Variable Annuity Terminology 2024 is a guide to navigating the complex world of variable annuities. Variable annuities are a type of insurance product that combines investment growth with guaranteed income streams for retirement. This guide provides a comprehensive overview of key terminology, investment options, tax implications, and important considerations for choosing the right variable annuity.

A 7% return on an annuity can be a desirable outcome, but it’s important to understand the factors that influence annuity rates. Annuity 7 Percent 2024 explores the factors that can impact annuity rates and the potential for achieving a 7% return.

Variable annuities have evolved significantly over time, offering greater flexibility and customization to meet individual needs. They have become increasingly popular as a retirement savings tool, providing a unique blend of risk and potential reward. Understanding the terminology associated with variable annuities is crucial for making informed decisions about your retirement planning.

Calculating the value of an annuity can be a complex task, but it’s essential for making informed financial decisions. Calculate Annuity Lic 2024 provides a comprehensive guide on how to calculate the present value of an annuity based on various factors.

Introduction to Variable Annuities

Variable annuities are a type of retirement savings product that offers the potential for higher returns than traditional fixed annuities. They are designed to help individuals accumulate wealth for retirement by allowing them to invest in a variety of sub-accounts, similar to mutual funds.

Determining the appropriate annuity amount for a specific lump sum requires careful calculation. How Much Annuity For 80000 2024 provides guidance on how to calculate the annuity amount that can be generated from a lump sum of $80,000.

Variable annuities are a complex financial product, and it’s crucial to understand their intricacies before making an investment decision.

Understanding the tax implications of annuities is crucial for planning your finances. Is Annuity Income 2024 sheds light on whether annuity payments are considered taxable income and the relevant tax rules.

What are Variable Annuities?

Variable annuities are contracts between an individual and an insurance company. The individual invests a lump sum or makes regular payments into the annuity, and the insurance company manages the funds. Unlike fixed annuities, which guarantee a fixed rate of return, variable annuities offer the potential for higher returns but also carry the risk of losing money.

Guaranteed annuities offer a fixed rate of return for a specific period. Annuity 6 Guaranteed 2024 provides information on the benefits and drawbacks of guaranteed annuities, including their potential limitations.

The value of the annuity is tied to the performance of the underlying investments, which are typically mutual funds or sub-accounts that track specific market indices.

Joint life living benefit options can provide a stream of income for multiple individuals. Variable Annuity Joint Life Living Benefit 2024 explores the benefits and considerations of this type of annuity for couples or other joint beneficiaries.

History of Variable Annuities

Variable annuities were first introduced in the 1950s as a way for investors to participate in the stock market while receiving tax-deferred growth. Early variable annuities were primarily marketed to individuals seeking long-term growth potential, but their popularity has grown significantly over the years, particularly among those nearing retirement.

Annuity and perpetuity are both financial instruments that provide a stream of payments over time. However, they differ in their duration. Annuity Vs Perpetuity 2024 helps you understand the key differences and choose the right option for your needs.

Key Features and Benefits of Variable Annuities, Variable Annuity Terminology 2024

Variable annuities offer several key features and benefits that make them an attractive retirement savings option for some investors:

- Tax-deferred growth:Earnings from variable annuities are not taxed until they are withdrawn, which allows for tax-efficient growth over time.

- Investment flexibility:Variable annuities offer a wide range of investment options, allowing individuals to tailor their portfolio to their risk tolerance and financial goals.

- Guaranteed death benefit:Many variable annuities offer a guaranteed minimum death benefit, which ensures that a certain amount of money will be paid to beneficiaries upon the death of the annuitant, even if the annuity’s value has declined.

- Living benefit riders:Some variable annuities offer living benefit riders, which provide guaranteed income payments for life, regardless of market performance. These riders can provide peace of mind for individuals who are concerned about outliving their savings.

Key Terminology Explained

Understanding the terminology associated with variable annuities is essential for making informed investment decisions. Here are some of the key terms you should be familiar with:

| Term | Definition |

|---|---|

| Accumulation Units | Units of account that represent the investor’s ownership in the variable annuity’s underlying investment portfolio. The value of accumulation units fluctuates based on the performance of the sub-accounts. |

| Annuity Units | Units of account that are used to calculate the amount of income payments the annuitant will receive during the payout phase. The number of annuity units is determined by the value of the accumulation units at the time the annuity is annuitized. |

| Death Benefit | A guaranteed payment that is made to the beneficiary of the annuity upon the death of the annuitant. The death benefit may be a fixed amount, a percentage of the annuity’s value, or a combination of both. |

| Expense Ratio | The annual fee charged by the insurance company to manage the variable annuity. The expense ratio is typically expressed as a percentage of the annuity’s value. |

| Guaranteed Minimum Death Benefit (GMDB) | A guaranteed minimum payment that will be made to the beneficiary of the annuity upon the death of the annuitant, even if the annuity’s value has declined. The GMDB is typically a fixed amount or a percentage of the original investment. |

| Guaranteed Minimum Withdrawal Benefit (GMWB) | A guarantee that allows the annuitant to withdraw a certain amount of money each year from the annuity, regardless of market performance. The GMWB is typically a fixed percentage of the original investment. |

| Living Benefit Riders | Optional features that can be added to a variable annuity to provide guaranteed income payments for life. Living benefit riders can protect against the risk of outliving your savings and ensure a steady stream of income during retirement. |

| Mortality and Expense (M&E) Charges | Fees that are charged to cover the insurance company’s costs of providing the death benefit and other guarantees. M&E charges are typically expressed as a percentage of the annuity’s value. |

| Surrender Charges | Fees that are charged if the annuitant withdraws money from the annuity before a certain period of time. Surrender charges are typically highest in the early years of the annuity and gradually decline over time. |

| Sub-accounts | Separate investment accounts within the variable annuity that track the performance of specific market indices or asset classes. Investors can choose to allocate their funds among different sub-accounts to diversify their portfolio. |

Understanding Investment Options

Variable annuities offer a wide range of investment options, allowing individuals to tailor their portfolio to their risk tolerance and financial goals. These investment options typically include:

- Stock funds:These funds invest in a portfolio of stocks, offering the potential for higher returns but also greater risk.

- Bond funds:These funds invest in a portfolio of bonds, which are considered less risky than stocks but also offer lower potential returns.

- Money market funds:These funds invest in short-term debt securities, offering low returns but high liquidity.

- Target-date funds:These funds automatically adjust their asset allocation over time, becoming more conservative as the investor approaches retirement.

Diversification within a Variable Annuity Portfolio

Diversification is crucial for managing risk in any investment portfolio, and variable annuities are no exception. By allocating funds across different asset classes, investors can reduce the overall risk of their portfolio. For example, an investor might choose to allocate a portion of their funds to a stock fund, a bond fund, and a money market fund.

Annuity contracts can be held in different types of accounts. Annuity Is Which Account 2024 discusses the common types of accounts used for holding annuities and the factors to consider when choosing an account.

This approach can help to mitigate the impact of any one asset class performing poorly.

Calculating the value of an annuity involves using specific formulas. Annuity Calculation Formula 2024 provides a detailed explanation of the formulas used to calculate the present value and future value of an annuity.

Tax Considerations

Variable annuities are taxed differently during the accumulation phase and the payout phase. Understanding the tax implications is crucial for making informed investment decisions.

Variable annuities are investment products that offer potential for growth but also carry some risk. Can You Lose Money In A Variable Annuity 2024 provides insights into the potential risks and rewards associated with variable annuities.

Taxation during the Accumulation Phase

Earnings from variable annuities are not taxed until they are withdrawn. This tax-deferred growth allows for compound interest to work its magic, potentially leading to higher returns over time. However, it’s important to note that the investment earnings are still subject to taxation when they are withdrawn.

Understanding the rate of return on an annuity is crucial for evaluating its performance. Calculating Annuity Rate Of Return 2024 explains how to calculate the annualized rate of return on an annuity and the factors that influence it.

Taxation during the Payout Phase

When you begin withdrawing money from your variable annuity during retirement, the withdrawals are typically taxed as ordinary income. This means that the amount of tax you pay will depend on your tax bracket at the time of withdrawal.

Annuity contracts are commonly used in various financial scenarios. Annuity Examples In Real Life 2024 explains how annuities are applied in real-world situations, such as retirement planning, investment strategies, and insurance policies.

Tax Scenarios

Here are a few examples of different tax scenarios related to variable annuities:

- Example 1:If you withdraw $10,000 from your variable annuity during retirement and your tax bracket is 25%, you will owe $2,500 in taxes on that withdrawal.

- Example 2:If you withdraw $10,000 from your variable annuity during retirement and your tax bracket is 12%, you will owe $1,200 in taxes on that withdrawal.

Advantages and Disadvantages

Variable annuities offer several advantages, but they also come with some potential disadvantages. It’s important to weigh these factors carefully before making an investment decision.

Excel offers powerful tools for financial analysis, including annuity calculations. Calculate Annuity Value In Excel 2024 demonstrates how to use Excel formulas and functions to calculate the present value and future value of an annuity.

Advantages of Investing in Variable Annuities

- Tax-deferred growth:Earnings from variable annuities are not taxed until they are withdrawn, allowing for tax-efficient growth over time.

- Investment flexibility:Variable annuities offer a wide range of investment options, allowing individuals to tailor their portfolio to their risk tolerance and financial goals.

- Guaranteed death benefit:Many variable annuities offer a guaranteed minimum death benefit, which ensures that a certain amount of money will be paid to beneficiaries upon the death of the annuitant, even if the annuity’s value has declined.

- Living benefit riders:Some variable annuities offer living benefit riders, which provide guaranteed income payments for life, regardless of market performance. These riders can provide peace of mind for individuals who are concerned about outliving their savings.

Disadvantages and Risks Associated with Variable Annuities

- Investment risk:The value of a variable annuity is tied to the performance of the underlying investments, which can fluctuate. Investors could lose money if the market declines.

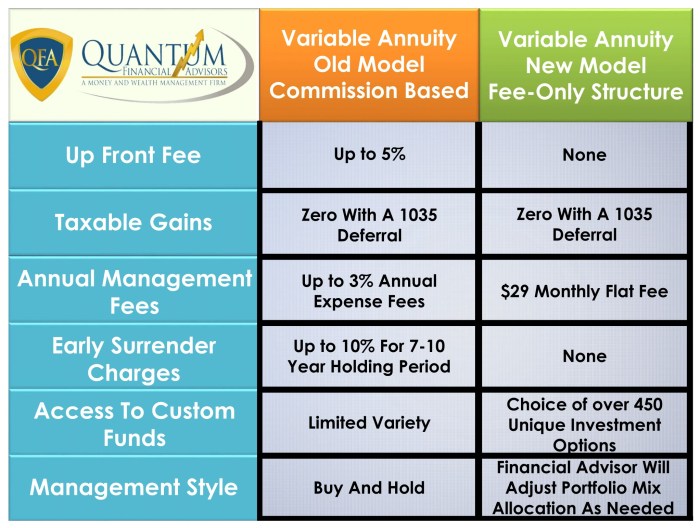

- Fees:Variable annuities typically have higher fees than traditional retirement savings accounts, such as IRAs or 401(k)s. These fees can erode returns over time.

- Complexity:Variable annuities are complex financial products that can be difficult to understand. Investors need to be comfortable with the risks involved before investing.

- Surrender charges:Variable annuities typically have surrender charges that are assessed if the annuitant withdraws money from the annuity before a certain period of time. These charges can be significant, especially in the early years of the annuity.

Choosing the Right Variable Annuity

Choosing the right variable annuity is a crucial decision that requires careful consideration. Here are some key factors to consider:

Key Factors to Consider

- Investment options:Make sure the variable annuity offers a wide range of investment options that align with your risk tolerance and financial goals.

- Fees:Compare the fees charged by different variable annuity providers to ensure you are getting a competitive deal.

- Guaranteed benefits:Consider the type of guaranteed benefits offered by the variable annuity, such as a guaranteed minimum death benefit or a guaranteed minimum withdrawal benefit.

- Living benefit riders:Determine whether you need a living benefit rider and compare the options offered by different providers.

- Customer service:Choose a provider with a strong reputation for customer service and financial stability.

Questions to Ask Potential Providers

- What investment options are available within the variable annuity?

- What are the fees associated with the variable annuity?

- What type of guaranteed benefits are offered?

- What living benefit riders are available?

- What is the provider’s track record for customer service and financial stability?

Comparing Different Variable Annuity Products and Features

When comparing different variable annuity products, it’s important to consider the overall value proposition. This includes the investment options, fees, guaranteed benefits, living benefit riders, and customer service. Don’t just focus on the lowest fees; consider the value you are receiving for the price.

Excel provides convenient tools for calculating annuity values. Calculating Annuity Excel 2024 demonstrates how to use Excel’s built-in functions to calculate the present value, future value, and other key metrics of an annuity.

Variable Annuities in 2024

The variable annuity market is constantly evolving, and it’s important to stay informed about the latest trends and developments. Here are some key factors to consider in 2024:

Current Market Conditions and Trends Affecting Variable Annuities

The current market conditions, including interest rates, inflation, and economic growth, can significantly impact the performance of variable annuities. It’s important to stay informed about these factors and how they may affect your investment decisions.

Recent Regulatory Changes or Updates Impacting the Industry

The financial services industry is subject to ongoing regulation, and changes to these regulations can impact the availability and features of variable annuities. It’s important to stay abreast of any recent regulatory changes or updates.

Annuity bonds are a type of bond that provides a stream of payments over time. Calculate Annuity Bond 2024 explores how to calculate the value of annuity bonds and their role in investment portfolios.

Emerging Trends and Innovations in the Variable Annuity Market

The variable annuity market is constantly evolving, with new products and features being introduced regularly. It’s important to stay informed about emerging trends and innovations, such as the development of variable annuities with enhanced living benefit riders or more flexible investment options.

End of Discussion: Variable Annuity Terminology 2024

Navigating the world of variable annuities can seem daunting, but with a thorough understanding of the terminology and key considerations, you can make informed decisions about your retirement savings. Variable annuities offer a powerful tool for building wealth and securing a comfortable retirement.

Remember to consult with a financial advisor to tailor a strategy that aligns with your individual needs and risk tolerance.

FAQ Resource

What are the risks associated with variable annuities?

Variable annuities carry investment risk, as the value of the underlying investments can fluctuate. Market downturns can negatively impact the value of your annuity, and there is no guarantee of principal protection.

How do I choose the right variable annuity?

Consider your investment goals, risk tolerance, and time horizon. Research different providers, compare features, and consult with a financial advisor to find an annuity that aligns with your needs.

Are there any fees associated with variable annuities?

Yes, variable annuities typically involve various fees, such as mortality and expense charges, surrender charges, and administrative fees. Be sure to understand all fees before making a decision.