USAA Loans offers a range of financial products tailored specifically for military members, veterans, and their families. With a rich history of serving those who serve, USAA has built a reputation for competitive rates, exceptional customer service, and a deep understanding of the unique financial needs of the military community.

Prosper is a popular online lending platform that offers Prosper Loans. These loans can be a good option for borrowers with good credit who need money for a variety of purposes, such as debt consolidation, home improvement, or medical expenses.

From personal loans to home mortgages, USAA provides a comprehensive suite of lending solutions designed to support military families throughout their financial journey. Whether you’re looking to consolidate debt, finance a new car, or purchase your dream home, USAA’s commitment to its members extends beyond traditional banking services, offering personalized guidance and support to help you achieve your financial goals.

Need a loan but don’t want to go far? Find Loans Near Me with our easy-to-use tool. We’ll show you the best loan options available in your area, so you can get the money you need quickly and easily.

USAA Loans Overview

USAA, known for its financial services catering to military members, veterans, and their families, also offers a range of loan products. The company’s lending history dates back to the early 20th century, with its roots in providing financial support to military personnel.

Chase Bank offers a variety of loan options, including Chase Loans. Whether you need a personal loan, a home equity loan, or a car loan, Chase has a loan option to fit your needs. Learn more about Chase loans and see if they’re right for you.

USAA’s commitment to serving the military community continues to this day, with a focus on offering competitive rates and personalized service.

Looking for the best car loan rates? We can help you find the best deal for your needs. Compare car loans from top lenders and get pre-approved in minutes. Best Car Loans is your one-stop shop for all your car financing needs.

Types of Loans Offered by USAA

USAA provides a variety of loan options to meet the diverse needs of its members. Here’s a breakdown of the most common loan types:

- Personal Loans:These unsecured loans offer flexibility for various purposes, such as debt consolidation, home improvements, or medical expenses.

- Auto Loans:USAA offers competitive rates on new and used car loans, with options for financing various vehicle types.

- Home Loans:From mortgages to home equity loans, USAA provides a range of financing solutions for purchasing or refinancing a home.

- Business Loans:USAA also offers business loans to military members and veterans who are entrepreneurs, helping them launch or grow their businesses.

Target Audience for USAA Loans

USAA loans are primarily designed for:

- Active Duty Military Personnel:USAA provides financial support to those serving in the armed forces, recognizing their unique financial needs.

- Veterans:USAA continues to serve those who have served, offering them access to competitive loan products and financial services.

- Families of Military Members and Veterans:USAA extends its services to the families of military personnel, ensuring they have access to financial assistance.

Loan Eligibility and Requirements

To be eligible for a USAA loan, applicants must meet specific criteria depending on the loan type. Here’s a general overview of the eligibility requirements:

Eligibility Criteria for USAA Loans

- Membership in USAA:Applicants must be active members of USAA, meaning they are currently serving in the military, are a veteran, or are a family member of a military member or veteran.

- Credit History:USAA typically requires a good credit score for loan approval. The specific score requirement varies depending on the loan type and amount.

- Income Verification:Applicants must demonstrate a stable income source to ensure they can afford the loan payments.

- Debt-to-Income Ratio:USAA considers the applicant’s debt-to-income ratio (DTI), which measures the percentage of income used for debt payments. A lower DTI generally improves loan approval chances.

Documentation Required for Loan Applications

When applying for a USAA loan, applicants will typically need to provide the following documentation:

- Proof of Identity:Driver’s license, passport, or military ID.

- Proof of Membership:USAA membership card or other documentation confirming membership.

- Income Verification:Pay stubs, tax returns, or bank statements.

- Credit History:Credit report from a credit bureau.

- Loan-Specific Documents:Depending on the loan type, additional documentation may be required, such as vehicle information for auto loans or property information for home loans.

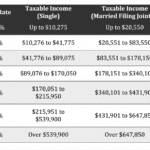

Credit Score Requirements and Debt-to-Income Ratio

While USAA doesn’t publicly disclose specific credit score requirements for each loan type, generally, a good credit score is essential for loan approval. A higher credit score typically results in more favorable loan terms, such as lower interest rates. Similarly, a lower debt-to-income ratio indicates better financial stability and can improve loan approval chances.

Unlock the equity in your home with Equity Release. This can be a great way to access funds for home improvements, debt consolidation, or other financial needs. Learn more about equity release and see if it’s right for you.

Loan Interest Rates and Fees

USAA’s interest rates and fees for loans vary depending on factors like creditworthiness, loan amount, and loan term. Understanding these aspects is crucial for comparing USAA loans with other financial institutions and making informed decisions.

If you’re a small business owner, an SBA 7a Loan can help you get the funding you need to grow your business. These loans offer flexible terms and competitive interest rates, making them a great option for small businesses.

Interest Rates and Fees Associated with USAA Loans

- Annual Percentage Rate (APR):This represents the total cost of borrowing, including the interest rate and any fees. USAA’s APRs are typically competitive, especially for military members and veterans.

- Origination Fees:These are one-time fees charged for processing the loan application. The amount can vary depending on the loan type and amount.

- Late Payment Penalties:Late payments on USAA loans may result in penalties, which can significantly increase the overall cost of borrowing.

Comparison of USAA Loan Rates with Other Institutions

USAA’s loan rates are generally competitive, especially for military members and veterans. However, it’s essential to compare rates from other financial institutions, including credit unions, banks, and online lenders, to ensure you’re getting the best deal. Factors like your credit score, loan amount, and loan term can significantly impact interest rates.

Tired of high credit card interest rates? A Credit Card Consolidation Loan can help you combine your high-interest debt into one lower monthly payment. This can save you money on interest and help you pay off your debt faster.

Factors Influencing Interest Rates

Several factors can influence the interest rate you receive on a USAA loan, including:

- Creditworthiness:Applicants with higher credit scores generally qualify for lower interest rates.

- Loan Amount:Larger loan amounts may be associated with higher interest rates.

- Loan Term:Longer loan terms can result in lower monthly payments but may lead to higher overall interest costs.

Loan Application and Approval Process

Applying for a USAA loan is generally straightforward, with multiple application methods available. The approval process involves a review of your application and financial information.

Looking to tap into your home’s equity for a second time? Learn more about Second Mortgage Rates and see if this is the right option for your needs. We can help you find the best rates and terms for your second mortgage.

Steps Involved in Applying for a USAA Loan

- Gather Required Documentation:Prepare the necessary documents, including proof of identity, income verification, and credit history.

- Submit an Application:You can apply for a USAA loan online, over the phone, or in person at a USAA branch.

- Loan Review and Approval:USAA will review your application and financial information to determine your eligibility and loan terms.

- Loan Disbursement:Once approved, the loan funds will be disbursed to your account according to the agreed-upon terms.

Application Methods

- Online:USAA’s website provides a convenient platform to apply for loans online.

- Phone:You can contact USAA’s customer service to apply for a loan over the phone.

- In-Person:Visit a USAA branch to apply for a loan in person.

Loan Processing Times and Approval Factors

The processing time for USAA loan applications can vary depending on the loan type and the completeness of your application. Typically, it takes a few business days for USAA to review your application and make a decision. Factors that can influence the approval process include your credit score, income verification, and the amount of the loan you are requesting.

Loan Repayment Options and Flexibility

USAA offers various repayment options to accommodate different financial situations and preferences. The company also provides flexibility in terms of payment deferment, forbearance, and loan modification programs.

Looking for the best VA loan rates? We can help you find the lowest rates available. VA Loan Rates are often lower than conventional mortgage rates, making it easier for veterans to buy a home. Get a free quote today and see how much you can save.

Repayment Options for USAA Loans

- Monthly Payments:The most common repayment method involves making regular monthly payments until the loan is fully repaid.

- Lump Sum Payments:You may have the option to make a lump sum payment to reduce the principal balance or repay the loan in full.

- Early Repayment Options:USAA may allow you to repay the loan early without penalties, potentially saving on interest costs.

Flexibility in Repayment

USAA offers several programs to provide flexibility in loan repayment, including:

- Payment Deferment:This allows you to temporarily postpone loan payments under specific circumstances, such as military deployment or unemployment.

- Forbearance:Similar to deferment, forbearance allows you to temporarily reduce or suspend loan payments. However, interest may still accrue during this period.

- Loan Modification Programs:USAA may offer loan modification programs to adjust loan terms, such as extending the loan term or lowering the interest rate, to make payments more manageable.

Consequences of Late Payments and Default

Late payments on USAA loans can result in penalties, which can increase the overall cost of borrowing. If you fail to make payments according to the loan agreement, USAA may take legal action to collect the debt, potentially affecting your credit score and future borrowing opportunities.

Ready to buy your first home? House Loans can help you make your dream a reality. We offer a variety of loan options to fit your budget and needs, so you can find the perfect home loan for you.

USAA Loan Advantages and Disadvantages: Usaa Loans

USAA loans offer several advantages, particularly for military members and veterans. However, it’s essential to consider potential drawbacks before making a decision.

Advantages of USAA Loans

- Competitive Rates:USAA often offers competitive interest rates, especially for military members and veterans.

- Excellent Customer Service:USAA is known for its exceptional customer service, with dedicated support for military families.

- Special Benefits for Military Members:USAA provides unique benefits for military members, such as reduced interest rates, loan forgiveness programs, and financial counseling.

Potential Drawbacks of USAA Loans

- Limited Loan Options:Compared to some other financial institutions, USAA may have a more limited range of loan products.

- Stricter Eligibility Requirements:USAA’s membership requirement and credit score criteria may make it challenging for some applicants to qualify.

- Specific Limitations for Certain Loan Types:USAA may have specific limitations or requirements for certain loan types, such as home loans or business loans.

Comparison with Other Financial Institutions

While USAA offers competitive rates and excellent customer service, it’s crucial to compare loan options from other financial institutions, such as credit unions, banks, and online lenders, to find the best deal based on your individual needs and circumstances.

Need a quick loan of $5,000? We can help you find the best 5000 Loan options available. We compare loans from top lenders, so you can find the best rates and terms for your needs.

Customer Reviews and Experiences

Customer reviews and testimonials provide valuable insights into the overall experience of obtaining a USAA loan. These reviews can shed light on aspects like the loan approval process, interest rates, customer service, and overall satisfaction.

Understanding Loan Interest Rates is crucial when choosing a loan. We provide a comprehensive guide to help you compare rates and make the best decision for your financial situation.

Analysis of Customer Reviews

Customer reviews of USAA loans are generally positive, with many borrowers praising the company’s competitive rates, excellent customer service, and dedicated support for military families. However, some reviews highlight concerns about limited loan options, stricter eligibility requirements, and potential delays in the loan approval process.

Need cash fast? A Same Day Cash Advance can provide you with the funds you need, when you need them. We offer a quick and easy application process, so you can get the money you need in no time.

Insights from Customer Experiences, Usaa Loans

Positive reviews often mention the ease of the application process, the helpfulness of USAA representatives, and the quick processing times. Negative reviews may point to challenges in meeting eligibility criteria, difficulties in securing a loan, or issues with customer service responsiveness.

Overall Assessment of USAA’s Reputation and Customer Service

Based on available data, USAA maintains a strong reputation for its commitment to serving military members and veterans. The company’s customer service is generally well-regarded, with a focus on providing personalized support and guidance. However, it’s essential to research and compare loan options from different institutions to make the most informed decision.

Are you a member of the military? You may be eligible for special loan programs, like Military Loans. These loans often have lower interest rates and flexible terms, making it easier for military members to achieve their financial goals.

Alternatives to USAA Loans

While USAA offers valuable loan options for military members and veterans, other lenders may provide alternative financing solutions. Exploring these alternatives can help you find the best deal based on your individual needs and circumstances.

Alternative Lending Options for Military Members and Veterans

- Government-Backed Loans:The U.S. Department of Veterans Affairs (VA) offers home loans with favorable terms for eligible veterans, active duty military personnel, and surviving spouses.

- Credit Unions:Credit unions often offer competitive rates and personalized service to members, including those in the military community.

- Online Lenders:Online lenders provide a convenient way to compare loan options from various institutions, often with streamlined application processes.

Comparison with USAA Loans

When comparing alternatives to USAA loans, consider factors like interest rates, eligibility requirements, loan terms, and customer service. Government-backed loans often have lower interest rates and flexible terms but may have specific eligibility criteria. Credit unions offer competitive rates and personalized service, while online lenders provide convenience and a wider range of loan options.

Guidance on Choosing the Most Suitable Loan Option

The best loan option for you depends on your individual needs, credit score, loan amount, and financial situation. Consider researching and comparing loan options from different lenders to find the most suitable deal. Consulting with a financial advisor can provide valuable guidance in making informed decisions.

Closure

USAA Loans stands out as a reliable and trusted financial partner for military families, offering a unique blend of competitive rates, dedicated customer service, and a deep understanding of the military lifestyle. Whether you’re a current service member, a veteran, or a family member, USAA provides the financial resources and support you need to navigate life’s financial challenges and achieve your financial aspirations.

Thinking about buying a new home? A Mortgage Loan can help you finance your dream home. We offer a variety of mortgage loan options to fit your unique needs. Get a free quote today and start the home buying process.

FAQ Guide

What are the benefits of using USAA Loans?

USAA Loans offer competitive interest rates, dedicated customer service, and special benefits for military members, such as discounts and priority processing.

How do I apply for a USAA Loan?

You can apply for a USAA loan online, over the phone, or in person at a USAA branch. The application process is straightforward and typically involves providing personal information, income documentation, and credit history.

What are the credit score requirements for USAA Loans?

USAA’s credit score requirements vary depending on the type of loan you’re seeking. However, generally, a good credit score is beneficial for securing favorable loan terms.

Are there any fees associated with USAA Loans?

USAA Loans may have fees associated with loan origination, late payments, or early repayment. It’s essential to review the loan agreement carefully to understand any applicable fees.