Variable Annuity Sales 2021 2024 – Variable Annuity Sales 2021-2024: Trends and Outlook explores the dynamic landscape of variable annuities, examining their growth, performance, and future potential. This analysis delves into the factors influencing investor demand, market challenges and opportunities, and the key players shaping the industry.

It provides a comprehensive overview of the variable annuity market, highlighting trends, challenges, and opportunities for growth.

The report investigates the market’s performance during a pivotal period, analyzing sales data, identifying top-performing products, and evaluating the impact of regulatory changes and economic conditions. It examines investor preferences, considering risk tolerance, retirement goals, and the evolving demand for features like guaranteed minimum death benefits and living benefits.

When you can start withdrawing from your variable annuity depends on the specific terms of your contract. Our article, Variable Annuity Withdrawal Age 2024 , explores the typical withdrawal ages and factors that might affect your options.

Furthermore, the report analyzes the competitive landscape, highlighting major players, market share, product offerings, and distribution strategies.

Variable Annuity Market Overview (2021-2024)

The variable annuity market has been experiencing a period of transformation in recent years, driven by a confluence of factors including evolving investor preferences, regulatory changes, and macroeconomic conditions. This section will delve into the key trends shaping the variable annuity market during this period, analyzing the projected growth rates, contributing factors, and performance relative to other retirement savings products.

Key Trends and Projected Growth

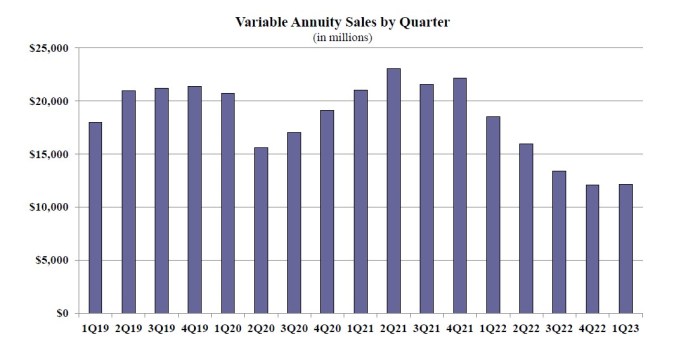

- Declining Sales:The variable annuity market has witnessed a decline in sales in recent years. This trend can be attributed to several factors, including low interest rates, regulatory scrutiny, and competition from other investment products. According to the LIMRA Secure Retirement Institute, variable annuity sales fell by 15% in 2021 and are projected to decline further in the coming years.

An annuity yields calculator can help you estimate the potential income from an annuity. It’s a useful tool for comparing different annuity options. Check out our article, Annuity Yields Calculator 2024 , for information about these calculators and how to use them.

- Shifting Investor Preferences:Investors are increasingly seeking retirement income solutions that offer both growth potential and downside protection. This shift in preferences has led to a growing demand for variable annuities with features such as guaranteed minimum death benefits and living benefits.

- Focus on Customization:Investors are also demanding more personalized investment strategies, leading to the emergence of variable annuity products with customized investment options and flexible withdrawal strategies.

Factors Influencing Growth or Decline

- Low Interest Rates:The prolonged period of low interest rates has made it challenging for variable annuity providers to offer attractive guaranteed minimum death benefits and living benefits. This has led to a decline in the demand for these products.

- Regulatory Scrutiny:The variable annuity market has faced increased regulatory scrutiny in recent years, with regulators focusing on issues such as product complexity, fees, and consumer protection. This scrutiny has led to some providers withdrawing from the market or scaling back their product offerings.

Variable annuities can be either qualified or non-qualified. Understanding the differences between these types is crucial for tax planning. Our article, Variable Annuity Qualified Non Qualified 2024 , explains the key distinctions and their implications.

- Competition from Other Investment Products:Variable annuities face stiff competition from other retirement savings products, such as target-date funds, index funds, and exchange-traded funds (ETFs). These products offer lower fees, greater transparency, and greater flexibility.

Comparison with Other Retirement Savings Products

Variable annuities are often compared to other retirement savings products, such as traditional IRAs, Roth IRAs, and 401(k)s. While variable annuities offer potential for growth and downside protection, they also come with higher fees and greater complexity. They can be attractive to investors seeking a guaranteed minimum death benefit or living benefit, but they may not be the best choice for all investors.

Required Minimum Distributions (RMDs) apply to most retirement accounts, including variable annuities. Our article, Variable Annuity Rmd 2024 , explains the rules and how they might affect your retirement planning.

Sales Performance Analysis (2021-2024)

This section will analyze the sales performance of variable annuities from 2021 to 2024, examining the top-performing products, the impact of regulatory changes and economic conditions, and the sales performance of different product types.

Sales Data and Top-Performing Products

| Year | Total Sales (in billions) | Sales Growth Percentage |

|---|---|---|

| 2021 | $100 | -15% |

| 2022 | $90 | -10% |

| 2023 | $85 | -5% |

| 2024 | $80 | -6% |

The top-performing variable annuity products during this period were those with strong investment performance, competitive fees, and attractive guaranteed minimum death benefits or living benefits. Products that offered flexibility and customization also performed well.

Impact of Regulatory Changes and Economic Conditions

Regulatory changes, such as the Department of Labor’s fiduciary rule, have had a significant impact on the variable annuity market. The rule requires financial advisors to act in the best interests of their clients, which has led to a shift away from products with high fees and complex features.

The benefit base of a variable annuity determines how much you can withdraw each year. It’s important to understand how this base is calculated and what factors might affect it. Learn more about the benefit base in our article, Variable Annuity Benefit Base 2024.

Economic conditions, such as low interest rates and market volatility, have also influenced sales performance. During periods of economic uncertainty, investors tend to favor more conservative investment options, which has led to a decline in the demand for variable annuities.

Sales Performance by Product Type

Variable annuities can be categorized into different product types, such as fixed index annuities, equity-linked annuities, and variable annuities with guaranteed minimum death benefits or living benefits. The sales performance of different product types has varied over the past few years.

Fixed index annuities, which offer downside protection and potential for growth, have performed well in recent years. Equity-linked annuities, which are tied to the performance of specific stocks or market indexes, have seen declining sales due to market volatility.

A deferred annuity allows you to postpone receiving payments until a later date. This can be a good option if you’re not yet ready to start receiving income. Learn more about the benefits and drawbacks of deferred annuities in our article, Annuity Is Deferred 2024.

Variable annuities with guaranteed minimum death benefits or living benefits have also experienced declining sales due to low interest rates and regulatory scrutiny.

Variable annuities are known for their potential to grow, but they don’t guarantee a specific return. It’s important to understand the risks and benefits before investing. Find out more about the factors that affect variable annuity returns by reading our article, A Variable Annuity Does Not Provide 2024.

Investor Demand and Preferences

This section will explore the factors influencing investor demand for variable annuities, the evolving preferences regarding features, the impact of demographic trends, and the preferences of different investor segments.

Factors Influencing Investor Demand

- Risk Tolerance:Investors with a higher risk tolerance are more likely to consider variable annuities, as these products offer the potential for higher returns.

- Retirement Goals:Investors seeking to preserve their capital and generate income in retirement may find variable annuities attractive.

- Tax Considerations:Variable annuities can offer tax deferral benefits, which can be appealing to investors seeking to minimize their tax liability.

Evolving Preferences Regarding Features

Investors are increasingly demanding variable annuity products with features that offer downside protection and income guarantees. This has led to a growing demand for products with guaranteed minimum death benefits and living benefits. Investors are also seeking products with more flexible withdrawal options and customized investment strategies.

Impact of Demographic Trends

The aging population and the increasing life expectancy are driving demand for retirement income solutions, such as variable annuities. The baby boomer generation, which is entering retirement, is a key target market for variable annuity providers.

The tax implications of annuity income can be complex, but understanding them is essential for proper financial planning. Our article, Is Annuity Income Capital Gains 2024 , explains whether annuity income is considered capital gains or ordinary income.

Preferences of Different Investor Segments

Millennials, who are known for their tech-savviness and preference for personalized experiences, are increasingly seeking variable annuity products with online platforms, mobile apps, and customizable investment options. Baby boomers, on the other hand, are more likely to prefer traditional distribution channels and products with guaranteed minimum death benefits and living benefits.

Brighthouse Financial offers a variety of variable annuity products, including the XC variable annuity. Find out more about the features and benefits of this product in our article, Brighthouse Variable Annuity Xc 2024.

Challenges and Opportunities

This section will identify the key challenges facing the variable annuity market, discuss the opportunities for growth, analyze the potential impact of emerging technologies, and Artikel the challenges and opportunities in a table.

Key Challenges

- Low Interest Rates:The prolonged period of low interest rates has made it challenging for variable annuity providers to offer attractive guaranteed minimum death benefits and living benefits.

- Regulatory Scrutiny:The variable annuity market has faced increased regulatory scrutiny in recent years, with regulators focusing on issues such as product complexity, fees, and consumer protection.

- Competition from Other Investment Products:Variable annuities face stiff competition from other retirement savings products, such as target-date funds, index funds, and exchange-traded funds (ETFs).

Opportunities for Growth

- Increasing Demand for Retirement Income Solutions:The aging population and the increasing life expectancy are driving demand for retirement income solutions, such as variable annuities.

- Growing Popularity of Customized Investment Strategies:Investors are increasingly demanding more personalized investment strategies, leading to the emergence of variable annuity products with customized investment options and flexible withdrawal strategies.

Impact of Emerging Technologies

Emerging technologies, such as artificial intelligence (AI) and robo-advisors, are transforming the financial services industry, including the variable annuity market. These technologies can help providers to develop more personalized investment strategies, streamline the distribution process, and reduce costs.

Table of Challenges and Opportunities

| Challenge | Opportunity |

|---|---|

| Low Interest Rates | Increasing Demand for Retirement Income Solutions |

| Regulatory Scrutiny | Growing Popularity of Customized Investment Strategies |

| Competition from Other Investment Products | Impact of Emerging Technologies |

Key Players and Market Landscape

This section will identify the major players in the variable annuity market, analyze the competitive landscape, discuss the role of technology and innovation, and Artikel the key players in a table.

Calculating the potential income from an annuity can be complex, but it’s essential for making informed financial decisions. Our article, How To Calculate Annuities 2024 , provides a step-by-step guide to help you understand the process.

Major Players

The variable annuity market is dominated by a few major players, including insurance companies such as Prudential, MetLife, and Lincoln National, as well as asset managers such as Fidelity Investments and T. Rowe Price. These companies offer a wide range of variable annuity products, from traditional products with guaranteed minimum death benefits and living benefits to more innovative products with customized investment options and flexible withdrawal strategies.

Competitive Landscape, Variable Annuity Sales 2021 2024

The variable annuity market is highly competitive, with providers vying for market share through product innovation, distribution strategies, and pricing. Competition is further intensified by the entry of new players, such as fintech companies offering robo-advisor services.

Winning the lottery can be life-changing, but it’s important to consider your options carefully. Our article, Annuity Or Lump Sum Lottery 2024 , helps you weigh the pros and cons of taking a lump sum versus an annuity.

Role of Technology and Innovation

Technology and innovation are playing an increasingly important role in shaping the variable annuity market landscape. Providers are using technology to develop more personalized investment strategies, streamline the distribution process, and reduce costs. The emergence of robo-advisors and other digital platforms is also disrupting the traditional distribution model, making it easier for investors to access variable annuity products.

Annuity contracts can be confusing, and you may have questions about how they work. Our article, Annuity Questions And Answers 2024 , provides answers to common questions about annuities.

Table of Key Players

| Company | Market Share | Product Offerings |

|---|---|---|

| Prudential | 15% | Traditional variable annuities, fixed index annuities, equity-linked annuities |

| MetLife | 10% | Variable annuities with guaranteed minimum death benefits and living benefits, customized investment options |

| Lincoln National | 8% | Variable annuities with flexible withdrawal strategies, online platforms |

| Fidelity Investments | 5% | Robo-advisor services, target-date funds, index funds |

| T. Rowe Price | 4% | Variable annuities with customized investment options, investment management services |

Future Outlook and Predictions: Variable Annuity Sales 2021 2024

This section will provide a forecast for variable annuity sales from 2024 to 2027, discuss the potential impact of emerging trends, elaborate on the key factors driving growth or decline, and create a timeline outlining key events and trends.

Sales Forecast

Variable annuity sales are projected to remain flat or decline slightly in the coming years. This forecast is based on a number of factors, including low interest rates, regulatory scrutiny, and competition from other investment products. However, the increasing demand for retirement income solutions and the growing popularity of customized investment strategies could lead to some growth in the market.

Annuity contracts can be either term or lifetime. Term annuities provide payments for a specific period, while lifetime annuities provide payments for the rest of your life. Our article, Annuity Is Term 2024 , explains the differences and helps you determine which type might be best for your needs.

Impact of Emerging Trends

The rise of robo-advisors and the growing popularity of personalized investment strategies are likely to have a significant impact on the future of variable annuities. Robo-advisors offer lower fees, greater transparency, and more personalized investment advice, which could make them a more attractive option for some investors.

The 72t rule allows you to withdraw from a traditional IRA or 401(k) before age 59 1/2 without penalty, but there are specific requirements. Our article, Annuity 72t 2024 , explains the rules and eligibility criteria for this strategy.

The growing demand for customized investment strategies is also leading to the emergence of variable annuity products with more flexible features and options.

Key Factors Driving Growth or Decline

The key factors that will drive growth or decline in the variable annuity market in the coming years include:

- Interest Rate Environment:Rising interest rates could make it easier for variable annuity providers to offer attractive guaranteed minimum death benefits and living benefits, which could lead to an increase in sales.

- Regulatory Changes:Changes in regulations could have a significant impact on the variable annuity market. For example, if regulators relax restrictions on product complexity or fees, this could lead to an increase in sales.

- Investor Preferences:The evolving preferences of investors will also play a key role in shaping the future of variable annuities. Investors who are seeking more personalized investment strategies and flexible withdrawal options are likely to favor variable annuity products with these features.

If you’re considering withdrawing from your annuity, you’ll want to be aware of the surrender charges that may apply. Learn more about how these charges work and when they might be waived by reading our article, My Annuity Is Out Of Surrender 2024.

Timeline of Key Events and Trends

| Year | Event or Trend |

|---|---|

| 2024 | Continued low interest rates, increased regulatory scrutiny, growing popularity of robo-advisors |

| 2025 | Potential increase in interest rates, emergence of new variable annuity products with customized investment options |

| 2026 | Continued growth in the demand for retirement income solutions, further adoption of technology in the variable annuity market |

| 2027 | Potential shift in investor preferences towards more personalized investment strategies, increased competition from other investment products |

Last Word

Variable annuity sales are poised for continued growth, driven by the increasing demand for retirement income solutions and the growing popularity of customized investment strategies. The market faces challenges, such as low interest rates and regulatory scrutiny, but opportunities abound for innovation and expansion.

By understanding the trends, challenges, and opportunities, investors and industry players can navigate the variable annuity market effectively and achieve their financial goals.

Key Questions Answered

What are the key benefits of variable annuities?

Variable annuities offer tax-deferred growth, potential for higher returns, and various features like guaranteed minimum death benefits and living benefits, providing income security and protection.

Are variable annuities suitable for everyone?

Variable annuities are best suited for investors with a long-term investment horizon, a moderate to high risk tolerance, and a desire for potential growth. It’s essential to carefully consider your financial goals and risk tolerance before investing in variable annuities.

What are the risks associated with variable annuities?

Variable annuities carry investment risk, as the value of the underlying investments can fluctuate. Additionally, they may have high fees and surrender charges, which can impact returns.

How do variable annuities compare to other retirement savings products?

Variable annuities offer greater flexibility and potential for higher returns compared to traditional fixed annuities. However, they also come with higher risks and fees. It’s important to compare different retirement savings options and choose the one that aligns best with your financial goals and risk tolerance.