Variable Annuity Vs 401k 2024: Navigating the retirement savings landscape can feel overwhelming, especially with the vast array of investment options available. Two popular choices often top the list: variable annuities and 401(k) plans. Both offer potential tax advantages and growth opportunities, but their intricacies and nuances can leave even seasoned investors scratching their heads.

This guide aims to shed light on the key differences between these two retirement vehicles, helping you make an informed decision that aligns with your individual financial goals and risk tolerance.

Variable annuities and 401(k) plans are both designed to help individuals save for retirement, but they differ in their structure, investment options, and potential benefits. Variable annuities are insurance-based products that offer a range of investment options, often including mutual funds and exchange-traded funds (ETFs).

Annuity payments are often a part of retirement planning, and understanding how they work is crucial. If you’re wondering if an annuity is counted as income in 2024, you can find the answer here.

They can provide additional features such as death benefits and guaranteed income streams, but they also come with higher fees and potential surrender charges. 401(k) plans, on the other hand, are employer-sponsored retirement savings plans that allow employees to contribute pre-tax income to a diversified portfolio.

Annuity rates can fluctuate, so it’s important to stay up-to-date. You can find information on annuity rates from 2021 to 2024 here.

They often include employer matching contributions, providing a significant boost to retirement savings. The choice between these two options depends on a variety of factors, including your age, risk tolerance, and financial situation. By understanding the pros and cons of each option, you can make a decision that sets you on the right path towards a secure retirement.

Variable Annuities vs. 401(k) Plans: A Comprehensive Guide for 2024

Retirement planning is a crucial aspect of financial well-being, and choosing the right investment vehicles is paramount to securing a comfortable future. Variable annuities and 401(k) plans are two popular retirement savings options, each with its own set of advantages and disadvantages.

Tax treatment is a key consideration when it comes to annuities. To learn if annuities are exempt from taxes in 2024, check out this link here.

This article will provide a comprehensive comparison of these plans, highlighting their key features, potential benefits, and drawbacks to help you make an informed decision about which one best suits your individual needs and circumstances.

Variable Annuities

Variable annuities are insurance-based investment products that offer a combination of tax-deferred growth, guaranteed income, and death benefit protection. They function similarly to mutual funds, allowing you to invest in a variety of sub-accounts, such as stocks, bonds, and other assets.

- How Variable Annuities Work:You invest in a variable annuity contract, and the insurance company allocates your contributions to sub-accounts based on your investment choices. The value of your annuity fluctuates based on the performance of the underlying investments.

- Sub-Account Options:Variable annuities typically offer a range of sub-account options, including mutual funds, exchange-traded funds (ETFs), and sometimes even individual stocks. The specific investment options available vary by insurance company.

- Role of the Insurance Company:The insurance company plays a key role in managing the annuity contract, providing investment options, and guaranteeing certain benefits, such as death benefits and potential living benefits.

- Potential Benefits:

- Tax Deferral:Earnings on your investments within a variable annuity are not taxed until you withdraw them in retirement.

- Death Benefit:Most variable annuities include a death benefit that guarantees a minimum payout to your beneficiaries, even if the market value of your annuity has declined.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed minimum income payments or protection against market losses. These benefits can provide additional peace of mind and financial security.

- Potential Drawbacks:

- Fees:Variable annuities typically carry higher fees than 401(k) plans, including annual administrative fees, investment management fees, and surrender charges.

- Investment Risk:The value of your variable annuity is tied to the performance of the underlying investments, so it carries inherent investment risk. If the market declines, the value of your annuity could decrease.

- Surrender Charges:Many variable annuities have surrender charges that apply if you withdraw funds before a certain period, which can deter you from accessing your money when you need it.

Types of Variable Annuities

Variable annuities come in several different variations, each with its own features and benefits. Some common types include:

- Fixed-Indexed Annuities:These annuities link returns to the performance of a specific index, such as the S&P 500, but with a guaranteed minimum return.

- Equity-Indexed Annuities:Similar to fixed-indexed annuities, these annuities provide a guaranteed minimum return, but they also allow for potential upside growth tied to the performance of a specific equity index.

- Variable Universal Life Insurance:This type of life insurance policy combines death benefit coverage with investment options, similar to variable annuities.

| Type of Variable Annuity | Key Features | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Fixed-Indexed Annuity | Guaranteed minimum return, linked to a specific index | Protection against market losses, potential for growth | Limited upside potential, may have higher fees than other types |

| Equity-Indexed Annuity | Guaranteed minimum return, potential for growth tied to a specific equity index | Higher potential for growth than fixed-indexed annuities, protection against market losses | May have higher fees than other types, limited upside potential |

| Variable Universal Life Insurance | Combines death benefit coverage with investment options | Flexibility to adjust death benefit and investment allocation, potential for growth | Higher premiums than traditional life insurance, may have higher fees than other types |

401(k) Plans

401(k) plans are employer-sponsored retirement savings plans that allow employees to contribute pre-tax dollars to a tax-deferred account. They offer a variety of investment options and often include employer matching contributions.

- How 401(k) Plans Work:You contribute a portion of your paycheck to your 401(k) plan, and the funds are invested in a variety of options, such as mutual funds, ETFs, or company stock. Your contributions are deducted from your paycheck before taxes, reducing your taxable income.

Many people seek the security of an annuity that lasts a lifetime. For information on annuities that provide payments for life in 2024, check out this resource here.

- Investment Options:401(k) plans typically offer a range of investment options, including mutual funds, ETFs, and sometimes company stock. The specific investment options available vary by employer.

- Employer Matching Contributions:Many employers offer matching contributions to their employees’ 401(k) plans, meaning they contribute a certain percentage of your contributions, up to a specified limit. This is essentially free money that can significantly boost your retirement savings.

- Potential Benefits:

- Tax Deferral:Earnings on your investments within a 401(k) plan are not taxed until you withdraw them in retirement.

- Employer Matching:Employer matching contributions can significantly increase your retirement savings.

- Potential for Growth:401(k) plans offer a variety of investment options that can potentially grow your savings over time.

- Potential Drawbacks:

- Limited Investment Choices:401(k) plans may offer a limited number of investment options compared to variable annuities.

- Vesting Schedules:Employer matching contributions are often subject to vesting schedules, which means you don’t own the full amount of the employer’s match until you have worked for the company for a certain period.

Types of 401(k) Plans

There are several different types of 401(k) plans, each with its own features and tax implications. Some common types include:

- Traditional 401(k):Contributions are made pre-tax, reducing your taxable income in the present. Withdrawals in retirement are taxed as ordinary income.

- Roth 401(k):Contributions are made after-tax, but withdrawals in retirement are tax-free.

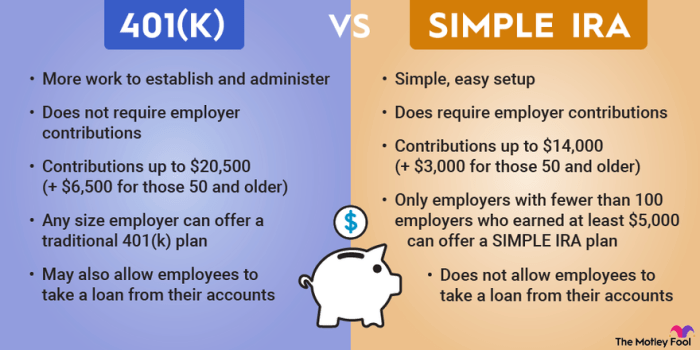

- SIMPLE IRA:A simplified retirement plan available to small businesses. Contributions are made pre-tax, and withdrawals in retirement are taxed as ordinary income.

| Type of 401(k) Plan | Key Features | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Traditional 401(k) | Pre-tax contributions, tax-deferred growth | Lower taxable income in the present, tax-deferred growth | Withdrawals in retirement are taxed as ordinary income |

| Roth 401(k) | After-tax contributions, tax-free withdrawals in retirement | Tax-free withdrawals in retirement, potential for growth | Contributions are not tax-deductible |

| SIMPLE IRA | Simplified retirement plan for small businesses, pre-tax contributions | Lower taxable income in the present, tax-deferred growth | Limited investment options, withdrawals in retirement are taxed as ordinary income |

Variable Annuities vs. 401(k) Plans: A Comparison

Variable annuities and 401(k) plans offer distinct advantages and disadvantages, and the best choice for you will depend on your individual circumstances and financial goals. Here is a side-by-side comparison of these two retirement savings options:

| Feature | Variable Annuity | 401(k) Plan |

|---|---|---|

| Investment Options | Wide range of sub-account options, including mutual funds, ETFs, and sometimes individual stocks | Limited investment options, typically mutual funds, ETFs, and sometimes company stock |

| Flexibility | More flexibility in investment choices and potential for customized investment strategies | Less flexibility, investment options are limited by the employer |

| Tax Implications | Tax-deferred growth, withdrawals in retirement are taxed as ordinary income | Tax-deferred growth, withdrawals in retirement are taxed as ordinary income (traditional 401(k)) or tax-free (Roth 401(k)) |

| Fees and Expenses | Higher fees than 401(k) plans, including annual administrative fees, investment management fees, and surrender charges | Lower fees than variable annuities, typically only annual administrative fees and investment management fees |

| Risk and Potential Returns | Higher risk, potential for higher returns, but also potential for losses | Lower risk, potential for lower returns, but also less potential for losses |

| Suitability for Different Investors | More suitable for investors with a long time horizon, high risk tolerance, and a need for guaranteed income or protection against market downturns | More suitable for investors with a shorter time horizon, lower risk tolerance, and a need for employer matching contributions |

Examples of Scenarios:

Variable annuities are a type of investment that can be complex. If you’re not sure what a variable annuity is, you can find a clear explanation here.

- Variable Annuity:A retiree seeking guaranteed income and protection against market losses might choose a variable annuity with a living benefit.

- 401(k) Plan:A young employee with a long time horizon and a high risk tolerance might choose a 401(k) plan with a focus on growth-oriented investments.

Factors to Consider When Choosing Between Variable Annuities and 401(k) Plans, Variable Annuity Vs 401k 2024

The decision of whether to invest in a variable annuity or a 401(k) plan depends on several factors, including:

- Age and Time Horizon:Variable annuities are generally more suitable for individuals with a longer time horizon, as they allow for greater potential growth and recovery from market downturns. 401(k) plans are often a better choice for individuals with a shorter time horizon, as they typically offer lower risk and a more predictable return.

John Hancock is a well-known provider of variable annuities. To learn more about their variable annuity offerings in 2024, check out this link here.

- Risk Tolerance and Investment Goals:Variable annuities are a higher-risk investment, but they also offer the potential for higher returns. If you have a high risk tolerance and are comfortable with the possibility of market fluctuations, a variable annuity might be a good option. 401(k) plans are generally considered lower-risk investments, and they may be a better choice if you prefer a more conservative approach.

- Financial Situation and Income Level:If you have a high income and are comfortable with the fees associated with variable annuities, they can be a valuable tool for tax-deferred growth and potential income guarantees. However, if you have a limited income and are concerned about the fees, a 401(k) plan might be a more affordable option.

If you’re planning to invest $100,000 in an annuity, you’ll want to know what kind of payments you can expect. You can find information on how much annuity you might receive for $100,000 in 2024 here.

- Tax Bracket and Future Tax Implications:Variable annuities and 401(k) plans both offer tax-deferred growth, but the tax implications of withdrawals can differ. If you expect to be in a higher tax bracket in retirement, a Roth 401(k) might be a better choice, as withdrawals are tax-free.

Hartford is another major provider of annuities. For details on their Director M Variable Annuity in 2024, check out this link here.

- Existing Retirement Savings and Other Investments:Your existing retirement savings and other investments should be considered when deciding whether to invest in a variable annuity or a 401(k) plan. If you already have a diversified portfolio of investments, a 401(k) plan might be sufficient. However, if you are looking for additional protection against market losses or guaranteed income, a variable annuity might be a good option.

When you’re planning for retirement, understanding how annuity payments are calculated is essential. You can find information on calculating annuity due payments in 2024 here.

- Need for Guaranteed Income or Protection Against Market Downturns:If you are concerned about market volatility and want to ensure a guaranteed income stream in retirement, a variable annuity with living benefits might be a good option. However, if you are comfortable with market risk and are not concerned about guaranteed income, a 401(k) plan might be sufficient.

The BA II Plus calculator is a popular tool for financial calculations. Learn how to calculate annuity due payments on this calculator in 2024 here.

Examples:

- Age and Time Horizon:A 30-year-old individual with a long time horizon might be comfortable with the higher risk of a variable annuity, as they have more time to recover from market downturns. A 60-year-old individual with a shorter time horizon might prefer the lower risk of a 401(k) plan.

As an annuity grows, it’s helpful to track its progress. You can find information on how to calculate annuity growth in 2024 here.

- Risk Tolerance and Investment Goals:An investor with a high risk tolerance and a goal of maximizing growth might choose a variable annuity with a focus on equities. An investor with a lower risk tolerance and a goal of preserving capital might choose a 401(k) plan with a focus on bonds.

Conclusion

Ultimately, the decision between a variable annuity and a 401(k) plan is a personal one, influenced by individual circumstances, financial goals, and risk appetite. While both options offer advantages and disadvantages, understanding the key differences and considering your unique needs is crucial for making an informed choice.

There are many different retirement savings options available. To understand the differences between annuities and IRAs in 2024, check out this link here.

Remember, consulting with a qualified financial advisor can provide personalized guidance and help you navigate the complexities of retirement planning. By carefully evaluating your options and seeking professional advice, you can confidently choose the path that leads you towards a financially secure future.

FAQs: Variable Annuity Vs 401k 2024

What are the tax implications of variable annuities and 401(k) plans?

Both variable annuities and 401(k) plans offer tax deferral on contributions and earnings. This means that you won’t pay taxes on your investment growth until you withdraw the funds in retirement. However, withdrawals from traditional 401(k) plans are taxed as ordinary income, while withdrawals from Roth 401(k) plans are tax-free.

Variable annuities may have additional tax implications depending on the type of annuity and how it is structured. It’s essential to consult with a tax professional to understand the specific tax implications of your chosen investment vehicle.

For those considering a 457 B Variable Annuity, there are important details to understand. Learn more about this type of annuity and its features for 2024 here.

What are the fees associated with variable annuities and 401(k) plans?

If you’re in Singapore and considering an annuity, a helpful tool is an annuity calculator. You can find one for 2024 here.

Variable annuities generally have higher fees than 401(k) plans. These fees can include administrative fees, investment management fees, and surrender charges. 401(k) plans typically have lower fees, but there may be administrative fees and investment management fees associated with specific investment options within the plan.

It’s crucial to carefully review the fee structure of any investment option before making a decision.

What are the risks associated with variable annuities and 401(k) plans?

Both variable annuities and 401(k) plans carry investment risk. Variable annuities involve the risk of losing money due to market fluctuations, and they also have additional risks associated with insurance company guarantees. 401(k) plans also involve investment risk, but the risk can be mitigated by diversifying your investments across different asset classes.

Tax implications are a key consideration when it comes to annuities. To learn if a Single Life Annuity is taxable in 2024, you can find the answer here.

It’s essential to understand the risks associated with any investment before making a decision.

How do I choose the right retirement savings plan for me?

Choosing the right retirement savings plan depends on your individual circumstances, financial goals, and risk tolerance. Consider factors such as your age, time horizon, income level, and need for guaranteed income or protection against market downturns. Consulting with a qualified financial advisor can help you determine the best plan for your specific needs.