Variable Annuity Funds 2024: A Comprehensive Guide offer a unique blend of growth potential and guaranteed income, making them a popular choice for investors seeking a balance between risk and reward. These funds, unlike traditional annuities, invest in a portfolio of stocks, bonds, and other assets, allowing for potential growth but also exposing investors to market fluctuations.

Winning the lottery can be life-changing. Use an annuity calculator designed for lottery winnings in 2024 to make informed decisions about your prize.

Vari

Annuity products are often confused with life insurance. Clarify the differences and understand whether an annuity is considered life insurance in 2024.

able annuity funds have evolved significantly over the years, adapting to changing market conditions and investor needs. They offer a range of features, including tax advantages, guaranteed minimum death benefits, and the flexibility to adjust investment strategies based on individual goals and risk tolerance.

Variable Annuity Funds: An Overview

Variable annuity funds are a type of investment product that offers the potential for growth while also providing some protection against market downturns. They are a popular choice for investors seeking to diversify their portfolios and generate long-term returns.

What are Variable Annuity Funds?

Variable annuity funds are a type of retirement savings product that allows investors to allocate their money into a variety of sub-accounts, each of which invests in a different asset class, such as stocks, bonds, or real estate. The value of these sub-accounts fluctuates based on the performance of the underlying investments.

This means that the value of your variable annuity can go up or down depending on market conditions.

Key Features of Variable Annuity Funds

Here are some key features that differentiate variable annuity funds from other investment products:

- Growth Potential:Variable annuity funds offer the potential for higher returns than traditional fixed annuities, as the value of your investment is tied to the performance of the underlying investments.

- Diversification:Variable annuity funds allow you to diversify your portfolio across a range of asset classes, which can help to reduce risk.

- Tax Advantages:Variable annuity funds offer tax-deferred growth, meaning that you don’t have to pay taxes on the earnings until you withdraw them in retirement.

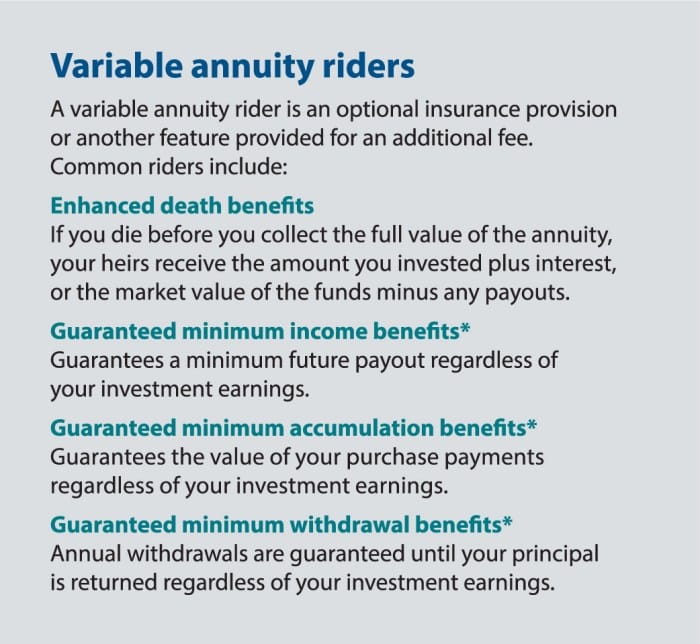

- Guaranteed Minimum Death Benefits:Some variable annuity funds offer guaranteed minimum death benefits, which ensure that your beneficiaries will receive a certain amount of money even if the value of your investment declines.

Historical Context of Variable Annuity Funds

Variable annuities were first introduced in the 1950s as a way to provide investors with a way to participate in the stock market while also receiving some protection from market downturns. Over the years, variable annuities have evolved to offer a wider range of investment options and features, such as guaranteed minimum death benefits and living benefits.

How Variable Annuity Funds Work

Variable annuity funds work by allowing investors to allocate their money into a variety of sub-accounts, each of which invests in a different asset class. The value of these sub-accounts fluctuates based on the performance of the underlying investments.

Investment Strategies

Variable annuity funds typically employ a variety of investment strategies, depending on the specific sub-account. Some common strategies include:

- Active Management:Some sub-accounts are actively managed by professional fund managers who seek to outperform the market.

- Passive Management:Other sub-accounts are passively managed, tracking a specific index, such as the S&P 500.

- Target-Date Funds:These sub-accounts are designed to become more conservative as you approach retirement, gradually shifting from stocks to bonds.

The Annuity Exclusion Ratio 2024 helps determine how much of your annuity payments are considered tax-free. Understanding this ratio is crucial for planning your retirement income and minimizing your tax liability.

Sub-Accounts and Underlying Investment Options

Each sub-account within a variable annuity fund invests in a specific underlying investment, such as a mutual fund, exchange-traded fund (ETF), or a managed account. These underlying investments can be diversified across different asset classes, including:

- Stocks:Stocks represent ownership in publicly traded companies and offer the potential for higher returns but also carry higher risk.

- Bonds:Bonds are debt securities that pay a fixed interest rate and are generally considered less risky than stocks.

- Real Estate:Real estate investments can provide diversification and potential for appreciation, but they can also be illiquid.

- Commodities:Commodities are raw materials, such as oil, gold, and wheat, that can provide inflation protection and diversification.

Many people are interested in accessing their annuity funds before age 59 1/2. Learn about the Annuity 59 1/2 Rule in 2024 and the potential tax penalties that may apply.

Allocating Funds

When you invest in a variable annuity fund, you will need to allocate your funds across the different sub-accounts. This allocation will depend on your risk tolerance and investment goals. For example, if you are a young investor with a long time horizon, you may choose to allocate a larger portion of your funds to stocks, which have the potential for higher growth.

Understanding the tax implications of inherited annuities is crucial. Find out how inherited annuities are taxed in 2024 to ensure you’re prepared.

However, if you are closer to retirement, you may prefer to allocate a larger portion of your funds to bonds, which are generally considered less risky.

Fidelity offers a range of variable annuity products. Explore the variable annuity options available through Fidelity in 2024 to find the right fit for your financial goals.

Advantages and Disadvantages of Variable Annuity Funds

Variable annuity funds offer both potential benefits and drawbacks. It is important to carefully consider these factors before making an investment decision.

Advantages

- Growth Potential:Variable annuity funds offer the potential for higher returns than traditional fixed annuities, as the value of your investment is tied to the performance of the underlying investments.

- Diversification:Variable annuity funds allow you to diversify your portfolio across a range of asset classes, which can help to reduce risk.

- Tax Advantages:Variable annuity funds offer tax-deferred growth, meaning that you don’t have to pay taxes on the earnings until you withdraw them in retirement.

- Guaranteed Minimum Death Benefits:Some variable annuity funds offer guaranteed minimum death benefits, which ensure that your beneficiaries will receive a certain amount of money even if the value of your investment declines.

- Living Benefits:Some variable annuity funds offer living benefits, such as guaranteed income payments or protection against market downturns. These benefits can provide peace of mind in retirement.

Calculators can be helpful tools for managing your finances. Learn how to calculate an annuity on a Casio calculator in 2024 to make informed decisions about your annuity investments.

Disadvantages

- Potential for Losses:The value of your variable annuity can go down as well as up, depending on the performance of the underlying investments. You could lose some or all of your principal investment.

- High Fees:Variable annuity funds typically have higher fees than other investment products, such as mutual funds or ETFs.

- Surrender Charges:Some variable annuity funds impose surrender charges if you withdraw your money before a certain period of time. These charges can be substantial, so it is important to read the prospectus carefully before investing.

- Complexity:Variable annuity funds can be complex products, and it is important to understand the risks and fees involved before investing.

Choosing the Right Variable Annuity Fund

Selecting the right variable annuity fund is crucial to meeting your investment goals and managing risk effectively. Consider these factors:

Investment Options

- Sub-account Options:Assess the range of sub-accounts offered by the variable annuity fund, ensuring they align with your investment preferences and risk tolerance.

- Underlying Investments:Examine the specific underlying investments within each sub-account, focusing on their performance history, fees, and diversification strategies.

Annuity rates can fluctuate. Stay informed about the current 3-year annuity rates in 2024 to make informed decisions.

Fees

- Annual Fees:Compare the annual fees charged by different variable annuity funds, including expense ratios, administrative fees, and mortality and expense charges.

- Surrender Charges:Understand the surrender charges imposed by the variable annuity fund, including the duration of the surrender period and the applicable percentages.

Guarantees

- Guaranteed Minimum Death Benefits:Determine if the variable annuity fund offers guaranteed minimum death benefits, and if so, the level of protection provided.

- Living Benefits:Evaluate any living benefits offered by the variable annuity fund, such as guaranteed income payments or protection against market downturns.

Transparency is essential in the financial industry. Variable annuity disclosure requirements in 2024 are designed to ensure that investors have all the necessary information to make sound decisions.

Checklist

Before investing in a variable annuity fund, consider these questions:

- What are your investment goals?

- What is your risk tolerance?

- How long do you plan to invest?

- What are your tax considerations?

- What are the fees and charges associated with the variable annuity fund?

- What guarantees are offered by the variable annuity fund?

- Do you understand the risks involved?

Variable Annuity Funds in 2024: Current Trends and Outlook

The variable annuity fund industry is constantly evolving, influenced by market conditions and regulatory changes. Here are some key trends to consider:

Impact of Market Conditions, Variable Annuity Funds 2024

- Interest Rates:Rising interest rates can impact the performance of fixed income investments, which are a common component of variable annuity funds. This can affect the overall return potential of variable annuities.

- Inflation:High inflation can erode the purchasing power of retirement savings, making it crucial for variable annuity funds to generate returns that outpace inflation.

- Market Volatility:Market volatility can impact the value of variable annuity funds, particularly those with a higher allocation to stocks. Investors should carefully consider their risk tolerance before investing in variable annuities.

Looking for annuity quotes in Canada? Explore the annuity quotes available in Canada in 2024 and find the best options for your needs.

Emerging Trends

- Increased Focus on Living Benefits:Variable annuity funds are increasingly offering living benefits, such as guaranteed income payments or protection against market downturns. These benefits can provide peace of mind in retirement.

- Growth of Target-Date Funds:Target-date funds are becoming more popular as a way to simplify retirement planning. These funds automatically adjust their asset allocation over time to become more conservative as you approach retirement.

- Digitalization:The variable annuity fund industry is embracing digitalization, offering online platforms and mobile apps for account management and investment tracking.

Fixed annuities offer a guaranteed rate of return. Discover the benefits of a 4-year fixed annuity in 2024 and how it can provide stability for your retirement.

Expert Insights and Predictions

Experts believe that variable annuity funds will continue to play a significant role in retirement planning, offering investors a way to participate in the stock market while also receiving some protection from market downturns. However, they also caution investors to carefully consider the risks and fees involved before investing.

Tax Considerations for Variable Annuity Funds: Variable Annuity Funds 2024

Variable annuity funds offer tax-deferred growth, meaning that you don’t have to pay taxes on the earnings until you withdraw them in retirement. However, there are some important tax considerations to keep in mind:

Tax Treatment of Withdrawals

Withdrawals from a variable annuity fund are generally taxed as ordinary income. This means that the withdrawals will be taxed at your ordinary income tax rate.

Variable annuities offer the potential for growth, but it’s important to understand the role of accumulation units in variable annuities in 2024.

Tax Treatment of Distributions

Distributions from a variable annuity fund, such as death benefits, are also generally taxed as ordinary income. However, there are some exceptions to this rule, such as distributions from a qualified retirement plan.

Minimizing Tax Liabilities

Here are some tips for minimizing your tax liabilities associated with variable annuity funds:

- Withdrawals in Retirement:Withdrawals from a variable annuity fund in retirement are generally taxed as ordinary income. However, you may be able to minimize your tax liability by withdrawing money from a Roth IRA or other tax-advantaged account first.

- Tax-Loss Harvesting:If you have losses in your variable annuity fund, you may be able to offset gains in other investments through tax-loss harvesting. This can help to reduce your overall tax liability.

Regulatory Landscape for Variable Annuity Funds

Variable annuity funds are subject to a number of regulations designed to protect investors and ensure the safety and fairness of these investments.

Planning for your retirement? Use the Annuity Calculator Soup 2024 to estimate your potential income and see how an annuity could fit into your retirement strategy.

Regulatory Framework

The regulatory framework governing variable annuity funds is complex and involves a number of federal and state agencies, including the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and state insurance regulators.

Key Regulations

Some key regulations governing variable annuity funds include:

- The Securities Act of 1933:This act requires variable annuity funds to register with the SEC and to provide investors with a prospectus that discloses important information about the fund.

- The Investment Company Act of 1940:This act regulates the structure and operations of variable annuity funds.

- The Employee Retirement Income Security Act of 1974 (ERISA):This act governs the administration of variable annuity funds that are part of employer-sponsored retirement plans.

Role of Regulatory Bodies

Regulatory bodies play an important role in ensuring the safety and fairness of variable annuity fund investments. They do this by:

- Enforcing Regulations:Regulatory bodies enforce the laws and regulations governing variable annuity funds.

- Protecting Investors:Regulatory bodies work to protect investors from fraud and abuse.

- Promoting Transparency:Regulatory bodies require variable annuity funds to disclose important information to investors.

Wrap-Up

Variable annuity funds offer a compelling investment option for those seeking a balanced approach to retirement planning. By carefully considering your investment goals, risk tolerance, and financial circumstances, you can determine if a variable annuity fund is the right fit for your portfolio.

As always, seeking professional financial advice is recommended before making any investment decisions.

In 2024, annuities are proving to be a valuable investment option. Learn more about the value of annuities in 2024 and how they can contribute to your financial security.

Expert Answers

What are the minimum investment requirements for variable annuity funds?

Minimum investment requirements vary depending on the specific fund and the issuing company. It’s best to check with the provider for details.

How do I choose the right variable annuity fund for my needs?

The J Calculation 2024 is a key factor in determining the interest rate for your annuity. It’s important to understand this calculation to make informed decisions about your annuity investments.

Consider your investment goals, risk tolerance, time horizon, and desired level of guarantees when choosing a variable annuity fund. It’s also important to compare fees and investment options across different funds.

Are there any tax implications associated with variable annuity funds?

Yes, there are tax implications associated with withdrawals and distributions from variable annuity funds. Consult with a tax advisor for personalized guidance.

What are the potential risks associated with variable annuity funds?

Variable annuity funds are subject to market risk, meaning the value of your investment can fluctuate. There is also the potential for loss of principal.