W9 Form October 2024 for partnerships takes center stage, guiding partnerships through the process of providing their tax identification information to payers. This form, a vital document for accurate tax reporting, requires specific information about the partnership, its partners, and its tax identification number.

Understanding the W9 Form’s purpose, requirements, and updates for partnerships is crucial for seamless tax compliance.

This guide delves into the intricacies of the W9 form, specifically focusing on the requirements for partnerships. We will explore the information needed, how to correctly fill out the form, and any changes expected in October 2024. Furthermore, we will discuss the tax implications of the W9 form for partnerships and provide tips for avoiding common mistakes.

Understanding the W9 Form

The W9 form is a crucial document used by businesses and individuals to provide their tax identification information to others. It’s essential for various financial transactions, including payments for services, interest income, and more. This form helps ensure proper tax reporting and prevents tax penalties.

Be aware of any potential tax changes that might affect the October 2024 deadline. Staying informed about tax updates can help you avoid surprises and ensure you’re filing correctly.

W9 Form Information Breakdown

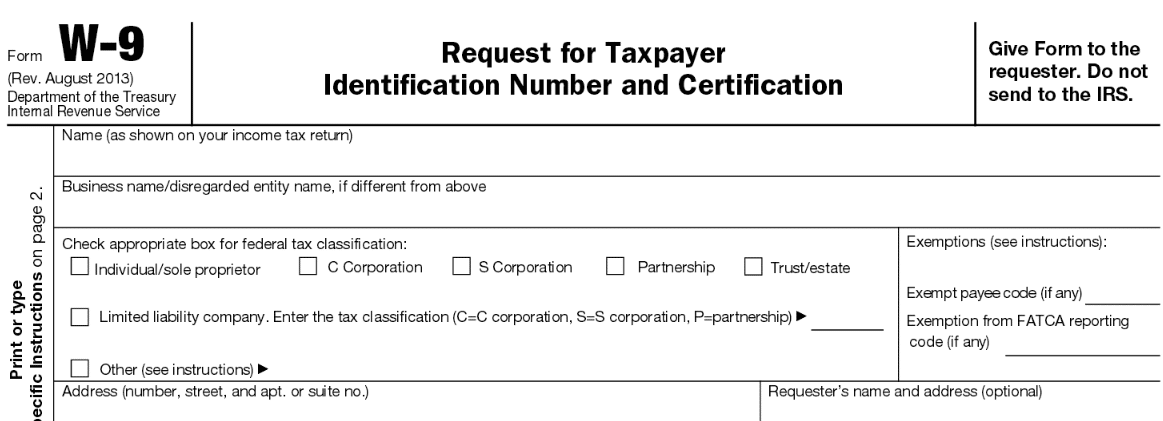

The W9 form requires specific information to accurately identify the recipient and their tax status. Here’s a detailed breakdown of the sections:

- Requestor Name, Address, and TIN:This section captures the details of the entity requesting the W9 form. It’s important to note that this is not the information you are providing. This is the information of the person or organization who needs your tax information.

Planning for your future? The IRA contribution limits for 2024 and 2025 are important to know when making financial decisions. Understanding these limits can help you maximize your retirement savings.

- Payer’s Name, Address, and TIN:This section is where you provide your personal or business information. The Payer’s name is the name of your business or your full name if you’re an individual. The address should be your business address or your home address, and the TIN is your Taxpayer Identification Number, which is either your Social Security Number (SSN) or your Employer Identification Number (EIN).

- Exemption from Backup Withholding:This section allows you to claim exemption from backup withholding if you meet specific criteria. Backup withholding is a tax withholding mechanism that applies to certain payments when the payer doesn’t have sufficient information to correctly report the income to the IRS.

If you’re self-employed, you’ll want to check out the IRA contribution limits for self-employed in 2024. These limits can help you save for retirement and potentially reduce your tax burden.

- Certification:This section requires you to sign and date the form, certifying the accuracy of the information provided.

Filling Out the W9 Form

To ensure accuracy and avoid potential penalties, follow these steps when filling out the W9 form:

- Gather Required Information:Before starting, collect all the necessary information, including your full name, address, Social Security Number (SSN) or Employer Identification Number (EIN), and any relevant exemption information.

- Print or Download the Form:You can obtain the W9 form from the IRS website or from the entity requesting the form. Print or download the form and ensure it’s the latest version.

- Complete the Form:Carefully fill out all sections of the form using black ink. Double-check the accuracy of all information before submitting it.

- Sign and Date:Sign and date the form in the designated area. Your signature confirms that you have reviewed and certified the accuracy of the information provided.

- Submit the Form:Submit the completed W9 form to the requesting entity as instructed. They may accept the form electronically or require a physical copy.

Remember, providing inaccurate information on a W9 form can lead to penalties and tax issues. It’s essential to ensure all information is accurate and up-to-date.

The tax deductions for the October 2024 deadline can vary, so it’s important to stay informed about your options. Taking advantage of available deductions can help you reduce your tax liability.

W9 Form for Partnerships

The W9 form is used by businesses and individuals to provide their tax identification number (TIN) to others. Partnerships, like individuals, must complete the W9 form to ensure they are properly identified for tax purposes. However, there are specific requirements for partnerships when filing the W9 form, which are different from the requirements for individuals.

If you’re married, it’s important to know the IRA contribution limits for married couples in 2024. These limits can help you maximize your retirement savings as a couple.

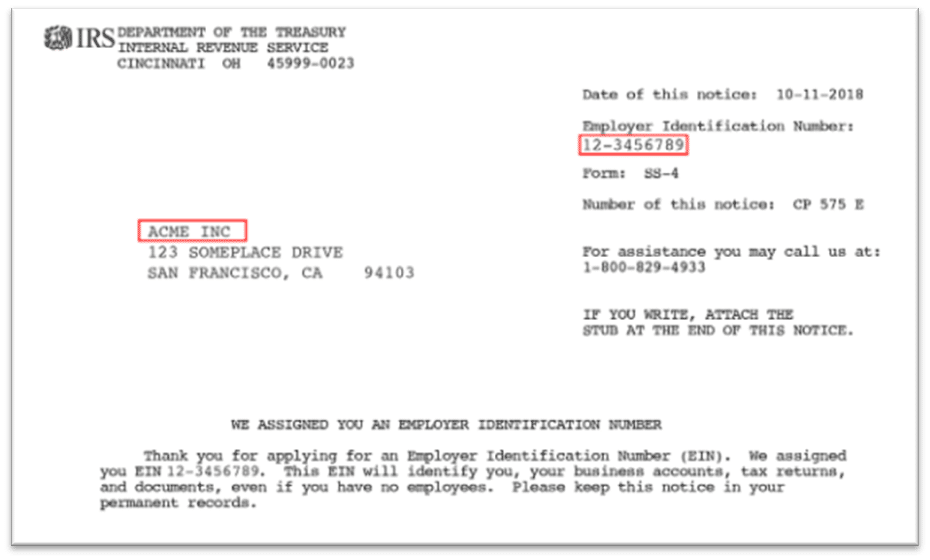

Identifying the Correct Tax Identification Number (TIN) for a Partnership

The TIN for a partnership is its Employer Identification Number (EIN). The EIN is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes. It is essential to use the correct TIN on the W9 form to avoid delays in processing payments and potential penalties.

Looking for the latest mileage rate for business use? You can find the mileage rate for October 2024 and other important tax information on our website. Stay up-to-date on tax changes and maximize your deductions.

The EIN is a unique identifier for your partnership, ensuring accurate tax reporting and compliance.

Don’t miss the tax deadline! Make sure you know the tax deadline for October 2024 to avoid any penalties. Stay organized and plan ahead to ensure you meet all your tax obligations.

To determine the correct TIN for a partnership, follow these steps:

- Check your partnership agreement: The partnership agreement should clearly state the EIN assigned to the partnership.

- Contact the IRS: If you cannot locate your EIN in the partnership agreement, contact the IRS directly. You can call the IRS at 1-800-829-1040 or visit the IRS website to request your EIN.

- Review previous tax returns: If you have filed previous tax returns for your partnership, the EIN should be listed on those returns.

Information Required for Partnerships on the W9 Form

The information required for partnerships on the W9 form is similar to the information required for individuals, but there are some key differences.

Need to track your business mileage? The October 2024 mileage rate for business use is a valuable tool for claiming deductions on your taxes. Keep accurate records of your travel to maximize your tax savings.

- Name:The name of the partnership should be entered in the “Name” field.

- Business Address:The business address of the partnership should be entered in the “Business Address” field. This is the physical address where the partnership conducts its business operations.

- TIN:The partnership’s EIN should be entered in the “TIN” field.

- Exemption from Backup Withholding:Partnerships are typically exempt from backup withholding, but they must still provide their EIN on the W9 form.

- Signature and Date:The W9 form must be signed by an authorized representative of the partnership and dated.

Differences in Information Required for Partnerships Compared to Individuals

While both individuals and partnerships need to complete the W9 form, there are some key differences in the information required.

Stay informed about your retirement savings. The IRA contribution limits for 2024 are essential for anyone planning for the future. Make sure you’re taking advantage of these limits to maximize your savings.

- TIN:Individuals use their Social Security Number (SSN) as their TIN, while partnerships use their EIN.

- Business Address:Individuals typically provide their home address, while partnerships provide their business address.

- Exemption from Backup Withholding:Partnerships are typically exempt from backup withholding, while individuals may be subject to it depending on their circumstances.

October 2024 Updates

While the W9 form is generally updated annually, the IRS has not yet announced any significant changes expected for the October 2024 version. The current version of the W9 form (Rev. December 2022) is still in effect, and it’s unlikely that any substantial modifications will occur for the October 2024 version.

Are you a business owner? Keep track of the October 2024 mileage rate changes to ensure you’re claiming the correct deductions on your taxes. Understanding these changes can help you maximize your tax savings.

W9 Form in October 2024

It is highly probable that the W9 form in October 2024 will remain largely unchanged from the current version (Rev. December 2022). The IRS typically announces any revisions to the W9 form well in advance, usually through official publications or press releases.

Planning your retirement savings? Knowing the IRA contribution limits for 2024 and beyond is crucial. This information can help you make informed decisions about your retirement planning.

However, there might be minor updates or clarifications regarding specific sections, especially if any new tax regulations or guidelines come into effect.

New Regulations or Guidelines

While no new regulations specifically impacting the W9 form for partnerships are anticipated for October 2024, it’s important to stay informed about any changes in tax law or reporting requirements. The IRS often provides updates on its website, and it’s recommended to check for any new guidelines or regulations related to partnerships.

Filing and Submitting the W9 Form

The W9 form, a crucial document for partnerships, requires proper filing and submission to ensure accurate reporting and tax compliance. This section provides a comprehensive guide to filing and submitting the W9 form, covering both electronic and physical methods.

Get a clear picture of how taxes work in 2024. The tax rates for each tax bracket in 2024 can help you understand your tax liability and plan your finances accordingly.

Submitting the W9 Form Electronically

Submitting the W9 form electronically offers convenience and efficiency, allowing you to avoid physical mailing. Several methods are available for electronic submission:

- Online Portals:Many online platforms, including tax preparation software and financial institutions, provide dedicated portals for submitting W9 forms electronically. These portals often streamline the process, allowing for secure uploads and confirmations.

- Email:Some organizations may accept W9 forms via email, particularly for established relationships. However, it’s crucial to confirm the recipient’s preferred format and security protocols before sending the form electronically.

- Secure File Transfer:For sensitive information, secure file transfer protocols (SFTP) offer a secure method for transmitting W9 forms. These protocols encrypt data during transmission, protecting it from unauthorized access.

Submitting the W9 Form Physically

For partnerships that prefer traditional methods, physical submission remains a viable option.

Curious about the highest tax bracket in 2024? Check out this article to learn about the highest tax bracket in 2024 and how it affects your tax liability. Understanding tax brackets can help you plan your finances effectively.

- US Mail:The most common method for physical submission is through the US Postal Service. Ensure the form is sent to the correct address, as indicated on the recipient’s instructions.

- Courier Services:For faster delivery, partnerships can utilize courier services like FedEx or UPS. These services offer tracking options, providing visibility into the form’s location during transit.

Confirmation of Receipt

Confirmation of receipt for a submitted W9 form is crucial for record-keeping and compliance. Here are some methods to obtain confirmation:

- Electronic Portals:Many online portals provide confirmation upon successful submission, generating a receipt or acknowledgment message.

- Email Confirmation:Some recipients, particularly those receiving forms via email, may send a confirmation email upon receipt.

- Tracking Numbers:For physical submissions via mail or courier services, tracking numbers provide visibility into the form’s location and delivery status.

- Requesting Confirmation:If confirmation is not automatically provided, partnerships can request it from the recipient, either via email or phone.

Common Mistakes and Solutions

Even with the detailed information provided about the W9 form, it’s common for partnerships to make mistakes when filing. These mistakes can lead to delays in receiving payments or even penalties. By understanding the common errors and taking preventative measures, you can ensure a smooth and accurate filing process.

Wondering how much the mileage rate is for October 2024? Find out the mileage rate for October 2024 and make sure you’re maximizing your tax deductions for business travel.

Incorrect TIN or Business Name

The TIN (Taxpayer Identification Number) and business name are critical elements on the W9 form. Incorrect information can result in misdirected payments or penalties.

The Seahawks’ comeback fell short in Week 5, but there were some bright spots. Check out our Rapid Reactions for a deeper dive into the game.

- Mistake:Providing an incorrect TIN or business name.

- Solution:Double-check the TIN and business name before submitting the form. Verify the information with the IRS website or your partnership’s official documentation.

Missing or Incomplete Information

The W9 form requires specific information about the partnership, including its structure and the names and addresses of its partners. Leaving out details or providing incomplete information can lead to rejection or delays.

- Mistake:Missing or incomplete information, such as the partnership’s legal structure or the names and addresses of partners.

- Solution:Carefully review the form instructions and ensure all required fields are completed accurately and thoroughly.

Incorrect Filing Status, W9 Form October 2024 for partnerships

The W9 form requires you to indicate the partnership’s filing status. Choosing the wrong status can lead to incorrect tax reporting and potential penalties.

- Mistake:Selecting the wrong filing status, such as choosing “Individual” instead of “Partnership.”

- Solution:Refer to the IRS instructions for the W9 form and carefully select the appropriate filing status for your partnership.

Failure to Update Information

Changes in partnership information, such as a new partner or address, must be updated on the W9 form. Failure to do so can lead to incorrect payments and penalties.

- Mistake:Not updating the W9 form with current information.

- Solution:Update the W9 form whenever there are changes in the partnership’s information, including name, address, TIN, or partners.

Submitting the Form to the Wrong Recipient

The W9 form is specifically for providing your taxpayer information to entities who need it for tax reporting purposes. Sending it to the wrong recipient can lead to confusion and delays.

- Mistake:Submitting the W9 form to an incorrect recipient.

- Solution:Ensure you are submitting the form to the correct recipient, such as the payer or the organization requesting it.

W9 Form Checklist

To ensure accuracy and completeness, consider the following checklist before submitting your W9 form:

- Have you provided the correct TIN and business name?

- Have you completed all required fields on the form?

- Have you selected the correct filing status for your partnership?

- Have you updated the form with any recent changes in your partnership’s information?

- Are you submitting the form to the correct recipient?

Final Conclusion

Navigating the W9 Form for partnerships can seem daunting, but with a clear understanding of its purpose, requirements, and updates, the process becomes straightforward. By following the steps Artikeld in this guide, partnerships can ensure they are providing accurate and complete information to their payers, ultimately simplifying their tax reporting and avoiding potential penalties.

Remember, staying informed and prepared is key to smooth tax compliance.

User Queries: W9 Form October 2024 For Partnerships

What happens if I don’t file a W9 form?

If you don’t file a W9 form, the payer may be required to withhold taxes at a higher rate, which could result in a larger tax liability for you.

Where can I find the latest version of the W9 form?

You can find the latest version of the W9 form on the IRS website.

What if my partnership information changes after I file a W9 form?

You should notify the payer of any changes to your partnership information, such as your name, address, or tax identification number, by filing a new W9 form.

Can I file the W9 form electronically?

Some payers may accept electronic filing of the W9 form. Check with the payer to see if they offer this option.