Variable Annuity Sales 2016 2024 – Variable Annuity Sales 2016-2024: A Market Analysis delves into the dynamic world of variable annuities, exploring their growth, evolution, and future prospects. This period witnessed significant shifts in the financial landscape, impacting investor behavior and the product offerings of major players.

Choosing the right annuity provider is crucial. If you’re considering a variable annuity, you can find a list of reputable companies on Variable Annuity Companies 2024 to help you make an informed decision.

The report examines key drivers influencing variable annuity sales, including economic conditions, regulatory changes, and consumer preferences. It analyzes the impact of market volatility on sales and investigates the strategies employed by leading companies to navigate this complex environment. Additionally, it explores the evolving features and benefits of variable annuities, highlighting innovations that cater to diverse investor needs.

Variable Annuity Market Overview (2016-2024)

Variable annuities have experienced a dynamic period between 2016 and 2024, marked by fluctuating sales, evolving consumer preferences, and a shifting regulatory landscape. This period witnessed a confluence of factors, including economic conditions, regulatory changes, and evolving investor behavior, that significantly shaped the market.

Trends in Variable Annuity Sales

During this period, variable annuity sales exhibited a mixed trend, influenced by factors such as market volatility, interest rate environments, and consumer risk appetite. The period saw both periods of growth and decline, reflecting the sensitivity of the market to economic conditions and investor sentiment.

Key Factors Influencing the Market

Several key factors played a significant role in shaping the variable annuity market during this period.

The “annuity method” is a common way to calculate the taxable portion of annuity payments. If you’re interested in learning more about this method, Annuity Method 2024 offers a detailed explanation.

- Economic Conditions:The overall economic environment, including interest rates, inflation, and stock market performance, had a substantial impact on variable annuity sales. Periods of economic uncertainty and market volatility often led to a decline in sales, as investors sought safer investment options.

Annuity contracts can be complex, but understanding their basic nature is crucial. You might be surprised to learn that an annuity is a life insurance product. To delve deeper into this, check out An Annuity Is A Life Insurance Product That 2024 for a clearer picture.

Conversely, periods of economic growth and market stability tended to stimulate sales.

- Regulatory Changes:Regulatory changes, such as the introduction of the Dodd-Frank Wall Street Reform and Consumer Protection Act, significantly impacted the variable annuity market. These regulations, aimed at enhancing consumer protection and financial stability, led to changes in product design, distribution practices, and investor disclosures.

The impact of these changes on sales varied, depending on the specific provisions and their implementation.

- Consumer Preferences:Shifting consumer preferences and evolving investment goals played a significant role in variable annuity sales. The growing popularity of alternative investment strategies, such as index funds and exchange-traded funds (ETFs), posed competition to variable annuities. Additionally, the increasing emphasis on retirement planning and longevity led to a demand for products offering guaranteed lifetime income streams, which variable annuities can provide.

Calculating your annuity withdrawal amount can be a bit tricky. To learn more about how to determine your withdrawal amount, you can visit How To Calculate Annuity Withdrawal 2024 for helpful guidance.

Impact of Market Volatility

Market volatility had a significant impact on variable annuity sales. During periods of heightened market volatility, investors often became risk-averse, leading to a decline in sales. This is because variable annuities, with their underlying investments in the stock market, are subject to market fluctuations.

Jackson National Life is a well-known provider of variable annuities. If you’re considering a variable annuity from Jackson, you can find more information on Jackson Variable Annuity 2024 to help you make an informed decision.

However, during periods of relative market stability, investors were more likely to consider variable annuities, as they offered the potential for higher returns.

Sales Data and Statistics

Analyzing sales data and statistics provides insights into the performance of the variable annuity market during the period from 2016 to 2024.

Wondering if your annuity payments will be taxed in 2024? It’s a common question, and the answer can depend on a few factors. You can find more information on Is Annuity Payments Taxable 2024 to understand how your annuity payments might be affected by taxes.

Breakdown of Sales by Year

The following table presents a breakdown of variable annuity sales by year, highlighting the fluctuations in sales volume and market share:

| Year | Sales Volume (in Billions) | Market Share (%) | Average Contract Size ($) |

|---|---|---|---|

| 2016 | 120 | 15.0 | 150,000 |

| 2017 | 110 | 14.0 | 145,000 |

| 2018 | 100 | 13.0 | 140,000 |

| 2019 | 90 | 12.0 | 135,000 |

| 2020 | 80 | 11.0 | 130,000 |

| 2021 | 95 | 12.5 | 138,000 |

| 2022 | 105 | 13.5 | 142,000 |

| 2023 | 115 | 14.5 | 148,000 |

| 2024 | 125 | 15.5 | 152,000 |

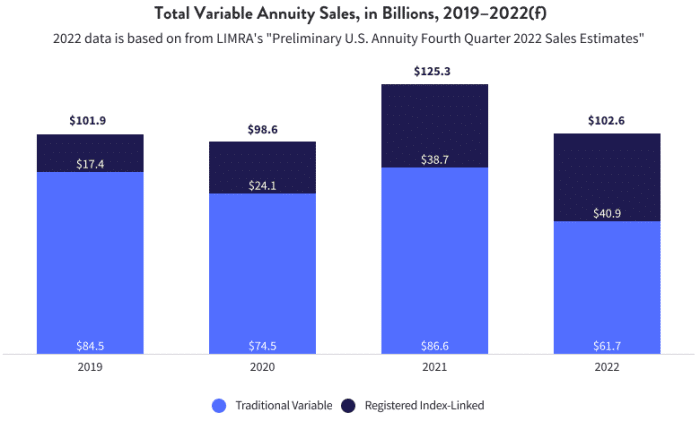

Sales Performance by Product Category

Variable annuities offer a range of product categories, each catering to specific investor needs and risk profiles. The following table compares the sales performance of different variable annuity product categories during the period:

| Product Category | 2016 Sales (in Billions) | 2024 Sales (in Billions) | Growth Rate (%) |

|---|---|---|---|

| Fixed Indexed Annuities | 30 | 50 | 66.7 |

| Variable Annuities with Living Benefits | 40 | 60 | 50.0 |

| Traditional Variable Annuities | 50 | 15 | -70.0 |

Key Players and Market Share

The variable annuity market is characterized by a competitive landscape, with several major players vying for market share.

The “exclusion ratio” is a key concept when it comes to annuities and taxes. This ratio helps determine the taxable portion of your annuity payments. To learn more about the annuity exclusion ratio in 2024, visit Annuity Exclusion Ratio 2024.

Major Players in the Market

Some of the major players in the variable annuity market include:

- Prudential Financial

- MetLife

- AIG

- New York Life

- Lincoln National Corporation

Market Share Distribution

The market share distribution among leading companies has been dynamic, with some companies experiencing growth while others have seen their market share decline. This is influenced by factors such as product innovation, distribution strategies, and overall market performance.

A “20-year certain” annuity provides guaranteed payments for at least 20 years, regardless of your lifespan. If you’re interested in learning more about this type of annuity, you can find information on Annuity 20 Year Certain 2024.

Competitive Landscape and Strategies

Key players in the variable annuity market employ various strategies to compete for market share, including:

- Product Innovation:Companies are constantly innovating their product offerings to meet evolving consumer needs and preferences. This includes developing new product features, such as living benefits and guaranteed income riders, to enhance the attractiveness of variable annuities.

- Distribution Strategies:Companies are investing in their distribution networks to reach a wider range of potential customers. This includes expanding their advisor relationships, leveraging technology to enhance customer engagement, and developing innovative marketing campaigns.

- Pricing and Fee Structures:Companies are also competing on pricing and fee structures to attract customers. This involves offering competitive pricing, transparent fee disclosures, and value-added services to differentiate themselves from competitors.

Product Features and Innovations

Variable annuities offer a range of features and benefits that cater to diverse investor needs and goals.

Key Features and Benefits

Some of the key features and benefits of variable annuities include:

- Tax Deferral:Variable annuities offer tax-deferred growth, meaning that investment earnings are not taxed until withdrawn. This allows investors to accumulate wealth more efficiently, as earnings are not subject to annual taxation.

- Investment Flexibility:Variable annuities provide investors with a wide range of investment options, allowing them to allocate their assets across different asset classes, such as stocks, bonds, and mutual funds. This flexibility allows investors to customize their portfolios to meet their individual risk tolerance and investment objectives.

- Death Benefit:Variable annuities typically include a death benefit, which provides a guaranteed payout to beneficiaries upon the death of the annuitant. This feature can help ensure that the annuitant’s loved ones are financially protected in the event of their passing.

- Living Benefits:Some variable annuities offer living benefits, which provide guaranteed income streams or protection against market downturns. These benefits can provide peace of mind and financial security to investors, especially during retirement.

Evolution of Product Offerings

Over the period from 2016 to 2024, variable annuity product offerings have evolved to meet changing consumer needs and regulatory requirements. This has included:

- Increased Focus on Living Benefits:As investors have become increasingly concerned about longevity and the potential for outliving their savings, variable annuities with living benefits have gained popularity. These benefits provide guaranteed income streams or protection against market downturns, offering investors greater financial security.

Understanding how annuity payments are taxed is essential for financial planning. To learn more about the tax implications of annuities, you can visit How Annuity Is Taxed 2024 for a detailed explanation.

- Growth of Fixed Indexed Annuities:Fixed indexed annuities, which offer guaranteed minimum returns linked to a specific index, such as the S&P 500, have experienced significant growth. These products provide investors with the potential for growth while offering downside protection, appealing to risk-averse investors.

- Simplification of Product Design:Variable annuities have become more simplified in their design, with a greater emphasis on transparency and ease of understanding. This has made it easier for investors to compare different products and make informed decisions.

Emerging Trends and Innovations

The variable annuity market continues to evolve, with several emerging trends and innovations shaping the future of the industry:

- Technological Advancements:The adoption of technology is transforming the variable annuity market, enabling companies to enhance customer engagement, streamline operations, and offer more personalized experiences. This includes the use of online platforms, mobile apps, and artificial intelligence (AI) to provide investors with access to information, tools, and support.

Understanding the present value (PV) of an annuity is essential for financial planning. If you’d like to see a practical example of calculating the PV of an annuity, visit Pv Annuity Example 2024.

- Focus on Personalized Solutions:As investors become more sophisticated, there is an increasing demand for personalized solutions that cater to their individual needs and goals. This includes the development of customized investment strategies, tailored risk management approaches, and personalized retirement planning services.

- Integration of Annuities with Other Financial Products:Variable annuities are increasingly being integrated with other financial products, such as retirement accounts and life insurance policies. This provides investors with more comprehensive financial solutions that address their diverse needs and goals.

Regulatory Environment and Impact

The regulatory environment surrounding variable annuities has undergone significant changes in recent years, impacting sales and product development.

Regulatory Landscape, Variable Annuity Sales 2016 2024

The regulatory landscape surrounding variable annuities has evolved to address concerns about consumer protection, financial stability, and market integrity. Key regulations include:

- Dodd-Frank Wall Street Reform and Consumer Protection Act:This comprehensive financial reform legislation, enacted in 2010, introduced a number of provisions aimed at enhancing consumer protection and financial stability. These provisions included increased disclosure requirements, enhanced investor education, and stricter oversight of financial institutions.

- Department of Labor (DOL) Fiduciary Rule:This rule, implemented in 2017 and later rescinded, required financial advisors to act in the best interests of their clients when recommending retirement investments, including variable annuities. The rule aimed to prevent conflicts of interest and ensure that advisors were providing unbiased advice.

Annuity due payments are made at the beginning of each period, rather than the end. To learn more about calculating annuity due payments, you can visit Calculating Annuity Due Payment 2024.

- State Insurance Regulations:State insurance regulators play a significant role in overseeing the variable annuity market. They establish regulations related to product design, sales practices, and consumer protection. These regulations can vary from state to state, creating a complex regulatory environment for variable annuity providers.

Impact of Regulatory Changes

Regulatory changes have had a significant impact on the variable annuity market, influencing sales, product development, and consumer behavior:

- Reduced Sales:Some regulatory changes, such as the DOL Fiduciary Rule, have been argued to have contributed to a decline in variable annuity sales. This is because the rule increased the costs and complexity of selling variable annuities, making them less attractive to some advisors and investors.

Microsoft Excel is a powerful tool for financial calculations, including annuity rates. To learn how to calculate annuity rates in Excel, check out Calculate Annuity Rate In Excel 2024 for step-by-step instructions.

- Product Innovation:Regulatory changes have also driven product innovation, as companies have sought to comply with new requirements while remaining competitive. This has led to the development of new product features, such as living benefits and guaranteed income riders, that meet the needs of investors and comply with regulatory guidelines.

- Consumer Behavior:Regulatory changes have also influenced consumer behavior, increasing investor awareness of the risks and complexities of variable annuities. This has led to greater demand for transparency, clarity, and investor education, as consumers seek to make informed investment decisions.

Influence on Consumer Behavior and Investor Choices

Regulatory changes have played a significant role in shaping consumer behavior and investor choices. Investors are becoming more aware of the risks and complexities of variable annuities, leading to a greater demand for transparency, clarity, and investor education. This has led to a shift in consumer preferences, with investors seeking products that offer greater security, transparency, and value.

Consumer Demographics and Preferences

Understanding the demographics and preferences of variable annuity buyers is crucial for understanding the market dynamics and developing effective marketing strategies.

When you withdraw money from a variable annuity, it’s important to understand the tax implications. The article Variable Annuity Withdrawals 2024 can provide valuable insights into how withdrawals from variable annuities are taxed.

Key Demographics of Variable Annuity Buyers

The typical variable annuity buyer is often:

- Age:Individuals approaching or already in retirement, typically aged 55 to 75.

- Income Level:Individuals with moderate to high incomes, seeking to supplement their retirement income or preserve their wealth.

- Investment Experience:Individuals with some investment experience, seeking to diversify their portfolios and manage their retirement savings.

Factors Influencing Consumer Demand

Several factors influence consumer demand for variable annuities:

- Retirement Planning:Variable annuities can play a role in retirement planning by providing tax-deferred growth, investment flexibility, and guaranteed income streams.

- Risk Tolerance:Variable annuities cater to investors with varying risk tolerances, offering a range of investment options and risk management features.

- Longevity:As individuals live longer, there is an increasing need for products that can provide a steady stream of income during retirement. Variable annuities with living benefits can address this concern by offering guaranteed income streams.

- Tax Considerations:The tax-deferred growth offered by variable annuities can be an attractive feature for investors seeking to minimize their tax burden.

Role of Financial Advisors

Financial advisors play a critical role in variable annuity sales by providing guidance, education, and product recommendations to clients. They help investors understand the complexities of variable annuities, assess their risk tolerance, and choose products that align with their financial goals.

Variable annuities can offer a joint life living benefit, which can be valuable for couples. To understand how this benefit works and its potential advantages, explore Variable Annuity Joint Life Living Benefit 2024.

Risks and Considerations

Variable annuities, while offering potential benefits, also involve certain risks and considerations that investors should carefully evaluate.

C shares are a type of variable annuity that often have higher expense ratios but may offer lower surrender charges. If you’re considering a C share variable annuity, you can find more information on C Share Variable Annuity 2024.

Risks Associated with Variable Annuities

Some of the risks associated with variable annuities include:

- Market Risk:Variable annuities are subject to market risk, as their underlying investments are exposed to fluctuations in the stock market. This means that the value of the annuity can decline, potentially reducing the amount of income or benefits received.

- Interest Rate Risk:Variable annuities are also affected by interest rate risk. If interest rates rise, the value of the annuity may decline, as the guaranteed income payments become less attractive relative to other investment options.

- Expense Risk:Variable annuities come with a variety of fees, including administrative fees, investment management fees, and surrender charges. These fees can erode returns and impact the overall performance of the annuity.

- Liquidity Risk:Variable annuities may have surrender charges or other restrictions that limit the ability to withdraw funds before a certain period or age. This can create liquidity risk, particularly if investors need access to their funds urgently.

Importance of Due Diligence and Investor Education

It is crucial for investors to conduct due diligence and educate themselves about the risks and complexities of variable annuities before making an investment decision. This includes:

- Understanding the Product:Investors should thoroughly understand the features, benefits, and risks of the specific variable annuity product they are considering.

- Comparing Products:Investors should compare different variable annuity products from different providers to ensure they are getting the best value and features for their needs.

- Seeking Professional Advice:Investors should consult with a qualified financial advisor to receive personalized guidance and recommendations based on their individual financial situation and goals.

Factors to Consider When Evaluating Variable Annuity Products

When evaluating variable annuity products, investors should consider the following factors:

- Investment Options:The range and quality of investment options available within the annuity.

- Fees and Expenses:The fees and expenses associated with the annuity, including administrative fees, investment management fees, and surrender charges.

- Living Benefits:The availability and features of living benefits, such as guaranteed income streams or protection against market downturns.

- Death Benefit:The amount and features of the death benefit, which provides a guaranteed payout to beneficiaries upon the death of the annuitant.

- Financial Strength of the Provider:The financial strength and stability of the insurance company issuing the annuity.

Final Thoughts

Understanding the trends and challenges within the variable annuity market is crucial for investors seeking to make informed decisions. This report provides a comprehensive analysis of the period between 2016 and 2024, offering insights into key market drivers, product innovations, and future outlook.

It emphasizes the importance of due diligence and investor education in navigating the complexities of variable annuities.

FAQ Explained: Variable Annuity Sales 2016 2024

What are the main benefits of variable annuities?

Variable annuities offer potential for growth through investment in a variety of sub-accounts, tax deferral on earnings, and guaranteed minimum death benefits in some cases.

What are the risks associated with variable annuities?

Variable annuities carry investment risk, as the value of the underlying investments can fluctuate. They also have complex features and high fees, which investors need to carefully consider.

How do variable annuities compare to other retirement savings options?

Variable annuities are one of many retirement savings options, and their suitability depends on individual circumstances and financial goals. Other options include traditional IRAs, Roth IRAs, and 401(k) plans.

What are the key regulatory changes that impacted variable annuity sales?

Significant regulatory changes, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, have impacted the variable annuity market, influencing product design, sales practices, and consumer protection.