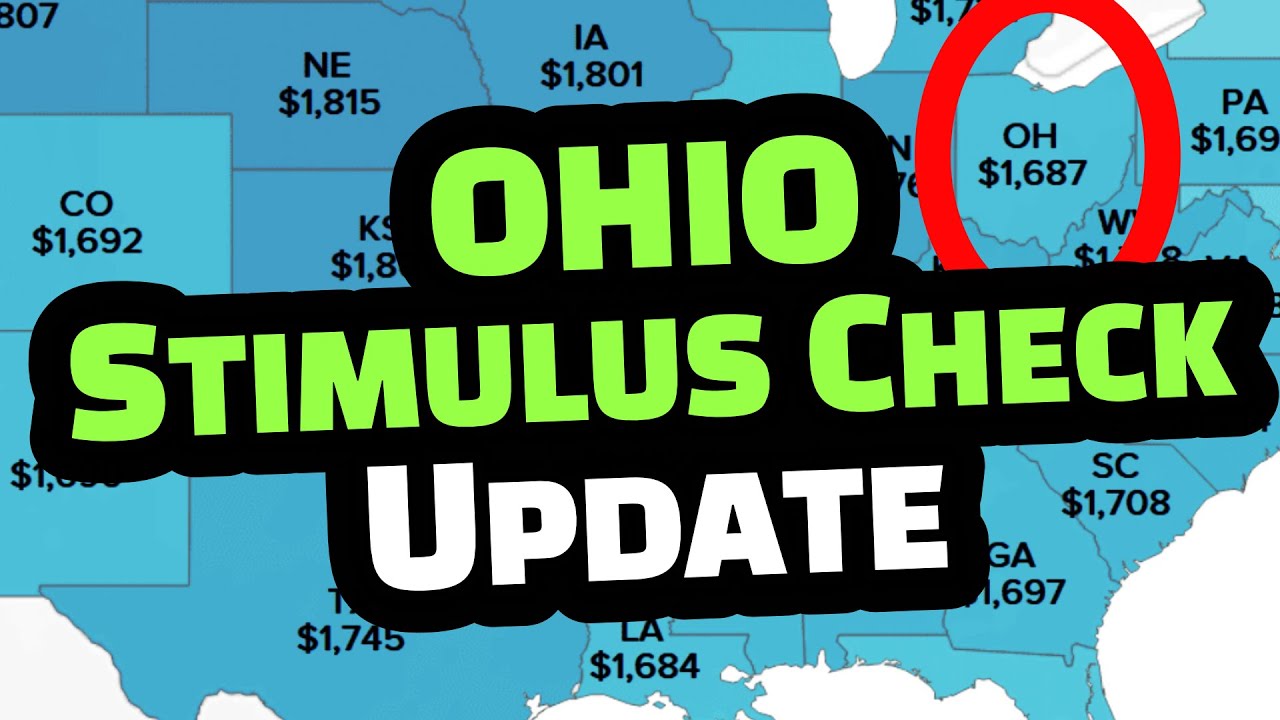

Troubleshooting Common Stimulus Check Application Issues in Ohio can be a frustrating experience, but with the right information and guidance, navigating the process can be less stressful. This guide provides insights into common issues, practical troubleshooting tips, and resources to help Ohio residents overcome hurdles and receive the stimulus checks they are entitled to.

Whether you’re facing issues with eligibility requirements, application processes, or encountering delays, this comprehensive guide offers solutions and strategies to address a range of common challenges. By understanding the process, identifying potential problems, and knowing where to seek assistance, you can confidently navigate the stimulus check application journey in Ohio.

Eligibility Requirements for Stimulus Checks in Ohio

Ohio residents who meet specific criteria may be eligible for stimulus checks. These checks are designed to provide financial assistance to individuals and families affected by economic hardship. The eligibility requirements are based on factors such as income, dependents, and filing status.

Understanding these requirements is crucial to determine whether you qualify for the stimulus check.

Discover how Stimulus Checks Application Process in Ohio has transformed methods in this topic.

Income Thresholds and Other Eligibility Factors

The eligibility for stimulus checks in Ohio is determined by income thresholds and other factors. The income thresholds are based on the Adjusted Gross Income (AGI) reported on your federal tax return. These thresholds vary depending on your filing status and the number of dependents you claim.

In addition to income, other factors that may affect eligibility include:

- Filing Status:Your filing status, such as single, married filing jointly, or head of household, impacts the income thresholds.

- Dependents:The number of dependents you claim on your tax return can also influence your eligibility.

- Age:While age is not a direct eligibility factor, certain age groups, such as children or seniors, may have specific eligibility requirements.

- Citizenship or Residency Status:You must be a U.S. citizen, lawful permanent resident, or meet specific residency requirements to be eligible.

Who Qualifies for Stimulus Checks

Here is a detailed breakdown of individuals and families who typically qualify for stimulus checks in Ohio:

- Individuals with low or moderate income:Those who earn below the established income thresholds are generally eligible.

- Families with dependents:Families with children, elderly parents, or other dependents may qualify, even if their income is higher than the single-person threshold.

- Seniors and disabled individuals:These groups often have special eligibility requirements, so it’s important to check specific guidelines.

Who Does Not Qualify for Stimulus Checks

While many Ohio residents may be eligible, there are some individuals who typically do not qualify for stimulus checks. These include:

- Individuals with high income:Those exceeding the established income thresholds generally do not qualify.

- Non-residents:Individuals who are not residents of Ohio are typically not eligible.

- Certain dependents:Dependents who are not claimed on a tax return may not be eligible for stimulus checks.

Application Process for Stimulus Checks in Ohio

The application process for stimulus checks in Ohio is designed to be straightforward and accessible. You can apply through various methods, including online, mail, or phone. Following these steps will help you navigate the application process efficiently:

Step-by-Step Guide for Applying

- Gather Necessary Information:Collect your Social Security number, income information from your tax return, and any other required documents.

- Choose Your Application Method:You can apply online through the Ohio Department of Taxation website, by mail using a paper application, or by phone through a designated hotline.

- Complete the Application:Carefully fill out all the required fields on the application form, ensuring accuracy and completeness.

- Submit Your Application:Submit your completed application through your chosen method, whether online, by mail, or by phone.

- Track Your Application:After submitting your application, you can track its status online or by phone.

Common Application Issues

While the application process is designed to be user-friendly, some common issues may arise during the application process. Understanding these issues and their solutions can help you avoid delays or complications.

Table of Common Application Issues

| Issue | Cause | Solution | Example |

|---|---|---|---|

| Incorrect Information | Mistakes in providing your Social Security number, income details, or other personal information. | Double-check all the information you enter on the application form. | Entering the wrong birthdate or Social Security number. |

| Missing Documents | Failing to provide required documents, such as tax returns or proof of identity. | Gather all the necessary documents before starting the application process. | Not submitting a copy of your tax return. |

| Technical Glitches | Experiencing technical issues with the online application portal or phone system. | Try refreshing the page, clearing your browser cache, or contacting customer support for assistance. | The website crashing or the phone line being busy. |

| Application Errors | Submitting an incomplete or inaccurate application. | Review your application thoroughly before submitting it. | Missing a required field or providing incorrect information. |

Troubleshooting Tips

Encountering application issues can be frustrating, but there are practical steps you can take to resolve them. Here are some troubleshooting tips to guide you through the process:

Troubleshooting Flowchart

The following flowchart illustrates the troubleshooting process for various scenarios:

[A flowchart should be inserted here, depicting the troubleshooting process. It should visually represent the steps involved in identifying and resolving common application issues. The flowchart should include decision points, actions to take, and potential outcomes. For example, the flowchart could start with “Application Issue Encountered?” and branch out to different issues like “Incorrect Information,” “Missing Documents,” or “Technical Glitches.” Each branch would then guide the user through specific troubleshooting steps.

You also can understand valuable knowledge by exploring Common Mistakes New Yorkns Avoid When Applying for a Stimulus Check.

The flowchart should be clear, concise, and easy to follow.]

You also can understand valuable knowledge by exploring Stimulus Check Application Process for Deceased Individuals in New York.

Helpful Resources and Contact Information

If you are unable to resolve application issues on your own, several resources are available to assist you. You can contact the Ohio Department of Taxation for assistance with your application. Their website provides contact information, including phone numbers and email addresses.

Additionally, local community organizations and financial literacy programs may offer support and guidance.

Status Updates and Delays

Once you have submitted your application, you can track its status and progress. The Ohio Department of Taxation provides tools to check the status of your application online or by phone. However, processing stimulus checks can sometimes take time, leading to delays.

Here are some common reasons for delays and potential solutions:

Common Delays and Solutions, Troubleshooting Common Stimulus Check Application Issues in Ohio

- High Application Volume:A surge in applications can lead to processing delays. Solution:Be patient and allow sufficient time for your application to be processed.

- Incomplete or Inaccurate Information:Missing or incorrect information on your application can cause delays. Solution:Double-check your application for accuracy and completeness.

- Verification Process:The Ohio Department of Taxation may need to verify your information, which can take time. Solution:Provide any requested documentation promptly to expedite the process.

- Technical Issues:Technical problems with the application system can cause delays. Solution:Contact customer support for assistance if you encounter any technical issues.

Appeals and Recourse: Troubleshooting Common Stimulus Check Application Issues In Ohio

If your stimulus check application is denied, you have the right to appeal the decision. The Ohio Department of Taxation Artikels the appeal process on its website. You can submit an appeal in writing, explaining the reasons for your disagreement with the denial.

The appeal process involves reviewing your application, gathering additional evidence, and presenting your case. Here are some options for seeking recourse if your application is rejected:

Appealing a Denied Application

The appeal process typically involves the following steps:

- Submit an Appeal:File a written appeal within a specified timeframe, outlining your reasons for disagreement.

- Provide Supporting Documentation:Gather any relevant evidence to support your appeal, such as tax returns, income statements, or other documentation.

- Review and Decision:The Ohio Department of Taxation will review your appeal and supporting documents and make a decision.

- Notification of Decision:You will be notified of the decision on your appeal in writing.

Successful Appeals and Strategies

Examples of successful appeals often involve providing compelling evidence to support the claim for eligibility. This might include documentation of income, dependents, or other factors that demonstrate your eligibility for the stimulus check. Appeals that clearly articulate the reasons for disagreement and present strong evidence are more likely to be successful.

Investigate the pros of accepting What to Do if You Missed the New York Stimulus Check Deadline in your business strategies.

Final Summary

Navigating the stimulus check application process in Ohio can be complex, but understanding the common issues, troubleshooting tips, and available resources can make a significant difference. By staying informed, proactive, and seeking assistance when needed, you can increase your chances of successfully receiving the stimulus checks you are eligible for.

Browse the implementation of Applying for a Stimulus Check by Mail in New York in real-world situations to understand its applications.

Remember, patience, persistence, and the right information are key to overcoming any obstacles you may encounter.

Obtain direct knowledge about the efficiency of Stimulus Check Application Process for Those with Limited Internet Access in New York through case studies.

FAQ Explained

How do I check the status of my stimulus check application?

You can check the status of your application online through the Ohio Department of Taxation website or by calling their customer service line.

What should I do if my application is denied?

If your application is denied, you can appeal the decision by submitting a written request to the Ohio Department of Taxation. Be sure to include supporting documentation that explains why you believe you are eligible for the stimulus check.

Can I apply for a stimulus check if I am a non-resident of Ohio?

No, you must be a resident of Ohio to be eligible for the stimulus check. The eligibility requirements are specific to the state.

What happens if I receive a stimulus check but I am not eligible?

If you received a stimulus check in error, you may be required to repay the amount. It is essential to contact the Ohio Department of Taxation to clarify your situation and determine the appropriate course of action.