The Future of CPI Calculation After November 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Consumer Price Index (CPI), a crucial economic indicator, measures inflation by tracking the average change in prices paid by urban consumers for a basket of goods and services.

The CPI is used for various purposes, including adjusting Social Security payments, calculating inflation-adjusted wages, and informing monetary policy decisions. As we approach November 2024, discussions about potential changes to the CPI calculation methods have sparked interest and debate among economists, policymakers, and the public.

This discussion delves into the complexities of the current CPI calculation methods, exploring their limitations and potential improvements. It examines the potential impact of these changes on economic data, policy decisions, and the lives of everyday Americans. We’ll also explore the role of technological advancements in shaping the future of CPI calculation, examining how emerging technologies can enhance accuracy and relevance.

Obtain recommendations related to Accuracy and Reliability of the November 2024 CPI Data that can assist you today.

The Current CPI Calculation Methods

The Consumer Price Index (CPI) is a vital economic indicator that measures changes in the prices of goods and services purchased by households. It’s used to track inflation, adjust wages, and inform government policies. In the United States, the Bureau of Labor Statistics (BLS) calculates the CPI, which is based on a complex methodology that involves collecting data on prices, weights, and consumer spending patterns.

Discover how CPI and Food Security in November 2024 has transformed methods in this topic.

Methodology for CPI Calculation

The CPI is calculated using a weighted average of price changes for a basket of goods and services that represents the typical consumption patterns of urban consumers. This basket is updated periodically to reflect changes in consumer spending habits.

Remember to click The CPI Basket of Goods and Services in November 2024: What’s Included? to understand more comprehensive aspects of the The CPI Basket of Goods and Services in November 2024: What’s Included? topic.

- Data Collection:The BLS collects price data from a wide range of sources, including retail stores, supermarkets, gas stations, and online retailers. This data is collected monthly for a vast sample of goods and services.

- Weighting:Each item in the CPI basket is assigned a weight based on its relative importance in consumer spending. These weights are derived from the Consumer Expenditure Survey, which tracks household spending patterns.

- Calculation:The CPI is calculated by comparing the weighted average price of the basket in the current period to the weighted average price in a base period. The resulting percentage change represents the rate of inflation.

Components of the CPI Basket

The CPI basket encompasses eight major categories, each with subcategories representing specific goods and services. The weighting of each category reflects its relative importance in consumer spending.

Check what professionals state about Decoding the November 2024 CPI: Key Terms and Concepts and its benefits for the industry.

| Category | Weight |

|---|---|

| Food and Beverages | 14.1% |

| Housing | 41.9% |

| Transportation | 16.2% |

| Medical Care | 8.3% |

| Recreation | 5.8% |

| Education and Communication | 6.0% |

| Apparel | 3.1% |

| Other Goods and Services | 4.6% |

Challenges and Limitations of the Current CPI Calculation Methods

Despite its importance, the CPI calculation faces several challenges and limitations.

- Substitution Bias:The CPI assumes consumers buy the same goods and services each month, even if prices change. However, consumers tend to substitute cheaper alternatives when prices rise, which the CPI doesn’t fully capture.

- Quality Changes:The CPI struggles to account for improvements in product quality over time. For example, a new smartphone with enhanced features might cost more but offer greater value, a factor not fully reflected in the CPI.

- New Products and Services:The CPI basket is updated periodically, but it can lag behind the introduction of new products and services, making it difficult to capture their impact on consumer spending.

- Data Collection Challenges:Collecting accurate price data from a vast array of sources can be challenging, especially for online retailers and services that are constantly evolving.

Potential Changes After November 2024

There is ongoing discussion about potential changes to the CPI calculation methods that could be implemented after November 2024. These changes aim to address the limitations of the current methodology and improve the accuracy and relevance of the CPI.

Learn about more about the process of CPI and Social Inequality in November 2024 in the field.

Potential Changes and Their Rationale

- Incorporating Substitution Bias:The BLS could explore methods to better account for consumer substitution behavior, such as using hedonic pricing techniques to adjust for quality changes and price differences across different goods and services.

- Updating the CPI Basket More Frequently:To better reflect the rapid pace of technological advancements and new product introductions, the BLS could consider updating the CPI basket more frequently than its current schedule.

- Improving Data Collection Methods:The BLS could leverage advancements in data collection technologies, such as web scraping and machine learning, to collect price data more efficiently and accurately from online retailers and services.

- Expanding the Scope of the CPI:The CPI currently focuses on urban consumers. Expanding its scope to include rural consumers and other demographic groups could provide a more comprehensive picture of inflation across the entire population.

Advantages and Disadvantages of Proposed Changes

While these proposed changes could improve the CPI’s accuracy and relevance, they also come with potential advantages and disadvantages.

Expand your understanding about CPI and the November 2024 Election with the sources we offer.

- Advantages:

- Improved Accuracy:Addressing substitution bias, updating the basket more frequently, and improving data collection methods could lead to a more accurate measure of inflation.

- Greater Relevance:Incorporating new products and services and expanding the scope of the CPI could make it more relevant to the changing spending patterns of consumers.

- Better Policy Decisions:A more accurate and relevant CPI could lead to more informed economic policy decisions, including monetary policy and government spending programs.

- Disadvantages:

- Increased Complexity:Implementing these changes could increase the complexity of the CPI calculation process, potentially leading to delays in data releases.

- Higher Costs:Improving data collection methods and expanding the scope of the CPI could require additional resources and funding.

- Potential for Bias:Changes to the methodology could introduce new biases or limitations that need to be carefully considered and addressed.

Impact on Economic Data and Policy

Changes in the CPI calculation methods could have significant implications for key economic indicators and policy decisions.

Impact on Inflation and Real GDP Growth

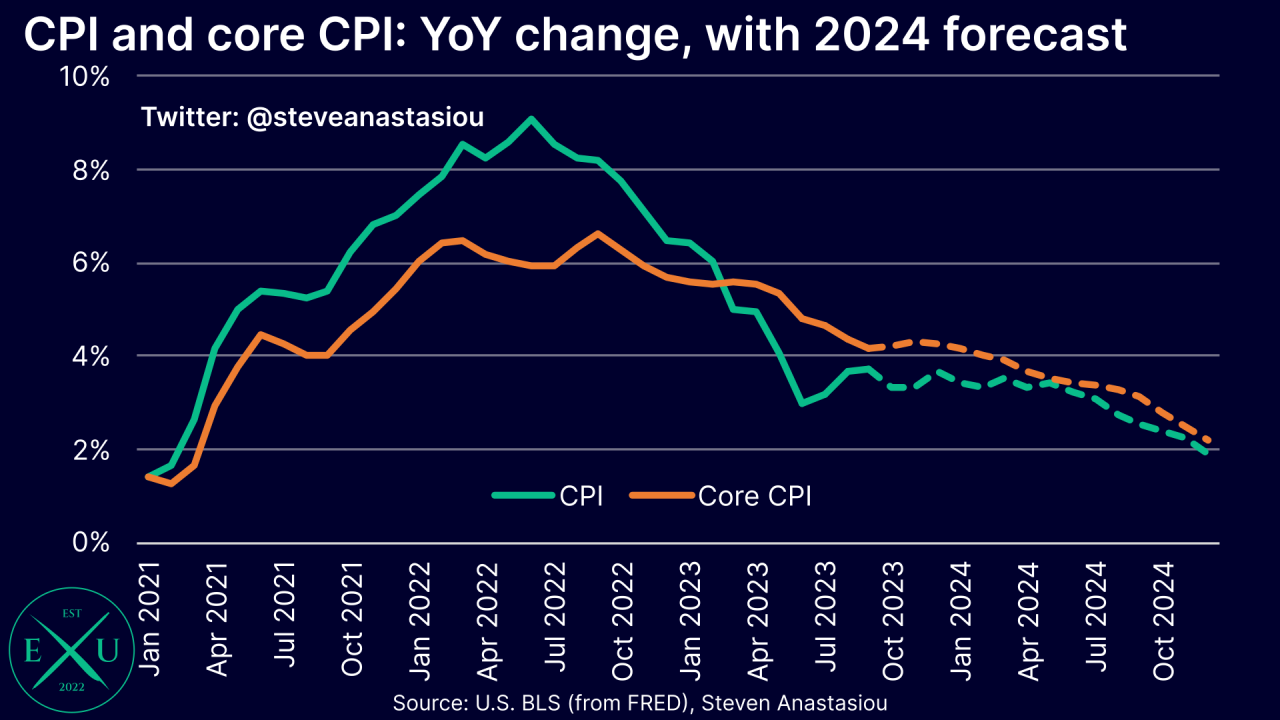

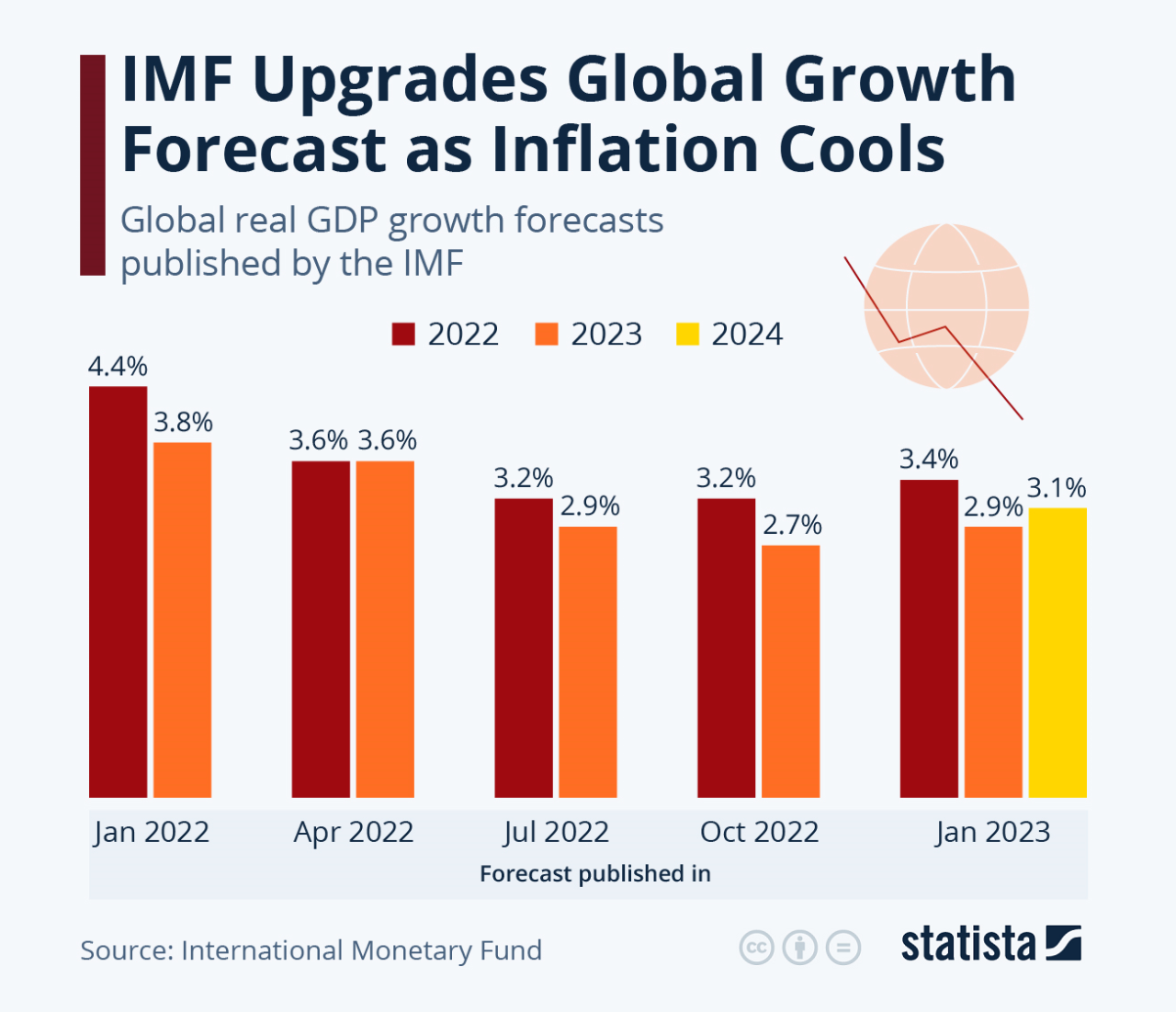

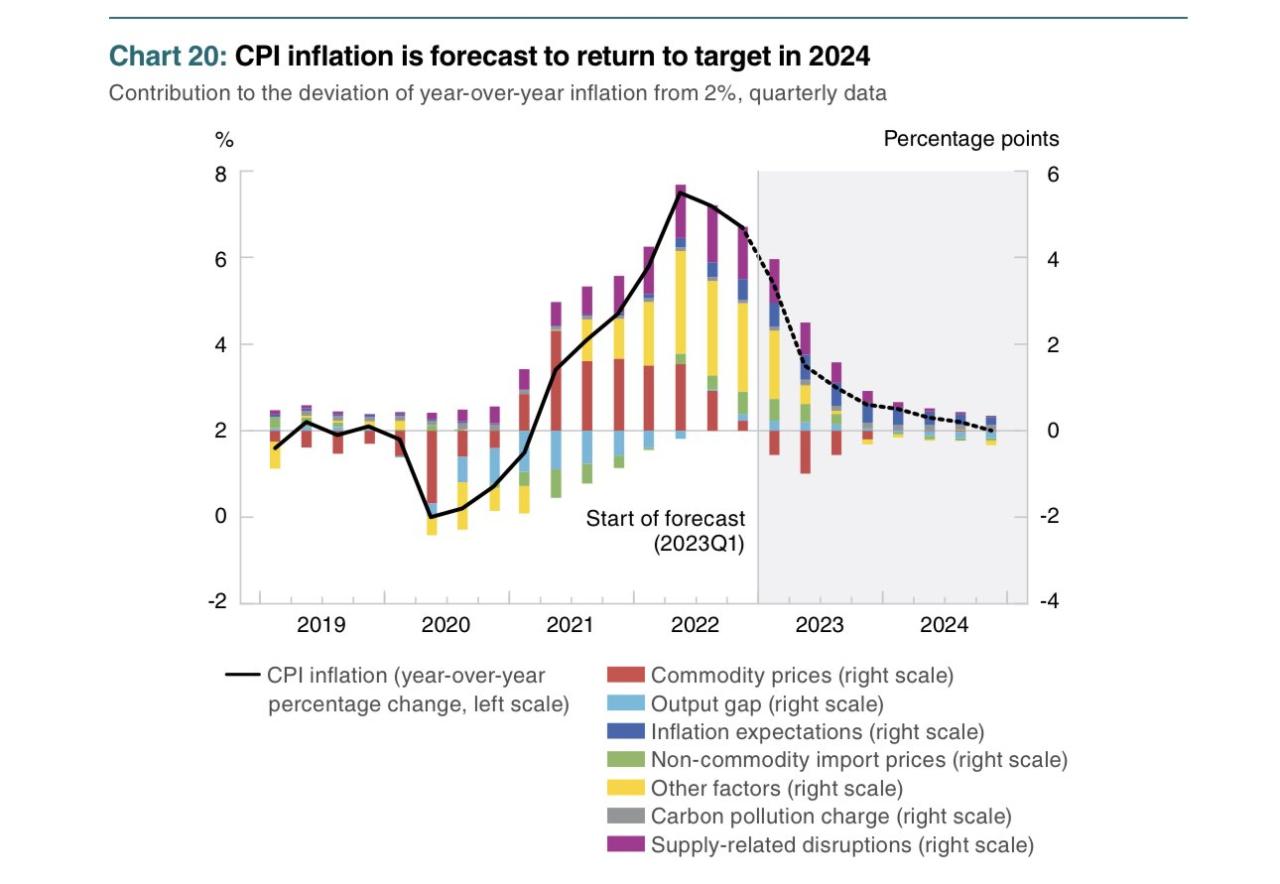

- Inflation:Changes in the CPI calculation methods could lead to different inflation readings, potentially affecting how policymakers perceive the economy’s health and guide their decisions.

- Real GDP Growth:The CPI is used to adjust nominal GDP for inflation to arrive at real GDP growth. Changes in the CPI could alter real GDP growth estimates, impacting our understanding of economic performance.

Implications for Monetary Policy

- Interest Rates:The Federal Reserve uses the CPI to track inflation and guide its monetary policy decisions, including setting interest rates. Changes in the CPI could influence the Fed’s perception of inflation and its response through interest rate adjustments.

- Quantitative Easing:The CPI is also a factor in determining the Fed’s use of quantitative easing, a tool to stimulate the economy. Changes in the CPI could affect the Fed’s decision to implement or adjust quantitative easing programs.

Influence on Government Spending and Social Programs

- Inflation Adjustments:Many government spending programs, such as Social Security and Medicare, are tied to inflation adjustments based on the CPI. Changes in the CPI could affect the level of benefits received by recipients of these programs.

- Cost-of-Living Adjustments (COLAs):Wages and salaries are often adjusted for inflation using the CPI. Changes in the CPI could influence the magnitude of COLAs, impacting the purchasing power of workers.

Technological Advancements and CPI Calculation: The Future Of CPI Calculation After November 2024

Emerging technologies and trends are transforming data collection, processing, and analysis, which could significantly impact the future of CPI calculation.

Advancements in Data Collection, Processing, and Analysis

- Big Data and Machine Learning:The availability of massive datasets and advanced machine learning algorithms can help the BLS automate data collection, identify price trends, and improve the accuracy of CPI calculations.

- Web Scraping and AI:Web scraping technologies and artificial intelligence (AI) can be used to extract price data from online retailers and services more efficiently and accurately, capturing the evolving online marketplace.

- Real-Time Data:The use of real-time data from online retailers and services could provide a more up-to-date and dynamic view of price changes, enhancing the CPI’s responsiveness to market fluctuations.

Potential Scenarios for Incorporating New Technologies

- Automated Data Collection:AI-powered systems could automatically collect price data from online retailers and services, reducing manual effort and improving data accuracy.

- Dynamic CPI Basket:Machine learning algorithms could continuously analyze consumer spending patterns and update the CPI basket in real-time to reflect changes in consumption habits.

- Personalized CPI:Technologies could be used to create personalized CPI indices that reflect the specific spending patterns of different consumer groups, providing a more granular view of inflation.

International Comparisons and Best Practices

Comparing the CPI calculation methods used in the United States with those employed in other major economies can provide insights into best practices and innovative approaches.

Learn about more about the process of Challenges in CPI Measurement for November 2024 in the field.

Comparison of CPI Calculation Methods

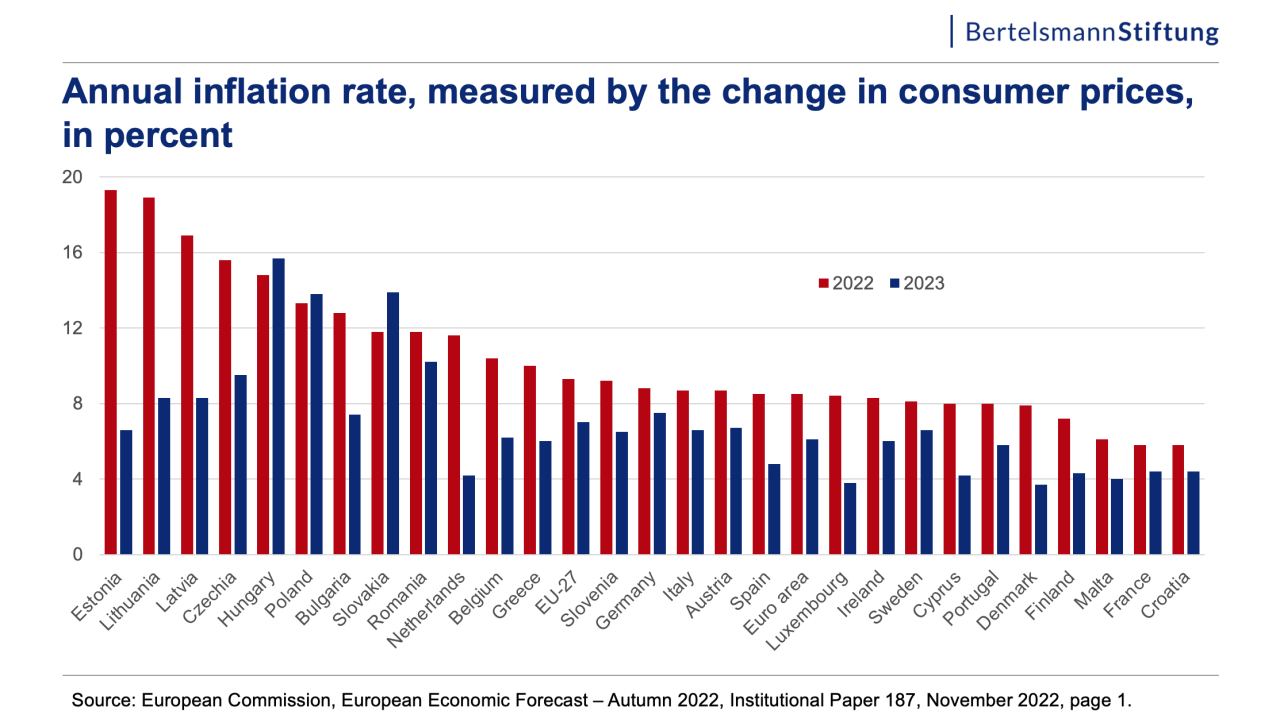

Different countries use varying methodologies for calculating their CPIs. While the core principles are similar, there are differences in the selection of goods and services, weighting methods, and data collection techniques.

You also can investigate more thoroughly about Seasonal Adjustment of November 2024 CPI Data to enhance your awareness in the field of Seasonal Adjustment of November 2024 CPI Data.

| Country | Methodology Highlights |

|---|---|

| United States | Weighted average of prices for a basket of goods and services, updated periodically, data collected from retail stores, supermarkets, and online retailers. |

| European Union | Harmonized Index of Consumer Prices (HICP), standardized methodology across EU member states, focus on core inflation, data collected from national statistical offices. |

| Japan | Consumer Price Index (CPI), uses a basket of goods and services based on household expenditure surveys, data collected from retail stores and online retailers. |

| China | Consumer Price Index (CPI), includes urban and rural areas, data collected from a network of retail stores, supermarkets, and online platforms. |

Best Practices and Innovative Approaches, The Future of CPI Calculation After November 2024

- Hedonic Pricing:Some countries, such as Canada and Australia, use hedonic pricing techniques to adjust for quality changes in goods and services, providing a more accurate measure of inflation.

- Dynamic Basket Updates:Several countries, including the United Kingdom and Germany, update their CPI baskets more frequently than the United States, better reflecting changes in consumer spending patterns.

- Real-Time Data Integration:Some countries are exploring the use of real-time data from online retailers and services to enhance the accuracy and responsiveness of their CPI calculations.

Potential for Adopting International Standards and Methodologies

The United States could consider adopting international standards and methodologies to enhance its CPI calculation. This could involve collaborating with other countries to share best practices, harmonize methodologies, and improve the comparability of CPI data across different economies.

Discover the crucial elements that make CPI and Consumer Confidence in November 2024 the top choice.

Closing Notes

The future of CPI calculation is a dynamic and evolving landscape. As technological advancements continue to reshape our world, the CPI must adapt to remain a reliable and accurate measure of inflation. By embracing innovation, incorporating international best practices, and fostering ongoing dialogue, we can ensure that the CPI remains a valuable tool for policymakers, businesses, and individuals alike.

This journey into the future of CPI calculation reveals the critical role it plays in our economy and underscores the importance of ongoing research and dialogue to ensure its continued relevance and accuracy.

You also can investigate more thoroughly about How the November 2024 CPI Affects Your Daily Life to enhance your awareness in the field of How the November 2024 CPI Affects Your Daily Life.

Detailed FAQs

What are some examples of emerging technologies that could impact CPI calculation?

Emerging technologies such as artificial intelligence (AI), big data analytics, and blockchain technology have the potential to revolutionize CPI calculation. AI can be used to analyze large datasets and identify price trends, while big data analytics can provide more comprehensive and granular data on consumer spending patterns.

Blockchain technology can enhance data security and transparency in the CPI calculation process.

How could changes in CPI calculation affect my personal finances?

Changes in CPI calculation could affect your personal finances through adjustments to Social Security payments, inflation-adjusted wages, and the cost of goods and services. If the CPI is recalculated to reflect a higher inflation rate, you might see a larger increase in your Social Security payments or a higher cost of living adjustment for your wages.

However, changes to the CPI could also lead to adjustments in the prices of goods and services, which could impact your overall spending.