Urgent Cash Loans are a lifeline for those facing unexpected financial emergencies. These loans, often characterized by quick approval and fast disbursement, offer immediate access to funds when traditional lending options prove too slow or restrictive. Whether it’s a medical bill, car repair, or unexpected expense, urgent cash loans provide a solution for those in need.

Are you planning a home renovation? A Home Renovation Loan can help you finance your project. These loans are designed specifically for home improvement projects, and they can be a great way to get the money you need to make your home dreams a reality.

However, it’s crucial to understand the intricacies of these loans, including their various types, eligibility criteria, and potential downsides. This guide delves into the world of urgent cash loans, providing insights into responsible borrowing practices and alternative financing options.

Looking for a loan with a low APR? You can find out more about Low Apr Loans. These loans typically have lower interest rates than traditional loans, which can save you money over the life of the loan.

What are Urgent Cash Loans?

Urgent cash loans are a type of short-term loan designed to provide individuals with quick access to funds when they face unexpected financial emergencies. Unlike traditional loans, which often require extensive paperwork and a longer processing time, urgent cash loans are typically processed quickly and can be disbursed within hours or even minutes.

Oportun offers loans to borrowers with limited credit history. These loans can be a good option for borrowers who are looking to build their credit or who need access to credit quickly. You can learn more about Oportun loans by checking out Oportun Loan.

Characteristics of Urgent Cash Loans

Urgent cash loans are characterized by:

- Smaller Loan Amounts:Urgent cash loans typically range from a few hundred dollars to a few thousand dollars, depending on the lender and the borrower’s financial situation.

- Short Repayment Terms:These loans typically have repayment terms ranging from a few weeks to a few months, often with a single lump-sum payment due at the end of the term.

- Higher Interest Rates:Due to the short-term nature and the risk associated with lending to borrowers in urgent situations, urgent cash loans usually come with significantly higher interest rates compared to traditional loans.

Common Situations for Urgent Cash Loans

Individuals might need urgent cash loans for various reasons, such as:

- Unexpected Medical Expenses:Covering unexpected medical bills or procedures.

- Car Repairs:Addressing sudden car breakdowns or repairs.

- Home Repairs:Handling urgent repairs or maintenance issues for a home.

- Unexpected Bills:Paying for unexpected utility bills, rent, or other essential expenses.

- Emergency Travel:Covering unexpected travel costs due to family emergencies or other unforeseen events.

Types of Urgent Cash Loans

Several types of urgent cash loans are available, each with its own set of features, benefits, and drawbacks. Some common types include:

Payday Loans, Urgent Cash Loans

Payday loans are short-term loans typically due on the borrower’s next payday. They are often characterized by very high interest rates and fees. Borrowers typically write a post-dated check to the lender, which is cashed on the due date. Payday loans are often seen as a last resort due to their high costs.

Need to borrow money? You can find out about different loan options by checking out Borrow Money. This site will help you compare different loan types and find the best option for your needs.

Installment Loans

Installment loans allow borrowers to repay the loan amount in regular installments over a set period, typically several months. While installment loans generally have lower interest rates than payday loans, they still tend to be more expensive than traditional loans.

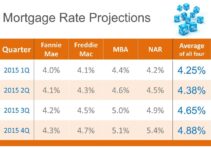

Home mortgage interest rates can fluctuate frequently, so it’s important to stay informed about the current rates. You can check out Home Mortgage Interest Rates to see what rates are currently available.

Cash Advances

Cash advances are loans offered by credit card companies, allowing cardholders to withdraw cash against their credit limit. Cash advances typically come with high interest rates and fees. It’s important to note that these loans can quickly accumulate debt if not managed responsibly.

A Lifetime Mortgage can be a good option for homeowners who want to stay in their homes for the rest of their lives. These loans are designed to be repaid from the proceeds of the sale of your home after you pass away.

Reputable Lenders

When considering urgent cash loans, it’s crucial to choose a reputable lender. Some examples of reputable lenders offering urgent cash loans include:

- Online Lenders:Many online lenders offer quick and convenient loan options, often with transparent terms and conditions.

- Credit Unions:Credit unions often provide more affordable loan options compared to traditional banks, particularly for members.

- Community Organizations:Some community organizations offer emergency financial assistance programs that can provide short-term loans or grants.

Eligibility and Requirements

To be eligible for an urgent cash loan, borrowers typically need to meet certain criteria and provide required documentation. These criteria and requirements can vary depending on the lender, but some common factors include:

Eligibility Criteria

- Age:Most lenders require borrowers to be at least 18 years old.

- Income:Borrowers typically need to demonstrate a regular income source to show their ability to repay the loan.

- Bank Account:A valid bank account is usually required for loan disbursement and repayment.

- Social Security Number:Lenders typically require a Social Security number for verification and credit checks.

Required Documentation

To apply for an urgent cash loan, borrowers usually need to provide the following documents:

- Proof of Identity:A driver’s license, passport, or other government-issued identification.

- Proof of Income:Pay stubs, bank statements, or tax returns.

- Proof of Residence:Utility bills, bank statements, or lease agreements.

Credit Score Impact

Credit score plays a significant role in loan approval and interest rates. Borrowers with good credit scores are typically more likely to be approved for loans and may qualify for lower interest rates. Conversely, borrowers with poor credit scores may face higher interest rates or even loan denials.

Pros and Cons of Urgent Cash Loans

Urgent cash loans can be a helpful option in emergencies, but it’s essential to weigh the pros and cons carefully before making a decision.

Looking for the best car loan rates? You can check out Best Car Loan Rates Today to see what rates are currently available. It’s important to compare rates from multiple lenders to get the best deal.

Pros

- Quick Access to Funds:Urgent cash loans can provide quick access to funds, often within hours or even minutes, which can be crucial in emergency situations.

- Flexibility in Repayment:Some lenders offer flexible repayment options, such as allowing borrowers to make partial payments or extend the repayment term.

- No Collateral Required:Most urgent cash loans do not require collateral, making them accessible to individuals who may not have assets to pledge.

Cons

- High Interest Rates:Urgent cash loans typically come with significantly higher interest rates than traditional loans, which can lead to substantial debt accumulation if not managed responsibly.

- Short Repayment Terms:The short repayment terms of urgent cash loans can make it challenging to repay the loan on time, especially if the borrower faces financial difficulties.

- Potential Debt Traps:Due to high interest rates and short repayment terms, borrowers can easily find themselves in a cycle of debt, taking out new loans to repay existing ones.

Pros and Cons Comparison Table

| Feature | Urgent Cash Loans | Traditional Loans |

|---|---|---|

| Interest Rates | High | Lower |

| Repayment Terms | Short | Longer |

| Loan Amounts | Smaller | Larger |

| Approval Process | Fast | Slower |

| Collateral Required | Typically Not | Often Required |

Responsible Borrowing and Repayment

Borrowing responsibly is crucial when considering urgent cash loans. Here are some tips for responsible borrowing and repayment:

Tips for Responsible Borrowing

- Compare Loan Offers:Compare offers from multiple lenders to find the most competitive interest rates and terms.

- Read the Fine Print:Carefully review the loan agreement, including the interest rates, fees, and repayment terms, before signing.

- Budget for Repayment:Create a realistic budget that includes the loan repayment amount to ensure you can afford the monthly payments.

- Consider Alternatives:Explore alternative financing options before resorting to urgent cash loans, such as personal loans, credit cards, or borrowing from family or friends.

Understanding Repayment Obligations

It’s essential to understand your repayment obligations and make payments on time to avoid late fees and potential damage to your credit score. Be aware of the due date and ensure you have sufficient funds to make the payment.

Managing Debt and Avoiding Financial Hardship

If you’re struggling to manage your debt, seek professional help from a credit counselor or financial advisor. They can provide guidance on debt management strategies and help you create a plan to get back on track.

If you need a quick loan and don’t want to go through a credit check, you can check out Quick Loans No Credit Check. These loans are typically short-term and have high interest rates, so they should only be used as a last resort.

Alternatives to Urgent Cash Loans

While urgent cash loans can provide a quick solution in emergencies, exploring alternative financing options can often be more beneficial in the long run.

Personal Loans

Personal loans offer fixed interest rates and longer repayment terms than urgent cash loans, making them a more affordable option for larger expenses or longer-term needs.

If you’re struggling with high-interest debt, Debt Consolidation can help. This involves combining multiple debts into a single loan with a lower interest rate.

Credit Cards

Credit cards can be a convenient option for unexpected expenses, but it’s essential to use them responsibly and avoid accumulating high balances.

If you’re a first-time homebuyer, you may want to consider an FHA loan. These loans are insured by the Federal Housing Administration, and they can be a great option for borrowers with lower credit scores or a smaller down payment.

You can learn more about these loans by checking out Fha Loan.

Borrowing from Family or Friends

Borrowing from family or friends can be a good option for smaller amounts, but it’s important to set clear repayment terms and avoid straining relationships.

If you’re a veteran, you may be eligible for a VA loan. These loans are backed by the Department of Veterans Affairs, and they can offer lower interest rates and other benefits. You can find out more about VA loan rates by checking out Va Loan Rates Today.

Comparing Alternatives

| Feature | Personal Loans | Credit Cards | Borrowing from Family or Friends |

|---|---|---|---|

| Interest Rates | Lower than Urgent Cash Loans | Variable, can be high | Often interest-free, but can strain relationships |

| Repayment Terms | Longer than Urgent Cash Loans | Minimum payments, can take years to repay | Negotiable, but can be challenging |

| Loan Amounts | Larger than Urgent Cash Loans | Limited by credit limit | Limited by personal relationships |

Seeking Financial Guidance: Urgent Cash Loans

If you’re facing financial difficulties or need guidance on debt management, several resources can provide support and assistance.

Bank of America offers a Home Equity Line of Credit (HELOC) that can be a good option for homeowners who need to borrow money against their home equity. You can find out more about this product by checking out Bank Of America Heloc.

Financial Counseling and Debt Consolidation Services

- National Foundation for Credit Counseling (NFCC):Offers free and confidential credit counseling services, including debt management plans and budgeting advice.

- Consumer Credit Counseling Service (CCCS):Provides credit counseling and debt consolidation services, helping individuals manage debt and improve their financial well-being.

- Local Community Organizations:Many local community organizations offer financial assistance programs and counseling services to individuals in need.

Responsible Financial Planning and Budgeting

To avoid the need for urgent cash loans in the future, it’s essential to practice responsible financial planning and budgeting. This includes creating a realistic budget, tracking your expenses, and saving for emergencies.

Outcome Summary

While urgent cash loans can be a valuable resource in times of need, it’s essential to approach them with caution. Thoroughly understand the loan terms, repayment obligations, and potential consequences of high interest rates. Exploring alternative financing options and seeking financial guidance can help you make informed decisions and avoid unnecessary financial strain.

Remember, responsible borrowing and financial planning are key to navigating unexpected expenses and achieving long-term financial stability.

User Queries

What are the typical interest rates for urgent cash loans?

Interest rates for urgent cash loans can vary widely, but they are generally higher than traditional loans due to the higher risk associated with short-term lending. Expect rates ranging from 100% to 500% APR or more.

If you need some quick cash, you can check out Speedy Cash Near Me. This site will help you find lenders in your area who offer quick cash loans. Remember to be aware of the terms and conditions of any loan before you take it out.

What are the potential consequences of defaulting on an urgent cash loan?

Are you looking to buy a home? You can find out what the current 30-year mortgage rates are by checking out 30 Year Mortgage Rates Today. Rates can change frequently, so it’s important to stay up-to-date.

Defaulting on an urgent cash loan can lead to several negative consequences, including:

- Additional fees and penalties

- Damage to your credit score

- Collection efforts by the lender

- Potential legal action

What are some tips for managing debt from urgent cash loans?

Need a personal loan? You can find out what options are available to you by checking out Personal Loans Near Me. You can find lenders in your area and compare their rates and terms.

Here are some tips for managing debt from urgent cash loans:

- Create a budget and stick to it.

- Prioritize repayment of high-interest debt.

- Consider debt consolidation or a balance transfer to lower interest rates.

- Seek professional financial counseling if needed.