Variable Annuity Qualification 2024: A Guide delves into the complexities of variable annuities, providing insights into their features, qualification requirements, and potential benefits. This guide is designed to equip individuals with the knowledge necessary to make informed decisions about whether a variable annuity aligns with their financial goals and risk tolerance.

Understanding different types of annuities is essential. This resource highlights five types of annuities to help you make an informed decision.

Variable annuities are a popular investment option for individuals seeking to grow their retirement savings. These contracts offer the potential for tax-deferred growth and a variety of investment options. However, they also come with certain risks and complexities that require careful consideration.

Understanding the qualifications and features of variable annuities is essential for investors to make informed decisions and maximize their potential returns.

For those who prefer a hands-on approach, learning how to calculate annuity payments manually can be helpful. This resource explains how to calculate annuity payments using a financial calculator.

Variable Annuities: A Comprehensive Guide for 2024: Variable Annuity Qualification 2024

Variable annuities are complex financial products that offer the potential for growth but also carry significant risks. This comprehensive guide provides a detailed overview of variable annuities, covering their basics, qualification requirements, key considerations, contract features, tax implications, comparisons with other retirement products, and regulatory oversight.

If you’re based in Hong Kong, you can find local annuity calculators to help you with your planning. Explore the annuity calculators available in Hong Kong.

Understanding these aspects is crucial for making informed decisions about whether a variable annuity aligns with your financial goals and risk tolerance.

If you’re considering an annuity, you’ll likely have many questions. Check out this resource for answers to common annuity questions. Understanding how annuities work is crucial before making any decisions.

Variable Annuity Basics

A variable annuity is a type of insurance contract that provides income for life. It differs from traditional fixed annuities in that the value of your investment is tied to the performance of a portfolio of sub-accounts, which invest in a variety of mutual funds.

This means your returns are not guaranteed, but they also have the potential to grow significantly over time.

Annuity payments can provide a steady stream of income during retirement. Learn more about the basics of annuities and how they work.

Here are some key features and potential benefits of variable annuities:

- Growth potential:Variable annuities offer the potential for higher returns compared to fixed annuities, as your investment is linked to the market performance of the underlying sub-accounts.

- Tax-deferred growth:Earnings within a variable annuity are not taxed until you withdraw them, providing tax-deferred growth potential.

- Lifetime income:Many variable annuities offer an optional guaranteed lifetime income rider, which provides a stream of income for life, even if your account balance runs out.

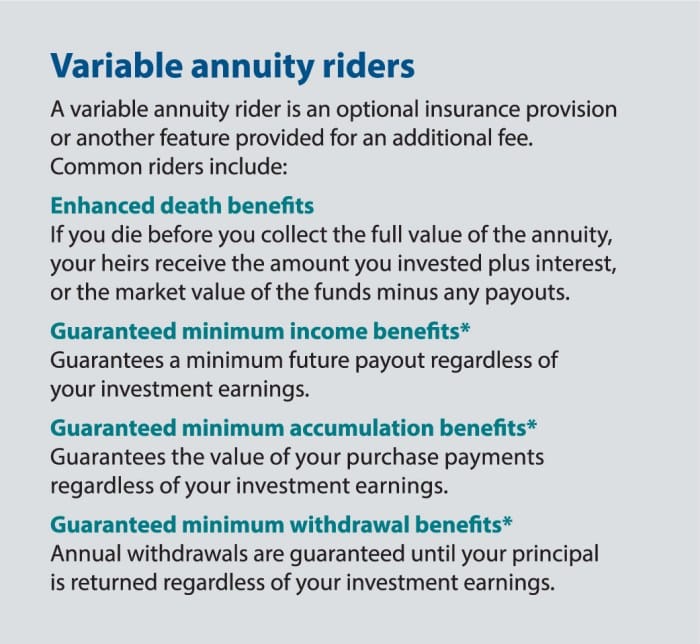

- Death benefit:Some variable annuities include a death benefit that guarantees a minimum payout to your beneficiaries, even if your account balance is less than the original investment.

There are different types of variable annuities, each with its own unique characteristics:

- Equity-indexed annuities:These annuities link their returns to the performance of a specific stock index, such as the S&P 500. They offer a degree of protection against market losses while still providing potential for growth.

- Fixed-indexed annuities:These annuities provide a guaranteed minimum return, typically based on a fixed interest rate, while also offering the potential for higher returns linked to a specific index.

- Traditional variable annuities:These annuities offer the broadest range of investment options, allowing you to allocate your funds across a variety of sub-accounts, including stocks, bonds, and other asset classes.

The returns on a variable annuity are determined by the performance of the underlying sub-accounts you choose. These sub-accounts are similar to mutual funds, and they invest in a variety of assets, such as stocks, bonds, and real estate. The returns on each sub-account will fluctuate based on market conditions.

Accurately calculating annuity payments is crucial for financial planning. This article provides a step-by-step guide on how to calculate annuity payments.

Qualification Requirements for Variable Annuities in 2024

The eligibility criteria for purchasing a variable annuity in 2024 may vary depending on the insurance company offering the product. However, there are some general requirements that typically apply:

- Age:Most insurance companies require a minimum age, typically 18 or 21, to purchase a variable annuity.

- Financial capacity:You must have the financial means to afford the initial investment and ongoing fees associated with a variable annuity. This may include income, assets, or a combination of both.

- Health status:Some variable annuities may have health requirements, especially if they include a guaranteed lifetime income rider. For example, you may need to undergo a medical exam or provide medical records.

It’s important to note that specific requirements and restrictions can vary significantly between insurance companies. Therefore, it’s essential to consult with a financial advisor to determine if a variable annuity is suitable for your situation and to understand the specific eligibility criteria for the product you’re considering.

Annuity options can be tailored to different age groups. Explore the specific considerations for annuities for those aged 85 and older.

Key Considerations for Variable Annuity Qualification

Before pursuing a variable annuity, it’s crucial to consider several factors:

- Risk tolerance:Variable annuities carry significant market risk, as your investment is tied to the performance of the underlying sub-accounts. If you have a low risk tolerance, a variable annuity may not be the right choice for you.

- Time horizon:Variable annuities are generally considered long-term investments, as they are designed to provide income for life. If you have a short-term investment horizon, a variable annuity may not be suitable.

- Financial goals:Variable annuities can be used for a variety of financial goals, such as retirement income, supplemental income, or estate planning. It’s important to ensure that a variable annuity aligns with your specific financial objectives.

It’s essential to weigh the potential risks and benefits of a variable annuity before making a decision. A financial advisor can help you assess your risk tolerance, time horizon, and financial goals to determine if a variable annuity is the right investment for you.

It’s important to plan for the future of your annuity. Consider the implications of not having a beneficiary designated for your annuity.

Variable Annuity Contract Features

Variable annuity contracts can vary significantly in terms of their features and benefits. Here’s a table comparing some key features of different variable annuity contracts available in 2024:

| Feature | Contract A | Contract B | Contract C |

|---|---|---|---|

| Fees | $100 annual fee, 1% asset management fee | $50 annual fee, 0.75% asset management fee | $0 annual fee, 1.25% asset management fee |

| Investment options | 100+ sub-accounts | 50+ sub-accounts | 20+ sub-accounts |

| Death benefit | Guaranteed death benefit equal to original investment | Optional death benefit rider available | No death benefit included |

| Surrender charges | 7-year surrender charge schedule | 5-year surrender charge schedule | No surrender charges |

This table is for illustrative purposes only and does not represent all variable annuity contracts available in the market. It’s crucial to carefully review the contract terms and conditions of any variable annuity you’re considering to understand the specific features and fees associated with that product.

The variable annuity market is constantly evolving. Stay up-to-date on the latest trends and developments in the variable annuity market.

Tax Implications of Variable Annuities

The tax treatment of variable annuities can be complex. Here’s a summary of the key tax implications:

- Tax-deferred growth:Earnings within a variable annuity are not taxed until you withdraw them. This means your investment can grow tax-deferred over time, potentially leading to higher returns.

- Withdrawals:When you withdraw money from a variable annuity, the withdrawals are typically taxed as ordinary income. However, if you withdraw only your contributions (not earnings), the withdrawals may be tax-free.

- Distributions:If you choose to receive a guaranteed lifetime income stream from a variable annuity, the distributions are typically taxed as ordinary income.

- Early withdrawals:If you withdraw money from a variable annuity before age 59 1/2, you may be subject to a 10% early withdrawal penalty, in addition to ordinary income tax. This penalty may be waived in certain situations, such as for qualified medical expenses or for a first-time home purchase.

The Hartford Director M Variable Annuity is a popular option for those seeking a more flexible retirement income stream. Learn more about the features and benefits of this annuity to see if it aligns with your financial goals.

- Surrender charges:If you withdraw money from a variable annuity before the surrender charge period expires, you may be subject to a surrender charge. This charge is typically a percentage of the amount withdrawn and can vary depending on the insurance company and the contract terms.

Annuities can be used for various financial purposes, including loans. This resource explains the formula used for calculating annuity loans.

It’s essential to consult with a tax advisor to understand the specific tax implications of a variable annuity in your situation. They can help you determine the best withdrawal strategy to minimize your tax liability.

Comparison with Other Retirement Products, Variable Annuity Qualification 2024

Variable annuities are just one of many retirement savings options available. It’s important to compare them with other popular retirement products to determine which one is best suited for your needs.

Choosing the right annuity issuer is crucial. Take the time to research different companies and their offerings before making a decision. Explore the factors to consider when selecting an annuity issuer.

Here’s a table comparing variable annuities with traditional IRAs, Roth IRAs, and 401(k) plans:

| Feature | Variable Annuity | Traditional IRA | Roth IRA | 401(k) |

|---|---|---|---|---|

| Contribution limits | No annual limit, but subject to investment limits | $6,500 (2024) | $6,500 (2024) | $22,500 (2024) |

| Tax treatment | Tax-deferred growth, withdrawals taxed as ordinary income | Tax-deductible contributions, withdrawals taxed as ordinary income | Non-deductible contributions, tax-free withdrawals | Tax-deferred growth, withdrawals taxed as ordinary income |

| Investment options | Sub-accounts investing in a variety of assets | Wide range of investments, including mutual funds, ETFs, and stocks | Wide range of investments, including mutual funds, ETFs, and stocks | Limited investment options, typically offered by employer |

The suitability of a variable annuity will depend on your individual circumstances and financial goals. For example, if you’re seeking a guaranteed lifetime income stream, a variable annuity with a guaranteed lifetime income rider may be a good option. However, if you prefer to have more control over your investments and are comfortable with market risk, a traditional IRA or Roth IRA may be a better choice.

Annuity due is a type of annuity where payments are made at the beginning of each period. This can be a beneficial option in certain situations. Read more about the characteristics of an annuity due.

Variable Annuity Regulation and Oversight

Variable annuities are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These organizations set standards for the sale and distribution of variable annuities, and they monitor the industry to protect investors from fraud and abuse.

Recent changes to regulations have focused on increasing transparency and disclosure requirements for variable annuity products. For example, the SEC has implemented new rules requiring insurance companies to provide investors with more detailed information about the fees and risks associated with variable annuities.

Variable annuity investors are protected by a variety of consumer protections, including:

- Prospectus disclosure:Insurance companies are required to provide investors with a prospectus that Artikels the key features, risks, and fees associated with the variable annuity.

- Suitability requirements:Financial advisors are required to ensure that variable annuities are suitable for their clients based on their financial situation, risk tolerance, and investment goals.

- Investor protection:The SEC and FINRA have established rules and regulations to protect investors from fraud and abuse in the variable annuity market.

It’s essential to understand the regulatory framework surrounding variable annuities and to take advantage of the consumer protections in place to protect your investment.

Final Thoughts

In conclusion, variable annuities can be a valuable tool for retirement planning, but it is crucial to understand the qualifications, risks, and potential benefits before making a decision. By carefully evaluating your individual circumstances and financial goals, you can determine whether a variable annuity is the right fit for you.

NerdWallet offers a helpful annuity calculator to help you estimate potential payments. Try out the NerdWallet annuity calculator to get a better understanding of your options.

Consulting with a financial advisor can provide personalized guidance and help you navigate the intricacies of this complex investment product.

Question & Answer Hub

What is the minimum age requirement to purchase a variable annuity in 2024?

Variable annuities offer the potential for growth, but it’s important to understand the risks involved. Get informed about the characteristics of variable annuities before making any investments.

There is generally no minimum age requirement to purchase a variable annuity. However, certain insurance companies may have their own age restrictions.

Are there any income requirements for variable annuity qualification?

There are no specific income requirements for variable annuity qualification. However, your financial situation will be considered by the insurance company when determining your eligibility.

How do variable annuity returns work?

Variable annuity returns are determined by the performance of the sub-accounts you choose to invest in. These sub-accounts are similar to mutual funds and offer a range of investment options, such as stocks, bonds, and money market instruments. Your returns will fluctuate based on the performance of the chosen sub-accounts.

What are the tax implications of variable annuities?

Variable annuity withdrawals are taxed as ordinary income. However, the growth within the annuity is tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. Early withdrawals may be subject to penalties.