Variable Annuity Vs Fixed Annuity 2024: Choosing the Right Option, a crucial decision for those seeking retirement income security. Annuities, financial products designed to provide a steady stream of income during retirement, come in various forms, each with its own set of advantages and disadvantages.

Wondering what an annuity is and how it works? This article provides a clear explanation of annuities and their potential benefits. Visit Annuity Kya Hai 2024 to learn more.

Two prominent types are fixed annuities and variable annuities, each offering distinct features and risk profiles. This guide will delve into the nuances of both types, examining their core characteristics, potential benefits, and inherent risks to empower you with the knowledge needed to make an informed decision.

An annuity is a financial product that provides a steady income stream, often for a specified period or for life. To learn more about annuities and how they can help you achieve your financial goals, check out this resource on Annuity Is 2024.

Fixed annuities provide a guaranteed interest rate, ensuring predictable income payments. They offer stability and security but may limit growth potential due to inflation. Variable annuities, on the other hand, invest your contributions in a range of market options, potentially leading to higher returns but also carrying the risk of principal loss.

Annuity payments are often guaranteed for a set period or for life, making them a reliable source of income. For more information on the certainty of annuity payments, visit Is Annuity Certain 2024.

Understanding the intricacies of each type is essential for aligning your investment choices with your financial goals, risk tolerance, and time horizon.

Annuity payments can be a valuable source of income, especially during retirement. For information on how annuities can provide income and how to choose the right annuity for your needs, visit Annuity Is Income 2024.

Annuities: A Retirement Planning Tool

Annuities are financial products designed to provide a stream of income, typically during retirement. They are contracts between an individual and an insurance company, where the individual makes a lump-sum payment or series of payments, and in return, the insurance company promises to make regular payments to the individual in the future.

Annuity streams can provide a steady source of income for a set period or for life. For more information on annuity streams and their features, visit Is Annuity Stream 2024.

Annuities can be a valuable tool for retirement planning, offering guaranteed income streams and the potential for growth, depending on the type of annuity chosen.

A 3-year annuity calculator can help you estimate the payments you would receive over a three-year period. For more information on this type of calculator, check out 3 Year Annuity Calculator 2024.

There are various types of annuities available, each with its own features and benefits. Two primary categories of annuities are fixed annuities and variable annuities. These differ primarily in their investment components and the level of risk involved.

One of the benefits of annuities is that the income they provide is often guaranteed. For more information on the guaranteed income feature of annuities, visit Is Annuity Income Guaranteed 2024.

Fixed Annuities

Fixed annuities provide a guaranteed interest rate on the invested principal, ensuring a predictable stream of income. This type of annuity is suitable for individuals seeking stability and a secure income source in retirement. The interest rate is fixed for a specific period, offering a predictable return.

Need a quick way to calculate annuity payments? A quick annuity calculator can help you estimate your potential income. Check out Annuity Calculator Quick 2024 for a simple and efficient tool.

However, fixed annuities typically have limited growth potential and may not keep pace with inflation, potentially reducing the purchasing power of the income stream over time.

Whether or not an annuity is worth it for you depends on your individual circumstances and financial goals. To learn more about the pros and cons of annuities, visit Is Getting An Annuity Worth It 2024.

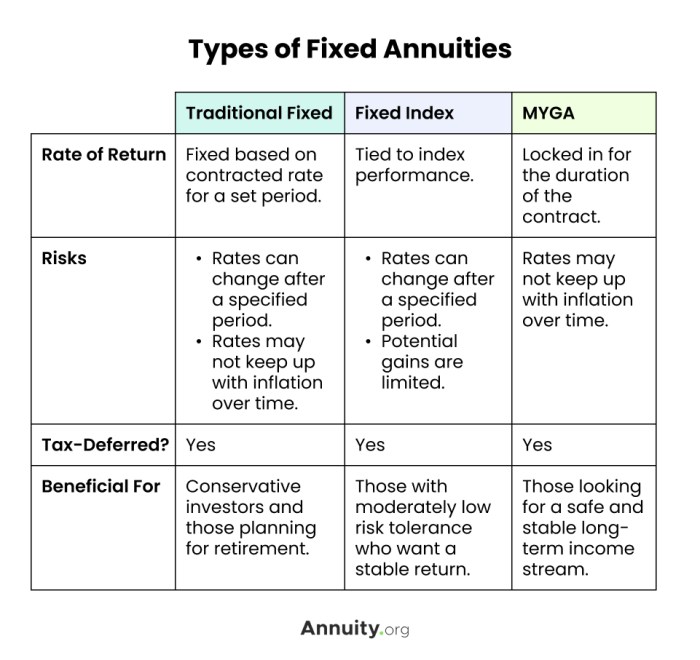

Fixed annuities come in various forms, including:

- Immediate Annuities:Payments begin immediately after the initial premium is paid. These are ideal for individuals seeking immediate income upon retirement.

- Deferred Annuities:Payments begin at a future date, allowing individuals to accumulate funds over time before receiving income. These are suitable for those planning for retirement several years in the future.

- Indexed Annuities:Interest rates are linked to the performance of a specific market index, offering potential for higher returns while still providing a minimum guaranteed rate.

Variable Annuities

Variable annuities differ from fixed annuities by offering the potential for higher returns but also carrying a higher risk. They invest the principal in a sub-account, which is similar to a mutual fund, allowing the value to fluctuate based on market performance.

If you’re working with HVAC systems, you’ll need to understand the “J” calculation, which is a critical part of system design and performance evaluation. Check out this resource on J Calculation Hvac 2024 to learn more about this important concept.

This provides the opportunity for growth but also exposes the individual to the possibility of losing principal if the market declines.

Variable annuities offer a range of investment options, enabling individuals to customize their portfolios based on their risk tolerance and investment goals. These options can include stocks, bonds, and other investment vehicles. However, it’s crucial to understand that variable annuities are not FDIC insured and the value of the investment can fluctuate.

If you’re using a financial calculator like the BA II Plus, it’s important to know how to calculate annuity due payments. Learn more about Calculating Annuity Due On Ba Ii Plus 2024 to master this calculation.

Therefore, it’s important to carefully consider the risks associated with variable annuities before investing.

Understanding annuity formulas is important if you want to calculate the present or future value of an annuity. Check out this resource on R Annuity Formula 2024 to learn more about these formulas.

Comparing Fixed and Variable Annuities, Variable Annuity Vs Fixed Annuity 2024

Understanding the key differences between fixed and variable annuities is essential for making informed investment decisions. Here’s a table comparing the two types across various factors:

| Feature | Fixed Annuity | Variable Annuity |

|---|---|---|

| Interest Rate Guarantees | Guaranteed interest rate for a specific period | No guaranteed interest rate; returns fluctuate based on market performance |

| Investment Options | Limited to a fixed interest rate | Wide range of investment options, including stocks, bonds, and other assets |

| Potential for Growth | Limited growth potential, typically tied to the guaranteed interest rate | Potential for higher growth but also higher risk of losing principal |

| Risk Levels | Low risk, guaranteed income stream | Higher risk, potential for both higher returns and losses |

| Fees and Expenses | Generally lower fees than variable annuities | Higher fees, including investment management fees and mortality charges |

The suitability of fixed and variable annuities depends on individual circumstances, including risk tolerance, investment goals, and time horizon. For individuals seeking a secure income stream with low risk, a fixed annuity may be a suitable choice. On the other hand, individuals with a longer time horizon and a higher risk tolerance might prefer the potential for higher returns offered by variable annuities.

Before you purchase an annuity, it’s essential to understand how much income you can expect. A helpful tool for this is an annuity calculator. Check out Calculate Your Annuity 2024 to estimate your potential annuity income.

Last Point: Variable Annuity Vs Fixed Annuity 2024

Ultimately, the choice between a fixed and variable annuity hinges on your individual circumstances, financial objectives, and risk appetite. Careful consideration of factors such as your age, investment experience, income needs, and market outlook is crucial. Consulting with a qualified financial advisor can provide personalized guidance tailored to your specific situation.

An annuity estimator can provide a quick and easy way to estimate your potential annuity income. Visit Annuity Estimator 2024 to explore this valuable tool.

Remember, making an informed decision empowers you to navigate the complexities of retirement planning and secure a comfortable future.

Key Questions Answered

What is the minimum investment amount for an annuity?

Minimum investment amounts vary depending on the annuity provider and product. Some annuities may have a minimum investment requirement of a few thousand dollars, while others may have higher thresholds.

Can I withdraw money from an annuity before retirement?

You may be able to withdraw money from an annuity before retirement, but penalties and fees may apply. The terms and conditions governing withdrawals vary by annuity provider and product.

A fixed annuity can provide a stable stream of income for retirement. If you’re considering this option, you’ll want to understand the different types of fixed annuities available. Learn more about 4 Fixed Annuity 2024 and how they can work for you.

What are the tax implications of annuity withdrawals?

Withdrawals from an annuity are generally taxed as ordinary income. However, the tax treatment of withdrawals can vary depending on the type of annuity and the age of the annuitant. It is important to consult with a tax advisor to understand the tax implications of your specific situation.