Variable Annuity Explained 2024: In a world of ever-changing financial landscapes, variable annuities stand out as a complex yet potentially rewarding investment option. This comprehensive guide aims to demystify these instruments, providing insights into their workings, benefits, risks, and considerations for investors in 2024.

Variable annuities offer flexibility and potential for growth, but it’s important to understand the contracts involved. The Variable Annuity Contracts 2024 article provides insights into the terms and conditions of these contracts.

Variable annuities offer a unique blend of guaranteed income and market-linked growth, making them appealing to those seeking a balance between security and potential returns. However, understanding their intricacies is crucial before making an informed decision.

If you’re considering an annuity as part of your retirement plan, you’ll need to understand how to calculate the potential income. The Calculating Tsp Annuity 2024 article explains the process for calculating a TSP annuity.

Introduction to Variable Annuities

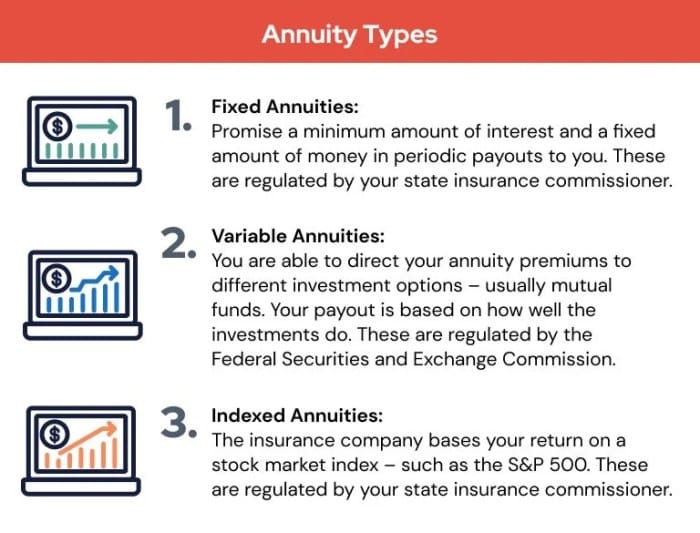

Variable annuities are a type of insurance product that combines investment features with guaranteed income streams. They differ from traditional annuities, which offer fixed payouts based on a predetermined interest rate. Variable annuities allow investors to choose from a range of investment options, similar to mutual funds, and the payout amount is determined by the performance of these investments.

Annuity income is often subject to taxation. The Is Annuity Income Taxable In India 2024 article addresses the tax implications of annuities in India.

Benefits and Risks

Variable annuities offer potential for higher returns than traditional annuities, but they also carry greater risk. The value of the investment options within a variable annuity can fluctuate with market conditions, leading to potential losses.

Are you planning for retirement? A Qualified Longevity Annuity Contract (QLAC) can be a valuable tool to help you secure your future. The Qlac Annuity Calculator 2024 can help you determine how much you can contribute and what kind of income you can expect to receive later in life.

- Benefits:Potential for higher returns, tax-deferred growth, guaranteed income options, and death benefit protection.

- Risks:Market volatility, investment losses, potential for fees to erode returns, and lack of guaranteed return.

Target Audience

Variable annuities are typically suitable for investors with a long-term investment horizon and a higher risk tolerance. They are often targeted at individuals seeking to:

- Grow their retirement savings.

- Protect their principal against inflation.

- Generate a stream of income in retirement.

How Variable Annuities Work

Variable annuities operate through a combination of investment options and insurance guarantees. They are structured as contracts between the investor and an insurance company, providing a framework for managing the investment and the potential for future income.

Investment Options

Variable annuities offer a variety of investment options, typically in the form of sub-accounts. These sub-accounts are similar to mutual funds, allowing investors to diversify their portfolio across different asset classes, such as stocks, bonds, and money market instruments.

The UK government offers a variety of financial planning tools, including annuity calculators. The Annuity Calculator Uk Gov 2024 article provides information on how to access and utilize these calculators.

Sub-Accounts

Sub-accounts within a variable annuity contract function as separate investment compartments. Each sub-account holds a specific investment option, and the value of each sub-account fluctuates based on the performance of the underlying investments. Investors can allocate their funds across different sub-accounts based on their risk tolerance and investment goals.

Annuity payments can start immediately or at a later date. The Annuity Is Immediate 2024 article discusses the benefits and considerations of an immediate annuity.

Insurance Company Role

The insurance company plays a crucial role in a variable annuity contract. It provides the underlying insurance guarantees, such as death benefit protection and living benefit options, while also managing the investment options within the contract.

To evaluate the profitability of an annuity, you can use an Internal Rate of Return (IRR) calculator. The Irr Calculator Annuity 2024 article explains how to use this calculator and interpret the results.

Key Features and Components: Variable Annuity Explained 2024

Variable annuities offer several key features that provide additional benefits and protections to investors.

Once you’ve decided on an annuity, it’s important to understand how to calculate your withdrawals. The How To Calculate Annuity Withdrawal 2024 guide provides helpful information on factors like your age, the amount of your principal, and the interest rate.

Death Benefit

A death benefit is a guarantee that a certain amount of money will be paid to the beneficiary of the annuity contract upon the death of the annuitant. This benefit can provide financial security for loved ones in the event of an unexpected death.

Annuity payouts can be structured in various ways, including a five-year payout. The Annuity 5 Year Payout 2024 article delves into the specifics of this type of payout and its advantages and disadvantages.

Living Benefits, Variable Annuity Explained 2024

Living benefits are optional features that provide additional income guarantees during the annuitant’s lifetime. These benefits can help ensure a consistent stream of income, even if the investment performance of the variable annuity contract falls short of expectations. Common living benefit options include:

- Guaranteed Minimum Income:Provides a guaranteed minimum monthly income stream for life, regardless of the investment performance of the sub-accounts.

- Guaranteed Minimum Withdrawal Benefits:Allows the annuitant to withdraw a specific amount of money each year, even if the investment performance is negative. This feature provides a level of protection against market downturns.

Fee Structure

Variable annuities come with a range of fees, which can impact the overall returns on the investment. It’s crucial to understand the fee structure before investing in a variable annuity contract.

To make informed decisions about annuities, understanding present value is crucial. The Calculating Annuity Present Values 2024 article explains the concept of present value and how to calculate it for annuities.

- Management Fees:Charged for managing the investment options within the sub-accounts.

- Mortality and Expense Charges:Fees associated with the insurance guarantees and administrative expenses.

- Surrender Charges:Fees assessed if the annuitant withdraws funds from the contract before a certain period. These charges can be significant in the early years of the contract.

Advantages and Disadvantages

Variable annuities offer a unique combination of investment and insurance features, but they also come with potential drawbacks. It’s important to weigh the advantages and disadvantages carefully before deciding if a variable annuity is the right investment for you.

Determining the right annuity rate is crucial for maximizing your income. The Calculating An Annuity Rate 2024 article provides insights into how to calculate the most suitable annuity rate for your situation.

| Feature | Advantages | Disadvantages |

|---|---|---|

| Investment Options | Potential for higher returns through diverse investment options. | Market volatility and investment losses are possible. |

| Tax-Deferred Growth | Earnings within the annuity contract grow tax-deferred, meaning taxes are not paid until withdrawals are made. | Tax liability on withdrawals may be higher in retirement. |

| Guaranteed Income Options | Provides protection against market downturns and ensures a stream of income in retirement. | Fees associated with living benefit options can erode returns. |

| Death Benefit | Provides financial security for beneficiaries in the event of the annuitant’s death. | May be less beneficial if the annuitant has other life insurance policies. |

| Fees | Can be complex and may erode returns over time. | Requires careful consideration of the fee structure before investing. |

Tax-Deferred Growth

One of the key advantages of variable annuities is the tax-deferred growth of earnings. This means that the investment income within the annuity contract is not taxed until the annuitant begins to withdraw funds. This feature can significantly reduce the overall tax burden on investment gains over time.

While annuities offer income security, it’s important to distinguish them from life insurance. The Is Annuity Life Insurance 2024 article clarifies the differences between these two financial products.

Risks

Variable annuities carry several risks, including:

- Market Volatility:The value of the investment options within a variable annuity can fluctuate with market conditions, leading to potential losses.

- Investment Losses:If the investments within the variable annuity perform poorly, the value of the contract may decline, potentially reducing the future payout.

- Fees:The fees associated with variable annuities can erode returns over time, reducing the overall investment growth.

Considerations for Investors

Before investing in a variable annuity, it’s essential to carefully consider your individual circumstances, including your risk tolerance, investment goals, and financial situation.

Risk Tolerance and Investment Goals

Variable annuities are not suitable for all investors. They are generally considered a higher-risk investment option and require a long-term investment horizon. It’s crucial to understand your risk tolerance and investment goals before considering a variable annuity.

Contract Selection

The process of selecting an appropriate variable annuity contract involves considering several factors, including:

- Investment Options:Choose a contract that offers a range of investment options that align with your risk tolerance and investment goals.

- Fees:Compare the fee structures of different contracts to find one with competitive charges.

- Living Benefits:Determine if you need additional income guarantees and choose a contract that offers appropriate living benefit options.

- Death Benefit:Consider the death benefit provisions of the contract and ensure they meet your needs.

Insurance Company Assessment

Before investing in a variable annuity, it’s essential to assess the financial strength and reputation of the insurance company offering the contract. Look for companies with strong financial ratings and a history of stability. You can research the company’s financial performance, regulatory history, and customer satisfaction ratings.

Variable annuities offer a balance between guaranteed income and potential growth. The A Variable Annuity Guarantees Which Of The Following 2024 article explains the key guarantees you can expect from this type of annuity.

2024 Market Outlook and Trends

The performance of variable annuities in 2024 will depend on a variety of factors, including the overall economic environment, interest rates, and market volatility. It’s crucial to stay informed about current market conditions and their potential impact on variable annuity performance.

If you inherit an annuity, the What Happens When I Inherit An Annuity 2024 article outlines the steps you need to take and the potential benefits and obligations involved.

Market Conditions

The current market environment is characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors could impact the performance of the investment options within variable annuities. For example, rising interest rates could negatively impact the value of bond investments, while geopolitical tensions could lead to market volatility.

Emerging Trends

Several emerging trends are likely to shape the variable annuity market in 2024, including:

- Increased focus on transparency and disclosure:Regulators are placing greater emphasis on transparency and disclosure requirements for variable annuities, making it easier for investors to understand the features and risks of these products.

- Growth of personalized investment options:Variable annuity providers are increasingly offering customized investment options to meet the unique needs of individual investors.

- Adoption of technology:The use of technology is becoming more prevalent in the variable annuity market, with online platforms and mobile apps making it easier for investors to manage their accounts and access information.

Expert Insights

Financial experts suggest that variable annuities could continue to be a popular investment option in 2024, particularly for investors seeking a combination of investment growth and income guarantees. However, it’s crucial to carefully consider the risks and fees associated with these products before making any investment decisions.

End of Discussion

Variable annuities, while offering potential for growth and income, come with inherent risks and complexities. By understanding the underlying mechanics, benefits, and potential drawbacks, investors can make informed decisions about whether this investment strategy aligns with their financial goals and risk tolerance.

This guide has provided a framework for navigating the variable annuity landscape, empowering you to make confident choices for your financial future.

Question Bank

What are the main differences between variable annuities and traditional annuities?

Traditional annuities provide fixed payments, while variable annuities offer growth potential linked to market performance. This means that variable annuities carry more risk but also have the potential for higher returns.

Are variable annuities suitable for everyone?

Be aware of potential penalties when withdrawing from an annuity early. The Annuity 10 Penalty 2024 article details the specifics of these penalties and when they might apply.

Variable annuities are generally more suitable for long-term investors with a higher risk tolerance and a desire for potential market-linked growth. They may not be appropriate for those seeking guaranteed income or those with a short-term investment horizon.

What are the key factors to consider when choosing a variable annuity?

Consider factors such as the underlying investment options, fees, surrender charges, death benefits, living benefits, and the financial strength of the insurance company offering the annuity.