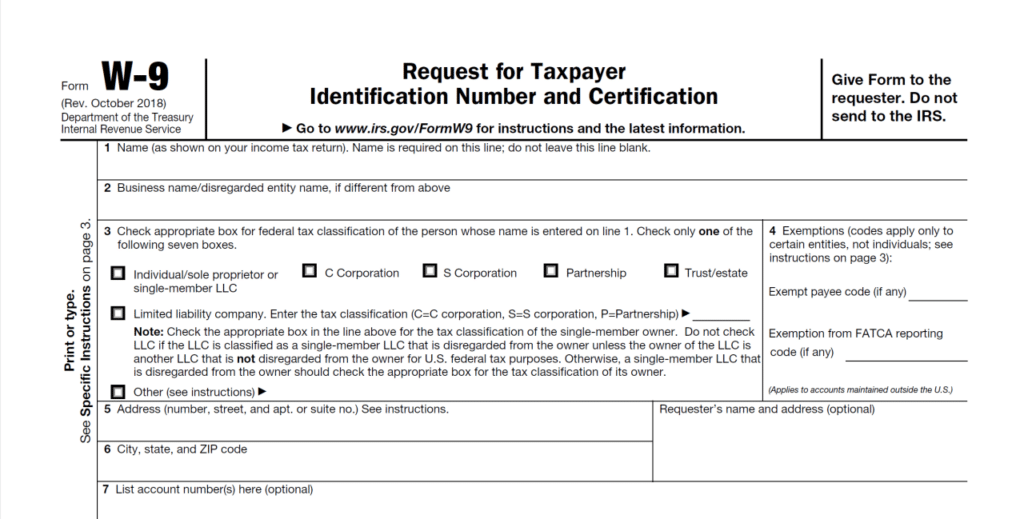

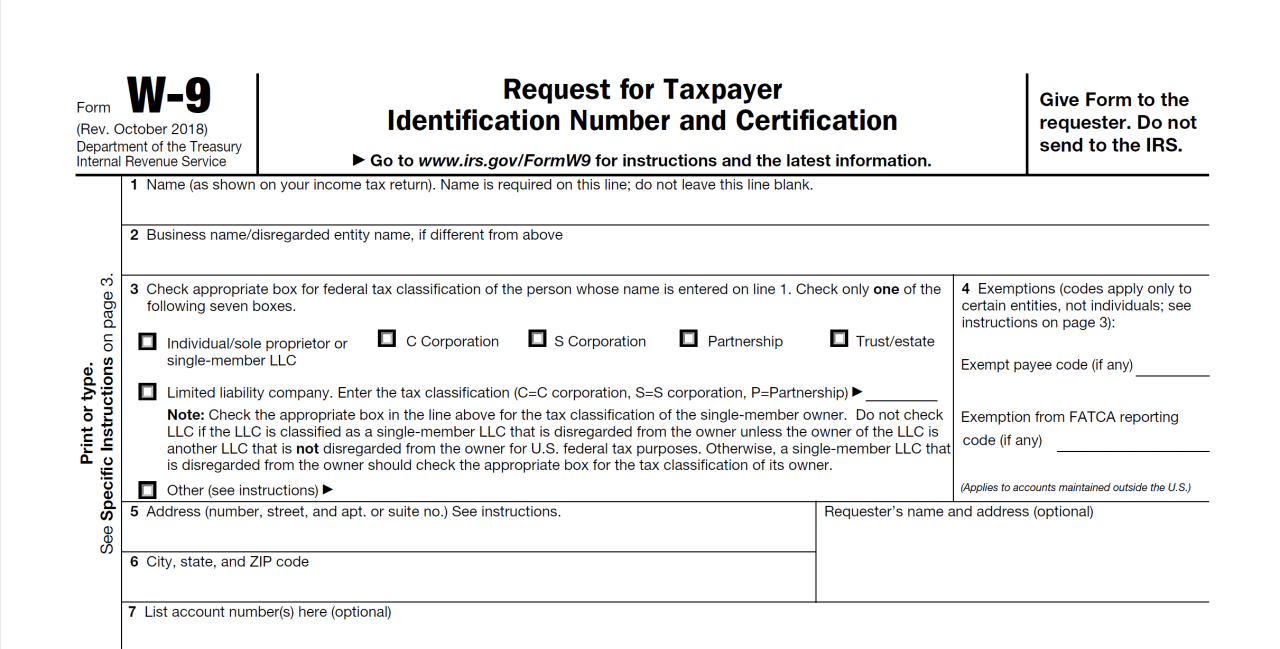

W9 Form October 2024 for sole proprietorships is a crucial document that helps businesses comply with tax regulations. It serves as a vital tool for clients and payers to collect essential information from independent contractors and sole proprietors, ensuring accurate tax reporting and payment.

This guide will provide a comprehensive overview of the W9 form, its importance for sole proprietorships, and the steps involved in completing it accurately.

The W9 form, officially known as the Request for Taxpayer Identification Number and Certification, is required for sole proprietorships to provide their tax identification number (TIN) and other necessary information to clients or payers. This form plays a significant role in tax compliance and helps ensure that taxes are reported and paid correctly.

Understanding the W9 Form

The W9 Form is a vital document for sole proprietorships, serving as a critical tool for tax reporting and financial management. It’s a simple, yet essential, form that ensures accurate information exchange between businesses and their clients.

When it comes to moving expenses, the mileage rate is an important factor. If you’re looking for information on the mileage rate for October 2024 , there are several resources available.

The Purpose of the W9 Form for Sole Proprietorships

The W9 Form is designed to provide essential information about a sole proprietor’s tax identification number (TIN) and legal name. This information is crucial for the recipient of the form, often a client or payer, to correctly report payments made to the sole proprietor for tax purposes.

The tax rates for each tax bracket in 2024 vary depending on your income level. Knowing these rates can help you plan your finances and understand your potential tax liability.

Key Information Required on the W9 Form

The W9 Form requires specific information from sole proprietors to ensure accurate reporting and tax compliance.

The Seahawks had a tough battle in Week 5, but ultimately fell short in their comeback attempt. Read more about their performance and key takeaways in this Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss article.

- Taxpayer Identification Number (TIN):This is either your Social Security Number (SSN) or Employer Identification Number (EIN). For sole proprietorships, your SSN is generally used as your TIN.

- Legal Name:This is the name under which you operate your business. It’s essential to use your legal name, as it appears on your tax documents.

- Business Name (Optional):If you operate under a different name, you can include it in this section. This helps clients identify you correctly.

- Address:You’ll need to provide your current mailing address, which is used for communication purposes.

- Exemption from Backup Withholding:This section allows you to claim an exemption from backup withholding, which applies to certain situations like incorrect TINs or failure to provide a TIN.

Importance of Accurate and Complete Information on the W9 Form

Providing accurate and complete information on the W9 Form is critical for several reasons:

- Accurate Tax Reporting:The recipient of the W9 Form uses the information to report payments made to you on their tax returns. Incorrect information can lead to errors in tax reporting, resulting in penalties or audits.

- Compliance with Tax Laws:Filing a W9 Form with accurate information ensures compliance with IRS regulations, minimizing the risk of penalties or legal issues.

- Smooth Business Transactions:Accurate W9 Forms facilitate smooth financial transactions, as clients can accurately report payments and avoid delays or complications.

Filing Deadlines and Requirements

The W9 form is an important document for businesses, particularly sole proprietorships, as it provides crucial information to payers regarding tax identification numbers and reporting requirements. Understanding the filing deadlines and requirements is essential for smooth financial transactions and compliance with tax regulations.

The mileage rate for October 2024 is calculated based on the standard mileage rate set by the IRS. This rate is adjusted periodically to reflect changes in fuel prices and other relevant factors.

Filing Deadlines

The filing deadline for W9 forms is generally upon request from the payer. This means that a sole proprietor must submit the W9 form whenever a payer requests it, typically before making any payments. There is no specific deadline for submitting a W9 form, as it depends on the individual circumstances and the payer’s requirements.

If you’re contributing to a Roth IRA, understanding the contribution limits is crucial. The IRA contribution limits for Roth IRA in 2024 can help you maximize your retirement savings potential.

Requirements for Sole Proprietorships

Sole proprietorships, as unincorporated businesses owned by a single individual, have specific requirements when filling out the W9 form.

It’s natural to be curious about the highest tax bracket in 2024. This bracket is the top tier of the tax system, and knowing its details can be useful for tax planning purposes.

- Name:The full legal name of the sole proprietor must be provided in the designated field.

- Taxpayer Identification Number (TIN):The sole proprietor’s Social Security Number (SSN) is used as the TIN for tax purposes.

- Business Address:The sole proprietor’s business address, where they operate their business, should be provided.

With the new year comes new tax brackets. If you’re wondering about the new tax brackets for 2024 , you’re not alone. Understanding these brackets is important for calculating your tax obligations.

- Exemption from Backup Withholding:If the sole proprietor is exempt from backup withholding, they must check the relevant box and provide the reason for exemption.

Comparison with Other Business Structures

The W9 form requirements for sole proprietorships differ from other business structures in some key aspects.

If you’re a single filer, knowing the tax brackets for 2024 is crucial for budgeting and planning. The tax brackets for single filers in 2024 are based on your income level and can significantly impact your tax liability.

- Partnerships:Partnerships typically use their Employer Identification Number (EIN) instead of an SSN.

- Corporations:Corporations also use their EIN for tax purposes and provide the corporation’s name and address.

- Limited Liability Companies (LLCs):Depending on how the LLC is structured, it may use an EIN or the owner’s SSN.

Small business owners can take advantage of IRA contributions to save for retirement. The IRA contribution limits for small business owners in 2024 can help you plan your retirement savings strategy.

Importance of W9 Forms for Sole Proprietorships

The W9 form is a crucial document for sole proprietorships as it provides essential information to clients and payers, enabling them to correctly report payments made to the business owner for tax purposes. Failing to provide a completed W9 form can lead to significant complications for both the business owner and the payer, impacting tax reporting and compliance.

The IRS regularly updates the mileage rate, so it’s important to stay informed about any changes. To find out if the mileage rate is changing in October 2024 , you can consult the IRS website or other reliable sources.

Implications of Not Providing a W9 Form

Not providing a W9 form to clients or payers can result in several negative consequences for sole proprietorships:

- Incorrect Tax Reporting:Payers may be unable to correctly classify payments made to the business owner, leading to potential errors in tax reporting and withholdings. This can result in underpayment of taxes and penalties for the business owner.

- Delayed Payments:Payers may delay or withhold payments until they receive the necessary information from the business owner. This can disrupt cash flow and impact the business’s financial stability.

- Non-Compliance with IRS Regulations:Failure to provide a W9 form can be considered non-compliance with IRS regulations, potentially leading to fines and penalties for the business owner.

- Lost Business Opportunities:Some clients or payers may require a W9 form before engaging with a business. Not providing this form can lead to lost business opportunities.

Impact on Tax Reporting and Compliance

W9 forms play a vital role in ensuring accurate tax reporting and compliance for sole proprietorships:

- Correct Tax Identification Number (TIN):The W9 form provides the business owner’s TIN, which is essential for the payer to report income correctly on Form 1099-NEC or 1099-MISC.

- Accurate Withholding:The W9 form helps the payer determine the appropriate amount of taxes to withhold from payments made to the business owner. This ensures the business owner is not overpaying or underpaying taxes.

- Simplified Tax Filing:By providing the necessary information on the W9 form, the business owner simplifies the process of filing their taxes, as the payer will have already reported the income correctly on Form 1099.

Consequences of Errors or Inaccuracies

Errors or inaccuracies on the W9 form can lead to several consequences for sole proprietorships:

- Incorrect Tax Reporting:Errors on the W9 form can lead to incorrect reporting of income and withholdings, resulting in potential tax penalties and audits.

- Delayed Payments:Payers may need to request corrections or additional information, leading to delays in payments and potential disruptions to cash flow.

- Non-Compliance Penalties:The IRS may impose penalties for filing inaccurate or incomplete W9 forms.

Additional Resources and Support

Navigating the world of W9 forms can be a bit daunting, especially for new sole proprietors. Thankfully, there are various resources available to help you understand and complete your W9 forms correctly.

Government Agencies and Organizations

These agencies and organizations provide official guidance and support related to W9 forms.

Moving expenses can be a significant part of a relocation, and understanding the current mileage rate is essential for accurate deductions. You can find the latest information on the October 2024 mileage rate for moving expenses to ensure you’re taking advantage of all available tax benefits.

- Internal Revenue Service (IRS):The IRS is the primary source for information about W9 forms. You can access their website for comprehensive information, FAQs, and downloadable forms.

- Website:www.irs.gov

- Phone:1-800-829-1040

- Small Business Administration (SBA):The SBA offers resources and support for small businesses, including information about tax forms like the W9.

- Website:www.sba.gov

- Phone:1-800-827-5722

Online Resources and Documentation, W9 Form October 2024 for sole proprietorships

A plethora of online resources and documentation are available to assist you with W9 forms.

| Resource | Description | Link |

|---|---|---|

| IRS Publication 1220, “Understanding Your Tax Liability” | This publication provides detailed information about various tax forms, including the W9. | www.irs.gov/pub/irs-pdf/p1220.pdf |

| IRS Form W9 Instructions | These instructions provide a step-by-step guide to filling out the W9 form. | www.irs.gov/pub/irs-pdf/fw9.pdf |

| Tax Preparation Software | Popular tax preparation software programs often include features that guide you through the process of filling out W9 forms. | [Insert relevant links for specific tax preparation software] |

Last Word: W9 Form October 2024 For Sole Proprietorships

Understanding and completing the W9 form correctly is essential for sole proprietorships operating in the United States. By adhering to the guidelines and providing accurate information, sole proprietors can ensure smooth tax reporting and avoid potential penalties. It’s important to remember that the W9 form is a vital tool for tax compliance and plays a critical role in the financial success of any sole proprietorship.

FAQ Guide

What happens if I don’t provide a W9 form?

If you don’t provide a W9 form to your clients or payers, they may withhold a higher percentage of taxes from your payments to cover potential tax liabilities. This can result in a significant reduction in your earnings.

Can I use a W9 form from a previous year?

No, you should always use the most current version of the W9 form. The form may be updated periodically to reflect changes in tax laws or regulations.

Where can I find the latest W9 form?

You can download the latest version of the W9 form from the IRS website.

What if I make a mistake on my W9 form?

If you discover an error on your W9 form, you should contact the client or payer who received it and provide them with a corrected form.

The tax bracket thresholds for 2024 are the income levels that determine which tax bracket you fall into. Knowing these thresholds can help you plan your finances and understand your tax obligations.

For married couples, the IRA contribution limits are often higher than for single filers. The IRA contribution limits for married couples in 2024 can help you save more for retirement as a couple.

The mileage rate for October 2024 is a key factor for those who deduct moving expenses. It’s important to stay informed about the current rate to ensure you’re taking advantage of all available tax benefits.

Understanding how tax brackets affect your income is essential for financial planning. The tax brackets for 2024 can impact your tax liability and potentially influence your financial decisions.