Variable Annuity Liquidity 2024: Navigating Market Trends explores the complexities of accessing your funds from variable annuities in a dynamic financial landscape. This type of annuity offers the potential for growth through investment options, but understanding its liquidity characteristics is crucial for maximizing your financial flexibility.

If you’re a customer of RBC, you can use their Annuity Calculator Rbc 2024 to get personalized estimates for your potential annuity payouts.

The article delves into the unique features of variable annuities, comparing them to traditional annuities and highlighting key differences in liquidity. It explores the various withdrawal options available, including potential surrender charges and tax implications. Furthermore, it analyzes the impact of current market conditions, such as interest rate fluctuations, inflation, and economic growth, on variable annuity liquidity.

By understanding these factors, investors can make informed decisions about accessing their funds while balancing potential growth.

Variable Annuity Basics

A variable annuity is a type of retirement savings product that offers the potential for growth based on the performance of underlying investments. It’s a complex product, and understanding its key features is crucial before making any investment decisions.

The best annuity for you depends on your individual circumstances. Check out Annuity Which Is Best 2024 for guidance on finding the right fit.

Defining a Variable Annuity

A variable annuity is a contract between an individual and an insurance company. The individual makes a lump sum payment or series of payments into the annuity, and the insurance company invests that money in a variety of sub-accounts. These sub-accounts are typically tied to mutual funds or other investment options, allowing the value of the annuity to fluctuate based on the performance of the underlying investments.

Knowing how to calculate annuity withdrawals is essential for financial planning. Check out How To Calculate Annuity Withdrawal 2024 for step-by-step instructions.

Investment Options in Variable Annuities

Variable annuities offer a range of investment options, providing investors with flexibility in customizing their portfolio based on their risk tolerance and investment goals. These options can include:

- Equity Sub-accounts:These track the performance of stocks, offering the potential for higher returns but also greater volatility.

- Fixed Income Sub-accounts:These invest in bonds, providing more stability and lower risk than equity sub-accounts.

- Money Market Sub-accounts:These invest in short-term debt securities, offering low returns but high liquidity.

- Target-Date Funds:These funds automatically adjust their asset allocation based on the investor’s target retirement date, becoming more conservative as retirement nears.

Guaranteed Minimum Death Benefit

Many variable annuities include a guaranteed minimum death benefit (GMD). This feature ensures that a beneficiary will receive a minimum payout, even if the value of the annuity has declined. The GMD is typically based on the initial investment amount or a percentage of it, providing a safety net for beneficiaries in case of the annuitant’s death.

Liquidity in Variable Annuities

Liquidity refers to the ease with which an asset can be converted into cash. While variable annuities offer the potential for growth, understanding their liquidity characteristics is essential, especially when considering withdrawal options.

Liquidity Differences from Traditional Annuities

Variable annuities differ from traditional fixed annuities in terms of liquidity. Fixed annuities provide guaranteed payouts, but withdrawals may be limited or subject to penalties. In contrast, variable annuities allow for more flexibility in withdrawals, but the amount received can fluctuate based on the performance of the underlying investments.

Variable annuities can be a valuable addition to your retirement portfolio. For more information, check out Variable Annuity For Retirement 2024.

This flexibility comes with the risk of losing principal if the market performs poorly.

When it comes to annuities, understanding the future value is crucial. Use a Fv Calculator Annuity 2024 to estimate your potential returns.

Withdrawal Options in Variable Annuities

Variable annuities offer various withdrawal options, each with its own terms and conditions. These options may include:

- Fixed Withdrawals:These involve withdrawing a predetermined amount from the annuity each year. The amount can be fixed or adjusted based on inflation.

- Variable Withdrawals:These allow for flexible withdrawals, but the amount received can fluctuate based on the performance of the underlying investments.

- Lump Sum Withdrawals:These allow for withdrawing the entire balance of the annuity in a single payment. However, this option may be subject to surrender charges and tax implications.

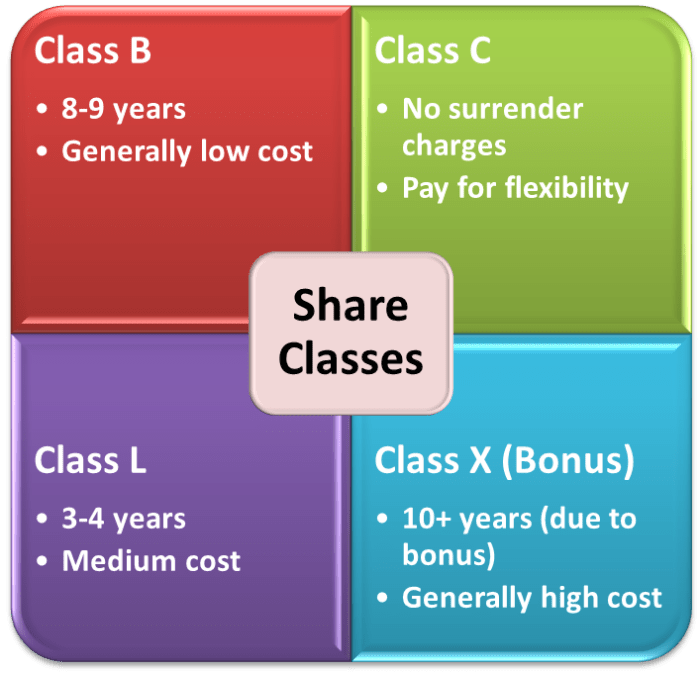

Surrender Charges and Tax Implications

Variable annuities often include surrender charges, which are fees assessed when withdrawing funds before a certain period. These charges can be substantial, particularly in the early years of the annuity. Withdrawals from variable annuities are generally taxed as ordinary income, subject to federal and state income taxes.

If you’re in the UK, you can explore different annuity options available to you through Annuity Uk 2024.

Examples of Withdrawal Options for Financial Goals

Variable annuity withdrawal options can be used to meet various financial goals, such as:

- Retirement Income:Withdrawals can provide a stream of income during retirement.

- Emergency Expenses:Withdrawals can help cover unexpected expenses.

- Education Costs:Withdrawals can be used to pay for college tuition or other educational expenses.

Market Factors Affecting Liquidity in 2024

The liquidity of variable annuities can be influenced by various market factors. Understanding these factors is crucial for investors to make informed decisions about their withdrawal strategies.

Annuities can be a valuable tool for those approaching retirement. For insights on annuities for individuals over 85, visit Annuity 85 Years Old 2024.

Impact of Interest Rate Changes

Interest rate changes can significantly impact variable annuity liquidity. Rising interest rates can lead to lower bond prices, potentially impacting the performance of fixed income sub-accounts and reducing the overall value of the annuity. This can affect withdrawal options, as the amount available for withdrawal may decrease.

If you’re looking for a specific LIC annuity number, Annuity Number Lic 2024 might have the information you need.

Inflation and Economic Growth Projections

Inflation and economic growth projections play a vital role in determining the performance of investments within variable annuities. High inflation can erode the purchasing power of withdrawals, while strong economic growth can boost investment returns. Investors need to consider these factors when making withdrawal decisions to ensure their funds keep pace with inflation and meet their financial goals.

Geopolitical Events

Geopolitical events, such as wars, trade disputes, or political instability, can create market volatility and impact investment performance. These events can lead to unpredictable market movements, affecting the value of variable annuities and influencing withdrawal options.

Interested in a career working with variable annuities? Variable Annuity Jobs 2024 might have the information you need to start your journey.

Strategies for Managing Liquidity in 2024: Variable Annuity Liquidity 2024

Managing liquidity in variable annuities involves balancing the need for income with the potential for investment growth. Several strategies can help investors optimize their withdrawal options while maintaining their investment potential.

If you’re thinking about investing in an annuity, it’s a good idea to use a Calculator Annuity Savings 2024 to get a better grasp of how much you might accumulate over time.

Optimizing Withdrawal Options

To maximize liquidity while maintaining investment growth potential, investors can consider the following strategies:

- Minimize Surrender Charges:Investors should aim to avoid withdrawing funds before the surrender charge period expires, as these charges can significantly reduce the amount received.

- Consider Fixed Withdrawals:Fixed withdrawals can provide a predictable stream of income while preserving the potential for investment growth. However, this strategy may not be suitable for those with fluctuating income needs.

- Utilize Variable Withdrawals Strategically:Variable withdrawals offer flexibility, but investors need to carefully consider the potential impact of market fluctuations on the amount received.

Assessing Risk Tolerance and Time Horizon, Variable Annuity Liquidity 2024

When making withdrawal decisions, investors should assess their risk tolerance and time horizon. Those with a high risk tolerance and a longer time horizon may be willing to take on more risk in their investment portfolio, potentially leading to higher returns but also greater volatility.

While annuities offer benefits, there are also some potential Annuity Issues 2024 to be aware of. It’s important to do your research and choose the right type for your needs.

Conversely, those with a low risk tolerance and a shorter time horizon may prefer a more conservative approach, prioritizing stability and income over potential growth.

Hargreaves Lansdown offers a helpful Annuity Calculator Hargreaves Lansdown 2024 to estimate your potential annuity income.

Structuring Withdrawals for Financial Goals

Investors can structure withdrawals to meet specific financial goals, such as:

- Retirement Income:Withdrawals can be structured to provide a steady stream of income throughout retirement, adjusting for inflation and other expenses.

- Education Costs:Withdrawals can be timed to coincide with education expenses, ensuring funds are available when needed.

- Emergency Expenses:A portion of the annuity can be set aside as an emergency fund, providing access to funds in case of unexpected events.

Considerations for Variable Annuity Holders

Variable annuity holders should proactively review their contracts and understand the terms and conditions related to withdrawals. Seeking professional advice from a financial advisor can help make informed decisions about liquidity.

Reviewing Contracts and Withdrawal Provisions

It’s crucial for variable annuity holders to review their contracts carefully and understand the terms and conditions related to withdrawals. This includes understanding surrender charges, withdrawal limits, and any other fees or restrictions that may apply. Understanding these provisions is essential for making informed decisions about when and how to withdraw funds.

Looking for some real-world examples of how annuities work? Check out Annuity Examples 2024 for a clear understanding of how these financial instruments can be used in different scenarios.

Role of Financial Advisors

Financial advisors can play a vital role in helping individuals make informed decisions about variable annuity liquidity. They can provide guidance on assessing risk tolerance, developing withdrawal strategies, and understanding the tax implications of withdrawals. Financial advisors can also help individuals navigate the complexities of variable annuity contracts and ensure their withdrawal decisions align with their overall financial goals.

Challenges and Opportunities

Variable annuities offer the potential for growth but also come with challenges related to liquidity. Investors need to carefully consider the potential impact of market fluctuations on their withdrawals and understand the terms and conditions of their contracts. However, with careful planning and professional advice, variable annuities can be a valuable tool for achieving long-term financial goals.

Variable annuities offer a unique way to invest within your IRA. Learn more about Variable Annuity Ira 2024 and its potential benefits.

Last Point

Navigating variable annuity liquidity in 2024 requires a careful consideration of market trends, withdrawal options, and individual financial goals. By understanding the intricacies of these instruments, investors can make informed decisions about accessing their funds while managing potential risks and maximizing their financial flexibility.

This article serves as a guide for navigating the complexities of variable annuity liquidity in a dynamic financial landscape.

Annuity payments are essentially a stream of future cash flows. To determine the present value of those payments, explore Annuity Is Present Value 2024 for a deeper understanding.

Question & Answer Hub

What are the potential risks associated with variable annuity liquidity?

Variable annuities carry risks related to market performance, surrender charges, and potential tax implications. Market fluctuations can impact the value of your investments, and surrender charges may apply if you withdraw funds before a certain period. Additionally, withdrawals may be subject to taxation.

It’s important to carefully consider these factors before making withdrawal decisions.

How can I determine if a variable annuity is right for my financial goals?

Consulting with a financial advisor is crucial to determine if a variable annuity aligns with your financial goals, risk tolerance, and time horizon. They can help you assess your needs and guide you towards the most suitable investment strategies.