Variable Annuity Surrender Charges 2024 are a crucial aspect of variable annuity contracts that can significantly impact your investment returns. These charges, imposed by insurance companies, are designed to compensate them for the potential loss they incur when an investor surrenders their annuity before a specified period.

Unde

Tax implications are an important factor to consider when planning for retirement. Understanding whether annuity interest is taxable can help you make informed financial decisions. Consulting with a tax advisor can provide valuable guidance on navigating the complexities of annuity taxation.

rstanding these charges is vital for making informed investment decisions, especially in the context of the ever-evolving financial landscape of 2024.

When it comes to retirement planning, the decision between an annuity vs. IRA can be a tough one. Both options have their pros and cons, so it’s important to carefully consider your individual needs and circumstances before making a decision.

An IRA offers tax-deferred growth, while an annuity provides guaranteed income payments. Understanding the differences between these options can help you make the best choice for your future.

This guide delves into the intricacies of variable annuity surrender charges, exploring their purpose, structure, impact on investment returns, and potential alternatives. We’ll analyze the factors driving changes in surrender charges, highlight the risks associated with surrendering annuities during market volatility, and provide insights into strategies for minimizing their impact.

For those living in New Zealand, exploring retirement income options is essential. An annuity calculator for New Zealand can be a helpful resource for estimating future income streams. By inputting your personal details and financial goals, you can gain valuable insights into how an annuity might fit into your retirement plan.

By equipping you with the knowledge and tools to navigate this complex aspect of variable annuities, we aim to empower you to make well-informed financial choices.

Variable Annuity Surrender Charges: An Overview: Variable Annuity Surrender Charges 2024

Variable annuities are complex financial products that offer growth potential through investments in a variety of sub-accounts, but they also come with a key feature: surrender charges. Understanding these charges is crucial for investors considering a variable annuity, as they can significantly impact your returns, especially if you need to withdraw your funds early.

What are Surrender Charges?

Surrender charges are fees imposed by insurance companies when you withdraw money from a variable annuity before a certain period, known as the surrender period. These charges are designed to discourage investors from withdrawing their money too early, as they can erode the potential for long-term growth.

Purpose of Surrender Charges

The primary purpose of surrender charges is to protect the insurance company from losses associated with early withdrawals. When an investor withdraws funds from a variable annuity, the insurance company may need to sell investments to cover the withdrawal, potentially at a loss if the market has declined.

Surrender charges help offset these potential losses.

Impact on Investors

Surrender charges can significantly impact an investor’s overall return. If you need to withdraw funds before the surrender period ends, you’ll face these fees, reducing the amount you receive. The longer you stay invested, the lower the surrender charges become, allowing you to benefit more from the potential growth of your investments.

Typical Surrender Charge Schedules, Variable Annuity Surrender Charges 2024

Surrender charge schedules vary depending on the insurance company and the specific variable annuity product. Here are some common examples:

- Step-down Schedule:This structure features a series of declining surrender charges over a set period, typically 7 to 10 years. For example, the surrender charge might be 8% in the first year, decreasing to 7% in the second year, and so on, until it reaches zero.

The retirement planning landscape is changing, and annuity jobs are becoming increasingly sought after. As individuals seek secure and predictable income streams, annuities are gaining popularity. If you’re looking for a career path that offers both financial stability and the opportunity to help others, an annuity career might be the right fit for you.

- Declining Schedule:Similar to a step-down schedule, but the surrender charges decline gradually over a longer period, often 10 to 15 years.

- Front-end Loaded:This structure charges a significant upfront fee, typically 5% to 10%, and then no further surrender charges apply after that initial period.

Surrender Charges in 2024

The variable annuity market is constantly evolving, and surrender charge structures are no exception. In 2024, we’ve observed some notable trends:

Trends in Surrender Charges

- Shorter Surrender Periods:Some insurance companies are offering shorter surrender periods, typically 5 to 7 years, to make their variable annuities more appealing to investors with shorter time horizons.

- Lower Surrender Charges:In a competitive market, some insurance companies are reducing surrender charges to attract more investors. This can result in lower fees overall, potentially improving investment returns.

- Increased Flexibility:Certain variable annuities now offer more flexibility in surrender charge structures, allowing investors to choose options that align with their individual needs and investment goals.

Comparing Surrender Charge Structures

Surrender charge structures can vary significantly across different variable annuity providers. It’s essential to compare the surrender charges of various products before making a decision. Consider factors such as the surrender period, the rate of decline, and the overall impact on your potential returns.

Winning the lottery can be a life-changing event, but it’s important to plan for the future. Calculating lottery annuity payments can help you understand the long-term financial implications of your winnings. It’s essential to consult with a financial advisor to make informed decisions about managing your newfound wealth.

Factors Influencing Surrender Charge Adjustments

Insurance companies adjust surrender charges based on various factors, including:

- Market Conditions:Volatility in the financial markets can influence surrender charge adjustments. During periods of market uncertainty, insurance companies may adjust surrender charges to mitigate their risk.

- Competition:The competitive landscape in the variable annuity market plays a role in surrender charge adjustments. Companies may adjust their charges to remain competitive and attract investors.

- Regulatory Changes:Regulatory changes can also influence surrender charge structures. For example, new regulations may require insurance companies to disclose surrender charges more transparently.

Retirement planning involves a variety of strategies, and regular contributions can enhance your future income. An annuity calculator with monthly contributions can help you visualize the potential impact of regular savings on your retirement income. By tracking your contributions and potential growth, you can gain a better understanding of your financial trajectory.

Impact of Surrender Charges on Investment Returns

Surrender charges can significantly impact the overall return on your variable annuity investment. Understanding this impact is crucial for making informed investment decisions.

Potential Impact on Investment Returns

Surrender charges act as a barrier to early withdrawals, effectively reducing the amount you receive. If you need to withdraw funds before the surrender period ends, the charges can eat into your potential gains.

When it comes to financial planning, understanding the concept of present value is crucial. A PV annuity sheet is a valuable tool for calculating the present value of a series of future payments. This information can help you make informed decisions about investments and financial planning strategies.

Hypothetical Scenario

Imagine you invest $100,000 in a variable annuity with a 7% surrender charge in the first year. After one year, your investment grows to $107,000. If you need to withdraw your funds, you’ll face a $7,000 surrender charge, leaving you with only $100,000.

Strategies for Minimizing Impact

Here are some strategies to minimize the impact of surrender charges:

- Long-term Investment Horizon:If you have a long-term investment horizon, the surrender charges will have less impact on your overall return. The longer you stay invested, the lower the charges become.

- Consider Other Investment Options:If you anticipate needing to withdraw funds early, consider alternative investment options that don’t have surrender charges, such as mutual funds or ETFs.

- Negotiate Surrender Charges:In some cases, you may be able to negotiate lower surrender charges with the insurance company. This can be particularly helpful if you have a large investment or a long-term relationship with the company.

Surrender Charges and Market Volatility

Market volatility can significantly impact investment decisions, especially when it comes to variable annuities with surrender charges. Understanding the relationship between these factors is essential for investors.

Impact on Investment Decisions

During market downturns, investors may be tempted to withdraw their funds to avoid further losses. However, surrender charges can make this decision more difficult. If you withdraw your funds during a market downturn, you’ll face the surrender charge, potentially exacerbating your losses.

Potential Risks

The potential risks associated with surrendering a variable annuity during market instability include:

- Loss of Potential Growth:Surrendering your variable annuity during a market downturn means missing out on the potential for future growth as the market recovers.

- Timing Risk:It’s impossible to predict when the market will bottom out. Surrendering your investment during a downturn could result in selling at the wrong time, locking in losses.

- Tax Implications:Surrendering a variable annuity may trigger tax implications, depending on the type of annuity and your tax situation.

Alternatives to Variable Annuities with Surrender Charges

If you’re concerned about surrender charges, consider alternative investment options that offer similar benefits without these fees.

If you’re looking for a short-term investment with potential for growth, 3-year annuity rates can be an attractive option. These annuities offer a fixed interest rate for a three-year period, providing a sense of stability and predictability. However, it’s important to research and compare rates from different providers before making a decision.

Comparing Investment Options

Here’s a comparison of variable annuities, index annuities, and mutual funds:

| Feature | Variable Annuity | Index Annuity | Mutual Fund |

|---|---|---|---|

| Growth Potential | High | Moderate | High |

| Risk Level | High | Moderate | High |

| Surrender Charges | Yes | No | No |

| Guaranteed Returns | No | Yes (capped) | No |

| Tax Advantages | Deferred | Deferred | No |

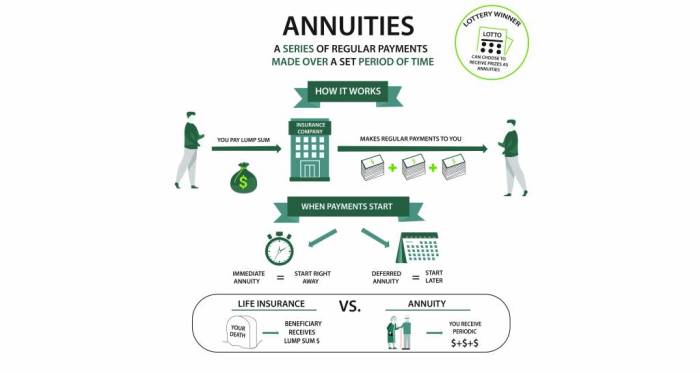

The question of whether an annuity is life insurance is a common one. While annuities and life insurance share some similarities, they are fundamentally different products. Annuities focus on providing income payments, while life insurance provides a death benefit to beneficiaries.

Understanding the distinctions between these financial tools is crucial for making informed decisions about your financial future.

Advantages and Disadvantages

- Index Annuities:Index annuities offer a potential for growth linked to a specific market index, such as the S&P 500. They also provide a guaranteed minimum return, which can protect your investment from losses. However, index annuities typically have lower growth potential than variable annuities and may have limitations on withdrawals.

Understanding the nuances of financial accounting is crucial for individuals and organizations alike. An annuity fund is often considered an unrestricted fund, meaning it can be used for a variety of purposes. This designation can impact how the fund is managed and invested, so it’s essential to be aware of the specific regulations and guidelines.

- Mutual Funds:Mutual funds offer a diversified investment approach, allowing you to invest in a basket of stocks, bonds, or other assets. They are typically more liquid than variable annuities, meaning you can access your funds more easily. However, mutual funds don’t offer the same tax advantages as variable annuities.

For residents of Westmont, Illinois, seeking health insurance options, an annuity health plan might be a viable choice. Annuities can offer a combination of health insurance coverage and retirement income, providing comprehensive financial protection. Researching local providers and comparing plans can help you find the best fit for your needs.

Understanding Surrender Charge Structures

It’s crucial to understand the different surrender charge structures to make informed decisions about variable annuities.

Annuity calculations can sometimes seem complex, but understanding the fundamentals can make a big difference. If you have questions about annuity calculations , seeking answers from reliable sources is important. Numerous resources are available online and through financial advisors to help you navigate these concepts.

Common Surrender Charge Structures

Here’s a breakdown of common surrender charge structures:

- Step-down Schedule:This structure features a series of declining surrender charges over a set period, typically 7 to 10 years. The surrender charge might be 8% in the first year, decreasing to 7% in the second year, and so on, until it reaches zero.

Choosing the right retirement planning strategy is essential, and annuities can play a significant role. A 5-year annuity can offer a fixed income stream for a set period, providing stability and predictability. However, it’s crucial to consider the potential for inflation and interest rate changes when making this decision.

- Declining Schedule:Similar to a step-down schedule, but the surrender charges decline gradually over a longer period, often 10 to 15 years.

- Front-end Loaded:This structure charges a significant upfront fee, typically 5% to 10%, and then no further surrender charges apply after that initial period.

Impact of Structures over Time

The surrender charge structure significantly affects the amount you pay over time. For example, a step-down schedule with a higher initial surrender charge may result in paying more in fees during the early years but less in the later years.

Visual Representation

[Visual representation of a typical surrender charge schedule using a chart or graph]

Considerations for Investors

When evaluating variable annuities with surrender charges, consider these factors:

Investment Goals

What are your investment goals? Are you looking for long-term growth, income generation, or a combination of both?

Time Horizon

How long do you plan to stay invested? If you have a short time horizon, the surrender charges may significantly impact your returns.

Risk Tolerance

How much risk are you willing to take? Variable annuities are considered higher risk investments, and surrender charges can add to the risk.

For those seeking a guaranteed income stream for a specific period, a 20-year certain annuity can provide peace of mind. This type of annuity guarantees regular payments for at least 20 years, regardless of how long you live. This can be a valuable tool for ensuring financial security during your retirement years.

Guidance on Appropriateness

If you’re unsure whether a variable annuity with surrender charges is appropriate for you, consult a financial advisor. They can help you assess your needs, goals, and risk tolerance and recommend the best investment options.

Retirement planning is essential for everyone, and it’s never too late to start. If you’re over 85, you may be considering your options for a secure income stream. An annuity for those over 85 can provide a guaranteed income for life, ensuring financial stability in your later years.

It’s important to consult with a financial advisor to determine if an annuity is the right choice for you.

Resources and Additional Information

Here are some resources for learning more about variable annuities and surrender charges:

Reputable Sources of Information

- Financial Industry Regulatory Authority (FINRA):FINRA is a self-regulatory organization that oversees the securities industry. Their website provides information on variable annuities and other investment products.

- Securities and Exchange Commission (SEC):The SEC is the primary regulator of the securities markets. Their website offers resources on investor education and protection.

- National Association of Insurance Commissioners (NAIC):The NAIC is a non-profit organization that represents state insurance regulators. Their website provides information on insurance regulations, including those related to variable annuities.

Financial Advisors and Professionals

- Certified Financial Planner (CFP):CFP professionals are required to meet rigorous education and experience requirements. They can provide personalized financial advice, including guidance on variable annuities.

- Registered Investment Advisor (RIA):RIAs are fiduciaries, meaning they are legally obligated to act in their clients’ best interests. They can offer investment advice and manage your portfolio.

Relevant Regulatory Bodies and Industry Organizations

- Financial Industry Regulatory Authority (FINRA)

- Securities and Exchange Commission (SEC)

- National Association of Insurance Commissioners (NAIC)

- American Council of Life Insurers (ACLI)

Last Point

In conclusion, variable annuity surrender charges remain a significant factor in the investment landscape, impacting both potential returns and the overall attractiveness of these financial products. While surrender charges serve a purpose for insurance companies, it’s essential for investors to understand their implications and explore alternatives that might align better with their financial goals and risk tolerance.

By carefully considering the factors discussed in this guide, you can make informed decisions about variable annuities and navigate the complex world of surrender charges with greater confidence.

FAQ

Are surrender charges always the same across all variable annuity providers?

No, surrender charges vary depending on the insurance company, the specific annuity contract, and the length of time you’ve held the annuity. It’s essential to compare surrender charge structures across different providers before making a decision.

How can I minimize the impact of surrender charges on my investment returns?

Consider strategies like choosing annuities with shorter surrender charge periods, investing for the long term to minimize the likelihood of surrendering early, and exploring alternative investment options that may not have surrender charges.

What are some examples of alternative investments that may offer similar benefits without surrender charges?

Index annuities, mutual funds, and exchange-traded funds (ETFs) are examples of alternative investments that may offer growth potential without surrender charges. However, it’s important to research and compare the specific features and risks associated with each option.

Can I avoid surrender charges entirely?

While some variable annuities offer surrender charge waivers under specific circumstances, such as death or disability, it’s not always possible to avoid them entirely. Understanding the terms of your annuity contract is crucial.