Us Home Mortgage 2024 delves into the intricate landscape of the American housing market, examining the forces shaping mortgage rates, affordability, and the future of homeownership. From analyzing historical trends and predicting future movements in interest rates to exploring the diverse types of mortgages available, this comprehensive guide provides insights into the complexities of securing a home loan in today’s dynamic market.

Understanding the intricacies of the mortgage market is crucial for both potential homebuyers and those seeking to refinance existing loans. Whether you’re a first-time buyer, an experienced investor, or simply curious about the forces driving the housing market, this exploration offers a wealth of information and practical advice.

US Home Mortgage Market Overview in 2024

The US home mortgage market is a dynamic and complex landscape influenced by various economic factors, government policies, and consumer behavior. In 2024, the market is expected to navigate a path shaped by several key trends.

Current State of the US Home Mortgage Market

The US home mortgage market is currently experiencing a period of transition. After a surge in activity during the pandemic, the market has cooled somewhat, with rising interest rates and inflation impacting affordability and demand.

Want to know the latest bank rates? Stay informed with the current Bank Rates Today 2024 to find the best options.

Key Trends Shaping the Market in 2024

Several key trends are expected to shape the US home mortgage market in 2024, including:

- Interest Rate Volatility:Interest rates are expected to remain volatile throughout 2024, influenced by factors such as inflation, the Federal Reserve’s monetary policy, and global economic conditions.

- Affordability Concerns:Rising home prices and interest rates continue to pose affordability challenges for potential homebuyers, particularly first-time buyers.

- Shifting Housing Market Dynamics:The housing market is expected to experience a period of adjustment, with potential shifts in inventory levels, price growth, and buyer demand.

- Technological Advancements:The mortgage lending industry is increasingly embracing technology, with digital mortgage applications, online platforms, and automated processes becoming more prevalent.

Anticipated Impact of Economic Factors on Mortgage Rates and Affordability

Economic factors such as inflation, unemployment rates, and consumer confidence will continue to play a significant role in influencing mortgage rates and affordability in 2024. Rising inflation can lead to higher interest rates as the Federal Reserve attempts to control price increases.

First-time homebuyers, get a grasp on the current market with First Time Mortgage 2024 information and resources.

Potential for Growth or Contraction in the Market

The potential for growth or contraction in the US home mortgage market in 2024 will depend on a complex interplay of economic factors, interest rate movements, and consumer sentiment. If inflation cools and interest rates stabilize, the market could see increased activity and potential growth.

For veterans seeking the best loan rates, check out the current Best Va Loan Rates 2024 to find the right fit.

Mortgage Interest Rates and Predictions

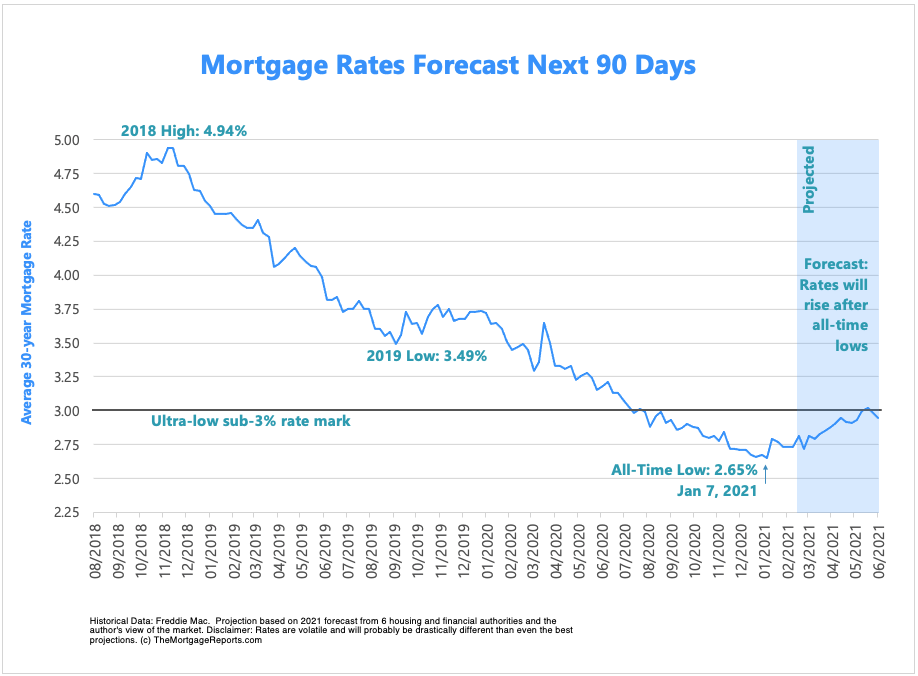

Mortgage interest rates have historically fluctuated based on a variety of factors, including economic conditions, inflation, and Federal Reserve policy.

Get a head start on your mortgage journey with Rocket Mortgage. Check out their Rocket Mortgage Pre Approval 2024 process.

Historical Trends of Mortgage Interest Rates

Over the past few decades, mortgage interest rates have experienced periods of both significant increases and decreases.

Freddie Mac is a major player in the mortgage market. Check out their current Freddie Mac Mortgage Rates 2024 to see what’s out there.

Factors Influencing Current Interest Rates

Several factors are influencing current mortgage interest rates, including:

- Federal Reserve Policy:The Federal Reserve’s monetary policy decisions, particularly its target for the federal funds rate, directly impact mortgage rates.

- Inflation:High inflation typically leads to higher interest rates as lenders seek to protect their returns against eroding purchasing power.

- Economic Growth:Strong economic growth can lead to higher interest rates as investors demand higher returns for their investments.

- Global Economic Conditions:Global economic events, such as international trade tensions or geopolitical instability, can also influence mortgage rates.

Predictions for Mortgage Interest Rate Movements Throughout 2024

Predicting mortgage interest rate movements is inherently challenging due to the complex interplay of economic factors. However, based on current trends and expert analysis, some analysts predict that mortgage rates could remain elevated throughout 2024, potentially fluctuating within a range of 5% to 7%.

Potential Impact of Federal Reserve Policies on Mortgage Rates

The Federal Reserve’s actions will have a significant impact on mortgage rates in 2024. If the Fed continues to raise interest rates to combat inflation, mortgage rates are likely to remain elevated. Conversely, if the Fed pauses or reverses its rate hikes, mortgage rates could potentially decline.

Home Affordability and Housing Market Dynamics

Home affordability is a critical concern for potential homebuyers, particularly in a market characterized by rising home prices and interest rates.

Looking for a 30-year fixed mortgage? Get the latest information on 30 Year Fixed Mortgage 2024 rates and options.

Affordability Challenges Facing Potential Homebuyers

Rising home prices and interest rates have significantly impacted home affordability, making it more challenging for potential homebuyers, especially first-time buyers, to enter the housing market.

Comparison of Current Housing Market Conditions to Historical Trends

The current housing market is experiencing a period of adjustment following a surge in activity during the pandemic. Compared to historical trends, home price appreciation has slowed, and inventory levels have increased somewhat, but affordability remains a significant challenge.

Impact of Rising Home Prices and Mortgage Rates on Affordability

The combined effect of rising home prices and mortgage rates has significantly reduced affordability for potential homebuyers. This has led to a decrease in demand in some segments of the market, particularly among first-time buyers.

Mr. Cooper is a well-known mortgage company. Explore their offerings and see what Mr Cooper Mortgage Company 2024 has to offer.

Potential for Shifts in Housing Market Dynamics

The housing market is expected to continue to adjust in 2024, with potential shifts in inventory levels, price growth, and buyer demand.

Types of Mortgages and Their Features

There are various types of mortgages available to homebuyers, each with its own unique features, benefits, and suitability for different situations.

Different Types of Mortgages Available to Homebuyers

Here are some common types of mortgages:

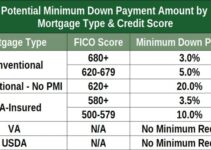

- Conventional Mortgages:These mortgages are not insured or guaranteed by the government. They typically require a higher credit score and down payment.

- Conforming Mortgages:These mortgages meet specific guidelines set by Fannie Mae and Freddie Mac, which are government-sponsored enterprises. They often have lower interest rates and more lenient qualifying requirements than non-conforming mortgages.

- Non-Conforming Mortgages:These mortgages do not meet the guidelines set by Fannie Mae and Freddie Mac. They typically have higher interest rates and more stringent qualifying requirements.

- Government-Backed Mortgages:These mortgages are insured or guaranteed by the government, such as FHA, VA, and USDA loans. They often have lower down payment requirements and more flexible qualifying guidelines.

- Adjustable-Rate Mortgages (ARMs):These mortgages have interest rates that adjust periodically based on a specific index. They can offer lower initial interest rates but may become more expensive over time if rates rise.

- Fixed-Rate Mortgages:These mortgages have interest rates that remain fixed for the entire loan term. They offer stability and predictability in monthly payments.

Key Features and Benefits of Each Mortgage Type

Each type of mortgage has its own unique features and benefits.

Learn about the specifics of Conventional Home Loan 2024 options and see if it’s right for you.

Comparison and Contrast of Suitability for Various Situations

The suitability of different mortgage types depends on individual circumstances, such as credit score, down payment amount, and financial goals.

Advantages and Disadvantages of Each Mortgage Type

Each type of mortgage has both advantages and disadvantages.

Navigating the Mortgage Application Process

The mortgage application process can seem daunting, but with proper preparation and understanding, it can be a smoother experience.

Steps Involved in the Mortgage Application Process

The mortgage application process typically involves several steps:

- Pre-Approval:Getting pre-approved for a mortgage can help you understand your borrowing power and make a stronger offer when purchasing a home.

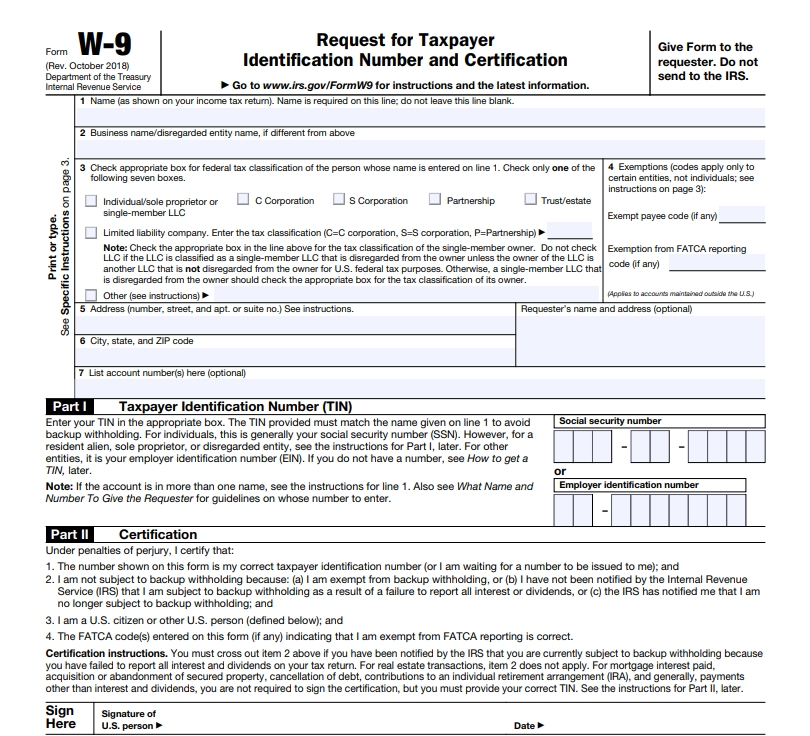

- Loan Application:Once you have found a home, you will need to submit a formal loan application to your chosen lender.

- Loan Underwriting:The lender will review your application and financial documents to determine your eligibility for a loan.

- Loan Closing:If your loan is approved, you will attend a closing meeting to sign the final loan documents.

Guidance on Preparing for a Mortgage Application

To prepare for a mortgage application, it is essential to:

- Check Your Credit Score:A good credit score is crucial for obtaining a favorable mortgage rate.

- Gather Financial Documents:Be ready to provide your lender with documentation such as pay stubs, bank statements, and tax returns.

- Save for a Down Payment:The amount of your down payment will affect your loan terms and eligibility.

Importance of Credit Scores and Financial History

Your credit score and financial history play a significant role in the mortgage application process. A higher credit score generally results in lower interest rates and more favorable loan terms.

Veterans, explore the current Veterans United Interest Rates 2024 to find the best loan options for you.

Tips for Securing the Best Mortgage Terms

To secure the best mortgage terms, consider the following tips:

- Shop Around:Compare rates and terms from multiple lenders to find the best deal.

- Improve Your Credit Score:Take steps to improve your credit score before applying for a mortgage.

- Negotiate:Don’t be afraid to negotiate with your lender for better terms.

Mortgage Lending Landscape and Key Players

The mortgage lending industry is a complex ecosystem with various players, each playing a crucial role in facilitating homeownership.

Thinking about a 30-year fixed mortgage? Stay up-to-date with the current Mortgage Rates Today 30 Year Fixed 2024 to see what’s out there.

Major Players in the Mortgage Lending Industry

Key players in the mortgage lending industry include:

- Banks:Traditional banks are major players in the mortgage lending market, offering a wide range of loan products and services.

- Credit Unions:Credit unions are member-owned financial institutions that often offer competitive mortgage rates and personalized service.

- Mortgage Lenders:Specialized mortgage lenders focus exclusively on providing mortgage loans and may offer more flexible options or niche products.

Role of Banks, Credit Unions, and Mortgage Lenders

Each player in the mortgage lending industry has a distinct role:

- Banks:Banks typically offer a wide range of mortgage products, including conventional, conforming, and non-conforming loans.

- Credit Unions:Credit unions often focus on providing competitive rates and personalized service to their members.

- Mortgage Lenders:Specialized mortgage lenders may offer more flexible loan options, such as jumbo loans or loans for borrowers with less-than-perfect credit.

Impact of Technology on the Mortgage Lending Landscape

Technology is transforming the mortgage lending landscape, with digital mortgage applications, online platforms, and automated processes becoming increasingly common.

Analysis of the Competitive Landscape Within the Mortgage Industry

The mortgage industry is highly competitive, with lenders vying for borrowers through competitive rates, flexible terms, and innovative products.

Government Programs and Support for Homeownership

The US government offers various programs designed to support homeownership, making it more accessible for eligible individuals and families.

Want the stability of a fixed rate? Research Fixed Interest Rate Home Loan 2024 options to secure your payments.

Government Programs Aimed at Supporting Homeownership

Here are some key government programs:

- Federal Housing Administration (FHA) Loans:FHA loans are insured by the government, making them more accessible to borrowers with lower credit scores or down payments.

- Department of Veterans Affairs (VA) Loans:VA loans are available to eligible veterans, active-duty military personnel, and surviving spouses.

- United States Department of Agriculture (USDA) Loans:USDA loans are designed to support homeownership in rural areas.

Eligibility Requirements for These Programs, Us Home Mortgage 2024

Each government program has specific eligibility requirements, such as income limits, credit score thresholds, and property location.

Considering a mortgage with Bank of America? Take a look at the current Bank Of America Mortgage Rates 2024 to compare.

Benefits and Potential Drawbacks of Government-Backed Mortgages

Government-backed mortgages offer several benefits, including lower down payment requirements, more flexible qualifying guidelines, and potentially lower interest rates.

Examples of Successful Homeownership Programs

The government has implemented various successful homeownership programs over the years, including the Community Reinvestment Act, which encourages banks to invest in low- and moderate-income communities, and the HOPE VI program, which aims to revitalize public housing communities.

Secu offers mortgage options. Explore their Secu Mortgage Rates 2024 to see what’s available.

Future Outlook for the US Home Mortgage Market: Us Home Mortgage 2024

The future of the US home mortgage market is likely to be shaped by a combination of economic trends, demographic shifts, and technological advancements.

Predictions for the Future of the US Home Mortgage Market

The US home mortgage market is expected to continue to evolve in the coming years, influenced by factors such as:

- Interest Rate Trends:Mortgage rates are likely to remain volatile, influenced by inflation and Federal Reserve policy.

- Housing Market Dynamics:The housing market is expected to experience a period of adjustment, with potential shifts in inventory levels, price growth, and buyer demand.

- Technological Advancements:The mortgage lending industry is expected to continue to embrace technology, with digital mortgage applications, online platforms, and automated processes becoming more prevalent.

Potential Challenges and Opportunities Facing the Industry

The mortgage lending industry faces several challenges, including:

- Rising Interest Rates:Higher interest rates can reduce affordability and dampen demand for mortgages.

- Economic Uncertainty:Economic downturns or recessions can lead to higher loan delinquencies and defaults.

- Competition:The mortgage lending industry is highly competitive, with lenders vying for borrowers through competitive rates, flexible terms, and innovative products.

Analysis of the Long-Term Impact of Demographic Shifts on the Housing Market

Demographic shifts, such as an aging population and increasing urbanization, will continue to influence the housing market.

Looking to secure a home loan from St. George? Check out the current St. George Home Loan Rates 2024 to see what’s available.

Identification of Key Factors That Will Shape the Future of Homeownership

Key factors that will shape the future of homeownership include:

- Economic Growth:Strong economic growth can create more job opportunities and increase demand for housing.

- Government Policies:Government policies, such as tax incentives or regulations, can influence affordability and accessibility of homeownership.

- Technological Advancements:Technology is transforming the housing market, with online platforms, smart homes, and sustainable building practices becoming more common.

Final Summary

As the housing market continues to evolve, staying informed about the latest trends and developments is essential. From understanding the impact of economic factors on mortgage rates to navigating the complexities of the mortgage application process, this guide provides a comprehensive overview of the key considerations for those seeking to achieve their homeownership goals in 2024.

Understanding current mortgage rates is crucial for any homebuyer. Explore the latest Mortgage Loan Rates 2024 to make informed decisions.

FAQ Insights

What is the current average mortgage interest rate?

The average mortgage interest rate fluctuates daily, so it’s best to check with a mortgage lender for the most up-to-date information.

How do I improve my credit score to qualify for a better mortgage rate?

Pay bills on time, keep credit utilization low, and avoid opening too many new credit accounts.

What are some government programs that can help me buy a home?

The Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the USDA Rural Development program offer programs for qualified borrowers.