Variable Annuity Enhanced Death Benefit 2024 offers a unique approach to securing your loved ones’ financial future. This type of annuity combines the potential for growth of a variable annuity with an enhanced death benefit that can provide a greater payout to your beneficiaries than a standard variable annuity.

Annuity loans are a type of loan that’s based on annuity payments. If you’re considering this type of loan, it’s essential to understand how to Calculate Annuity Loan 2024 to make informed financial decisions.

It’s a complex financial product, but understanding its mechanics can help you determine if it’s the right choice for your specific needs.

Figuring out the present value of an annuity can be a bit daunting, but there are online tools that can help. Try using the Pv Calculator Annuity 2024 to easily calculate the present value of your annuity.

The enhanced death benefit acts as a safety net, guaranteeing a minimum payout to your beneficiaries, even if the market performance of your investment portfolio is below expectations. This feature provides peace of mind, knowing that your loved ones will receive a predetermined amount, regardless of market fluctuations.

If you’re looking for information about Annuity Health in Westmont, IL, you’ve come to the right place. Learn more about Annuity Health Westmont Il 2024 and how they can help you with your health insurance needs.

While the potential for higher returns is attractive, it’s crucial to consider the associated risks and costs before making a decision.

Want to understand the basics of annuities? There are plenty of resources available online, including a simple Annuity Calculator Basic 2024 that can help you grasp the fundamentals.

Variable Annuity Enhanced Death Benefit Basics

Variable annuities with enhanced death benefits offer a way to potentially increase the payout to your beneficiaries in the event of your passing. This feature provides additional protection for your loved ones by ensuring they receive a larger sum than the standard death benefit, which is typically based on the account value at the time of death.

A PV Annuity of 1 Table is a handy tool for determining the present value of an annuity. You can find more information on Pv Annuity Of 1 Table 2024 and how to use it effectively.

Defining Enhanced Death Benefits

Enhanced death benefits, in simple terms, provide an extra layer of financial security for your beneficiaries. Instead of just receiving the account value at the time of your death, they could receive a higher amount, often based on a percentage of the initial investment or a guaranteed minimum death benefit.

A financial calculator can be a valuable tool for calculating annuities. Learn How To Calculate Annuity In Financial Calculator 2024 and streamline your calculations.

This enhancement can significantly improve the financial well-being of your loved ones, especially if the market performance has been unfavorable.

Features and Benefits

Enhanced death benefits are typically offered as an optional rider for variable annuities. They come with a variety of features and benefits, including:

- Guaranteed minimum death benefit:This guarantees a minimum payout to your beneficiaries, regardless of the performance of your investments. The minimum is often set at the initial investment amount, but it can vary depending on the contract.

- Percentage of premium death benefit:This option guarantees a death benefit that is a certain percentage of the premiums you’ve paid, regardless of the market performance. The percentage can vary depending on the contract.

- Enhanced death benefit with a cap:This option provides a death benefit that is greater than the account value, but it is capped at a certain amount. This can provide additional protection while limiting the potential cost of the enhancement.

Comparison with Standard Death Benefits

Standard variable annuity death benefits typically pay out the account value at the time of death. This means that if the market performance has been poor, your beneficiaries may receive a smaller amount than they would have received with an enhanced death benefit.

Need to estimate your future annuity payments? NerdWallet offers a user-friendly annuity calculator that can help you visualize your financial future. Check out the Annuity Calculator Nerdwallet 2024 to get started.

Enhanced death benefits offer additional protection against market volatility, ensuring that your beneficiaries receive a minimum payout, even if the market value of your investments has declined.

Calculating a growing annuity in Excel can be a bit tricky, but it’s definitely doable. You can find a step-by-step guide on how to calculate a growing annuity in Excel 2024 to help you with the process.

Understanding the Mechanics

Understanding how enhanced death benefits work is crucial for making informed decisions about your financial planning.

Wondering what an annuity fund is? It’s essentially a pool of money set aside for annuity payments. You can learn more about Annuity Fund Is 2024 and how they work.

Calculation and Payout

The calculation and payout of enhanced death benefits vary depending on the specific type of enhancement chosen. However, most enhancements involve a combination of the account value and a guaranteed minimum or percentage of premiums paid. The payout is typically made to the beneficiary designated in the annuity contract.

Variable annuities can be a bit complex, but understanding the different types of Variable Annuity Blocks 2024 can help you make informed investment decisions.

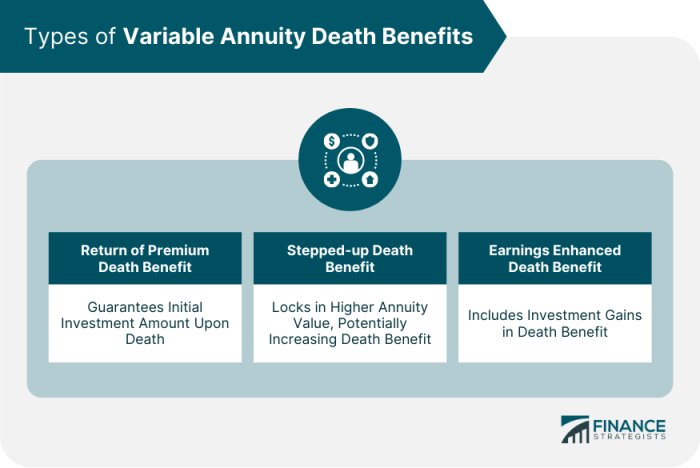

Types of Enhancements

There are various types of enhanced death benefits available, each with its own features and potential benefits:

- Guaranteed Minimum Death Benefit (GMDB):This guarantees a minimum payout to your beneficiaries, regardless of the performance of your investments. The minimum is often set at the initial investment amount, but it can vary depending on the contract.

- Percentage of Premium Death Benefit:This option guarantees a death benefit that is a certain percentage of the premiums you’ve paid, regardless of the market performance. The percentage can vary depending on the contract.

- Enhanced Death Benefit with a Cap:This option provides a death benefit that is greater than the account value, but it is capped at a certain amount. This can provide additional protection while limiting the potential cost of the enhancement.

- Rollover Death Benefit:This option allows the death benefit to be rolled over to a beneficiary’s own variable annuity contract, allowing them to continue benefiting from the growth potential of the investment.

Market Performance Impact

The performance of the underlying investments in your variable annuity can impact the death benefit payout, especially with enhanced death benefits. For example, if the market performs well, the death benefit payout may be higher than the guaranteed minimum. Conversely, if the market performs poorly, the death benefit payout may be closer to the guaranteed minimum or percentage of premiums paid.

The Knights of Columbus offers a variety of financial products, including annuities. If you’re interested in learning more about K Of C Annuity 2024 , you can find information online.

Potential Risks

While enhanced death benefits offer additional protection, it’s important to be aware of potential risks:

- Higher Costs:Enhanced death benefits typically come with higher fees than standard variable annuities. These fees can impact the overall growth potential of your investment.

- Limited Investment Options:Some enhanced death benefit options may restrict your investment choices, limiting your potential for growth.

- Complexity:Understanding the mechanics and features of enhanced death benefits can be complex. It’s important to consult with a financial advisor to ensure you understand the implications of choosing this option.

Benefits and Considerations

Enhanced death benefits can be a valuable addition to your financial plan, but it’s important to weigh the benefits against potential drawbacks.

Advantages

Here are some advantages of choosing a variable annuity with an enhanced death benefit:

- Guaranteed Minimum Payout:This ensures your beneficiaries receive a minimum amount, even if the market performance is unfavorable.

- Potential for Higher Payout:If the market performs well, your beneficiaries could receive a death benefit that is higher than the guaranteed minimum.

- Peace of Mind:Enhanced death benefits can provide peace of mind, knowing that your loved ones will be financially protected in the event of your passing.

Drawbacks and Limitations

While enhanced death benefits offer advantages, it’s important to consider potential drawbacks:

- Higher Costs:Enhanced death benefits typically come with higher fees than standard variable annuities, which can impact the overall growth potential of your investment.

- Limited Investment Options:Some enhanced death benefit options may restrict your investment choices, limiting your potential for growth.

- Complexity:Understanding the mechanics and features of enhanced death benefits can be complex. It’s important to consult with a financial advisor to ensure you understand the implications of choosing this option.

Costs and Fees

The costs and fees associated with enhanced death benefits can vary depending on the specific contract and provider. It’s important to carefully review the contract and compare fees before making a decision. Some common fees associated with enhanced death benefits include:

- Rider Fees:These fees are charged for the enhanced death benefit rider, which can be a percentage of the account value or a fixed amount.

- Administrative Fees:These fees cover the administrative costs of managing the annuity contract.

- Investment Fees:These fees are charged for managing the underlying investments in your variable annuity.

Suitability

Determining if an enhanced death benefit is suitable for your needs depends on several factors, including:

- Your Financial Goals:If your primary goal is to provide a guaranteed minimum payout to your beneficiaries, an enhanced death benefit may be a good option.

- Risk Tolerance:If you have a low risk tolerance, an enhanced death benefit can provide additional protection against market volatility.

- Financial Situation:If you have a limited budget, the higher costs associated with enhanced death benefits may not be feasible.

Key Factors to Consider in 2024

The variable annuity market is constantly evolving, and it’s important to stay informed about current trends and developments.

The BA II Plus financial calculator is a popular tool for calculating annuities. Learn how to Calculate Annuity Factor On Ba Ii Plus 2024 and simplify your calculations.

Market Conditions

In 2024, the variable annuity market is likely to be influenced by factors such as interest rates, inflation, and economic growth. These factors can impact the performance of underlying investments and the overall value of your annuity.

Imagine receiving a $3 million annuity payout! While it might seem like a dream, it’s not impossible. Read more about 3 Million Annuity Payout 2024 and the factors that can influence your payout.

Regulatory Changes

Regulatory changes can also impact variable annuity enhanced death benefits. For example, recent changes in regulations have focused on transparency and disclosure requirements, making it easier for consumers to understand the features and costs of these products.

Emerging Trends

Emerging trends in variable annuity enhanced death benefits include:

- Customization:Providers are offering more customizable death benefit options, allowing investors to tailor the coverage to their specific needs.

- Technology:Technology is playing a greater role in the variable annuity market, with online platforms and mobile apps making it easier to manage your account and access information.

- Sustainability:There is growing interest in sustainable investing, with providers offering variable annuities that invest in environmentally and socially responsible companies.

Future Outlook

The future outlook for variable annuity enhanced death benefits is positive, with providers expected to continue offering innovative and competitive products. However, it’s important to carefully research and compare options before making a decision.

Calculating annuity cash flows is a crucial step in understanding your financial future. You can find helpful information on Calculating Annuity Cash Flows 2024 to guide you through the process.

Case Studies and Examples: Variable Annuity Enhanced Death Benefit 2024

To illustrate the potential benefits of enhanced death benefits, consider the following hypothetical scenario:

Hypothetical Scenario

Imagine you invest $100,000 in a variable annuity with a guaranteed minimum death benefit (GMDB) of $100,000. After 10 years, the market value of your investment has grown to $150,000. However, due to a market downturn, the value drops to $80,000 at the time of your death.

With a standard death benefit, your beneficiaries would receive $80,000. However, with a GMDB, they would receive the guaranteed minimum of $100,000.

Variable annuities come with different contract terms and conditions. It’s important to carefully review the details of Variable Annuity Contracts 2024 before making any decisions.

Payout Comparison

The following table compares the payout amounts for a standard death benefit versus an enhanced death benefit in the above scenario:

| Death Benefit Type | Payout Amount |

|---|---|

| Standard Death Benefit | $80,000 |

| Guaranteed Minimum Death Benefit (GMDB) | $100,000 |

Key Considerations, Variable Annuity Enhanced Death Benefit 2024

When choosing an enhanced death benefit, it’s important to consider the following factors:

- Cost:Enhanced death benefits typically come with higher fees than standard variable annuities.

- Guaranteed Minimum:The guaranteed minimum death benefit should be sufficient to meet your beneficiaries’ needs.

- Investment Options:Ensure that the investment options available with the enhanced death benefit align with your investment goals.

Investment Strategy Impact

The investment strategy you choose can significantly impact the death benefit payout. For example, investing in a diversified portfolio of stocks and bonds can help mitigate risk and potentially increase returns over the long term.

Final Summary

Choosing a variable annuity with an enhanced death benefit requires careful consideration. It’s essential to weigh the potential benefits against the risks and costs involved. By understanding the mechanics of this type of annuity, evaluating your individual needs and goals, and seeking professional financial advice, you can make an informed decision that aligns with your financial objectives.

Questions and Answers

What are the main advantages of choosing a variable annuity with an enhanced death benefit?

The main advantages include a guaranteed minimum death benefit, potential for higher returns compared to traditional annuities, and tax-deferred growth of investment earnings.

How does the enhanced death benefit affect my beneficiary’s tax liability?

The death benefit is generally considered income tax-free for your beneficiary. However, it’s essential to consult with a tax professional to determine the specific tax implications for your situation.

Are there any fees associated with enhanced death benefits?

Yes, there are typically additional fees associated with enhanced death benefits. These fees can vary depending on the insurer and the specific type of enhancement chosen. It’s important to understand these fees and compare them across different insurers before making a decision.