Variable Annuity Accumulation Units 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Variable Annuity Accumulation Units (VAUs) are a key component of variable annuities, which are retirement savings products that offer the potential for growth while also providing some protection against market downturns.

Want to understand how the compound value of an annuity is calculated? A compound value annuity factor table can help you visualize this process. You can find a detailed explanation and table for 2024 here: Compound Value Annuity Factor Table 2024.

This

For those who are comfortable with programming, you can create your own annuity calculator using Visual Basic. You can find a guide and code examples for creating an annuity calculator in Visual Basic in 2024 here: Annuity Calculator Visual Basic 2024.

This guide can help you develop your own customized financial planning tool.

If you’re in the UK and considering an annuity, it’s helpful to use an annuity calculator to compare different options. You can find a UK-specific annuity calculator for 2024 here: Annuity Calculator Uk 2024. This tool can help you make informed decisions about your retirement planning.

table can help you understand the power of compounding over time.

VAUs

Curious about the meaning of “annuity” in Tamil? You can find a comprehensive explanation of this financial concept in Tamil language by visiting this link: Annuity Meaning In Tamil 2024. Understanding the nuances of financial terms in your native language can make a big difference in managing your finances.

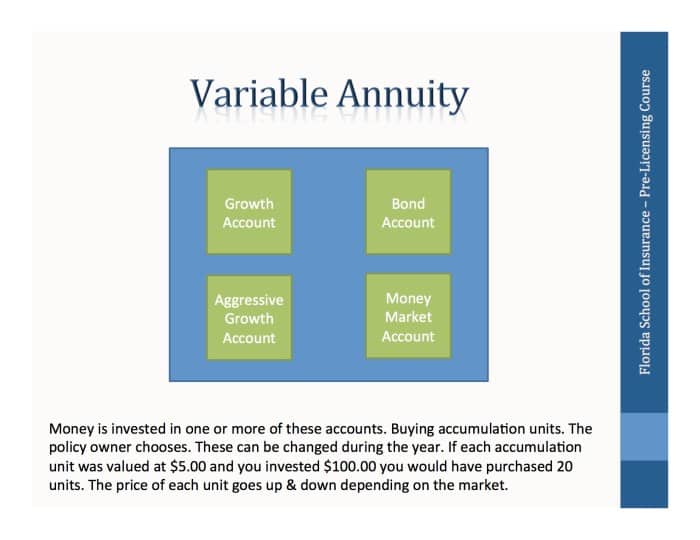

represent units of ownership in the underlying investment sub-accounts within a variable annuity contract. Each VAU is linked to a specific sub-account, and its value fluctuates based on the performance of that sub-account.

VAUs provide a way for investors to participate in the growth potential of the stock market while also benefiting from the tax-deferred growth of a variable annuity. This means that any earnings on your VAUs are not taxed until you withdraw them in retirement.

Looking for a tool to help you estimate the potential growth of your annuity savings? An annuity savings calculator can provide valuable insights. You can find a guide and calculator for 2024 here: Calculator Annuity Savings 2024. This tool can help you make informed decisions about your savings strategy.

Variable Annuity Accumulation Units: An Overview

Variable annuity accumulation units (VAUs) are a key component of variable annuities, which are retirement savings products that offer the potential for higher returns than traditional fixed annuities. VAUs represent your ownership in the underlying investment sub-accounts within the variable annuity contract.

Want to calculate the potential growth of your annuity over time? You can find a guide and calculator for calculating annuity growth in 2024 here: Calculate Annuity Growth 2024. This tool can help you understand the potential long-term impact of your annuity investment.

Think of them like shares of stock, but instead of representing a portion of a company, they represent a portion of a specific investment portfolio within your annuity.

Annuity payments can provide a reliable source of income during retirement, but are they right for everyone? You can find a comprehensive overview of the advantages and disadvantages of annuities in 2024 here: Annuity Is Good 2024. This article will help you determine if an annuity is a good fit for your financial situation.

The Role of VAUs in Accumulation

VAUs play a crucial role in the accumulation phase of a variable annuity. When you contribute to your variable annuity, your money is used to purchase VAUs. The number of VAUs you receive will depend on the current value of the underlying investment sub-accounts.

Is an annuity a good investment for you? It depends on your individual financial goals and risk tolerance. You can find a detailed analysis of the pros and cons of annuities as an investment in 2024 here: Is Annuity Good Investment 2024.

This article will help you weigh the potential benefits and risks.

As the value of the sub-accounts increases, so too does the value of your VAUs, potentially leading to growth in your retirement savings.

Link to Underlying Investment Sub-accounts

VAUs are directly linked to the performance of the underlying investment sub-accounts. These sub-accounts are typically comprised of mutual funds or exchange-traded funds (ETFs) that invest in a variety of asset classes, such as stocks, bonds, and real estate. The value of your VAUs will fluctuate based on the performance of these underlying investments.

Examples of VAU Usage

Imagine you invest $10,000 in a variable annuity with an underlying sub-account invested in a stock mutual fund. If the stock market performs well and the mutual fund’s value increases, the value of your VAUs will also increase. Conversely, if the stock market declines, the value of your VAUs will decrease.

The same principle applies to other types of investment sub-accounts, such as bond funds or real estate funds.

Factors Influencing VAU Growth in 2024

Predicting the future performance of any investment is difficult, but understanding the key factors that can influence VAU growth can help you make informed investment decisions.

Interest Rate Changes

Interest rate changes can have a significant impact on VAU growth. When interest rates rise, bond yields typically increase, which can negatively impact the performance of bond-heavy sub-accounts. Conversely, when interest rates fall, bond yields tend to decline, which can benefit bond-heavy sub-accounts.

Want to understand how to calculate the value of an annuity? It’s not as complex as it sounds! You can find a detailed explanation of the annuity formula and its applications in 2024 by checking out this article: How To Calculate Annuity Formula 2024.

It’s a great resource for anyone wanting to learn more about annuities.

Underlying Investment Sub-account Performance

The performance of the underlying investment sub-accounts is directly tied to the growth of your VAUs. If the sub-accounts perform well, your VAUs will likely increase in value. However, if the sub-accounts perform poorly, your VAUs may decline.

Market Volatility and Economic Conditions

Market volatility and economic conditions can also influence VAU growth. In periods of economic uncertainty or market turmoil, the value of VAUs can fluctuate significantly. It’s important to remember that variable annuities are subject to market risk, just like any other investment.

Growth Rates of Different VAU Types

The potential growth rates of different types of VAUs can vary depending on the underlying investment sub-accounts. For example, a VAU linked to a stock-heavy sub-account may have the potential for higher growth but also carries a higher level of risk.

A VAU linked to a bond-heavy sub-account may offer more stability but potentially lower returns.

Key Features of VAUs

VAUs have several key features that are important to understand before investing.

Accumulation Value

The accumulation value of your variable annuity represents the total value of your VAUs, including any growth or losses. It is calculated by multiplying the number of VAUs you own by the current value of the underlying investment sub-accounts.

Annuity payments are often associated with specific types of accounts. Learn more about which accounts are typically used for annuities in 2024 by visiting this article: Annuity Is Which Account 2024. Understanding the different account options can help you make informed financial decisions.

Fees, Variable Annuity Accumulation Units 2024

There are various fees associated with VAUs, including management fees, mortality and expense charges, and surrender charges. These fees can impact the growth of your VAUs, so it’s essential to carefully review the fee structure of any variable annuity contract before investing.

Death Benefits

Many variable annuity contracts offer death benefits, which provide a guaranteed minimum payout to your beneficiaries if you die before annuitizing your contract. The death benefit may be a fixed amount or a percentage of the accumulation value, depending on the contract terms.

Tax Implications

The tax implications of VAUs differ from traditional annuities. In general, the growth in your VAUs is not taxed until you withdraw the money. However, withdrawals are typically taxed as ordinary income.

Whether you’re dealing with a fixed or variable annuity, understanding how to calculate its value is crucial. You can find a detailed guide on calculating annuities in 2024 here: Calculating Annuities 2024. This guide will walk you through the steps and formulas needed to calculate the present and future value of your annuity.

VAU Growth Strategies for 2024

Developing a well-defined investment strategy for your VAUs can help you maximize your potential for growth.

Comparing Investment Strategies

| Strategy | Description | Potential Benefits | Potential Risks |

|---|---|---|---|

| Conservative | Focus on lower-risk investments, such as bonds or fixed income | Stability and lower risk | Lower potential for growth |

| Moderate | A balanced approach, with a mix of stocks, bonds, and other assets | Potential for growth with moderate risk | Moderate volatility |

| Aggressive | Emphasis on higher-growth investments, such as stocks or emerging markets | Potential for higher returns | Higher volatility and risk |

Planning for retirement with Schwab? They offer a handy annuity calculator that can help you estimate your future income stream. You can find the Schwab Annuity Calculator for 2024 here: Annuity Calculator Schwab 2024. This tool can be helpful for making informed decisions about your financial future.

Hypothetical Portfolio Allocation

A hypothetical portfolio allocation for a VAU-based investment in 2024 might include:* 60% Stocks (split between large-cap, mid-cap, and small-cap stocks)

- 30% Bonds (split between government bonds and corporate bonds)

- 10% Real Estate (through a REIT fund)

Asset Allocation and Diversification

Asset allocation and diversification are crucial for VAU growth. By allocating your investments across different asset classes, you can potentially reduce your overall risk and enhance your potential for returns.

Monitoring and Adjusting

It’s essential to monitor your VAU investments regularly and make adjustments as needed based on market conditions, your investment goals, and your risk tolerance. Consider consulting with a financial advisor to help you develop a personalized VAU investment strategy and make informed decisions.

Considerations for Investing in VAUs: Variable Annuity Accumulation Units 2024

Before investing in VAUs, it’s crucial to understand the risks and potential drawbacks.

A deferred annuity is a type of annuity that begins making payments at a later date. Want to understand how to calculate the value of a deferred annuity? You can find a detailed guide for 2024 here: Calculating A Deferred Annuity 2024.

This guide will walk you through the steps and formulas needed to make informed decisions.

Risks Associated with VAUs

Market Volatility

The value of VAUs can fluctuate significantly due to market volatility, which can impact your returns.

Fees

Fees associated with VAUs can eat into your returns.

Contract Terms and Conditions

Calculating the value of an annuity can seem daunting, but it’s a crucial step in understanding your financial options. You can find a comprehensive guide on how to calculate an annuity in 2024 here: Calculating Annuity 2024. This guide will break down the process and provide you with the tools you need to make informed decisions.

Carefully review the terms and conditions of your variable annuity contract before investing.

Limited Liquidity

Variable annuities may have restrictions on withdrawals, which can limit your access to your money.

Understanding Contract Terms

Thoroughly read and understand the terms and conditions of your variable annuity contract before investing. Pay close attention to the fee structure, death benefit provisions, and withdrawal restrictions.

Annuity payments can provide a steady stream of income during retirement. Learn more about how annuities can contribute to your income stream in 2024 by visiting this article: Annuity Is Income 2024. It’s a valuable resource for anyone looking to understand the potential benefits of annuities.

Comparison with Other Retirement Options

VAUs are just one of many retirement investment options. Compare and contrast VAUs with other options, such as mutual funds, ETFs, and traditional annuities, to determine the best fit for your individual needs and financial goals.

Integration into Financial Plan

VAUs can be a valuable component of a comprehensive financial plan. Consider how they can complement other retirement savings accounts, such as 401(k)s and IRAs, to help you reach your long-term financial goals.

Epilogue

Variable Annuities are a complex investment product, and VAUs are a key component of their operation. By understanding the factors that influence VAU growth, the key features of VAUs, and the strategies for investing in VAUs, you can make informed decisions about whether or not this type of investment is right for you.

As with any investment, it is important to carefully consider your risk tolerance, time horizon, and financial goals before making any decisions.

Answers to Common Questions

What are the different types of VAUs?

VAUs can be categorized based on the underlying investment sub-accounts they are linked to. Common types include equity VAUs, fixed income VAUs, and balanced VAUs. Equity VAUs are linked to sub-accounts that invest in stocks, fixed income VAUs are linked to sub-accounts that invest in bonds, and balanced VAUs are linked to sub-accounts that invest in a mix of stocks and bonds.

How do I choose the right VAU investment strategy?

The best VAU investment strategy for you will depend on your individual circumstances, such as your risk tolerance, time horizon, and financial goals. It’s important to consult with a financial advisor to determine the best approach for your specific needs.

What are the tax implications of VAUs?

The tax implications of VAUs can be complex, and they depend on the specific terms of your variable annuity contract. In general, earnings on VAUs are not taxed until you withdraw them in retirement. However, there may be some tax consequences when you withdraw money from your variable annuity, such as ordinary income tax on earnings and possibly a 10% penalty if you withdraw before age 59 1/2.