Tax Extension Deadline 2024: Your Guide to Filing – Navigating the complexities of tax season can be a daunting task, especially when faced with the looming deadline for filing your return. The good news is that the IRS offers a lifeline for taxpayers who need extra time to gather their documents and complete their filing – a tax extension.

This guide will equip you with the knowledge and resources to confidently understand and utilize this valuable option.

The tax extension deadline allows individuals and businesses to postpone the filing of their tax returns without facing penalties for late filing. However, it’s crucial to remember that while an extension grants extra time for filing, it does not extend the deadline for paying your taxes.

Understanding the intricacies of tax extensions is essential for navigating this process effectively.

Tax Extension Deadline Overview

The 2024 tax extension deadline provides taxpayers with additional time to file their federal income tax return. This extension allows individuals and businesses to delay the filing of their return, but it does not extend the time to pay any taxes owed.

Tax Extension Explained

A tax extension is a request for additional time to file your federal income tax return. It does not, however, extend the time to pay taxes owed. You must still pay your taxes by the original deadline, even if you file for an extension.

Taxpayers typically file for an extension when they need more time to gather financial documents, complete their tax calculations, or resolve tax-related issues.

Tax Extension Deadline 2024

The deadline to file for a tax extension in 2024 is October 15, 2024.

Benefits of Filing a Tax Extension

Filing a tax extension can provide several benefits for taxpayers. Here are a few examples:

- More time to gather financial documents: If you’re missing important documents like W-2s, 1099s, or other financial records, an extension can give you more time to obtain them.

- Additional time to complete tax calculations: If your tax situation is complex, you might need more time to complete your calculations and ensure accuracy. An extension allows for this.

- Time to resolve tax-related issues: If you’re facing tax-related issues, such as an audit or a dispute with the IRS, an extension can give you more time to resolve them.

Potential Drawbacks of Filing a Tax Extension

While a tax extension can be beneficial, there are also potential drawbacks to consider.

- Interest and penalties: You may still be subject to interest and penalties on any unpaid taxes, even if you file an extension. The IRS charges interest on underpayments and penalties for late payments or underpayments.

- Increased stress: Filing for an extension can add stress, as you’ll have a shorter time to complete your return after the extension period ends. This can lead to rushed preparation and potential errors.

- Potential for audits: While not a direct consequence of filing an extension, it is possible that the IRS may select your return for an audit if you file an extension. This can be due to the IRS’s focus on returns filed later than the original deadline.

Who Qualifies for an Extension

Anyone can file for an extension, but you must meet certain criteria for the IRS to grant it. It is important to understand the requirements and how to properly file for an extension.

Circumstances That Warrant an Extension

The IRS offers extensions for a variety of reasons. You can request an extension if you:

- Are out of the country

- Are experiencing a serious illness or death in the family

- Have a natural disaster that disrupts your ability to file

- Are facing other extenuating circumstances that prevent you from filing on time

It is important to note that an extension only gives you more time to file your taxes, not to pay them. You still have to pay any taxes you owe by the original deadline.

Requesting an Extension

The IRS makes it easy to request an extension. You can file for an extension online, by mail, or by fax. You can use Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

This form is available online on the IRS website.

Requirements for a Successful Extension Request

To ensure your extension request is successful, you must include the following information on your Form 4868:

- Your name, address, and Social Security number

- Your filing status

- The tax year for which you are requesting an extension

- Your estimated tax liability

- Your signature

You can also include a brief explanation of why you need an extension.

It is important to note that the IRS can deny your extension request if you do not meet the requirements or if you have a history of filing late.

Filing an Extension

You can file for an extension to your tax deadline if you need more time to gather your financial information and prepare your return. This extension allows you to postpone the filing deadline but not the payment deadline. If you owe taxes, you must still pay them by the original deadline, even if you file for an extension.

Filing an Extension Online

The IRS offers a convenient online method for filing an extension. You can use the IRS Free File program to e-file your extension, or you can use tax preparation software or an online tax service.Here’s a step-by-step guide to filing an extension online:

- Gather your personal information, such as your Social Security number, address, and filing status.

- Select an IRS Free File provider or a tax preparation software or online service that offers extension filing.

- Complete the extension form, which typically requires basic information about your income and dependents.

- Review your extension form carefully and submit it electronically.

- Keep a copy of your extension confirmation for your records.

Filing an Extension by Mail

You can also file an extension by mail using Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Here are the steps involved:

- Download Form 4868 from the IRS website.

- Complete the form with your personal information and sign it.

- Mail the form to the address listed on the form.

Remember to mail the form on or before the original filing deadline to ensure it is received on time.

Extension Filing Checklist

To ensure your extension is complete and accurate, use this checklist:

- Verify your personal information, such as your name, Social Security number, and address.

- Check your filing status (single, married filing jointly, etc.).

- Estimate your income and dependents.

- Sign and date the extension form.

- Mail or electronically file the form by the original filing deadline.

Extension Impact on Payment

While an extension gives you more time to file your taxes, it doesn’t extend the deadline for paying what you owe. You still need to pay your taxes by the original April 15th deadline, even if you’ve filed for an extension.

Late Payment Penalties

Late payment penalties are applied to any unpaid tax balance after the original filing deadline. The penalty is typically calculated as 0.5% of the unpaid amount for each month or part of a month that the balance remains unpaid, up to a maximum of 25%.

The penalty for late payment is typically 0.5% of the unpaid amount for each month or part of a month that the balance remains unpaid, up to a maximum of 25%.

Paying Taxes After an Extension

You can pay your taxes after filing an extension using various methods:

- Online Payment:Many online payment services allow you to pay your taxes directly to the IRS through their website or mobile app.

- Check or Money Order:You can send a check or money order payable to the U.S. Treasury. Be sure to include your name, address, Social Security number, and the tax year on the payment.

- Debit Card or Credit Card:You can use a debit card or credit card to pay your taxes through third-party payment processors like Pay1040 or PayUSAtax.

- Direct Debit:You can set up direct debit from your bank account to automatically pay your taxes on the due date.

Minimizing Penalties on Late Payments

There are several strategies to minimize late payment penalties:

- Pay as Much as Possible:Even if you can’t pay the entire amount owed, paying as much as possible by the original April 15th deadline can significantly reduce the penalty.

- Apply for a Payment Plan:If you can’t afford to pay your taxes in full, you can apply for a payment plan with the IRS.

- Seek IRS Relief:In some cases, the IRS may grant relief from penalties if you can demonstrate that you had a valid reason for not paying on time.

5. Common Tax Extension Mistakes

It’s understandable to feel overwhelmed when dealing with taxes, and the possibility of making mistakes can be stressful. While a tax extension can provide some breathing room, it’s crucial to file it correctly to avoid potential penalties. Here’s a breakdown of common mistakes and how to avoid them.

Common Tax Extension Mistakes

To ensure you avoid penalties and maintain a smooth tax process, it’s essential to understand the most common mistakes made when filing for a tax extension. The following table summarizes these errors, their potential consequences, and real-world examples to illustrate their impact.

| Mistake | Consequences | Example |

|---|---|---|

| Failing to file the extension form (Form 4868) by the deadline. | Penalties for late filing. The penalty for failing to file a tax return on time is 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum penalty of 25%. | John received a notice from the IRS stating that he had failed to file his tax extension by the deadline. He was assessed a late filing penalty, resulting in a significant financial burden. |

| Not paying the estimated taxes owed by the original deadline. | Interest charges on the unpaid taxes. The IRS charges interest on underpayments of taxes, which can significantly increase the total amount owed. | Mary requested a tax extension but didn’t realize she still had to pay her estimated taxes by the original deadline. As a result, she incurred interest charges on the unpaid amount. |

| Incorrectly calculating the estimated taxes owed. | Penalties for underpayment. If you underestimate your tax liability and don’t pay enough in estimated taxes, you may face penalties. | Sarah underestimated her income and didn’t pay enough in estimated taxes. When she filed her tax return, she owed a substantial amount, resulting in penalties for underpayment. |

| Failing to provide all necessary information on the extension form. | The IRS may reject the extension request. Incomplete or inaccurate information can delay the processing of your extension and may even lead to the IRS rejecting your request. | David filed his tax extension form but forgot to include his Social Security number. The IRS rejected his extension request, requiring him to file a new form with the missing information. |

| Not keeping accurate records to support the extension request. | Audits and penalties. The IRS may audit your return if they suspect that your extension request is not supported by proper documentation. | Emily filed for a tax extension but didn’t maintain adequate records to justify her request. The IRS audited her return, and she faced penalties due to insufficient documentation. |

Tax Extension Resources

Securing a tax extension can provide valuable time to gather necessary documents and complete your tax return accurately. However, navigating the extension process requires understanding the available resources and seeking reliable guidance. This section Artikels key resources that can assist taxpayers in understanding and managing tax extensions.

Official Government Resources

Government agencies provide comprehensive information on tax extensions. These resources offer official guidance, forms, and deadlines, ensuring accuracy and compliance.

If you’re looking for a new car, October is a great time to find some amazing deals. You can check out the Best Lease Deals October 2024 to find the perfect vehicle for you.

| Website Name | URL | Relevant Information |

|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov | Eligibility criteria, filing procedures, forms, penalties, and FAQs on tax extensions. |

| [State Tax Agency Website] | [State Agency URL] | State-specific information on tax extensions, including deadlines, forms, and procedures. |

Reputable Tax Preparation Services

Tax preparation services offer professional assistance with filing tax extensions and completing tax returns.

| Service Name | URL | Contact Information | Services Offered | Pricing |

|---|---|---|---|---|

| [Tax Preparation Service 1] | [Service 1 URL] | [Service 1 Contact Information] | Tax preparation, extension filing, and financial advice. | [Service 1 Pricing Structure] |

| [Tax Preparation Service 2] | [Service 2 URL] | [Service 2 Contact Information] | Tax preparation, extension filing, and online tax filing. | [Service 2 Pricing Structure] |

Tax-Related Organizations

Non-profit organizations offer free or low-cost tax assistance to eligible individuals and families.

| Organization Name | URL | Contact Information | Services Offered | Eligibility |

|---|---|---|---|---|

| [Tax-Related Organization 1] | [Organization 1 URL] | [Organization 1 Contact Information] | Free tax preparation and extension guidance. | [Organization 1 Eligibility Criteria] |

| [Tax-Related Organization 2] | [Organization 2 URL] | [Organization 2 Contact Information] | Low-cost tax preparation and extension filing assistance. | [Organization 2 Eligibility Criteria] |

Additional Information

Filing a tax extension is a valuable tool for taxpayers who need more time to gather their financial records and prepare their tax returns. It is crucial to remember that an extension only grants additional time to file your return, not to pay your taxes.

Tax extensions can be beneficial for taxpayers who require more time to gather their financial records, consult with a tax professional, or resolve any outstanding tax issues.

It is essential to understand that this information is for general guidance only and should not be considered legal or financial advice. For personalized guidance and assistance with tax extensions, it is always recommended to consult with a qualified tax professional.

Tax Extension and Business Owners

Business owners often face unique challenges when it comes to tax filing, especially meeting the traditional deadline. Running a business involves managing various complexities, making it difficult to gather all the necessary financial records and complete the tax return within the standard timeframe.

Impact of Extensions on Business Operations

Tax extensions can provide much-needed breathing room for business owners to focus on their core operations. It allows them to gather all the necessary financial information, work with their accountants, and ensure accuracy in their tax filings. This can prevent costly mistakes and potential penalties.

Strategies for Managing Taxes Effectively During an Extension

- Prioritize Record Keeping:Maintain meticulous records of all business transactions, including income, expenses, and inventory. This will make it easier to compile the information required for tax filing.

- Consult with a Tax Professional:Seek guidance from a qualified tax accountant or advisor to understand your specific tax obligations and navigate the complexities of business taxes. They can help you develop a tax strategy that minimizes your tax liability.

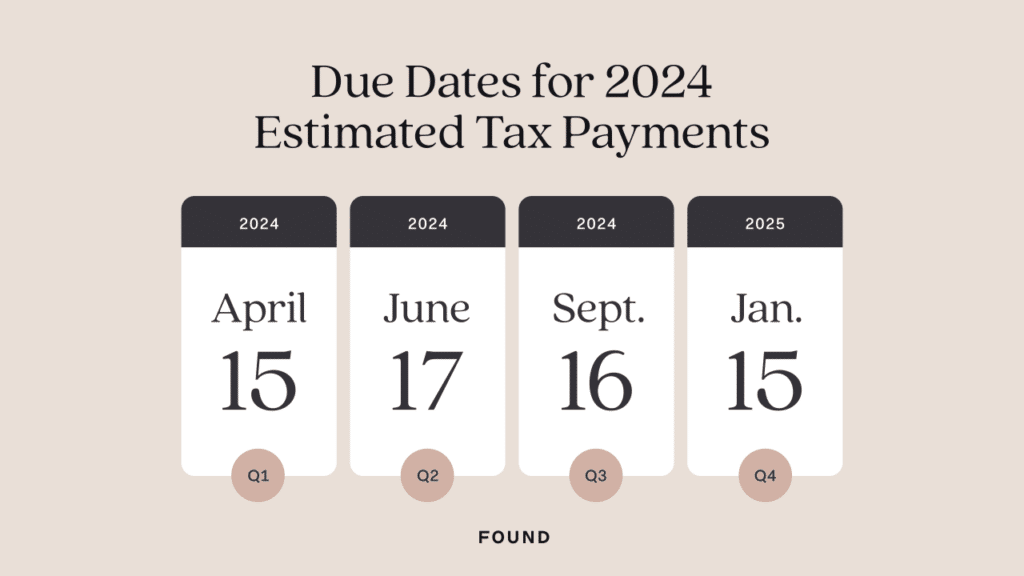

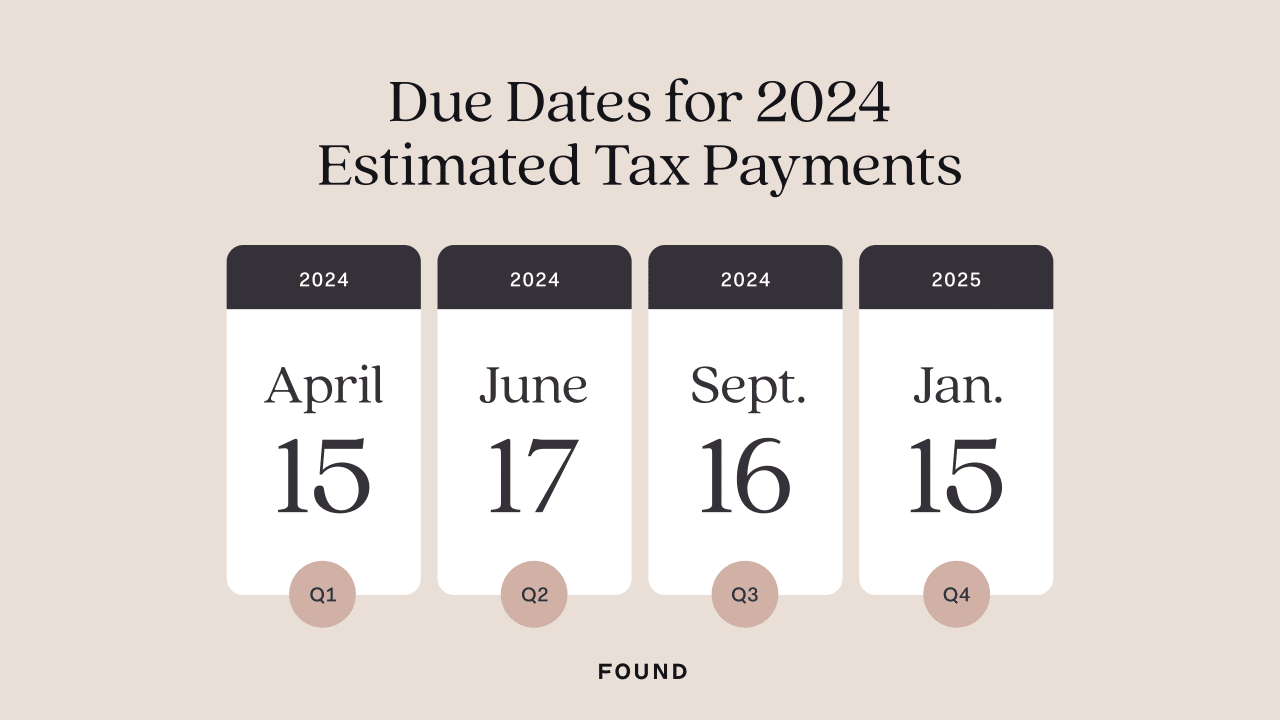

- Plan for Estimated Taxes:Make sure you’re paying estimated taxes throughout the year to avoid penalties. Consult with your tax advisor to determine the appropriate amount to pay.

- Take Advantage of Tax Deductions:Familiarize yourself with available tax deductions and credits for businesses. This can significantly reduce your tax burden.

Business Scenarios Where Extensions Are Crucial

- New Business Ventures:Starting a new business can be overwhelming. Extensions allow you to focus on establishing your business and getting it off the ground without the added pressure of an immediate tax deadline.

- Significant Business Changes:Mergers, acquisitions, or major restructuring can require extensive financial adjustments, making it challenging to meet the standard tax filing deadline. Extensions provide the necessary time to complete these adjustments accurately.

- Natural Disasters or Unexpected Events:Disruptions caused by natural disasters or unforeseen events can significantly impact a business’s ability to gather the necessary financial records. Extensions allow time to recover and rebuild before tackling tax filings.

- Complex Tax Situations:Businesses with intricate financial structures, international operations, or significant investments may require more time to prepare their tax returns. Extensions can help them navigate these complexities and ensure accuracy.

Tax Extension and Financial Planning

A tax extension can significantly impact your financial planning, especially if you’re not prepared for the potential consequences. While an extension grants you additional time to file your taxes, it doesn’t give you more time to pay them. Understanding how extensions affect your financial planning is crucial to avoiding potential pitfalls and making informed decisions.

Proactive Tax Planning

Proactive tax planning is essential to minimize your tax liability and optimize your financial position. It involves strategically structuring your finances to take advantage of tax deductions, credits, and other benefits. This approach allows you to control your tax obligations rather than reacting to them later.

Looking for the best car lease deals? Best Car Lease Deals October 2023 is a great resource. There are also some great deals on credit cards in October, check out Best Credit Cards October 2023. If you’re looking for the best CD rates, CD Rates October 2023 can help you find the best rates.

Incorporating Tax Considerations into Financial Strategies

- Investment Strategies:Tax-efficient investing can significantly reduce your tax burden. Consider strategies like tax-loss harvesting, which allows you to offset capital gains with losses, or investing in tax-advantaged accounts like IRAs and 401(k)s.

- Retirement Planning:Tax-advantaged retirement accounts like 401(k)s and IRAs offer significant tax benefits, reducing your tax liability in the present and potentially in retirement. Understanding the tax implications of different retirement account types is crucial for maximizing your savings.

- Estate Planning:Estate planning involves minimizing estate taxes and ensuring your assets are distributed according to your wishes. Tax-efficient strategies, such as trusts and charitable giving, can help you achieve your estate planning goals.

Impact of Extensions on Financial Decisions

Extensions can impact your financial decisions in various ways. For example, if you’re planning a major purchase, such as a home or a car, the extended filing deadline might affect your ability to secure financing. Lenders often require recent tax returns, and an extension can delay this process.

Similarly, if you’re planning to make a significant investment, the extended deadline might affect your investment strategy.

9. Tax Extension and Legal Implications

Tax extensions, while providing temporary relief, operate within a defined legal framework. Understanding the legal basis for extensions, the requirements for valid applications, and the potential consequences of incorrect filing is crucial for taxpayers. This section delves into the legal aspects of tax extensions, providing a comprehensive guide for navigating this complex process.

Understanding the Legal Framework

Tax extensions are governed by specific laws and regulations. For example, in the United States, the Internal Revenue Code (IRC) Section 6081 provides the legal basis for filing for an extension to file income tax returns. This section Artikels the requirements for obtaining an extension and the procedures for filing.

Are you curious about the Taxes Due October ? You can find out more about the IRS Tax Deadline October 2023 and when taxes are due in October. When Are Taxes Due In October is another great resource for this information.

Additionally, various court rulings have shaped the legal landscape surrounding tax extensions, establishing precedents and clarifying the application of relevant statutes.

Legal Requirements for a Valid Tax Extension Application

To ensure a valid tax extension application, taxpayers must meet specific legal requirements. These requirements vary depending on the jurisdiction. For instance, in the United States, a valid tax extension application typically requires:

- A completed Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return)

- Accurate taxpayer identification information (e.g., Social Security Number, Taxpayer Identification Number)

- Estimated tax liability for the tax year

- Filing the application by the original tax filing deadline

Failure to meet these requirements could result in the extension application being deemed invalid, leading to penalties.

Consequences of Incorrect Filing

Filing a tax extension incorrectly can lead to significant penalties. These penalties can include:

- Late filing penalties: These penalties are generally calculated as a percentage of the unpaid tax liability for each month or part of a month that the return is late. For example, in the United States, the late filing penalty for individual income tax returns is 0.5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum penalty of 25% of the unpaid tax liability.

- Late payment penalties: These penalties are also calculated as a percentage of the unpaid tax liability for each month or part of a month that the payment is late. In the United States, the late payment penalty is generally 0.5% of the unpaid tax liability for each month or part of a month that the payment is late, up to a maximum penalty of 25% of the unpaid tax liability.

- Underpayment penalties: These penalties are imposed when the taxpayer has not paid enough tax throughout the year. The underpayment penalty is generally calculated at an interest rate set by the Internal Revenue Service (IRS).

It’s important to note that these penalties can be avoided by filing the tax extension correctly and paying the estimated tax liability by the original tax filing deadline.

Potential Legal Actions for Failing to File a Tax Extension

Failing to file a tax extension altogether can have severe legal consequences. The tax authorities may take various legal actions, including:

- Issuing a notice of deficiency: This notice informs the taxpayer that the tax authorities have determined that they owe additional taxes. The taxpayer can challenge the notice by filing a petition with the Tax Court.

- Imposing penalties and interest: The tax authorities may impose penalties for late filing, late payment, and underpayment. These penalties can be substantial and can accrue over time.

- Taking enforcement action: In extreme cases, the tax authorities may take enforcement action, such as filing a lien against the taxpayer’s property or levying their bank accounts.

It is crucial to understand that the consequences of failing to file a tax extension can be significant and potentially devastating.

Real-World Legal Cases

Numerous real-world cases illustrate the legal implications of tax extension issues. For example, in the United States, the case ofUnited States v. Boyle* (1985) involved a taxpayer who failed to file a tax extension and subsequently faced significant penalties and interest.

The court ruled that the taxpayer’s failure to file a tax extension was a deliberate act of tax evasion, resulting in a substantial fine and imprisonment. Another notable case isCommissioner v. Schleier* (1957), which established a precedent for the treatment of tax extensions.

This case involved a taxpayer who filed a tax extension but failed to pay the estimated tax liability by the original tax filing deadline. The court ruled that the taxpayer was still liable for penalties and interest on the unpaid tax liability, despite having filed a valid tax extension.

Practical Tips for Navigating the Legal Process

To navigate the legal process of tax extensions effectively, taxpayers should consider the following tips:

- Consult with a qualified tax professional: Seeking advice from a tax professional can help taxpayers understand their legal obligations and ensure that they comply with all applicable laws and regulations.

- File the tax extension application on time: Failing to file the application by the original tax filing deadline can result in penalties.

- Pay the estimated tax liability by the original tax filing deadline: Even if a tax extension is granted, the estimated tax liability must still be paid by the original tax filing deadline to avoid penalties.

- Keep accurate records: Maintaining detailed records of income, expenses, and other relevant financial information can help taxpayers accurately calculate their tax liability and avoid potential penalties.

- Understand the legal consequences of incorrect filing: Taxpayers should be aware of the potential penalties and legal actions that can result from incorrect filing or failure to file a tax extension.

By following these tips, taxpayers can minimize their risk of legal complications and ensure that they comply with all applicable laws and regulations.

Need to know when your taxes are due in October? When Are Taxes Due In October can provide the information you need. You can also find out about the IRS October Deadline 2024 or 2024 October Tax Deadline to ensure you’re on track.

Tax Extension and the IRS: Tax Extension Deadline 2024

The Internal Revenue Service (IRS) plays a crucial role in processing tax extension requests. Understanding the IRS’s procedures, communication channels, and policies is vital for taxpayers seeking an extension.

IRS Processing of Extension Requests

The IRS is responsible for reviewing and approving tax extension requests. They use a specific process to ensure all applications meet the necessary criteria and are processed efficiently.

- Verification:The IRS verifies the taxpayer’s identity and confirms their eligibility for an extension. They also check for any outstanding tax liabilities or penalties.

- Review:The IRS reviews the extension request form (Form 4868) to ensure it is complete and accurate.

They also verify that the taxpayer has met the required filing deadline for the extension.

- Approval:Once the IRS approves the extension request, they issue a confirmation notice to the taxpayer. This notice confirms the extended filing deadline and provides details about any remaining tax obligations.

IRS Communication Channels

Taxpayers can communicate with the IRS about tax extensions through various channels.

- IRS Website:The IRS website provides comprehensive information on tax extensions, including forms, instructions, and FAQs.

- IRS Taxpayer Advocate Service:The Taxpayer Advocate Service (TAS) assists taxpayers who have issues with the IRS, including those related to tax extensions.

- IRS Telephone:The IRS offers a toll-free telephone number for taxpayers to contact customer service representatives.

Mortgage rates are constantly fluctuating, so it’s important to stay up-to-date on the latest trends. If you’re considering a home purchase, check out the Mortgage Rates October 2024 to see what’s happening in the market.

- IRS Mail:Taxpayers can submit tax extension requests and other correspondence to the IRS by mail.

IRS Policies on Tax Extensions, Tax Extension Deadline 2024

The IRS has established specific policies regarding tax extensions.

- Automatic Extension:The IRS grants an automatic extension for filing taxes, but not for paying taxes. This extension typically extends the filing deadline to October 15th.

- Extension for Specific Circumstances:The IRS may grant extensions beyond the automatic six-month period in specific circumstances, such as a natural disaster or a serious illness.

- Extension for Non-filing:Taxpayers who have not filed a tax return in previous years may need to provide additional information to the IRS when requesting an extension.

IRS Enforcement Procedures

The IRS enforces its policies regarding tax extensions.

- Penalties:If a taxpayer fails to file their tax return by the extended deadline, the IRS may impose penalties. These penalties can include late filing penalties and late payment penalties.

- Audits:The IRS may audit taxpayers who have filed for extensions to ensure they have complied with all tax laws.

- Legal Action:In extreme cases, the IRS may take legal action against taxpayers who have failed to file their tax return or pay their taxes by the extended deadline.

11. Tax Extension and the Economy

Tax extensions, while primarily a personal financial matter, can have far-reaching implications for the broader economy. By delaying tax payments, taxpayers might alter their spending and investment patterns, which in turn can affect business activity and government revenue. This section explores the intricate relationship between tax extensions and the economy, examining both the short-term and long-term impacts.

I. Broad Economic Implications

Tax extensions can influence the economy in various ways, both positively and negatively. The impact depends on the economic context, the specific provisions of the extension, and the behavior of taxpayers.

- Short-Term Effects:In the short term, tax extensions can provide a temporary boost to consumer spending. By delaying tax payments, taxpayers have more disposable income, which they might allocate towards purchases or investments. This can stimulate demand and support economic activity.

If you’re interested in the Jepi Dividend October 2023 , there’s information available online. The Jepi Dividend October 2023 is a great resource for investors. Mortgage Rates October 2024 can also provide insights into the current market.

However, the impact might be short-lived as taxpayers will eventually have to pay their taxes, potentially leading to a decrease in spending later.

- Long-Term Effects:The long-term effects of tax extensions are more complex. While they might provide temporary relief, they can also discourage long-term economic growth. If taxpayers consistently delay payments, it can reduce their incentive to save and invest, potentially hindering capital formation and innovation.

Additionally, if tax extensions become a recurring practice, they can erode the stability and predictability of the tax system, creating uncertainty for businesses and investors.

II. Impact on Government Revenue

Tax extensions can significantly affect government revenue, particularly in times of economic uncertainty.

- Recession:During a recession, tax extensions can lead to a decline in government revenue. As businesses struggle and individuals experience job losses, tax payments decrease, further exacerbating the economic downturn. The government might need to rely on borrowing to finance its operations, potentially increasing national debt.

- Expansion:During an economic expansion, tax extensions can have a less pronounced impact on government revenue. With higher incomes and business profits, taxpayers are more likely to pay their taxes on time, even with extensions available. However, extensions can still delay revenue collection, potentially impacting government spending on infrastructure, education, and other essential services.

October is a busy month for taxes, with a few important deadlines to keep in mind. For example, the IRS October Deadline 2024 is a crucial date for many taxpayers.

III. Influence on Consumer Spending

Tax extensions can directly influence consumer spending by affecting disposable income and consumer confidence.

- Disposable Income:Tax extensions provide a temporary increase in disposable income, allowing consumers to spend more on goods and services. This can boost demand in various sectors, particularly those catering to discretionary spending. However, the effect is likely to be short-lived, as taxpayers will eventually have to pay their taxes, potentially leading to a decrease in spending later.

- Consumer Confidence:Tax extensions can also impact consumer confidence. The availability of extensions might create a sense of optimism and financial security, encouraging consumers to spend more. However, if tax extensions become frequent, they can erode confidence in the stability of the tax system, potentially leading to reduced spending.

IV. Historical Examples

Throughout history, tax extensions have been implemented in various economic contexts. Analyzing their impact in different periods can provide valuable insights into their effects.

- Post-9/11:Following the September 11th attacks, the U.S. government extended tax deadlines to provide relief to individuals and businesses affected by the economic fallout. This extension helped to stabilize the economy by providing temporary financial relief and boosting consumer spending.

- Great Recession:During the Great Recession, the government implemented tax extensions to stimulate the economy. The extension of tax deadlines provided individuals and businesses with more time to manage their finances, helping to mitigate the impact of the economic downturn.

- COVID-19 Pandemic:The COVID-19 pandemic led to widespread economic disruptions, prompting governments worldwide to extend tax deadlines. These extensions provided much-needed relief to individuals and businesses struggling with financial hardship. However, the long-term impact of these extensions remains to be seen.

V. Writing

A comprehensive report on the economic implications of tax extensions should analyze the various factors discussed above, providing evidence-based analysis. The report should include:

- Quantitative Data:The report should include quantitative data on the impact of tax extensions on government revenue, consumer spending, and economic growth. This data can be obtained from government sources, economic research institutions, and industry reports.

- Case Studies:The report should include case studies of specific tax extensions implemented in recent history. These case studies should analyze the impact of the extensions on the economy, considering both positive and negative effects.

- Economic Models:The report should use economic models to simulate the impact of tax extensions on different economic variables. These models can help to understand the potential effects of tax extensions in different economic scenarios.

- Policy Recommendations:The report should conclude with policy recommendations regarding the use of tax extensions. These recommendations should be based on the evidence presented in the report and should consider the potential trade-offs involved.

12. Tax Extension and Tax Reform

The landscape of tax extensions can be significantly impacted by tax reform. As tax laws evolve, so too do the rules surrounding extensions. This section explores the potential effects of tax reform on the tax extension process, providing insights into the future of extension policies.

Potential Changes to Extension Policies

Proposed tax reforms, often aimed at simplifying the tax code and potentially altering individual income tax rates, can have far-reaching implications for tax extensions. Let’s examine how these reforms might affect the current system:

- Eligibility Criteria for Extensions: Tax reform could lead to changes in the eligibility criteria for extensions. For instance, simplifying the tax code might make it easier for taxpayers to prepare their returns, potentially reducing the need for extensions. Alternatively, if the reform introduces new tax provisions or complexities, it might necessitate an adjustment to the eligibility criteria, potentially broadening or narrowing the scope of those who qualify for extensions.

- Extension Deadlines: Tax reform could impact extension deadlines. A simplified tax code might allow for a shorter extension period, while more complex reforms might necessitate a longer period to comply. The overall goal of the reform would likely guide any adjustments to extension deadlines.

- The Process for Requesting and Obtaining Extensions: Tax reform could introduce changes to the process for requesting and obtaining extensions. This might involve streamlining the process through online portals or simplifying the documentation required. Conversely, the reform could also lead to stricter requirements or additional layers of verification.

Predicting the Future of Tax Extension Policies

Predicting the future of tax extension policies is a complex endeavor. However, by analyzing historical trends and current debates surrounding tax reform, we can identify potential changes.

| Specific Change | Rationale | Anticipated Impact on Taxpayers |

|---|---|---|

| Shortening the extension period from six months to three months | To encourage taxpayers to file their returns promptly and reduce the backlog of extensions processed by the IRS | Taxpayers would have less time to prepare their returns, potentially leading to increased stress and the need for professional assistance. |

| Introducing a digital platform for requesting and obtaining extensions | To streamline the process and reduce paperwork | Taxpayers would find it easier to request extensions and track their status online. |

| Eliminating the automatic extension for businesses with complex tax situations | To encourage businesses to plan their tax obligations more effectively | Businesses with complex tax situations would need to proactively request extensions, potentially leading to increased administrative burden. |

Key Arguments in the Tax Reform Debate

The debate surrounding tax reform is multifaceted, with proponents and opponents raising a range of arguments regarding the impact on extension policies. Understanding these arguments is crucial for navigating the potential changes.

If you’re looking for the best lease deals, you’ve come to the right place. Best Lease Deals October 2024 has all the latest information on lease deals for October 2024. If you’re interested in October 2023 deals, check out October 2023 Lease Deals for some great options.

Whether you’re looking for a new car or a used car, there are plenty of great deals to be had.

| Argument | Source | Supporting Evidence |

|---|---|---|

| Tax reform will simplify the tax code, reducing the need for extensions. | Tax Foundation | Studies have shown that simplified tax codes tend to result in lower compliance costs and fewer errors, potentially reducing the need for extensions. |

| Tax reform will increase compliance costs, leading to a higher demand for extensions. | Center on Budget and Policy Priorities | New tax provisions and complexities introduced by the reform could increase compliance costs for taxpayers, potentially leading to a higher demand for extensions. |

| Tax reform will benefit businesses, but it will disproportionately burden individuals, leading to a greater need for extensions among individuals. | Institute on Taxation and Economic Policy | Some argue that tax reform might benefit businesses through lower tax rates or deductions, while potentially increasing the tax burden on individuals, potentially leading to a greater need for extensions among individuals. |

Impact of Past Tax Reforms on Extension Policies

Examining the impact of past tax reforms on extension policies provides valuable insights into potential outcomes. Let’s analyze two significant reforms:

- Tax Reform Act of 1986: This reform aimed to simplify the tax code and reduce tax rates. It introduced changes to extension rules, including shortening the extension period from six months to four months. The intended consequence was to encourage taxpayers to file their returns promptly.

However, the reform also resulted in unintended consequences, such as an increase in the number of taxpayers seeking professional assistance.

- Tax Cuts and Jobs Act of 2017: This reform reduced corporate tax rates and made changes to individual income tax rates and deductions. While it did not directly impact extension rules, it indirectly affected the demand for extensions. The reform’s complexity and the introduction of new tax provisions led to increased uncertainty and a higher demand for professional advice, potentially leading to a greater need for extensions.

Tax Extension and Technology

Technology has revolutionized the way we manage our finances, and tax filing is no exception. The advent of online platforms and innovative tools has simplified the process of filing for tax extensions, making it more accessible and efficient than ever before.

Online Platforms for Extension Filing

Online platforms have made filing tax extensions a breeze. These platforms offer user-friendly interfaces, step-by-step guidance, and secure data encryption, ensuring a smooth and reliable experience. Popular platforms like TurboTax, H&R Block, and TaxAct allow taxpayers to file their extensions electronically, eliminating the need for paper forms and postage.

There was news about Geico Layoffs October 2023 , which impacted many employees.

Innovative Tools for Tax Management and Extensions

Beyond online filing, numerous innovative tools are available to assist taxpayers in managing their taxes and extensions. These tools include:

- Tax management apps:These apps allow users to track their income and expenses throughout the year, helping them estimate their tax liability and prepare for filing season. Examples include Mint, Personal Capital, and YNAB (You Need a Budget).

- Tax calculators:Online tax calculators provide estimates of tax liability based on various factors, such as income, deductions, and credits. These calculators can help taxpayers determine if they need to file an extension.

- E-signature software:E-signature software allows taxpayers to electronically sign documents, including tax forms and extensions, eliminating the need for physical signatures. Popular options include DocuSign and HelloSign.

Future of Technology in Tax Extension Procedures

The future of tax extension procedures is likely to be even more technology-driven. Expect advancements in:

- Artificial intelligence (AI):AI-powered tax software will become more sophisticated, offering personalized guidance and assistance with tax planning and extension filing.

- Blockchain technology:Blockchain could be used to secure and verify tax data, enhancing transparency and reducing fraud.

- Real-time tax reporting:Real-time data sharing between taxpayers and the IRS could streamline the extension process, allowing for faster processing and more accurate calculations.

14. Tax Extension and International Implications

Navigating the complexities of international tax obligations can be daunting, especially when it comes to tax extensions. As a US citizen residing in France, you face a unique set of challenges when filing your US tax return. This section delves into the intricate world of tax extensions for international taxpayers, providing a comprehensive understanding of the key factors to consider.

Eligibility Criteria for Tax Extensions in the US for International Taxpayers

US citizens residing abroad are generally eligible for tax extensions, just like domestic taxpayers. The IRS offers a standard six-month extension, pushing the filing deadline from April 15th to October 15th. However, it’s crucial to remember that while an extension grants additional time to file your return, it does not extend the payment deadline.

You are still obligated to pay any taxes owed by the original April 15th deadline.

Potential Impact of French Tax Regulations on the Extension Process

France’s tax regulations might influence your US tax obligations. For instance, if you’re earning income in France, you may be subject to French taxes. Understanding how US and French tax laws interact is crucial. Double taxation treaties between the US and France can help mitigate the burden of paying taxes in both countries.

However, these treaties often have complex rules and require careful consideration to ensure you’re taking advantage of all available deductions and credits.

Potential Penalties for Late Filing and Payment

Late filing and payment can result in significant penalties. The IRS imposes penalties for failure to file, failure to pay, and failure to pay estimated taxes. These penalties can be substantial, ranging from a percentage of the unpaid tax to interest charges.

It’s essential to stay informed about the specific penalties applicable to your situation and take steps to avoid them.

Best Practices for Managing US Tax Obligations While Living Abroad

Managing your US tax obligations while living abroad requires careful planning and proactive steps. Here are some key best practices:

- Consult with a qualified tax advisor specializing in international taxation. They can provide tailored advice based on your specific circumstances and help you navigate the complexities of US and French tax laws.

- Maintain accurate records of all income and expenses. This includes income earned in both the US and France, as well as any deductions and credits you may be eligible for.

- File your US tax return on time, even if you are requesting an extension. This will help you avoid late filing penalties.

- Pay any taxes owed by the original deadline, even if you are filing for an extension.

- Stay updated on changes in US and French tax laws. Tax regulations can change frequently, so it’s important to be aware of any new rules or updates.

Outcome Summary

In conclusion, understanding the Tax Extension Deadline 2024 and its implications is crucial for taxpayers seeking to avoid penalties and ensure compliance with tax regulations. By carefully considering the benefits and drawbacks of filing an extension, taxpayers can make informed decisions that align with their individual circumstances.

Remember, seeking professional guidance from a tax advisor can provide valuable insights and personalized support throughout the process.

FAQ Resource

What happens if I file for an extension but don’t pay my taxes by the original deadline?

While an extension allows you more time to file your return, it doesn’t extend the deadline for paying your taxes. Failure to pay by the original deadline can result in penalties and interest charges.

Can I file for an extension if I owe taxes?

Yes, you can file for an extension even if you owe taxes. However, you’ll still need to pay the amount you owe by the original deadline to avoid penalties.

How do I file for an extension?

You can file for an extension online through the IRS website, by mail using Form 4868, or through a tax professional.

What is the cost of filing for a tax extension?

Filing for a tax extension is typically free, but you may incur fees if you use a tax preparation service.

Can I extend my tax deadline multiple times?

You can only file for one extension at a time. If you need additional time beyond the initial extension period, you’ll need to file for another extension.