves as a vital document for businesses to provide their tax identification number (TIN) and other essential information to those who pay them, such as clients, vendors, and employers.

This information is essential for proper tax withholding and reporting, making it a critical aspect of business operations.

The October 2024 update brings potential changes to the W9 Form, necessitating businesses to stay informed about the latest regulations and guidelines. This guide will provide a comprehensive overview of the updated requirements, outlining the specific information businesses need to provide, how to accurately complete the form, and the implications for their financial and tax obligations.

Introduction to the W9 Form

The W9 Form is a crucial document used by businesses in the United States to gather taxpayer identification information from individuals and entities they are paying. It’s essential for proper tax reporting and ensures compliance with IRS regulations.The accurate completion of the W9 Form is vital for both the payer and the payee.

When filing your taxes, you may be eligible for certain deductions. These deductions can help reduce your tax liability. The tax deductions for the October 2024 deadline are typically announced in late summer or early fall.

For the payer, it allows them to accurately report payments made to the recipient on their tax return, avoiding potential penalties for incorrect reporting. For the payee, it ensures they receive the correct tax withholdings on their income and avoid potential penalties for non-compliance.

If you’re planning on claiming mileage deductions on your taxes, you’ll want to know the standard mileage rate for October 2024. This rate can change each year, so it’s important to stay up-to-date.

W9 Form Sections and Required Information

The W9 Form is divided into several sections, each requesting specific information from the payee. Here’s a breakdown of the key sections and the information they require:

- Payer’s Name, Address, and Taxpayer Identification Number (TIN):This section requests basic information about the payer, including their name, address, and TIN, typically their Employer Identification Number (EIN). This information is used to identify the payer for tax reporting purposes.

- Payee’s Name, Address, and TIN:This section gathers the payee’s name, address, and TIN. The TIN can be either a Social Security Number (SSN) or an EIN, depending on the payee’s status. It’s essential to provide the correct TIN to ensure accurate tax reporting and avoid penalties.

The mileage rate can change from year to year. If you’re claiming mileage deductions, it’s important to be aware of any October 2024 mileage rate changes that may affect your taxes.

- Exemption from Backup Withholding:This section allows the payee to claim exemption from backup withholding. Backup withholding is a mechanism used by the IRS to collect taxes from payees who haven’t provided a valid TIN or haven’t filed the necessary tax forms. The payee can claim exemption if they meet specific criteria, such as being a corporation or a government entity.

October 15th is the tax deadline for businesses, so make sure you have all your records in order. If you’re using the mileage deduction, you’ll need to know the October 2024 tax deadline for businesses and make sure your mileage logs are accurate.

- Certification:This section requires the payee to certify the accuracy of the information provided on the form. The payee must sign and date the form to confirm the accuracy of the information and their understanding of the consequences of providing false information.

Wondering where you can find the latest mileage rate for October 2024? You can find the most up-to-date information on the IRS website or by searching online for “mileage rate for October 2024”. The mileage rate for October 2024 is usually announced in late September or early October.

W9 Form Requirements for October 2024

The W9 form, a vital document for tax purposes, remains unchanged for October 2024. However, understanding the specific requirements and ensuring accurate information is crucial for smooth financial transactions.

The tax brackets for 2024 may be different than the ones for 2023. If you’re looking to plan your finances for the upcoming year, you’ll want to know the tax bracket changes for 2024 vs 2023. The IRS typically announces these changes in late summer or early fall.

Information Required on the W9 Form

The W9 form gathers information necessary for reporting tax payments to the IRS. Here’s a breakdown of the key information required:

- Name, Address, and Taxpayer Identification Number (TIN):This includes the business name, address, and either the Employer Identification Number (EIN) or Social Security Number (SSN), depending on the business structure.

- Exemption from Backup Withholding:This section allows businesses to claim an exemption from backup withholding if they meet specific criteria, such as being a US citizen or having a valid TIN.

- Certification:The final section requires the business owner or authorized representative to sign and certify the accuracy of the information provided.

Changes and Updates for October 2024

The W9 form has not undergone any significant changes or updates for October 2024. The IRS regularly reviews and updates its forms, but as of now, there are no notable alterations to the W9 form requirements.

The IRS uses a standard rate to calculate the mileage deduction. This rate is based on the cost of operating a vehicle, including factors like fuel, maintenance, and depreciation. The mileage rate for October 2024 is typically announced in late September or early October.

New Regulations and Guidelines, W9 Form October 2024 requirements for businesses

Currently, there are no new regulations or guidelines specifically impacting the W9 form for October 2024. However, it’s essential to stay informed about any potential changes or updates announced by the IRS through official channels.

The mileage rate for October 2024 is typically updated by the IRS around the beginning of the month. If you need to know the rate for October, it’s best to check the IRS website in late September or early October to see if the mileage rate has been updated.

Specific Information for Businesses

Businesses must provide accurate and complete information on the W9 form. This includes:

- Business Name:The legal name under which the business operates.

- Business Address:The physical address where the business is located.

- Taxpayer Identification Number (TIN):This is either the EIN or SSN, depending on the business structure. For example, corporations, partnerships, and LLCs typically have an EIN, while sole proprietorships use their SSN.

- Exemption from Backup Withholding:Businesses should carefully review the criteria for exemption and provide accurate information based on their situation.

- Certification:The business owner or authorized representative must sign and date the form, certifying the accuracy of the information provided.

Last Point

Understanding the W9 Form requirements for October 2024 is essential for businesses to maintain compliance and avoid potential penalties. Staying informed about the latest updates and accurately completing the form will ensure smooth tax reporting and a streamlined financial process.

By following the guidelines Artikeld in this guide, businesses can navigate the complexities of W9 Form compliance with ease and ensure a successful financial future.

Common Queries: W9 Form October 2024 Requirements For Businesses

What are the penalties for submitting an inaccurate W9 Form?

Penalties for submitting an inaccurate W9 Form can vary depending on the nature of the error and the intent. Penalties may include fines, interest charges, and potential legal action. It’s crucial to ensure accuracy and completeness when completing the W9 Form.

How long should I keep a copy of my submitted W9 Form?

It’s recommended to retain a copy of your submitted W9 Form for at least three years after the tax year to which it applies. This helps provide proof of submission and allows for easy access if needed for future reference.

Where can I find additional resources on the W9 Form?

The IRS website is the primary source for information and guidance on the W9 Form. You can find various publications, FAQs, and instructions on the IRS website. You can also consult with tax professionals for assistance with completing the form.

If you’re contributing to an IRA, you’ll want to know the contribution limits for 2024. The IRA contribution limits for 2024 are typically announced in late summer or early fall.

A tax bracket calculator can help you estimate your tax liability for 2024. The tax bracket calculator for 2024 can be found on the IRS website or other financial websites.

The mileage rate for October 2024 is used to calculate the deduction for business expenses. If you’re using your personal vehicle for business purposes, you’ll want to know the mileage rate for October 2024.

If you’re moving for work, you may be eligible for a deduction for your moving expenses. The October 2024 mileage rate for moving expenses is used to calculate this deduction.

Small business owners can also contribute to an IRA. The IRA contribution limits for small business owners in 2024 are typically announced in late summer or early fall.

If you’re using your personal vehicle for medical appointments, you may be eligible for a deduction for your medical expenses. The October 2024 mileage rate for medical expenses is used to calculate this deduction.

The tax rates for each tax bracket in 2024 can help you plan your finances for the year. The tax rates for each tax bracket in 2024 are typically announced in late summer or early fall.