Variable Annuity Exchange 2024: Navigating the Complexities of Variable Annuity Exchange in the Current Market. Variable annuities offer a way to grow your retirement savings, but they can also be complex. Understanding the ins and outs of exchanging a variable annuity can be crucial to maximizing your returns and ensuring a secure retirement.

An annuity with a 20-year certain period guarantees payments for at least 20 years, regardless of your lifespan. Annuity 20 Year Certain 2024 can help you understand the benefits and drawbacks of this type of annuity and whether it aligns with your retirement goals.

This guide explores the nuances of variable annuity exchanges, providing valuable insights into the factors influencing your decisions in 2024. We delve into the process, potential benefits and drawbacks, and highlight essential considerations to help you make informed choices.

Fixed annuities offer a guaranteed rate of return, providing a sense of security for your retirement income. 4 Fixed Annuity 2024 can guide you through the features and benefits of different fixed annuity options available in the market.

Variable Annuity Exchange Overview

A variable annuity exchange is a financial strategy where an individual replaces their existing variable annuity contract with a new one, typically from a different insurance company. This can be a complex process involving various factors, including the current market conditions, tax implications, and regulatory changes.

For individuals in Singapore, understanding the specific regulations and annuity options available is crucial. Annuity Calculator Singapore 2024 can provide valuable insights into the annuity landscape in Singapore, helping you make informed decisions for your retirement planning.

Understanding Variable Annuity Exchange

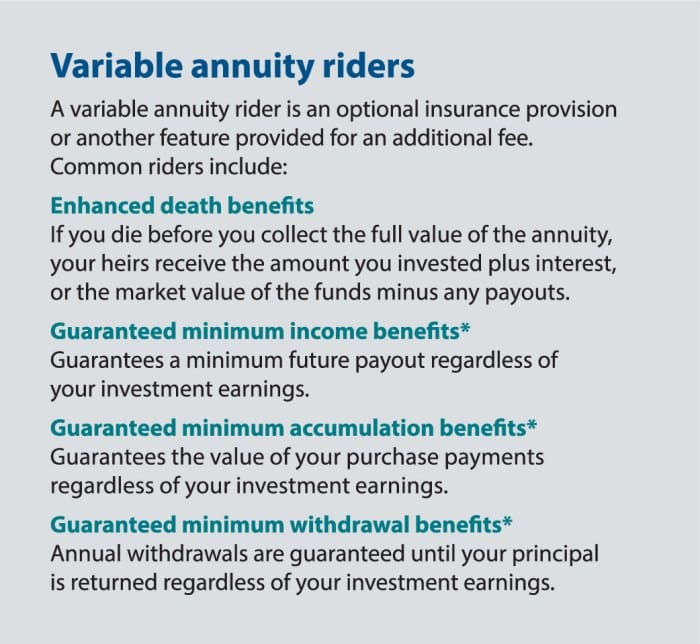

The primary reason for exchanging a variable annuity is to potentially improve the investment options, fees, or death benefit features. An exchange can offer access to a wider range of investment choices, lower expense ratios, or enhanced death benefits, depending on the new contract’s terms.

The annuity factor plays a significant role in determining the present value of an annuity. 3 Year Annuity Factor 2024 can help you understand how the annuity factor is calculated and its impact on your annuity payments.

Individuals may also consider an exchange to simplify their portfolio or to align their investments with their changing financial goals.

To estimate your potential lifetime income from an annuity, a lifetime annuity calculator is a valuable tool. Annuity Calculator Lifetime 2024 can help you understand how your age, gender, and other factors can affect your annuity payments over your lifetime.

Benefits and Drawbacks of Variable Annuity Exchange

Variable annuity exchanges can offer several potential benefits, including:

- Access to better investment options: The new contract may offer a broader range of investment choices, allowing individuals to diversify their portfolio and potentially achieve higher returns.

- Lower fees: The new contract may have lower expense ratios, resulting in greater investment growth over time.

- Enhanced death benefit features: The new contract may offer more favorable death benefit provisions, providing greater financial security for beneficiaries.

- Simplified portfolio: Consolidating multiple variable annuity contracts into a single one can streamline portfolio management.

However, there are also potential drawbacks to consider:

- Tax implications: Exchanging a variable annuity may trigger taxable events, resulting in capital gains or losses.

- Fees and expenses: The exchange process itself can involve fees and expenses, which may impact the overall return.

- Market risk: The value of the new variable annuity contract may fluctuate based on market conditions, potentially leading to losses.

- Complexity: The exchange process can be complex and time-consuming, requiring careful consideration and professional guidance.

Factors Influencing Exchange Decisions in 2024

Several factors can influence variable annuity exchange decisions in 2024, including market conditions, tax implications, and regulatory changes. Understanding these factors is crucial for making informed decisions.

The meaning of “annuity” in Bengali can be helpful for understanding financial concepts in that language. Annuity Is Bengali Meaning 2024 can provide you with the Bengali translation and explanation of the term “annuity.”

Market Conditions

The current market environment plays a significant role in variable annuity exchange decisions. For instance, rising interest rates can impact the value of fixed annuities, making variable annuities more attractive. Conversely, a volatile stock market may make investors hesitant to exchange their variable annuities.

An annuity of 3 million dollars can provide a significant stream of income for retirement. Annuity 3 Million 2024 can help you understand the factors that influence the amount of income you can expect from such an annuity and the potential benefits it offers.

Tax Implications

Tax implications are a major consideration for variable annuity exchanges. When an exchange occurs, the difference between the cost basis of the old contract and the value of the new contract may be subject to capital gains tax. Understanding the tax consequences is crucial for minimizing potential tax liabilities.

John Hancock is a well-known provider of annuities, offering a range of options to suit different needs. Annuity John Hancock 2024 can provide you with information about the specific annuity products offered by John Hancock and their features.

Regulatory Changes

Regulatory changes can impact the availability and features of variable annuity contracts. It’s important to stay informed about any new regulations or guidelines that could affect exchange decisions. For example, recent regulatory changes have focused on increasing transparency and consumer protection in the variable annuity market.

Casio calculators are commonly used for financial calculations, including annuity calculations. How To Calculate Annuity On Casio Calculator 2024 can provide step-by-step instructions on how to use a Casio calculator to calculate annuity payments.

Exchange Process and Considerations: Variable Annuity Exchange 2024

Exchanging a variable annuity involves several steps and considerations. It’s essential to understand the process and gather the necessary information before making a decision.

Annuity payments can be structured in various ways, including a single sum payment. Annuity Is A Single Sum 2024 can explain the advantages and disadvantages of a single sum annuity payment and help you decide if it’s the right option for you.

Steps Involved in the Exchange Process

- Contact a financial advisor: Discuss your financial goals and objectives with a qualified financial advisor to determine if an exchange is appropriate for you.

- Research new variable annuity contracts: Compare the features, fees, and investment options of different variable annuity contracts offered by various insurance companies.

- Request a quote from the new insurance company: Obtain a quote for the new variable annuity contract, including details on fees, expenses, and investment options.

- Review the contract documents: Carefully review the contract documents of the new variable annuity contract, paying attention to the terms and conditions, fees, and investment options.

- Complete the exchange application: Fill out the necessary paperwork and submit it to the new insurance company.

- Transfer funds: Transfer the funds from your old variable annuity contract to the new one.

Checklist of Essential Documents and Information

- Current variable annuity contract documents

- Investment account statements

- Tax identification number (TIN)

- Beneficiary information

- Financial goals and objectives

Variable Annuity Exchange Options

| Feature | Option 1 | Option 2 | Option 3 |

|---|---|---|---|

| Investment Options | Broad range of mutual funds | Limited selection of index funds | Customizable portfolio with ETFs and individual stocks |

| Fees | High expense ratios | Lower expense ratios | Variable fees based on portfolio complexity |

| Death Benefit | Guaranteed minimum death benefit | Enhanced death benefit with potential for growth | No death benefit |

Case Studies and Examples

Real-world examples of variable annuity exchanges can provide valuable insights into the potential outcomes and considerations involved. Analyzing specific scenarios can help illustrate the benefits and drawbacks of exchanging a variable annuity.

Calculating your TSP annuity can be a complex process, but it’s essential for planning your retirement income. Calculating Tsp Annuity 2024 can guide you through the steps involved in calculating your TSP annuity and help you understand the different payout options available.

Successful Variable Annuity Exchange

Consider a scenario where an individual has a variable annuity with high fees and limited investment options. By exchanging to a new contract with lower fees and a wider range of investment choices, they may be able to achieve higher returns and improve their overall financial position.

Understanding the rate of return on your annuity is crucial for assessing its performance. Calculating Annuity Rate Of Return 2024 can provide you with methods for calculating the rate of return on your annuity and help you compare it to other investment options.

This example highlights the potential benefits of exchanging a variable annuity when seeking better investment options and lower expenses.

Understanding the differences between an annuity and an IRA can be confusing, but it’s essential for making informed financial decisions. Annuity Vs Ira 2024 can help you weigh the pros and cons of each option and determine which best suits your individual needs and goals.

Variable Annuity Exchange with Potential Losses

In another scenario, an individual exchanges their variable annuity to a new contract with a more aggressive investment strategy. However, the market experiences a downturn, leading to losses in the value of the new contract. This example illustrates the importance of carefully considering the market risk associated with variable annuity exchanges and choosing an investment strategy that aligns with your risk tolerance.

Variable annuities offer the potential for growth, but they also come with investment risk. Variable Annuity Air 2024 can provide insights into the intricacies of variable annuities and help you understand the potential risks and rewards involved.

Seeking Professional Financial Advice

Before making any decisions regarding variable annuity exchanges, it’s crucial to seek professional financial advice from a qualified advisor. A financial advisor can help you assess your financial situation, evaluate the potential benefits and drawbacks of an exchange, and develop a personalized strategy that aligns with your goals.

Planning for retirement requires careful consideration of your future income needs. Annuity Calculator With Monthly Contributions 2024 can help you estimate the potential income stream you could receive from an annuity, based on your current savings and planned contributions.

Future Trends and Outlook

The variable annuity exchange landscape is constantly evolving, with emerging technologies and changing market conditions influencing future trends. Understanding these trends can help individuals make informed decisions about their variable annuities.

Potential Changes in the Variable Annuity Exchange Landscape

The variable annuity exchange landscape is likely to see further changes in 2024 and beyond. As technology advances, online platforms may offer more convenient and efficient ways to exchange variable annuities. Regulatory changes may also impact the availability and features of variable annuity contracts, influencing exchange decisions.

Impact of Emerging Technologies

Emerging technologies, such as artificial intelligence (AI) and robo-advisors, are expected to play a growing role in variable annuity exchanges. AI-powered tools can analyze vast amounts of data and provide personalized recommendations for exchange decisions. Robo-advisors can automate the exchange process, making it more efficient and accessible to individuals.

Role of Financial Advisors, Variable Annuity Exchange 2024

Despite technological advancements, the role of financial advisors remains crucial in navigating the complexities of variable annuity exchanges. Financial advisors provide personalized guidance, helping individuals understand the potential benefits and drawbacks of an exchange, assess their risk tolerance, and choose the right contract for their needs.

Wrap-Up

In conclusion, navigating the variable annuity exchange landscape requires careful consideration of market conditions, tax implications, and personal financial goals. While potential benefits exist, it’s crucial to understand the complexities and seek professional advice before making any decisions. This guide provides a solid foundation for informed action, empowering you to make the most of your variable annuity exchange journey.

Common Queries

What are the key advantages of exchanging a variable annuity?

Exchanging a variable annuity can offer advantages like accessing a different investment portfolio, potentially lower fees, or a more favorable surrender charge structure.

What are the potential tax implications of exchanging a variable annuity?

Exchanging a variable annuity may trigger taxable events, such as capital gains or losses, depending on the specific circumstances.

What are the essential documents needed for a variable annuity exchange?

Essential documents include your existing annuity contract, tax identification information, and potentially other financial statements.