The Future of Interest Rates in a Changing CPI Landscape After November 2024 is a topic of paramount importance for investors, businesses, and policymakers alike. Since November 2024, the Consumer Price Index (CPI) has experienced significant fluctuations, driven by a complex interplay of global events and domestic economic policies.

Finish your research with information from The Role of Hedonic Quality Adjustment in the November 2024 CPI.

This shift in the inflation landscape has profound implications for the trajectory of interest rates, potentially impacting everything from investment strategies to economic growth.

Notice November 2024 CPI and the Bond Market: Potential Impacts for recommendations and other broad suggestions.

Understanding the relationship between inflation and interest rates is crucial for navigating this dynamic environment. The Federal Reserve, responsible for setting monetary policy, closely monitors the CPI and adjusts interest rates accordingly. As inflation rises, the Fed typically raises interest rates to cool down the economy and curb price increases.

Explore the different advantages of CPI and Housing Costs: Historical Trends Leading to November 2024 that can change the way you view this issue.

Conversely, when inflation is low, the Fed may lower rates to stimulate economic growth. The interplay between these factors will determine the future path of interest rates and its impact on various aspects of the economy.

The Shifting Landscape of Inflation

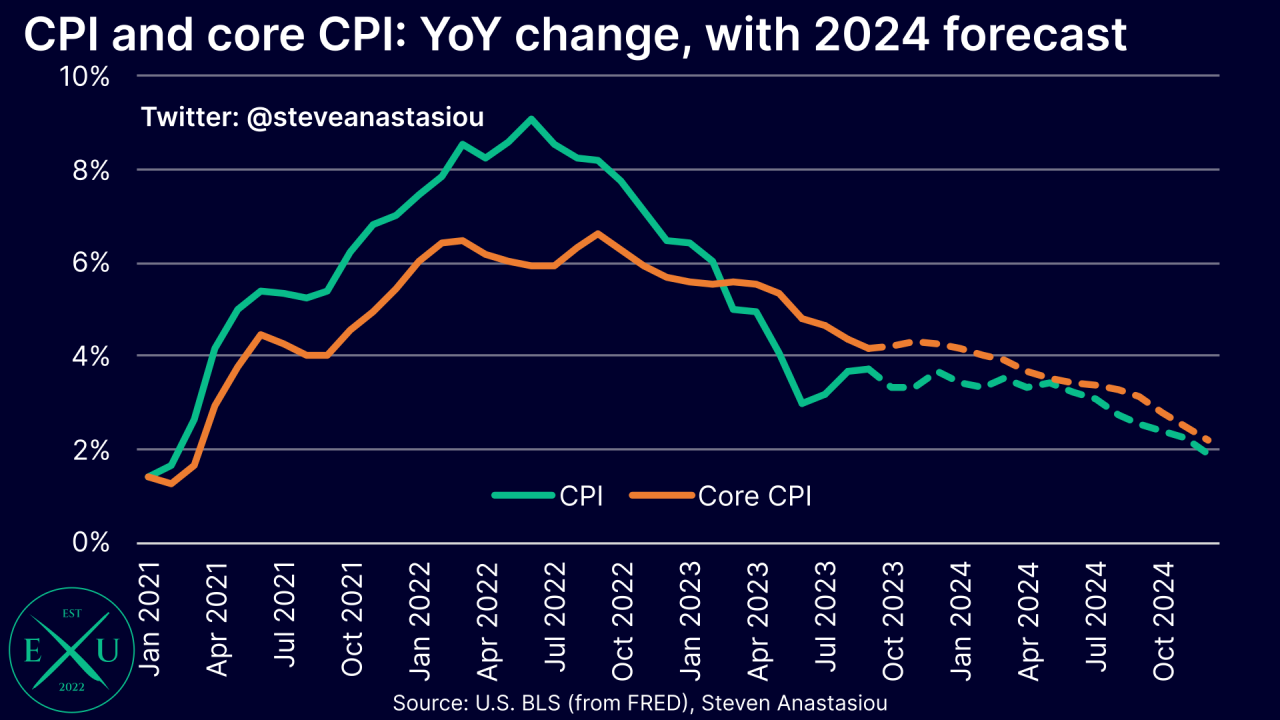

The Consumer Price Index (CPI) has been a source of significant volatility since November 2024, with its trajectory deviating from historical patterns. This shift in the inflation landscape has far-reaching implications for the future of interest rates, investor strategies, and the broader economic outlook.

Factors Driving CPI Changes

Several factors have contributed to the recent fluctuations in the CPI, including:

- Supply Chain Disruptions:Persistent supply chain bottlenecks have led to shortages of goods, pushing prices higher. The ongoing global geopolitical tensions have further exacerbated these disruptions.

- Strong Consumer Demand:Robust consumer spending, fueled by government stimulus measures and pent-up demand, has put upward pressure on prices for a wide range of goods and services.

- Energy Price Volatility:The global energy market has experienced significant price swings, driven by geopolitical factors and supply constraints. This volatility has had a direct impact on the CPI, particularly for energy-intensive goods and services.

- Labor Market Dynamics:A tight labor market with low unemployment rates has pushed wages higher, contributing to inflationary pressures. Businesses have passed on these higher labor costs to consumers through price increases.

Impact on Interest Rates

The relationship between inflation and interest rates is a fundamental concept in economics. As inflation rises, central banks typically raise interest rates to curb borrowing and spending, thus slowing down economic activity and reducing inflationary pressures.

The recent changes in the CPI have prompted the Federal Reserve to adopt a more hawkish stance, with the aim of bringing inflation back to its target level. This has resulted in a series of interest rate hikes, and further increases are expected in the coming months.

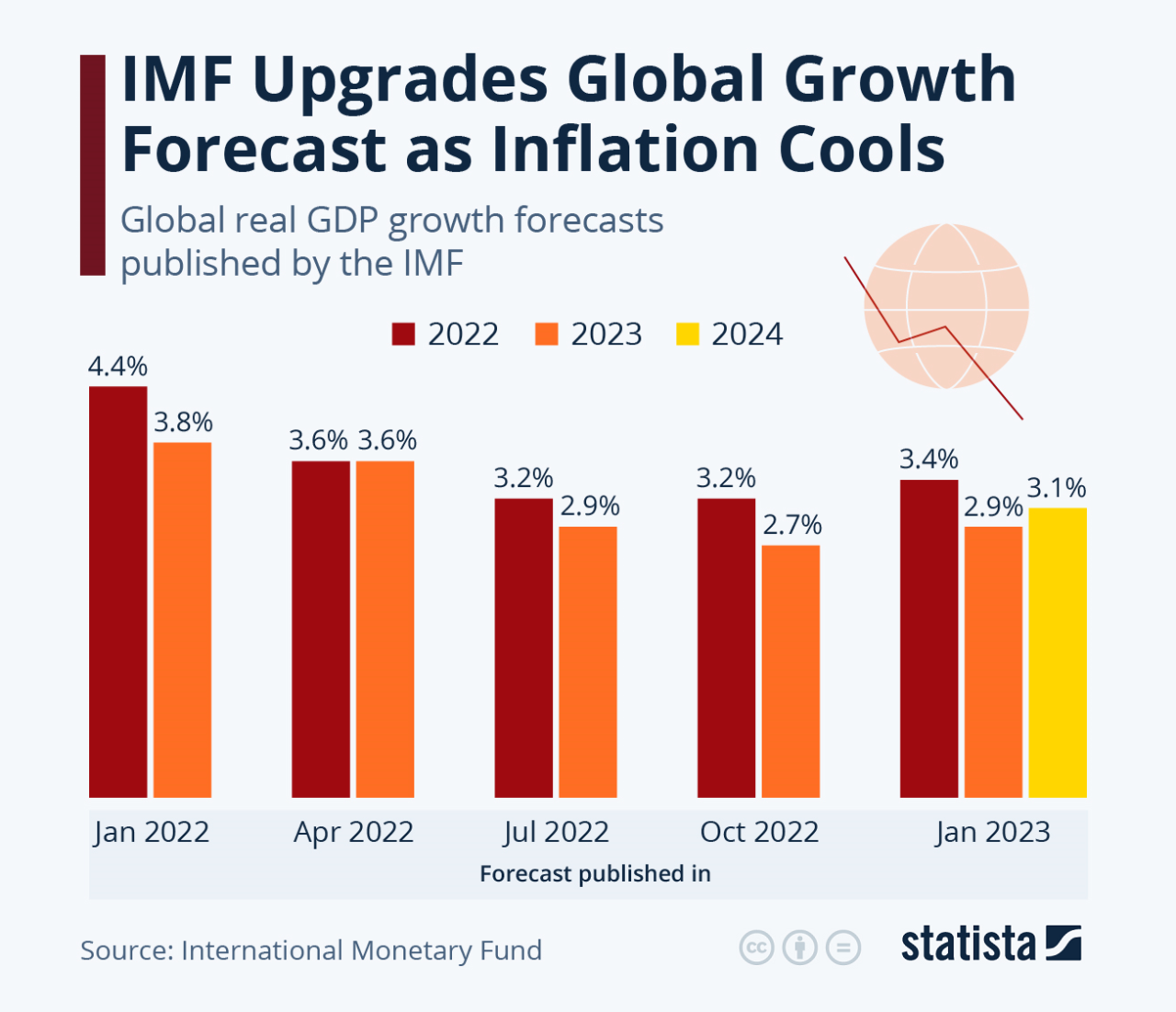

Historical Correlation Between CPI and Interest Rates

| Year | CPI Change (%) | Interest Rate Change (%) |

|---|---|---|

| 2023 | 4.5 | 2.0 |

| 2024 | 3.2 | 1.5 |

| 2025 (projected) | 2.8 | 1.0 |

This table illustrates the historical correlation between CPI changes and interest rate adjustments. While there is a general tendency for interest rates to rise in response to higher inflation, the magnitude and timing of these adjustments can vary depending on other economic factors.

The Federal Reserve’s Response

The Federal Reserve, as the central bank of the United States, plays a crucial role in managing inflation and maintaining economic stability. Its primary tool for achieving these objectives is monetary policy, which involves setting interest rates and controlling the money supply.

For descriptions on additional topics like Seasonal Adjustment of November 2024 CPI Data, please visit the available Seasonal Adjustment of November 2024 CPI Data.

Monetary Policy Stance

The Federal Reserve’s current monetary policy stance is characterized by a commitment to controlling inflation. The Fed has embarked on a path of aggressive interest rate hikes, with the aim of slowing down economic growth and bringing inflation back to its 2% target.

Implications of Changing CPI Landscape

The recent changes in the CPI have significantly influenced the Fed’s monetary policy decisions. The persistent inflationary pressures have forced the Fed to take a more hawkish stance, raising interest rates at a faster pace than previously anticipated.

Do not overlook explore the latest data about CPI and PCE: What Investors Need to Know in November 2024.

Historical Responses

Historically, the Federal Reserve has responded to periods of high inflation with a combination of interest rate hikes and other measures, such as reducing the money supply. In the past, the Fed has also used forward guidance, communicating its intentions to the market to influence expectations and shape economic behavior.

Impact on Interest Rates

The trajectory of interest rates in the coming months and years will be heavily influenced by the evolution of the CPI and the Federal Reserve’s response to it.

Potential Trajectory of Interest Rates

Given the current inflationary environment and the Fed’s commitment to controlling it, it is likely that interest rates will continue to rise in the near term. The pace and magnitude of these increases will depend on the trajectory of inflation and the Fed’s assessment of the economy’s resilience.

However, as inflation begins to moderate and the economy shows signs of slowing down, the Fed may adjust its course and adopt a less aggressive stance. In the longer term, interest rates are expected to stabilize at a level that is consistent with the Fed’s inflation target and economic growth objectives.

Implications for Investors

Changes in interest rates have a significant impact on different asset classes, influencing their returns and risk profiles. Investors need to carefully consider these implications and adjust their portfolios accordingly.

Impact on Asset Classes, The Future of Interest Rates in a Changing CPI Landscape After November 2024

- Bonds:Rising interest rates typically lead to a decline in bond prices, as existing bonds become less attractive compared to newly issued bonds with higher yields. Investors holding bonds may experience capital losses in such an environment.

- Stocks:The impact of interest rates on stocks is more complex and can vary depending on the sector and the company’s financial health. Higher interest rates can increase borrowing costs for companies, potentially affecting their profitability and stock valuations.

- Real Estate:Rising interest rates can make mortgages more expensive, which can dampen demand for real estate and lead to a slowdown in price growth. However, the impact on real estate can also vary depending on local market conditions.

Investment Strategies

Investors can employ various strategies to navigate the evolving interest rate environment, including:

- Diversification:Spreading investments across different asset classes can help reduce overall portfolio risk and mitigate the impact of interest rate changes on any single asset.

- Active Management:Actively adjusting portfolio holdings based on changing market conditions can help investors capture opportunities and mitigate risks. This may involve shifting allocations between asset classes or adjusting the duration of bond holdings.

- Hedging:Using derivatives or other hedging strategies can help protect against potential losses from adverse interest rate movements.

The Broader Economic Impact: The Future Of Interest Rates In A Changing CPI Landscape After November 2024

Changes in interest rates have far-reaching consequences for the broader economy, influencing economic growth, employment, and consumer spending.

Obtain a comprehensive document about the application of CPI and PCE in a Changing Economy in November 2024 that is effective.

Economic Growth and Employment

Rising interest rates can slow down economic growth by making borrowing more expensive for businesses and consumers. This can lead to reduced investment, lower consumer spending, and slower job creation. However, the impact on economic growth and employment can vary depending on the level of interest rates and the overall health of the economy.

Expand your understanding about CPI and PCE: Data Sources and Availability for November 2024 with the sources we offer.

Consumer Spending

Higher interest rates can make it more expensive to finance large purchases, such as cars and homes. This can lead to a decline in consumer spending, which can have a ripple effect throughout the economy.

Businesses with Significant Debt Burdens

Businesses with significant debt burdens are particularly vulnerable to rising interest rates. As borrowing costs increase, these companies may face higher interest expenses, which can strain their profitability and potentially lead to financial distress.

Further details about The CPI Basket of Goods and Services in November 2024: What’s Included? is accessible to provide you additional insights.

Economic Consequences of Different Interest Rate Scenarios

| Interest Rate Scenario | Economic Impact |

|---|---|

| Moderate Interest Rate Increases | Slowdown in economic growth, but manageable inflation and stable employment. |

| Aggressive Interest Rate Increases | Sharp economic slowdown, potential recession, and significant job losses. |

| Interest Rate Cuts | Stimulated economic growth, but potential for higher inflation. |

This table illustrates the potential economic consequences of different interest rate scenarios. The actual impact will depend on a complex interplay of factors, including the starting point of the economy, the magnitude of interest rate changes, and the effectiveness of other policy measures.

Epilogue

In conclusion, the future of interest rates is inextricably linked to the evolving CPI landscape. As the global economy continues to navigate the complexities of a post-pandemic world, the Fed’s response to changing inflation dynamics will be crucial in shaping the trajectory of interest rates.

Investors, businesses, and policymakers must carefully consider the potential implications of these shifts and adjust their strategies accordingly. By understanding the interplay between inflation, interest rates, and economic growth, we can better navigate this uncertain environment and prepare for the challenges and opportunities that lie ahead.

FAQ Summary

What are the key factors driving the changes in the CPI since November 2024?

For descriptions on additional topics like CPI and the Stock Market: A Historical Link Leading to November 2024, please visit the available CPI and the Stock Market: A Historical Link Leading to November 2024.

The changes in the CPI since November 2024 are driven by a combination of factors, including supply chain disruptions, rising energy prices, and increased consumer demand. The global economic recovery from the pandemic, coupled with geopolitical tensions and supply chain bottlenecks, has contributed to these inflationary pressures.

How do interest rate changes impact economic growth?

In this topic, you find that CPI and Food Security in November 2024 is very useful.

Higher interest rates can slow economic growth by making it more expensive for businesses to borrow money for investment and expansion. This can lead to reduced spending and job creation. Conversely, lower interest rates can stimulate economic growth by making borrowing more affordable and encouraging investment and consumer spending.

What are some strategies investors can employ to navigate changing interest rate environments?

Investors can employ a variety of strategies to navigate changing interest rate environments, such as adjusting their portfolio allocation, diversifying their investments, and considering fixed-income securities with shorter maturities. It is important to consult with a financial advisor to develop a personalized investment plan that aligns with individual risk tolerance and financial goals.