Troubleshooting Common Stimulus Check Application Issues in Illinois sets the stage for this informative guide, providing insights into navigating the process of applying for stimulus checks in Illinois. This article delves into common errors encountered, offering solutions and strategies to ensure a smooth application experience.

When investigating detailed guidance, check out Florida Stimulus Check Program FAQs and Clarifications now.

Receiving a stimulus check can be a vital financial lifeline, but the application process can sometimes present unexpected hurdles. From eligibility requirements to common application errors, this guide will equip you with the knowledge to overcome these challenges and maximize your chances of receiving your rightful stimulus funds.

Understanding Stimulus Check Eligibility in Illinois

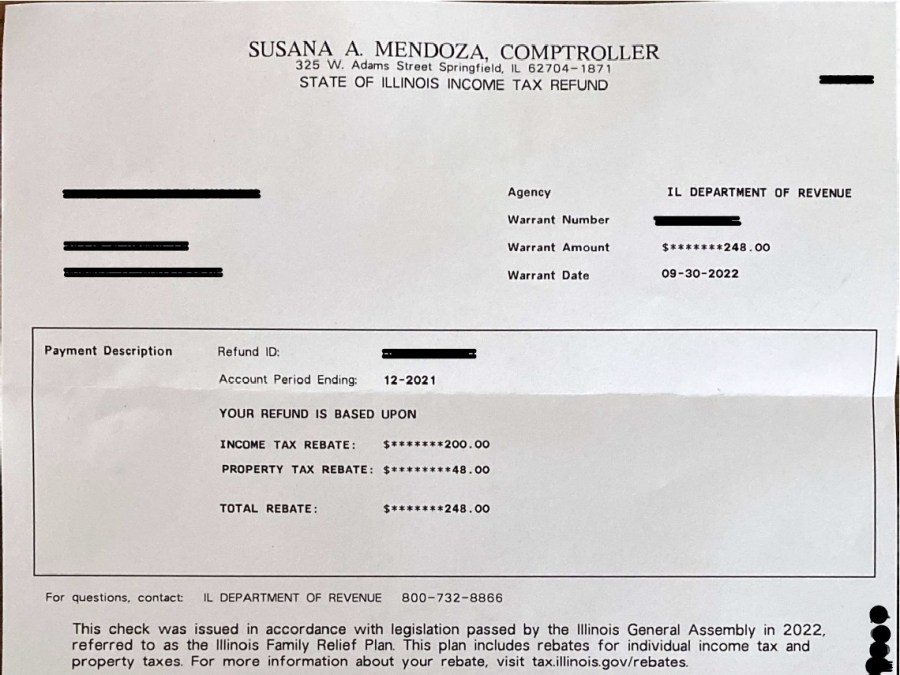

The Illinois stimulus check program, formally known as the “Illinois Emergency Relief and Recovery Program,” was designed to provide financial assistance to residents impacted by the COVID-19 pandemic. To qualify for the stimulus checks, Illinois residents had to meet specific eligibility criteria, which included income thresholds and filing status requirements.

You also can investigate more thoroughly about Stimulus Check Program and the Upcoming Election in Florida to enhance your awareness in the field of Stimulus Check Program and the Upcoming Election in Florida.

The amount of the stimulus check received varied based on individual circumstances.

Finish your research with information from Stimulus Checks Application Process in Illinois.

Eligibility Criteria

To be eligible for the Illinois stimulus check, residents needed to meet the following requirements:

- Be a resident of Illinois

- Have filed an Illinois income tax return for the 2020 tax year

- Have an adjusted gross income (AGI) below a certain threshold, which varied depending on filing status

Income Thresholds and Filing Status Requirements

The income thresholds for eligibility were as follows:

| Filing Status | AGI Threshold |

|---|---|

| Single | $75,000 |

| Married Filing Jointly | $150,000 |

| Head of Household | $112,500 |

Stimulus Check Amounts

The amount of the stimulus check received varied based on income and filing status. For example, single filers with an AGI below $25,000 received a $375 stimulus check, while those with an AGI between $25,000 and $75,000 received a prorated amount.

Remember to click Florida Stimulus Check Program Compared to Other States to understand more comprehensive aspects of the Florida Stimulus Check Program Compared to Other States topic.

Common Stimulus Check Application Issues

While the application process for the Illinois stimulus check was generally straightforward, some individuals encountered issues that resulted in delays or rejections. These issues often stemmed from errors in the application itself or problems with verifying the applicant’s identity and income information.

Application Errors

Some common application errors included:

- Incorrect or missing personal information

- Inaccurate income reporting

- Incorrect filing status

- Incomplete or missing supporting documentation

Reasons for Rejection or Delays

Common reasons for application rejection or delays included:

- Failure to meet eligibility criteria

- Inability to verify identity or income information

- Submission of incomplete or inaccurate documentation

- Duplicate applications

Issues Related to Identification Verification, Income Documentation, and Filing Status

Problems with identification verification, income documentation, and filing status were among the most frequent issues encountered during the application process. These issues could arise from:

- Missing or expired identification documents

- Inaccurate or incomplete income documentation, such as tax returns or pay stubs

- Conflicting information regarding filing status

Troubleshooting Application Errors

If you encountered issues with your Illinois stimulus check application, troubleshooting the problem was crucial. Here’s a step-by-step guide to help you resolve common application errors:

Step-by-Step Guide for Troubleshooting

- Review the Application:Carefully review your application for any errors or omissions. Double-check your personal information, income details, and filing status. Ensure all required fields are completed accurately.

- Verify Identification:Ensure your identification documents are valid and current. If you’re experiencing issues with identification verification, contact the Illinois Department of Revenue for assistance.

- Gather Supporting Documentation:Collect all necessary income documentation, such as tax returns, pay stubs, or other relevant financial records. Ensure these documents are accurate and complete.

- Contact the Illinois Department of Revenue:If you’re unable to resolve the issue independently, contact the Illinois Department of Revenue for assistance. They can provide guidance on addressing specific application errors and offer support in resolving verification issues.

Error Messages, Causes, and Solutions

| Error Message | Cause | Solution |

|---|---|---|

| Application rejected due to ineligibility | Failure to meet income or other eligibility criteria | Review the eligibility requirements and ensure you meet them. Contact the Illinois Department of Revenue for clarification if needed. |

| Unable to verify identity | Missing or expired identification documents, incorrect information | Provide valid and current identification documents. Contact the Illinois Department of Revenue if you need assistance with verification. |

| Income information not verified | Missing or inaccurate income documentation, discrepancies in reported income | Provide accurate and complete income documentation. Contact the Illinois Department of Revenue if you need assistance with verification. |

| Incorrect filing status | Incorrectly selected filing status | Review your filing status and ensure it’s accurate. Contact the Illinois Department of Revenue for clarification if needed. |

| Duplicate application | Submitting multiple applications | Ensure you’ve only submitted one application. Contact the Illinois Department of Revenue if you believe you’ve submitted duplicate applications. |

Resources and Contact Information

For assistance with Illinois stimulus check applications, you can contact the following resources:

- Illinois Department of Revenue:Website: https://www.revenue.illinois.gov/ , Phone: (800) 732-8866

- Illinois Emergency Relief and Recovery Program:Website: https://www.illinois.gov/dceo/Pages/Emergency-Relief-and-Recovery-Program.aspx

- United Way of Illinois:Website: https://www.unitedwayillinois.org/ , Phone: (312) 424-4000

Preventing Future Application Problems

To avoid common application issues in the future, it’s essential to take preventive measures. Here are some tips to ensure accurate and complete information is submitted and to maintain proper records:

Tips for Avoiding Common Mistakes

- Review Eligibility Requirements:Before applying for any government program, thoroughly review the eligibility requirements to ensure you qualify. This will prevent unnecessary delays or rejections.

- Gather Necessary Documentation:Collect all required documentation, such as identification, income verification, and other relevant documents, before starting the application process. This will ensure you have everything you need readily available.

- Double-Check Information:Carefully review all information you enter on the application form. Ensure all details, including personal information, income, and filing status, are accurate and complete.

- Maintain Records:Keep copies of all documentation you submit, including your application form and supporting documents. This will help you track the status of your application and provide proof of submission if needed.

Best Practices for Maintaining Records, Troubleshooting Common Stimulus Check Application Issues in Illinois

Here are some best practices for maintaining records related to government programs:

- Keep Documents Organized:Store all relevant documents in a secure and organized manner, preferably in a dedicated file or folder.

- Use a Filing System:Implement a filing system that allows you to easily retrieve documents when needed. This could involve using folders, labels, or a digital filing system.

- Back Up Documents:Make copies of important documents and store them in a separate location, such as a safe deposit box or cloud storage. This will ensure you have access to them even if the originals are lost or damaged.

Additional Resources and Information: Troubleshooting Common Stimulus Check Application Issues In Illinois

For more information and resources related to Illinois stimulus checks and other government programs, you can refer to the following websites and organizations:

Relevant Websites and Organizations

- Illinois Department of Revenue: https://www.revenue.illinois.gov/

- Illinois Emergency Relief and Recovery Program: https://www.illinois.gov/dceo/Pages/Emergency-Relief-and-Recovery-Program.aspx

- United Way of Illinois: https://www.unitedwayillinois.org/

- Internal Revenue Service (IRS): https://www.irs.gov/

- Federal Emergency Management Agency (FEMA): https://www.fema.gov/

Official Publications and Guides

For official publications and guides related to stimulus checks and other government programs, you can visit the following websites:

- Illinois Department of Revenue Publications: https://www.revenue.illinois.gov/Publications/index.aspx

- IRS Tax Publications: https://www.irs.gov/publications

- FEMA Publications: https://www.fema.gov/media-library/publications

Summary

Successfully navigating the stimulus check application process in Illinois requires careful attention to detail, understanding of eligibility criteria, and proactive troubleshooting. By following the tips and resources Artikeld in this guide, you can increase your chances of a smooth and successful application experience.

Remember, seeking assistance from relevant resources is key to resolving any issues and ensuring you receive the financial support you deserve.

Essential Questionnaire

What if I’m unsure about my eligibility for the stimulus check?

Remember to click Future of the Stimulus Check Program in Florida to understand more comprehensive aspects of the Future of the Stimulus Check Program in Florida topic.

The best way to determine your eligibility is to visit the official Illinois Department of Revenue website or consult with a tax professional. They can provide personalized guidance based on your specific circumstances.

What should I do if my application is rejected?

If your application is rejected, carefully review the rejection notice to understand the reason. Contact the Illinois Department of Revenue or a tax professional for assistance in addressing the issue and resubmitting your application.

Check what professionals state about Upcoming Deadlines for Florida Stimulus Check Applications and its benefits for the industry.

How long does it typically take to receive my stimulus check after submitting the application?

The processing time for stimulus checks can vary depending on the volume of applications and other factors. It’s advisable to check the official website for estimated processing timelines or contact the relevant department for updates.

Can I track the status of my stimulus check application?

Some states offer online portals or tracking systems to monitor the status of applications. Check the Illinois Department of Revenue website for any available tracking options.