Voya Variable Annuity Account X 2024 offers a unique approach to retirement planning, combining the potential for growth with the security of guaranteed income. This product caters to individuals seeking a personalized investment strategy that aligns with their risk tolerance and financial goals.

Annuity purchase involves making a lump sum payment in exchange for future income payments. For information on the process of purchasing an annuity, you can read this article: Annuity Is Purchased 2024.

This

An annuity can provide a consistent monthly income stream. For information on annuities that offer monthly payments, you can read this article: Annuity 2000 Per Month 2024.

guide delves into the key features, investment options, fees, and benefits of Voya Variable Annuity Account X 2024, providing a comprehensive understanding of its workings and suitability for different investors. We’ll explore its potential advantages and disadvantages, helping you make informed decisions about whether this product aligns with your retirement planning needs.

Voya Variable Annuity Account X 2024: Overview

The Voya Variable Annuity Account X 2024 is a type of retirement savings product that offers the potential for growth through investment in a variety of sub-accounts. It is designed to provide a steady stream of income during retirement, while also offering the opportunity to grow your savings over time.

Key Features and Benefits, Voya Variable Annuity Account X 2024

The Voya Variable Annuity Account X 2024 features several key benefits, including:

- Growth Potential:Variable annuities offer the potential for higher returns than traditional fixed annuities, as they are invested in a variety of sub-accounts that can fluctuate in value.

- Tax Deferral:Earnings within the annuity grow tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money in retirement.

Annuity savings calculators can help you estimate your potential retirement income. To find a helpful annuity savings calculator, check out this article: Calculator Annuity Savings 2024.

- Guaranteed Minimum Death Benefit:The Voya Variable Annuity Account X 2024 provides a guaranteed minimum death benefit, which ensures that your beneficiaries will receive a certain amount of money even if the value of your annuity declines.

- Living Benefit Options:The Voya Variable Annuity Account X 2024 offers a variety of living benefit options, such as guaranteed income riders, which can help provide you with a steady stream of income during retirement.

Converting a variable annuity to a Roth IRA can offer tax benefits. For information on this conversion process, you can read this article: Convert Variable Annuity To Roth Ira 2024.

Variable annuities involve investment options, and calculators can help you analyze potential growth. For a guide to variable annuity calculators, you can read this article: Variable Annuity Calculator 2024.

Annuity can be a part of a qualified retirement plan, offering tax advantages. To learn more about the tax implications of annuities in retirement planning, check out this article: Is An Annuity A Qualified Retirement Plan 2024.

Target Audience

The Voya Variable Annuity Account X 2024 is best suited for individuals who:

- Are nearing retirement or are already retired.

- Are seeking a retirement savings product that offers the potential for growth.

- Are comfortable with some investment risk.

- Want to receive a steady stream of income during retirement.

Annuity Certain, a type of annuity with a fixed payment period, is a common financial product. To learn more about how these annuities work and their potential benefits, check out this article: Annuity Certain Is An Example Of 2024.

Potential Risks and Drawbacks

It’s important to note that variable annuities also come with some potential risks and drawbacks, including:

- Market Risk:The value of your annuity can fluctuate based on the performance of the underlying investments.

- Fees and Expenses:Variable annuities often come with higher fees and expenses than traditional fixed annuities.

- Surrender Charges:If you withdraw money from your annuity before a certain period of time, you may have to pay surrender charges.

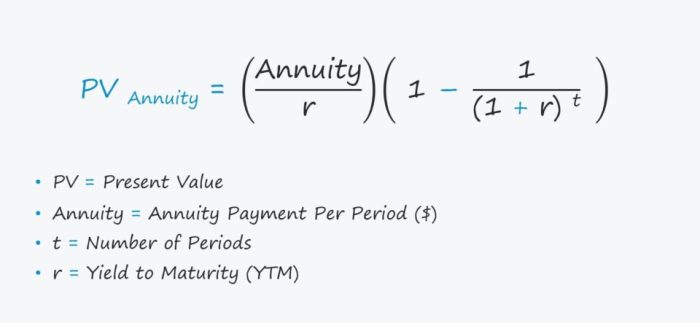

Calculating annual annuity payments can be complex. For a step-by-step guide on calculating annual annuity payments, you can read this article: How To Calculate Annual Annuity 2024.

- Complexity:Variable annuities can be complex products, and it’s important to understand the risks and potential drawbacks before investing.

Investment Options and Performance

The Voya Variable Annuity Account X 2024 offers a wide range of investment options, including:

- Mutual Funds:You can choose from a variety of mutual funds, which invest in stocks, bonds, or a combination of both.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds, but they are traded on stock exchanges like individual stocks.

- Annuities:You can allocate a portion of your account to other annuity products, such as fixed annuities or indexed annuities.

Investment Option Comparison

The investment options available within the Voya Variable Annuity Account X 2024 vary in terms of risk and potential return. For example:

- Stock Funds:Stock funds generally have higher potential returns than bond funds, but they also carry more risk.

- Bond Funds:Bond funds are considered less risky than stock funds, but they also have lower potential returns.

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return, but the rate is typically lower than what you might earn with variable annuities.

Historical Performance

The historical performance of the Voya Variable Annuity Account X 2024 will depend on the specific investment options you choose. However, it’s important to note that past performance is not necessarily indicative of future results. You should always consult with a financial advisor to discuss the potential risks and rewards of investing in a variable annuity.

Fees and Expenses

The Voya Variable Annuity Account X 2024 comes with a variety of fees and expenses, including:

- Mortality and Expense (M&E) Charges:These charges cover the cost of providing death benefits and administrative expenses.

- Investment Management Fees:These fees are charged by the mutual funds or ETFs that you invest in.

- Administrative Fees:These fees cover the cost of managing your account.

- Surrender Charges:These charges may apply if you withdraw money from your annuity before a certain period of time.

Annuity jackpot refers to a large payout from an annuity. To learn more about annuities and their potential for large payouts, you can read this article: Annuity Jackpot 2024.

Fee Table

Here is a table that details the different fee categories and their respective rates:

| Fee Category | Rate |

|---|---|

| Mortality and Expense (M&E) Charges | 0.50%

|

| Investment Management Fees | Varies depending on the specific fund |

| Administrative Fees | $10

|

| Surrender Charges | Varies depending on the length of time you’ve held the annuity |

Annuities can provide a steady stream of income during retirement. For a deeper understanding of how annuities work and their potential benefits, you can read this article: 9 Annuity 2024.

Impact of Fees and Expenses

Fees and expenses can have a significant impact on the overall returns of your annuity. It’s important to carefully consider the fees associated with different investment options before making a decision.

Death Benefit and Living Benefit Options: Voya Variable Annuity Account X 2024

The Voya Variable Annuity Account X 2024 offers a variety of death benefit and living benefit options, including:

- Guaranteed Minimum Death Benefit:This benefit guarantees that your beneficiaries will receive a certain amount of money even if the value of your annuity declines.

- Guaranteed Income Riders:These riders can help provide you with a steady stream of income during retirement.

- Enhanced Death Benefit Options:These options can provide your beneficiaries with a higher death benefit than the guaranteed minimum death benefit.

Annuity and pension are both retirement income options, but they have distinct characteristics. Understanding the differences between them is crucial for making informed financial decisions. This article can help you understand the differences: Annuity Vs Pension 2024.

Death Benefit and Living Benefit Option Comparison

The different death benefit and living benefit options available with the Voya Variable Annuity Account X 2024 vary in terms of their features and potential benefits. For example:

- Guaranteed Minimum Death Benefit:This benefit is typically the most basic option, but it provides a guaranteed payout to your beneficiaries.

- Guaranteed Income Riders:These riders can provide you with a guaranteed income stream during retirement, but they may come with higher fees.

- Enhanced Death Benefit Options:These options can provide your beneficiaries with a higher death benefit, but they may be more expensive.

Implications of Choosing Different Options

The death benefit and living benefit options you choose will have a significant impact on the overall cost and benefits of your annuity. It’s important to carefully consider your needs and objectives before making a decision.

Fixed variable annuities combine features of both fixed and variable annuities. For a detailed explanation of these types of annuities, you can check out this article: Fixed Variable Annuity Definition 2024.

Tax Considerations

The Voya Variable Annuity Account X 2024 offers tax-deferred growth, which means that you won’t have to pay taxes on your earnings until you withdraw the money in retirement.

Variable annuity accounts allow for investment growth potential. To learn more about these accounts and their features, you can check out this article: Variable Annuity Account 2024.

Tax Treatment of Withdrawals and Distributions

When you withdraw money from your annuity, the withdrawals are generally taxed as ordinary income. However, there are some exceptions to this rule, such as withdrawals made after age 59 1/2.

Tax Strategies

There are a number of tax strategies that can be employed to optimize tax efficiency when investing in a variable annuity. For example, you may want to consider:

- Taking withdrawals after age 59 1/2:This can help reduce your tax liability.

- Using a Roth IRA:A Roth IRA allows you to withdraw your earnings tax-free in retirement.

- Consulting with a tax advisor:A tax advisor can help you develop a tax strategy that is right for your individual needs.

Comparison with Other Annuities

The Voya Variable Annuity Account X 2024 is just one of many variable annuity products available in the market. It’s important to compare different products to find one that meets your specific needs.

Annuitant refers to the individual receiving payments from an annuity. To learn more about the role of an annuitant and how they benefit from these payments, you can read this article: K Is An Annuitant Currently Receiving Payments 2024.

Key Differences

Variable annuities from different providers can vary in terms of their features, fees, and investment options. For example:

- Fees:Some providers may charge higher fees than others.

- Investment Options:The investment options available may vary from provider to provider.

- Death Benefit and Living Benefit Options:The death benefit and living benefit options available may also vary.

Advantages and Disadvantages

The Voya Variable Annuity Account X 2024 has both advantages and disadvantages compared to other variable annuity products. It’s important to weigh these factors carefully before making a decision.

Conclusion

The Voya Variable Annuity Account X 2024 is a complex retirement savings product that offers both potential growth and a guaranteed minimum death benefit. It’s important to carefully consider the risks and potential drawbacks before investing in a variable annuity.

It’s also important to consult with a financial advisor to discuss your individual needs and objectives.

Closing Summary

Voya Variable Annuity Account X 2024 presents a compelling option for individuals seeking a balance between growth potential and income security in retirement. However, it’s crucial to understand the associated risks and carefully consider your financial goals, risk tolerance, and investment horizon before making any investment decisions.

Consulting with a qualified financial advisor is highly recommended to ensure the product aligns with your individual circumstances and objectives.

Commonly Asked Questions

What is the minimum investment amount required for Voya Variable Annuity Account X 2024?

The minimum investment amount may vary. It’s best to consult with a financial advisor or visit the Voya website for the most up-to-date information.

What are the surrender charges associated with Voya Variable Annuity Account X 2024?

Surrender charges are fees you may incur if you withdraw money from the annuity before a certain period. These charges typically decrease over time. Refer to the product prospectus for specific details.

Can I access my funds before retirement age?

Variable annuities offer investment options, but share class C can have higher fees. It’s important to understand the different share classes and their implications. You can find more information about variable annuity share class C in this article: Variable Annuity Share Class C 2024.

Early withdrawals may be subject to penalties and taxes. It’s essential to understand the withdrawal rules and potential consequences before taking any action.