Variable Annuity Companies 2024 take center stage in the financial landscape, offering a unique blend of investment potential and insurance protection. These companies cater to individuals seeking to grow their wealth while safeguarding their future. Variable annuities offer a diverse range of investment options, allowing investors to customize their portfolios based on their risk tolerance and financial goals.

Calculator.net offers a variety of online calculators, including one for annuities. If you’re looking for a quick and easy way to calculate annuity payments, you can visit Calculator.Net Annuity 2024. This calculator allows you to input different parameters and get an estimate of your annuity payments.

This guide delves into the intricacies of variable annuity companies, providing insights into their market landscape, key features, associated risks, and the crucial factors to consider when choosing the right company. We explore the latest innovations in variable annuity products, analyze the regulatory environment, and offer an outlook on the future of this dynamic industry.

A compound value annuity factor table is a useful tool for calculating the future value of an annuity. You can find a table for 2024 at Compound Value Annuity Factor Table 2024. This table can help you quickly determine the future value of an annuity based on the interest rate and number of periods.

Variable Annuity Companies: Overview and Landscape in 2024

Variable annuities are complex financial products that offer a combination of investment growth potential and guaranteed income features. They have become increasingly popular in recent years, particularly among retirees and those nearing retirement. In 2024, the variable annuity market continues to evolve, with new products and innovations emerging to meet the evolving needs of investors.

If you’re planning for retirement and have a pension pot, you might consider converting it into an annuity. To calculate the potential annuity payments you could receive, you can check out Calculate Annuity From Pension Pot 2024. This resource can help you understand the potential income stream you might receive.

This article provides a comprehensive overview of the variable annuity landscape, including key features, benefits, risks, and factors to consider when choosing a variable annuity company.

An annuity with an 8 percent interest rate can provide significant growth over time. If you’re considering an annuity with an 8 percent return, you can find more information at Annuity 8 Percent 2024. This link explores the potential benefits and considerations of an 8 percent annuity.

Current Market Landscape for Variable Annuity Companies

The variable annuity market is characterized by a diverse range of companies offering a variety of products and services. The market is highly competitive, with companies constantly striving to innovate and differentiate themselves. The overall market size has been growing steadily in recent years, driven by factors such as an aging population and increasing demand for retirement income solutions.

Annuity payments can provide a steady stream of income for retirement, and understanding how they work is crucial. If you’re considering an annuity of 600,000 in 2024, you might want to check out Annuity 600 000 2024 for more information.

This could help you make informed decisions about your financial future.

- Top 10 Variable Annuity Companies in the US:The top 10 variable annuity companies in the US, based on market share or other relevant metrics, are typically large, well-established financial institutions with extensive experience in the variable annuity market. They often have a wide range of product offerings, robust financial resources, and strong customer service capabilities.

When you purchase an annuity, you essentially trade a lump sum of money for a stream of future payments. To learn more about the process of purchasing an annuity, you can visit Annuity Is Purchased 2024. This link provides insights into the mechanics of purchasing an annuity and the factors to consider.

- Key Factors Driving Growth or Decline in the Variable Annuity Market:The variable annuity market is influenced by a number of factors, including interest rates, economic conditions, and regulatory changes. In 2024, the market is expected to continue to grow, driven by factors such as the aging population and increasing demand for retirement income solutions.

The JAIIB (Junior Associate of the Indian Institute of Bankers) exam covers a wide range of financial topics, including annuities. If you’re preparing for the JAIIB exam, you might want to check out Annuity Jaiib 2024 for study materials and resources related to annuities.

However, there are also some challenges facing the market, such as low interest rates and concerns about the potential for market volatility.

Key Features and Benefits of Variable Annuities

Variable annuities are insurance contracts that offer a combination of investment growth potential and guaranteed income features. They are designed to help investors accumulate wealth and generate retirement income.

Variable annuities can be a complex financial product. If you’re interested in learning more about variable annuities, specifically those offered by AIR, you can find more information at Variable Annuity Air 2024. This link provides insights into AIR’s variable annuity offerings and their features.

- Investment Options:Variable annuities offer a wide range of investment options, allowing investors to customize their portfolios based on their risk tolerance and investment goals. These options typically include mutual funds, exchange-traded funds (ETFs), and other investment vehicles.

- Potential for Growth:The investment portion of a variable annuity is tied to the performance of the underlying investments. This means that investors have the potential to earn higher returns than they would with a fixed annuity.

- Tax Deferral:Variable annuities offer tax deferral on investment earnings. This means that investors do not have to pay taxes on their earnings until they withdraw them from the annuity, which can help to reduce their overall tax burden.

- Guaranteed Minimum Death Benefit:Many variable annuities offer a guaranteed minimum death benefit, which ensures that a beneficiary will receive a minimum payout upon the death of the annuitant.

- Types of Variable Annuities:There are several different types of variable annuities available in the market, including traditional variable annuities, indexed variable annuities, and equity-indexed annuities. Each type has its own unique features and benefits.

Risks and Considerations Associated with Variable Annuities, Variable Annuity Companies 2024

While variable annuities offer a number of potential benefits, they also come with certain risks that investors need to be aware of.

An annuity is essentially a financial product that provides regular payments for a set period of time. To understand the concept in detail, you can refer to Annuity What Is It Definition 2024 , which explains the definition and workings of an annuity in a clear and concise manner.

- Market Volatility:The value of the investment portion of a variable annuity is tied to the performance of the underlying investments. This means that the value of the annuity can fluctuate with market conditions.

- Investment Risk:Investors are responsible for managing their own investment choices within a variable annuity. This means that they could lose money if their investments perform poorly.

- Potential for Loss of Principal:The value of the investment portion of a variable annuity can decline, and there is a potential for investors to lose their principal.

- Fees and Expenses:Variable annuities typically have higher fees and expenses than other types of investments. These fees can eat into the returns that investors earn on their investments.

Choosing the Right Variable Annuity Company

Choosing the right variable annuity company is an important decision that should not be taken lightly. There are a number of factors to consider when selecting a company, including financial stability, investment options, fees, and customer service.

Variable annuities have two phases: the accumulation phase and the payout phase. The accumulation phase is when you contribute to the annuity and your investments grow. To learn more about the accumulation phase of variable annuities, you can visit Variable Annuity Accumulation Phase 2024.

This link provides information on how investments grow during the accumulation phase.

- Financial Stability:It is important to choose a variable annuity company that has a strong financial track record and is well-capitalized. This will help to ensure that the company can meet its obligations to its policyholders.

- Investment Options:Consider the investment options offered by different variable annuity companies. Make sure that the company offers a wide range of investment options that align with your investment goals and risk tolerance.

- Fees and Expenses:Compare the fees and expenses associated with different variable annuity companies. Look for companies that offer low fees and transparent pricing.

- Customer Service:It is important to choose a variable annuity company that has a reputation for excellent customer service. Look for a company that is responsive to your needs and provides clear and concise information.

Variable Annuity Products and Innovations in 2024

The variable annuity market is constantly evolving, with new products and innovations emerging to meet the changing needs of investors.

Calculating interest on an annuity can be important for understanding its overall growth. You can find an interest calculator specifically designed for annuities at Interest Calculator Annuity 2024. This tool can help you estimate the interest earned on your annuity based on the interest rate and payment schedule.

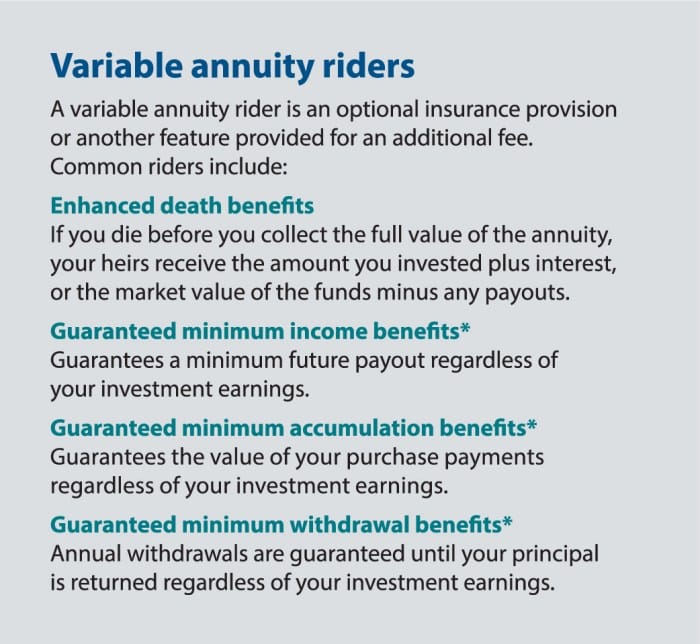

- Income Riders:Income riders are optional features that can be added to a variable annuity to provide guaranteed income payments during retirement. These riders can help to protect investors from the risk of outliving their savings.

- Living Benefit Options:Living benefit options are features that can be added to a variable annuity to provide guaranteed minimum withdrawal benefits or death benefits. These options can provide peace of mind for investors who are concerned about the potential for market volatility.

Variable annuities are a type of annuity where the payments can fluctuate based on the performance of underlying investments. However, it’s important to note that a variable annuity A Variable Annuity Does Not Provide 2024 a guaranteed rate of return, so there is inherent risk involved.

- Guaranteed Minimum Withdrawal Benefits:Guaranteed minimum withdrawal benefits (GMWBs) allow investors to withdraw a certain amount of money from their annuity each year, regardless of the performance of the underlying investments.

Regulatory Landscape and Industry Outlook for Variable Annuities

The variable annuity industry is subject to a number of regulations that are designed to protect investors. The regulatory environment for variable annuities is constantly evolving, with new rules and regulations being proposed and implemented on a regular basis.

- Current Regulatory Environment:The current regulatory environment for variable annuities is relatively stable, but there are a number of proposed regulations that could impact the industry in the future.

- Potential Impact of Regulatory Changes:Regulatory changes can have a significant impact on the variable annuity industry and investor behavior. For example, new regulations could affect the fees and expenses that companies can charge, the investment options that they can offer, or the guarantees that they can provide.

- Outlook for the Future of Variable Annuities:The future of variable annuities is uncertain, but the industry is expected to continue to evolve in response to changing market conditions and investor needs. Factors such as demographics, interest rates, and market conditions will play a role in shaping the future of the variable annuity market.

Calculating the future value of an annuity can be done with a simple formula, but using Excel can make the process much easier. If you’re looking to learn how to calculate annuity payments in Excel, Calculating Annuity In Excel 2024 can provide a step-by-step guide.

Final Summary: Variable Annuity Companies 2024

As you navigate the complex world of variable annuities, understanding the intricacies of these companies is essential. By carefully considering your financial needs, risk tolerance, and long-term goals, you can make informed decisions that align with your investment objectives. This guide provides a comprehensive framework for understanding the dynamics of variable annuity companies, empowering you to make informed choices and navigate this investment landscape with confidence.

Question & Answer Hub

What are the main differences between variable annuities and traditional annuities?

The HP-12C financial calculator is a popular tool among financial professionals. If you’re looking to calculate annuity payments using this calculator, you can find helpful resources at Calculate Annuity Hp12c 2024. This link provides detailed instructions and examples for calculating annuities on the HP-12C.

Variable annuities offer investment options, allowing the value of your annuity to fluctuate with market performance, while traditional annuities provide fixed payments based on a guaranteed interest rate.

How do I choose the right variable annuity company?

Hargreaves Lansdown is a well-known financial services provider, and they offer a handy online annuity calculator. If you’re interested in using their tool, you can find more information at Annuity Calculator Hargreaves Lansdown 2024. This calculator can help you estimate potential annuity payments based on your chosen parameters.

Consider factors such as financial stability, investment options, fees, customer service, and the company’s track record.

Are there any tax advantages to investing in variable annuities?

Yes, variable annuities offer tax deferral on earnings, meaning you won’t pay taxes until you withdraw the money in retirement.

What are some of the risks associated with variable annuities?

Variable annuities carry market risk, investment risk, and the potential for loss of principal. The value of your annuity can fluctuate with market performance, and you could lose some or all of your investment.