Transferring Chase Points to Travel Partners for Trip Delay Coverage offers a unique way to enhance your travel protection. By leveraging the power of Chase Ultimate Rewards points, you can unlock valuable benefits from various travel partners, including trip delay coverage.

This strategy empowers you to mitigate potential disruptions during your travels and potentially receive compensation for unexpected delays.

In this topic, you find that Is Chase Freedom Unlimited a Good Choice for Travel Insurance? is very useful.

This guide will explore the ins and outs of transferring Chase points to travel partners, highlighting the key benefits, considerations, and strategies involved. We’ll delve into specific travel partners offering trip delay coverage, compare their coverage terms and conditions, and discuss alternative options to ensure you’re well-equipped to handle travel disruptions.

In this topic, you find that How to Use Chase Freedom Unlimited Trip Delay Insurance is very useful.

Understanding Chase Points and Travel Partners

Chase Ultimate Rewards points are a flexible and valuable currency that can be redeemed for a variety of travel and everyday expenses. One of the most rewarding ways to use these points is by transferring them to Chase’s travel partners, unlocking exclusive benefits and maximizing their value.

This strategy can be particularly beneficial for travelers seeking trip delay coverage, as certain travel partners offer this valuable perk as part of their loyalty programs.

How Chase Ultimate Rewards Points Work

Chase Ultimate Rewards points are earned through the use of Chase credit cards, such as the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, and the Chase Freedom Unlimited®. These points can be redeemed for travel, cash back, gift cards, and other merchandise at a fixed value.

Examine how Understanding the Restrictions of Freedom Unlimited Trip Delay can boost performance in your area.

However, transferring them to travel partners can often yield a higher return on your points, especially for premium redemptions like flights and hotels.

Do not overlook the opportunity to discover more about the subject of Can You Use Chase Freedom Unlimited Points for Trip Delay Expenses?.

Benefits of Transferring Chase Points to Travel Partners

- Earning Miles and Points:Transferring Chase points to travel partners can allow you to earn additional miles and points, which can be used for future travel redemptions.

- Accessing Exclusive Benefits:Many travel partners offer exclusive benefits to their members, such as priority boarding, lounge access, and complimentary upgrades, which can be unlocked by transferring Chase points.

- Maximizing Value:Transferring Chase points to travel partners can often provide better value than redeeming them directly for travel through Chase’s portal. This is because travel partners often offer better redemption rates for premium awards.

Chase Travel Partners

Chase partners with a wide range of airlines and hotel programs, offering a variety of redemption options and transfer ratios. Here are some of the most popular Chase travel partners:

| Partner | Transfer Ratio | Redemption Rules |

|---|---|---|

| Aer Lingus | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Air France/KLM | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| British Airways | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Emirates | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Flying Blue (Air France/KLM) | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Iberia | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Japan Airlines | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Korean Air | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Singapore Airlines | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Southwest Airlines | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| United Airlines | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

| Virgin Atlantic | 1:1 | Points can be redeemed for flights, upgrades, and other travel-related expenses. |

Trip Delay Coverage Options with Travel Partners

Several travel partners offer trip delay coverage as a benefit of their loyalty programs. This coverage can provide financial reimbursement for expenses incurred due to unexpected delays, such as missed connections, bad weather, or mechanical issues. It’s important to note that coverage varies by partner, so understanding the terms and conditions is crucial before relying on this benefit.

Travel Partners Offering Trip Delay Coverage

- United Airlines:United MileagePlus offers trip delay coverage for eligible delays of 3 hours or more. Members can receive reimbursement for expenses such as meals, lodging, and transportation, up to a maximum amount.

- British Airways:British Airways Executive Club offers trip delay coverage for eligible delays of 4 hours or more. Members can receive reimbursement for expenses such as meals, lodging, and transportation, up to a maximum amount.

- Aer Lingus:Aer Lingus AerClub offers trip delay coverage for eligible delays of 6 hours or more. Members can receive reimbursement for expenses such as meals, lodging, and transportation, up to a maximum amount.

Coverage Details

The specific coverage provided by each partner varies, including eligible delays, maximum reimbursement amounts, and limitations. For example, some partners may only cover delays caused by specific factors, such as mechanical issues or bad weather. Others may have limits on the total amount of reimbursement available.

Examine how Does Chase Freedom Unlimited Have Trip Delay Insurance? can boost performance in your area.

It’s essential to review the terms and conditions of each program carefully to understand the extent of coverage.

Real-World Examples

Imagine you’re on a trip to Europe and your flight back to the United States is delayed due to a mechanical issue. If you’re a member of United MileagePlus, you may be eligible for reimbursement for expenses incurred during the delay, such as meals and lodging.

Examine how Filing a Claim with Chase Freedom Unlimited: What You Need to Know can boost performance in your area.

Similarly, if you’re a member of British Airways Executive Club and your flight is delayed for more than 4 hours due to bad weather, you may be eligible for reimbursement for expenses such as transportation and meals.

In this topic, you find that Combining Chase Freedom Unlimited with Other Travel Cards is very useful.

Strategies for Transferring Chase Points for Trip Delay Coverage

Transferring Chase points to a travel partner that offers trip delay coverage can be a smart strategy for maximizing the value of your points and protecting yourself against unexpected travel disruptions. Here are some strategies to consider:

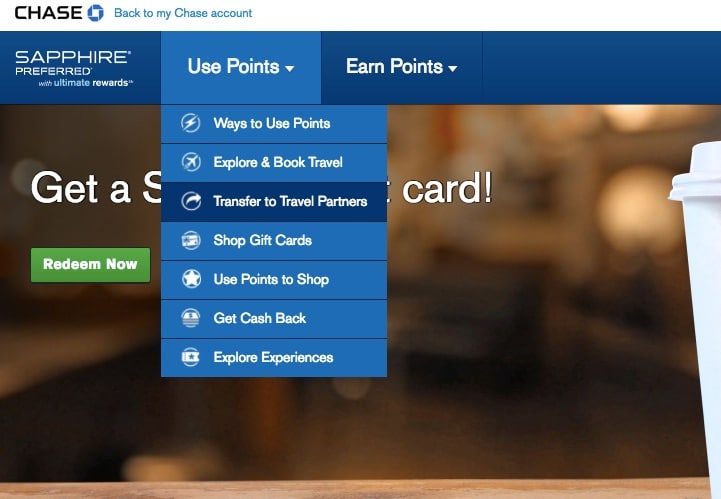

Steps Involved in Transferring Points

- Choose a Travel Partner:Identify a travel partner that offers trip delay coverage and aligns with your travel needs.

- Check Transfer Ratio:Review the transfer ratio between Chase Ultimate Rewards points and the partner’s loyalty program points.

- Initiate Transfer:Log in to your Chase Ultimate Rewards account and initiate the transfer to the chosen travel partner.

- Confirm Transfer:Verify the transfer completion and review the points balance in the partner’s loyalty program.

Comparing Transfer Ratios and Redemption Values

When comparing different partners, consider the transfer ratios and redemption values. A higher transfer ratio may mean you get more points for your Chase points, but it doesn’t necessarily translate to better value. It’s essential to compare the redemption values for the specific awards you’re interested in, such as flights, hotels, or trip delay coverage.

Drawbacks and Limitations

While transferring Chase points for trip delay coverage can be beneficial, it’s important to be aware of potential drawbacks. Some limitations include:

- Transfer Fees:Some travel partners may charge a fee for transferring points.

- Limited Coverage:The coverage provided by trip delay programs may be limited, and not all expenses may be eligible for reimbursement.

- Expiration Dates:Points earned through travel partners may have expiration dates, so it’s important to use them within the specified timeframe.

Alternative Options for Trip Delay Coverage: Transferring Chase Points To Travel Partners For Trip Delay Coverage

While transferring Chase points can be a valuable way to obtain trip delay coverage, other options are available. These alternatives can provide additional protection or offer more comprehensive coverage. Here are some alternatives to consider:

Travel Insurance, Transferring Chase Points to Travel Partners for Trip Delay Coverage

Travel insurance can provide comprehensive coverage for various travel disruptions, including trip delay. It often offers higher reimbursement limits and broader coverage than loyalty program benefits. However, travel insurance can be more expensive than relying on loyalty program benefits.

Credit Card Benefits

Some credit cards offer trip delay coverage as a benefit. These benefits typically provide coverage for eligible delays, but the terms and conditions may vary. It’s essential to review the terms and conditions of your credit card to understand the extent of coverage.

Other Loyalty Programs

Other loyalty programs, such as those offered by airlines, hotels, and car rental companies, may also provide trip delay coverage as a benefit. These programs often have different eligibility requirements and coverage limits, so it’s essential to compare them carefully.

In this topic, you find that Tips for Traveling with the Chase Freedom Unlimited Card is very useful.

Comparison Table

| Option | Cost | Coverage | Eligibility |

|---|---|---|---|

| Transferring Chase Points | No direct cost, but points are lost | Limited coverage, varies by partner | Membership in a travel partner’s loyalty program |

| Travel Insurance | Variable cost, depending on coverage | Comprehensive coverage, including trip delay | Purchase of travel insurance policy |

| Credit Card Benefits | No direct cost, but points are lost | Limited coverage, varies by credit card | Credit card membership |

| Other Loyalty Programs | No direct cost, but points are lost | Limited coverage, varies by program | Membership in a loyalty program |

Practical Considerations for Trip Delay Coverage

Understanding the terms and conditions of trip delay coverage is essential before transferring points. This ensures you know the extent of coverage and any limitations that may apply. Here are some practical considerations:

Terms and Conditions

Review the terms and conditions of the program carefully before transferring points. This includes understanding the definition of eligible delays, the maximum reimbursement amounts, and any limitations on coverage.

Examine how Using Chase Ultimate Rewards Points for Trip Delays can boost performance in your area.

Role of Travel Insurance

Travel insurance can supplement trip delay coverage provided by loyalty programs. It often offers higher reimbursement limits and broader coverage, providing additional protection in case of unexpected delays.

Examine how Chase Freedom Unlimited Trip Delay vs. Sapphire Preferred can boost performance in your area.

Maximizing Value

To maximize the value of trip delay coverage, consider the following tips:

- Choose a Program with Comprehensive Coverage:Select a program that offers comprehensive coverage for a variety of delays and expenses.

- Keep Track of Your Points:Monitor your points balance and expiration dates to ensure you can use them before they expire.

- Be Prepared for Unexpected Delays:Pack essentials, such as medication, important documents, and a change of clothes, in case of unexpected delays.

Closure

In conclusion, transferring Chase points to travel partners can be a strategic approach to maximizing your travel protection, especially when it comes to trip delay coverage. By carefully analyzing the transfer ratios, coverage terms, and alternative options, you can make informed decisions that align with your travel needs and preferences.

Remember, understanding the nuances of trip delay coverage and the role of travel insurance is crucial for maximizing the value of your points and minimizing potential risks.

Common Queries

How do I know which travel partners offer trip delay coverage?

You can check the terms and conditions of each travel partner’s loyalty program. Look for sections related to travel insurance or benefits that include trip delay coverage.

What are the common limitations of trip delay coverage?

Common limitations include minimum delay durations, maximum reimbursement amounts, specific eligible causes of delay, and documentation requirements.

Further details about Coverage Limits for Chase Freedom Unlimited Trip Delay is accessible to provide you additional insights.

Can I transfer Chase points to multiple travel partners for trip delay coverage?

Yes, you can transfer Chase points to multiple travel partners. This allows you to diversify your coverage and potentially access different benefits. However, be mindful of transfer ratios and redemption values.