Variable Annuity Plans 2024 take center stage as a compelling retirement savings option, offering a unique blend of growth potential and income security. This guide delves into the intricacies of these plans, exploring their history, workings, advantages, disadvantages, and current market landscape.

When planning for the future, it’s important to consider how much income you’ll need. The article What Annuity Is Required Over 12 Years 2024 explores the question of determining the right annuity amount for your specific needs.

We’ll navigate the complexities of investment choices, death benefits, and tax implications, providing insights for informed decision-making.

Variable annuities are insurance-based contracts that allow investors to accumulate wealth for retirement while potentially benefiting from market growth. These plans combine elements of both traditional annuities and mutual funds, offering a flexible and customizable approach to retirement planning. By understanding the key features and risks associated with variable annuities, individuals can determine if they align with their financial goals and risk tolerance.

Calculating the annual payment of an annuity is essential for understanding its financial implications. The article How To Calculate Annual Annuity 2024 provides guidance on this process.

Introduction to Variable Annuity Plans

Variable annuity plans are a type of retirement savings plan that offers the potential for growth while providing some protection against market downturns. They are a popular choice for investors who want to diversify their portfolio and potentially earn higher returns than traditional fixed annuities.Variable annuities have been around for decades, with the first plan being introduced in the 1950s.

However, they gained significant popularity in the 1980s and 1990s as investors sought out alternative investment options during periods of high inflation.Variable annuities are characterized by several key features, including:

Key Features and Characteristics of Variable Annuity Plans

- Investment component:Variable annuities allow investors to allocate their funds to a variety of sub-accounts, each with its own investment strategy and risk profile. This allows for customization and diversification.

- Tax deferral:Earnings on investments within a variable annuity are not taxed until they are withdrawn, which can provide significant tax advantages over other investment options.

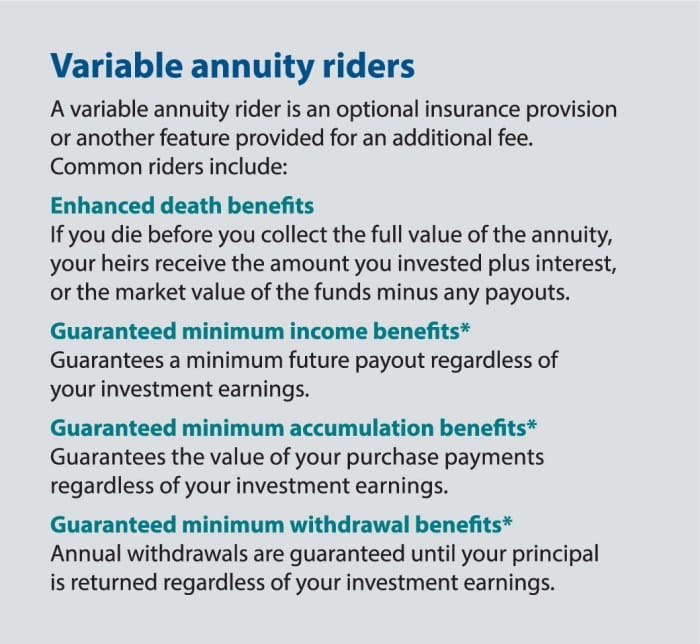

- Guaranteed minimum death benefit:Many variable annuity plans offer a guaranteed minimum death benefit, which ensures that a certain amount of money will be paid to the beneficiary upon the death of the annuitant.

- Living benefits:Some variable annuity plans offer living benefits, such as guaranteed income payments or protection against market downturns, which can provide additional security and peace of mind.

How Variable Annuity Plans Work

Variable annuity plans work by allowing investors to allocate their funds to a variety of sub-accounts, each with its own investment strategy and risk profile. These sub-accounts are typically managed by professional investment managers who aim to achieve specific investment goals.

The timing of annuity payments can vary. An “immediate annuity” starts paying out right away. The article Annuity Is Immediate 2024 discusses this type of annuity in more detail.

Investment Component of Variable Annuity Plans

The investment component of a variable annuity plan is the heart of the product. Investors have the option to choose from a variety of sub-accounts, each with its own investment strategy and risk profile. Common investment options include:

- Stock funds:These funds invest in stocks, which offer the potential for higher returns but also come with greater risk.

- Bond funds:These funds invest in bonds, which offer lower returns but are generally considered less risky than stocks.

- Money market funds:These funds invest in short-term debt instruments, which offer low returns but are very safe.

- Target-date funds:These funds automatically adjust their asset allocation over time, becoming more conservative as the investor gets closer to retirement.

Death Benefit and Living Benefit Options

Variable annuity plans may also offer death benefit and living benefit options, which can provide additional protection and flexibility.

Planning for retirement often involves considering annuity payments. The article Calculating Retirement Annuity Payments 2024 provides insights into how to calculate these payments.

- Death benefit:This benefit guarantees that a certain amount of money will be paid to the beneficiary upon the death of the annuitant, regardless of the performance of the underlying investments.

- Living benefit:This benefit provides additional protection against market downturns or guarantees a minimum income stream in retirement. Living benefits can take many forms, such as guaranteed income payments, protection against market losses, or a minimum withdrawal rate.

Role of the Insurance Company

The insurance company plays a key role in managing variable annuity plans. They are responsible for:

- Providing the annuity contract:This contract Artikels the terms and conditions of the plan, including the investment options, death benefit, and living benefits.

- Managing the sub-accounts:The insurance company typically manages the sub-accounts and ensures that the investments are made in accordance with the plan’s investment objectives.

- Providing customer service:The insurance company is responsible for providing customer service and answering questions about the plan.

Advantages and Disadvantages of Variable Annuity Plans

Variable annuity plans offer several potential advantages, including:

Potential Benefits of Variable Annuity Plans

- Tax deferral:Earnings on investments within a variable annuity are not taxed until they are withdrawn, which can provide significant tax advantages over other investment options.

- Guaranteed minimum death benefit:Many variable annuity plans offer a guaranteed minimum death benefit, which ensures that a certain amount of money will be paid to the beneficiary upon the death of the annuitant.

- Living benefits:Some variable annuity plans offer living benefits, such as guaranteed income payments or protection against market downturns, which can provide additional security and peace of mind.

- Diversification:Variable annuities allow investors to diversify their portfolio by investing in a variety of sub-accounts, each with its own investment strategy and risk profile.

However, variable annuities also have some potential disadvantages:

Potential Risks Associated with Variable Annuity Plans

- Market volatility:The value of investments within a variable annuity can fluctuate with market conditions, and investors could lose money if the market declines.

- Fees and expenses:Variable annuity plans can be expensive, with high fees for investment management, insurance, and other services.

- Complexity:Variable annuities can be complex to understand, and investors need to carefully consider the terms and conditions of the plan before making a decision.

Comparison with Other Retirement Savings Options

Variable annuity plans are just one of many retirement savings options available to investors. Other popular options include:

- Traditional IRAs:These accounts allow for pre-tax contributions and tax-deferred growth, but withdrawals in retirement are taxed as ordinary income.

- 401(k) plans:These employer-sponsored retirement plans offer tax-deferred growth and potential employer matching contributions.

- Roth IRAs:These accounts allow for after-tax contributions and tax-free withdrawals in retirement.

The best retirement savings option for you will depend on your individual circumstances, financial goals, and risk tolerance.

Variable Annuity Plans in 2024

The variable annuity market is constantly evolving, and there are several factors that could impact variable annuity plans in 2024.

Annuity contracts often involve specific interest rates. If you’re curious about how a 6% annuity works, the article 6 Percent Annuity 2024 might be of interest.

Current Market Conditions and Potential Impact

The current market conditions are characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors could impact the performance of variable annuity plans in several ways:

- Higher interest rates:Rising interest rates could lead to lower returns on bond investments, which could negatively impact the performance of some variable annuity sub-accounts.

- Market volatility:Increased market volatility could make it more difficult for investors to achieve their investment goals and could lead to greater losses if the market declines.

- Inflation:High inflation could erode the purchasing power of retirement savings, making it more difficult to maintain a comfortable lifestyle in retirement.

Recent Changes or Updates to Variable Annuity Plans in 2024

The insurance industry is constantly innovating, and there have been several recent changes to variable annuity plans in

Inheriting an annuity can bring up some interesting questions. To learn more about what happens in these scenarios, check out the article What Happens When I Inherit An Annuity 2024.

2024. These changes include

When researching annuity providers, it’s important to choose a reputable company. The article Is Annuity Gator Legit 2024 explores the legitimacy of a particular annuity provider.

- New investment options:Some insurance companies have introduced new investment options to meet the changing needs of investors, such as funds that focus on environmental, social, and governance (ESG) factors.

- Enhanced living benefits:Some insurance companies have enhanced their living benefit offerings, providing investors with more protection against market downturns and guaranteed income payments.

- Lower fees:Some insurance companies have lowered fees on their variable annuity plans to make them more competitive.

Potential Trends and Developments in the Variable Annuity Market

Several trends are expected to shape the variable annuity market in the remainder of 2024:

- Increased demand for guaranteed income:As investors become more concerned about longevity and market volatility, there is an increasing demand for guaranteed income products, such as variable annuities with living benefits.

- Focus on personalization:Insurance companies are increasingly focusing on providing personalized solutions that meet the specific needs and goals of individual investors.

- Greater transparency:Investors are demanding greater transparency from insurance companies about the fees and expenses associated with variable annuity plans.

Choosing a Variable Annuity Plan

Choosing a variable annuity plan is a significant decision, and it’s important to carefully consider your individual needs and goals. Here is a step-by-step guide to help you make an informed decision:

Step-by-Step Guide for Choosing a Variable Annuity Plan

- Define your financial goals:What are you hoping to achieve with a variable annuity plan? Are you saving for retirement, protecting your family’s financial security, or supplementing your income?

- Determine your risk tolerance:How comfortable are you with market volatility? Are you willing to accept the possibility of losing money in exchange for the potential for higher returns?

- Research different variable annuity plan providers:Compare the investment options, fees, death benefit, and living benefit options offered by different insurance companies.

- Read the annuity contract carefully:Make sure you understand the terms and conditions of the plan before making a decision.

- Consult with a financial advisor:A qualified financial advisor can help you assess your needs and goals, and recommend a variable annuity plan that is right for you.

Comparison Table of Variable Annuity Plan Providers

| Provider | Investment Options | Fees | Death Benefit | Living Benefits |

|---|---|---|---|---|

| Provider 1 | [Investment options offered] | [Fee structure] | [Death benefit details] | [Living benefit options] |

| Provider 2 | [Investment options offered] | [Fee structure] | [Death benefit details] | [Living benefit options] |

| Provider 3 | [Investment options offered] | [Fee structure] | [Death benefit details] | [Living benefit options] |

Tips for Selecting the Right Variable Annuity Plan

- Consider your investment goals:Choose a plan that aligns with your investment objectives and risk tolerance.

- Compare fees:Look for plans with low fees and expenses.

- Evaluate investment options:Make sure the plan offers a variety of investment options that meet your needs.

- Understand the death benefit and living benefit options:Choose a plan that provides the level of protection you require.

- Seek professional advice:Consult with a qualified financial advisor to ensure you make the right decision for your circumstances.

Variable Annuity Plans and Taxes

Variable annuity plans offer tax advantages, but it’s important to understand the tax implications of investing in these plans.

Understanding the formulas behind annuity calculations is crucial for making informed financial decisions. The article Formula For Calculating The Annuity 2024 delves into the mathematical aspects of annuities.

Tax Implications of Investing in Variable Annuity Plans

- Tax deferral:Earnings on investments within a variable annuity are not taxed until they are withdrawn, which can provide significant tax advantages over other investment options.

- Tax treatment of withdrawals:Withdrawals from a variable annuity are taxed as ordinary income, and any earnings that have been withdrawn are subject to taxes.

- 10% penalty for early withdrawals:If you withdraw money from a variable annuity before age 59 1/2, you may be subject to a 10% penalty on the withdrawn amount, in addition to ordinary income taxes.

Tax Treatment of Withdrawals and Distributions

Withdrawals from a variable annuity are generally subject to ordinary income taxes. However, there are some exceptions:

- Withdrawals of principal:Withdrawals of principal are generally tax-free, but you must keep track of your contributions to ensure that you are not withdrawing any earnings.

- Withdrawals of death benefits:Death benefits are generally tax-free to the beneficiary.

- Withdrawals of living benefits:Withdrawals of living benefits may be subject to taxes, depending on the specific terms of the plan.

Strategies for Minimizing Taxes Associated with Variable Annuity Plans

There are several strategies that investors can use to minimize taxes associated with variable annuity plans:

- Withdraw principal first:Withdraw principal before earnings to minimize the amount of taxable income.

- Consider Roth conversions:Convert a traditional IRA or 401(k) to a Roth IRA to avoid taxes on withdrawals in retirement.

- Use tax-loss harvesting:Sell losing investments within the variable annuity to offset capital gains from other investments.

- Consult with a tax advisor:A qualified tax advisor can help you develop a tax strategy that minimizes your tax liability.

Variable Annuity Plans and Estate Planning: Variable Annuity Plans 2024

Variable annuity plans can play a role in estate planning, providing a way to pass on wealth to beneficiaries while minimizing estate taxes.

Inheriting a variable annuity can be a unique experience. If you find yourself in this situation, the article I Inherited A Variable Annuity 2024 might provide some helpful insights.

Role of Variable Annuity Plans in Estate Planning

Variable annuities can be used to:

- Reduce estate taxes:Variable annuities can be structured to reduce estate taxes by passing wealth to beneficiaries outside of the estate.

- Provide income for beneficiaries:Variable annuities can provide a stream of income for beneficiaries after the death of the annuitant.

- Protect assets from creditors:In some cases, variable annuities can be structured to protect assets from creditors.

Minimizing Estate Taxes, Variable Annuity Plans 2024

Variable annuities can be used to minimize estate taxes by:

- Naming beneficiaries:By naming beneficiaries for the variable annuity, you can bypass the probate process and avoid estate taxes on the death benefit.

- Using trusts:Variable annuities can be held in trusts, which can provide additional estate tax benefits.

Benefits for Beneficiaries

Variable annuities can benefit beneficiaries by:

- Providing a stream of income:Variable annuities can provide a stream of income for beneficiaries after the death of the annuitant.

- Protecting assets from creditors:In some cases, variable annuities can be structured to protect assets from creditors.

- Minimizing estate taxes:Variable annuities can be used to minimize estate taxes by passing wealth to beneficiaries outside of the estate.

Final Summary

Variable annuity plans can be a valuable tool for retirement planning, but it’s essential to carefully consider their intricacies and potential risks before making a decision. By understanding the advantages, disadvantages, and tax implications of these plans, individuals can determine if they align with their financial goals and risk tolerance.

For those who prefer a more visual approach, spreadsheets can be a valuable tool. The article Calculating Annuity Cash Flows Excel 2024 provides a step-by-step guide to using Excel for annuity calculations.

Seeking professional financial advice is crucial to ensure you select a plan that best suits your individual circumstances and aspirations.

Annuity loans are another type of financial product that can be useful in certain situations. If you’re curious about the formulas behind these loans, you can find more information in Formula Annuity Loan 2024.

FAQ Section

What is the difference between a variable annuity and a traditional annuity?

A traditional annuity provides a guaranteed stream of income for life, while a variable annuity offers the potential for growth but does not guarantee a specific income stream. The value of a variable annuity is tied to the performance of underlying investments, making it subject to market volatility.

Are variable annuities suitable for everyone?

Excel is a powerful tool for financial calculations, including those related to annuities. The article Pv Annuity Excel 2024 dives into how to calculate the present value of an annuity using Excel.

Variable annuities are not suitable for everyone. They are best suited for individuals with a long-term investment horizon and a moderate to high risk tolerance. Individuals seeking guaranteed income streams or those with a short-term investment timeframe may be better suited to other retirement savings options.

The concept of “annuity” itself can be a bit confusing. The article Annuity Is Given By 2024 offers a clear explanation of what an annuity is and how it works.

What are the tax implications of withdrawing from a variable annuity?

Understanding how annuities work can be a bit tricky, especially when it comes to calculating their growth potential. Thankfully, resources like Calculating Growing Annuity 2024 can help break down the process.

Withdrawals from a variable annuity are generally taxed as ordinary income. However, certain withdrawals, such as those made after age 59 1/2, may qualify for favorable tax treatment. It’s essential to consult with a tax professional to understand the specific tax implications of your situation.

If you’re considering a large financial investment, you might be interested in learning about single premium annuities. A recent article titled G Purchased A $50 000 Single Premium 2024 explores this type of annuity, which involves a single lump sum payment in exchange for guaranteed income streams in the future.