Using CPI and PCE for Economic Analysis in November 2024 sets the stage for this exploration, offering readers a glimpse into the intricate world of economic indicators. The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) are crucial measures of inflation, providing valuable insights into the health of the economy.

November 2024 presents a particularly interesting moment for analyzing these indicators, as economic trends and policy decisions are closely intertwined.

This analysis delves into the intricacies of CPI and PCE, examining their methodologies, components, and implications for economic growth and consumer sentiment. We will explore how these indicators inform the Federal Reserve’s monetary policy decisions, potentially influencing interest rate adjustments and other economic policies.

By understanding the interplay between CPI, PCE, and economic growth, we can gain a deeper understanding of the forces shaping the economy in November 2024 and beyond.

Using CPI and PCE for Economic Analysis in November 2024

The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) are two key economic indicators that provide valuable insights into inflation and the overall health of the economy. They are closely monitored by economists, policymakers, and investors to understand the purchasing power of consumers and the trajectory of economic growth.

In November 2024, the release of these data points will be particularly significant, as they will provide crucial information about the current state of inflation and its impact on consumer spending and the Federal Reserve’s monetary policy decisions.

Obtain access to The Relationship Between CPI and Inflation Expectations in November 2024 to private resources that are additional.

CPI: Consumer Price Index

The CPI is a widely used measure of inflation that tracks changes in the prices of a basket of consumer goods and services. It is calculated by the Bureau of Labor Statistics (BLS) and is based on a weighted average of prices for a specific set of goods and services that represent the spending patterns of a typical urban consumer.

The CPI is a valuable tool for assessing the purchasing power of consumers and understanding how inflation affects their ability to afford essential goods and services.

Discover more by delving into Common Misconceptions about the CPI in November 2024 further.

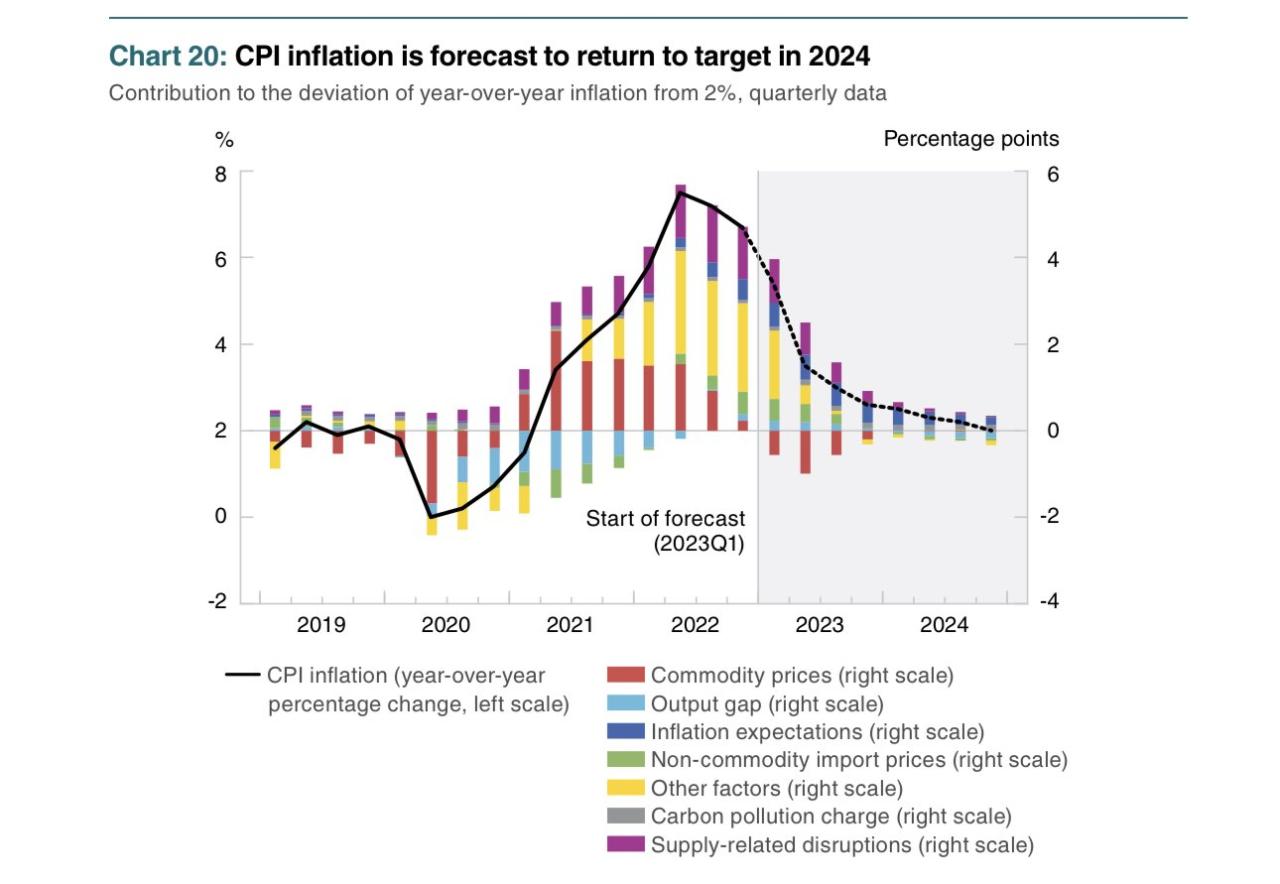

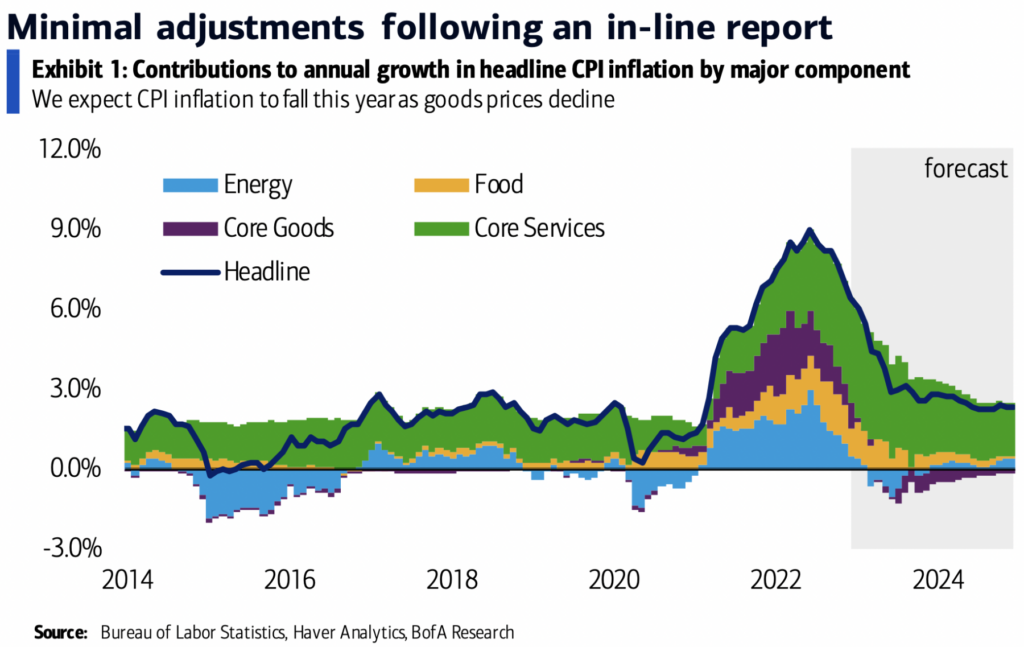

In November 2024, the CPI data will be closely scrutinized for insights into the current inflation environment. Key components of the CPI to watch include energy prices, food costs, and core inflation. Energy prices have been volatile in recent months, and any significant fluctuations could have a major impact on the overall CPI reading.

You also can investigate more thoroughly about CPI and the Sharing Economy in November 2024 to enhance your awareness in the field of CPI and the Sharing Economy in November 2024.

Food costs have also been rising, and continued increases could put pressure on household budgets. Core inflation, which excludes volatile food and energy prices, will provide a more nuanced view of underlying inflationary pressures.

Find out about how Inflation and Asset Prices in November 2024 can deliver the best answers for your issues.

| CPI Component | Percentage Change (November 2024) |

|---|---|

| Energy | [insert percentage change] |

| Food | [insert percentage change] |

| Housing | [insert percentage change] |

| Medical Care | [insert percentage change] |

| Transportation | [insert percentage change] |

| Recreation | [insert percentage change] |

| Education and Communication | [insert percentage change] |

| Core Inflation | [insert percentage change] |

PCE: Personal Consumption Expenditures

The PCE price index is another important measure of inflation, but it focuses on consumer spending rather than the price changes of a fixed basket of goods and services. The PCE index is calculated by the Bureau of Economic Analysis (BEA) and includes a broader range of goods and services than the CPI, including services like healthcare and education.

The PCE index also excludes certain goods, such as imported goods and investment goods, that are not typically considered part of consumer spending.

The PCE index is often considered a more comprehensive measure of inflation than the CPI, as it reflects the actual spending patterns of consumers. It is also the preferred measure of inflation by the Federal Reserve, as it is believed to be a better indicator of underlying inflation pressures.

The PCE data for November 2024 will provide insights into the level of consumer spending and its impact on economic growth. If consumer spending is strong, it suggests that the economy is healthy and that businesses are likely to continue investing and hiring.

However, if consumer spending is weak, it could signal a slowdown in economic growth.

Further details about Inflation Targeting and the CPI in November 2024 is accessible to provide you additional insights.

| Indicator | November 2024 Data |

|---|---|

| CPI | [insert CPI data] |

| PCE | [insert PCE data] |

Economic Implications, Using CPI and PCE for Economic Analysis in November 2024

The CPI and PCE data for November 2024 will have significant implications for the Federal Reserve’s monetary policy decisions. If the data show that inflation is higher than expected, the Fed may be more likely to raise interest rates to cool down the economy and bring inflation under control.

However, if the data show that inflation is lower than expected, the Fed may be more likely to keep interest rates steady or even lower them to stimulate economic growth.

Expand your understanding about Inflation and the Distribution of Income in November 2024 with the sources we offer.

The impact of inflation on the economy can be complex and multifaceted. High inflation can erode the purchasing power of consumers, leading to a decline in consumer spending and economic growth. It can also lead to higher interest rates, which can make it more expensive for businesses to borrow money and invest, further slowing economic growth.

However, moderate inflation can be beneficial for the economy, as it can encourage businesses to invest and consumers to spend.

Finish your research with information from The CPI and the Environment in November 2024.

| CPI and PCE Data Outcome | Potential Scenario for Economic Growth |

|---|---|

| Inflation higher than expected | Slower economic growth, potential recession |

| Inflation lower than expected | Stronger economic growth, potential for continued expansion |

| Inflation stable and within target range | Sustained economic growth, stable prices |

Conclusive Thoughts

The analysis of CPI and PCE in November 2024 provides a crucial snapshot of the economic landscape. Understanding the nuances of these indicators, their relationship to monetary policy, and their potential impact on consumer behavior is essential for navigating the complexities of the economy.

As we look ahead, the trends in CPI and PCE will continue to shape the economic outlook, influencing everything from interest rates to consumer spending. By staying informed about these key indicators, we can better understand the forces driving the economy and make informed decisions in the months and years to come.

FAQ Insights

What is the difference between CPI and PCE?

In this topic, you find that Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 is very useful.

The CPI measures inflation based on a fixed basket of goods and services, while the PCE index considers changes in consumer spending patterns over time, reflecting a broader range of goods and services.

How does the Federal Reserve use CPI and PCE data?

The Federal Reserve closely monitors CPI and PCE data to gauge inflation and guide its monetary policy decisions, including setting interest rates and adjusting the money supply.

Discover the crucial elements that make The Psychology of Inflation in November 2024 the top choice.

What are some of the key factors that could influence CPI and PCE in the future?

Check CPI November 2024: A Beginner’s Guide to Understanding Inflation to inspect complete evaluations and testimonials from users.

Factors such as global supply chain disruptions, energy prices, commodity costs, and changes in consumer demand can all impact future CPI and PCE trends.