Tax calculator 2024: How much will I owe in taxes? This question is on the minds of many as we approach the new year. Understanding your tax obligations is crucial for responsible financial planning, and a tax calculator can be an invaluable tool in this process.

By inputting your income, deductions, and other relevant information, these calculators provide an estimated tax liability, allowing you to anticipate your financial obligations and plan accordingly.

This guide delves into the world of tax calculators, exploring their purpose, benefits, and how to effectively utilize them for accurate tax estimations. We’ll cover the key factors that influence your tax liability, provide tips for minimizing your tax burden, and guide you through the process of filing your tax returns.

Understanding Tax Basics

The tax system in the United States can be complex, but understanding the fundamentals is crucial for every individual. Knowing how taxes work can help you make informed financial decisions and ensure you’re paying the correct amount.

If you’re self-employed, you might be interested in the IRA contribution limits for solo 401k in 2024. These limits can help you save for retirement while reducing your tax burden.

Types of Taxes

The Internal Revenue Service (IRS) collects various taxes from individuals. Here are some common types:

- Income Tax: The most significant tax for most individuals, income tax is levied on wages, salaries, investments, and other forms of income. The tax rate varies depending on your income level and filing status.

- Payroll Tax: These taxes are withheld from your paycheck and contribute to Social Security and Medicare, providing retirement and health insurance benefits.

- Property Tax: This tax is levied on real estate, including homes and land. The amount of property tax you owe depends on the value of your property and local tax rates.

- Sales Tax: This tax is added to the price of goods and services purchased at retail stores. The sales tax rate varies depending on the state and local jurisdiction.

- Capital Gains Tax: This tax is levied on profits made from the sale of assets, such as stocks, bonds, and real estate.

Factors Affecting Tax Liability

Several factors influence how much tax you owe:

- Income Level: Your income level directly impacts your tax liability. The higher your income, the higher your tax rate generally is.

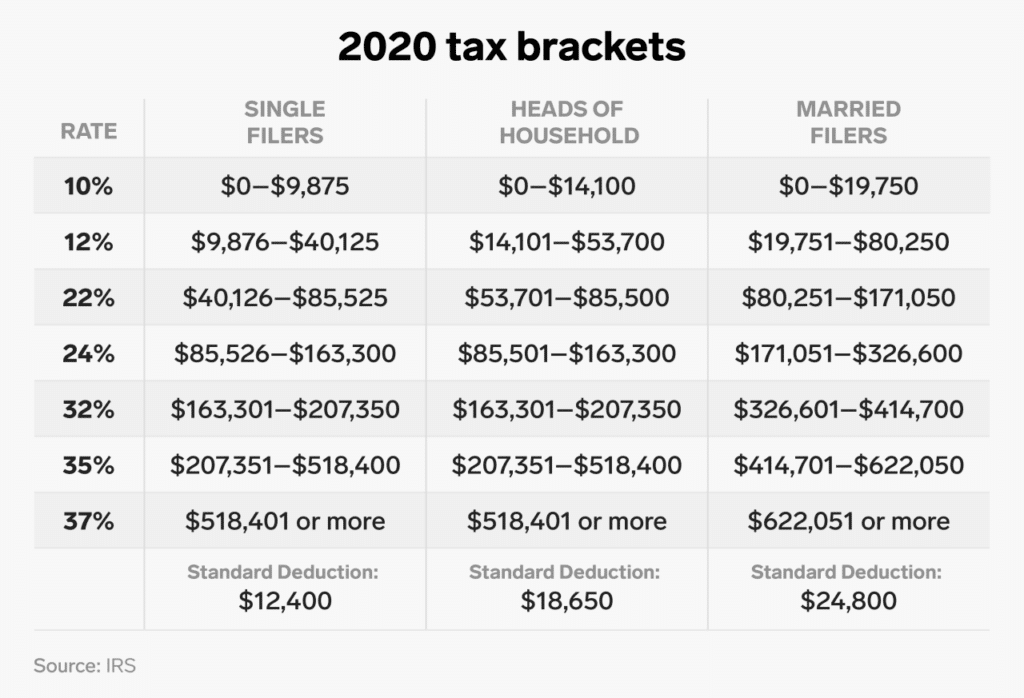

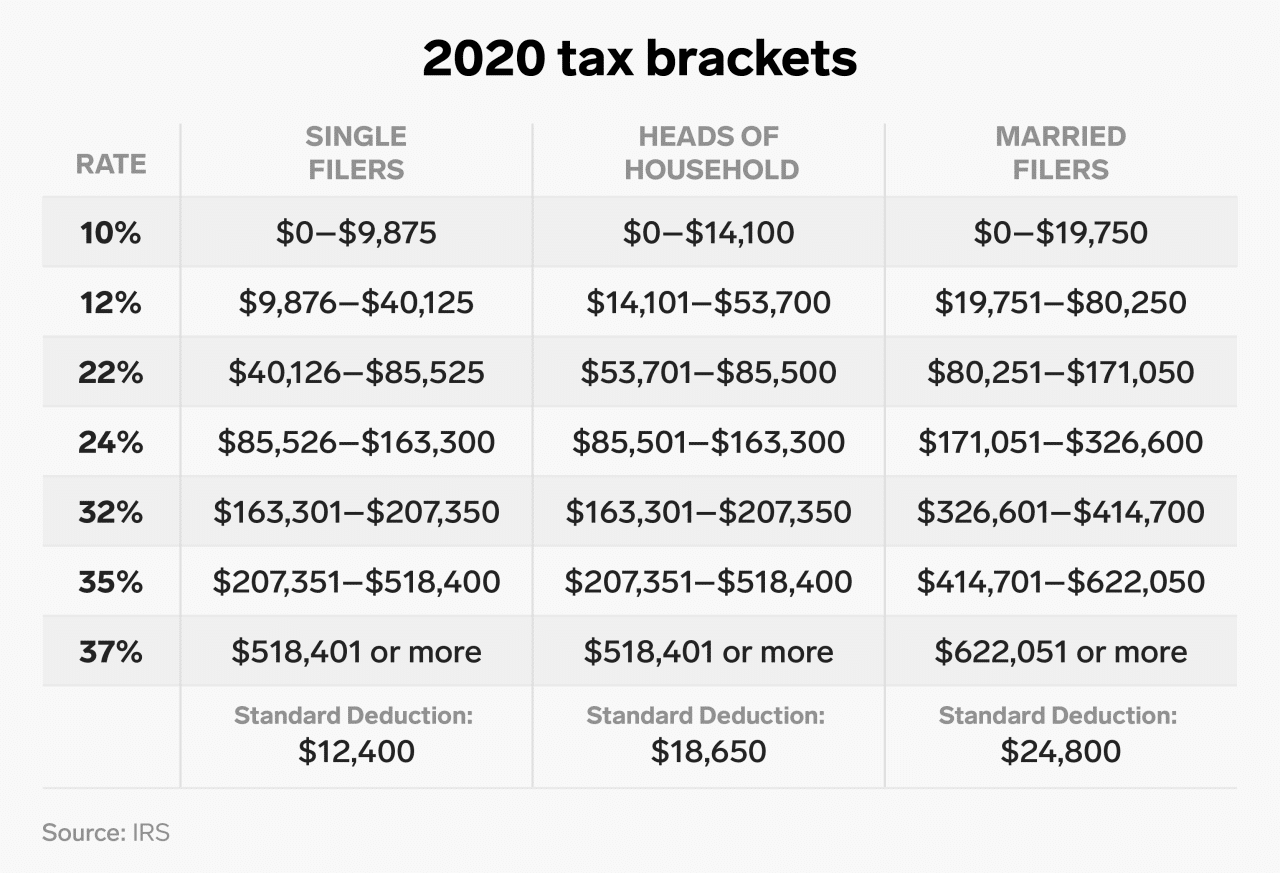

- Filing Status: Your filing status determines your tax bracket and the standard deduction you’re eligible for. Filing statuses include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

- Deductions: Deductions reduce your taxable income, lowering your overall tax liability. Examples include standard deduction, itemized deductions (such as mortgage interest, charitable contributions, and medical expenses), and business expenses.

- Credits: Tax credits directly reduce the amount of taxes you owe. Examples include the Earned Income Tax Credit (EITC), Child Tax Credit, and American Opportunity Tax Credit.

Common Tax Deductions and Credits

Here are some common tax deductions and credits available to individuals:

- Standard Deduction: A fixed amount that you can deduct from your taxable income. The standard deduction amount varies depending on your filing status and age.

- Itemized Deductions: These are specific expenses that you can deduct from your taxable income. Some common itemized deductions include:

- Mortgage Interest: You can deduct the interest paid on your home mortgage up to a certain limit.

- State and Local Taxes (SALT): You can deduct up to $10,000 in state and local taxes, including property taxes, income taxes, and sales taxes.

- Charitable Contributions: You can deduct cash contributions to qualified charities up to 60% of your Adjusted Gross Income (AGI).

- Medical Expenses: You can deduct medical expenses exceeding 7.5% of your AGI.

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and number of qualifying children.

- Child Tax Credit: This credit is available for each qualifying child under 17 years old. The amount of the credit is $2,000 per child.

- American Opportunity Tax Credit: This credit is available for the first four years of college education. The credit is worth up to $2,500 per student and is phased out based on income.

“It’s important to remember that tax laws are complex and can change frequently. Consulting a tax professional can help you navigate the intricacies of the tax system and ensure you’re taking advantage of all available deductions and credits.”

The mileage rate is used for a variety of tax deductions, including medical expenses and business travel. The mileage rate changes from time to time, so it’s important to stay informed.

Using a Tax Calculator for 2024

Tax calculators are valuable tools that can help you estimate your tax liability for 2024. They provide a quick and easy way to understand your potential tax burden based on your income, deductions, and credits.

Knowing your tax bracket is essential for making informed financial decisions. The tax brackets for 2024 in the United States can help you understand how much of your income will be taxed at different rates.

Tax Calculator Input Requirements

Tax calculators require specific information to provide accurate estimates. Here is a table showcasing the key inputs required for calculations:

| Input | Description |

|---|---|

| Filing Status | Single, Married Filing Jointly, Married Filing Separately, Head of Household, Qualifying Widow(er) |

| Income | Wages, salaries, tips, interest, dividends, capital gains, and other sources of income |

| Deductions | Standard deduction, itemized deductions (e.g., mortgage interest, charitable contributions, medical expenses) |

| Credits | Tax credits (e.g., Child Tax Credit, Earned Income Tax Credit) |

| Dependents | Number of dependents claimed on your tax return |

Adjusting Inputs for Individual Circumstances, Tax calculator 2024: How much will I owe in taxes?

You can adjust inputs based on your individual circumstances to obtain a more personalized tax estimate. For instance:

- Deductions:If you have significant medical expenses, mortgage interest, or charitable contributions, you might benefit from itemizing your deductions instead of taking the standard deduction.

- Credits:If you have children or qualify for the Earned Income Tax Credit, you can claim these credits to reduce your tax liability.

- Dependents:If you have dependents, you can claim them on your tax return, which can affect your tax bracket and potential credits.

Step-by-Step Guide to Using a Tax Calculator

Here is a step-by-step guide on how to use a tax calculator:

- Choose a Tax Calculator:There are numerous tax calculators available online. Select a reputable and reliable calculator from a trusted source.

- Provide Your Information:Enter your personal information, including your filing status, income, deductions, credits, and dependents.

- Review Your Results:Once you have entered all your information, the tax calculator will provide an estimate of your tax liability.

- Adjust Inputs as Needed:If you need to adjust your inputs based on your individual circumstances, you can do so and re-run the calculation.

Important Note:Tax calculators are estimations. It is essential to consult with a tax professional for personalized advice and to ensure accurate tax filing.

If you’re driving for medical reasons, you can deduct your mileage expenses. The October 2024 mileage rate for medical expenses will help you calculate your deductions.

Factors Affecting Tax Liability

Your tax liability is determined by various factors, including your income, deductions, credits, and applicable tax laws. Understanding how these factors influence your tax bill is crucial for effective tax planning and minimizing your tax burden.

If you’re planning on making a move in October 2024, be sure to check out the October 2024 mileage rate for moving expenses. You might be surprised at how much you can deduct for your transportation costs.

Income Changes and Tax Liability

Income is a primary factor in determining your tax liability. The more you earn, the higher your tax bracket, and consequently, the more taxes you’ll likely owe. Tax brackets are designed to be progressive, meaning that higher earners pay a larger percentage of their income in taxes.

The tax bracket thresholds for 2024 will help you understand how much of your income will be taxed at different rates.

For instance, if your income falls within a higher tax bracket, you’ll pay a higher percentage of your income in taxes compared to someone in a lower bracket.

If you’re dealing with a trust, you’ll need to understand the W9 Form requirements. The W9 Form October 2024 for trusts can help you stay compliant.

Deductions and Credits

Deductions and credits are valuable tools that can significantly reduce your tax liability.

It’s never too early to start planning for your financial future. The IRA contribution limits for 2024 and beyond can help you get a head start on saving for retirement.

Deductions

Deductions are expenses that you can subtract from your taxable income, thereby reducing the amount of income subject to taxes. Some common deductions include:

- Standard deduction: This is a fixed amount that you can deduct, regardless of your actual expenses.

- Itemized deductions: These are specific expenses that you can deduct, such as medical expenses, mortgage interest, and charitable donations.

Credits

Credits are direct reductions to your tax liability. They can be more valuable than deductions because they directly reduce the amount of taxes you owe, rather than reducing your taxable income. Some common tax credits include:

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families.

- Child Tax Credit: This credit provides a tax break for families with qualifying children.

- American Opportunity Tax Credit: This credit is available for qualified educational expenses.

Tax Law Changes and Regulations

Tax laws and regulations are subject to change, which can significantly impact your tax liability.

If you’re an independent contractor, you’ll need to complete a W9 Form for your clients. The W9 Form October 2024 for independent contractors provides the latest information on the form and its requirements.

Changes in Tax Laws

Changes in tax laws can affect your tax liability in various ways. For example, the Tax Cuts and Jobs Act of 2017 made significant changes to tax rates, deductions, and credits. It’s essential to stay informed about any changes to tax laws and their potential impact on your tax situation.

Missing the tax deadline can result in penalties. Check out the tax penalties for missing the October 2024 deadline to understand the potential consequences.

Changes in Regulations

The Internal Revenue Service (IRS) also issues regulations that provide guidance on how to interpret and apply tax laws. Changes in regulations can affect your tax liability, even if the underlying tax laws remain the same. For instance, the IRS may issue new regulations that clarify how to deduct certain expenses, or they may change the requirements for claiming certain credits.

It’s crucial to consult with a tax professional to understand the implications of any changes in tax laws or regulations and to ensure you are complying with the latest requirements.

The October 2024 mileage rate changes might affect your tax deductions for business travel, medical expenses, and other eligible expenses.

Tax Filing and Payment

Once you’ve calculated your tax liability, the next step is filing your tax return and paying any taxes owed. This process involves submitting your tax information to the Internal Revenue Service (IRS) and ensuring timely payment of your tax obligations.

Methods of Filing Taxes

There are several ways to file your taxes, each with its own advantages and disadvantages:

- Online Filing:This is the most popular method, as it’s convenient, fast, and often less error-prone. Many reputable tax software programs are available, allowing you to prepare and e-file your return electronically. This method often comes with features like built-in tax calculators and guidance to ensure accuracy.

If you’re looking to maximize your retirement savings, the 401k contribution limits for 2024 for traditional 401k can help you determine how much you can contribute.

- Mail-in Filing:You can download and print tax forms from the IRS website and mail them with the required documentation. This method is suitable for those who prefer a more traditional approach or have complex tax situations that require manual calculations.

- Tax Professional:If you find the process overwhelming or have a complex tax situation, hiring a tax professional is a good option. They can help you navigate the intricacies of tax laws, maximize deductions, and ensure your return is accurate.

Tax Filing Deadlines

The IRS sets deadlines for filing your taxes, which are typically:

- April 15th:This is the standard deadline for filing your individual income tax return. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

- October 15th:This is the deadline for filing an extension if you need more time to prepare your return. However, remember that an extension only grants you more time to file, not to pay. You still need to pay your taxes by the original deadline.

If you’re a small business owner, you can contribute to a 401k plan. The 401k contribution limits for 2024 for small businesses can help you determine how much you can save for retirement.

Penalties for Late Filing or Non-Payment

Failing to file your taxes on time or pay your taxes due can result in penalties. These penalties can include:

- Late Filing Penalty:This penalty is typically calculated as a percentage of your unpaid taxes, with the rate increasing the longer you delay filing.

- Late Payment Penalty:This penalty is also calculated as a percentage of your unpaid taxes, and it can accrue interest.

- Failure to Pay Penalty:This penalty is imposed for not paying your taxes by the due date, even if you filed your return on time.

Important Considerations

- Gather all necessary documents:Before filing, gather all relevant tax documents, such as W-2 forms, 1099 forms, and any other income or expense documentation.

- Choose the appropriate filing status:Determine your filing status based on your marital status and dependents.

- Review your return carefully:Before submitting your return, carefully review it for any errors or omissions.

- Keep records:Maintain copies of all tax documents and your filed return for future reference.

Common Tax-Related Questions

Tax calculators are a valuable tool for understanding your tax liability, but you may have some questions about how they work and what they can tell you. This section will address some common questions and provide clarity on important tax-related topics.

Tax Calculator Accuracy

Tax calculators provide estimates based on the information you input. While they strive for accuracy, it’s crucial to understand that they cannot account for every unique situation. For example, they may not include specific deductions or credits that might apply to you.

It’s important to consult with a tax professional for personalized advice.

Understanding Tax Liability

Tax liability refers to the total amount of taxes you owe to the government. It is calculated based on your taxable income, which is your gross income minus deductions and exemptions.

Tax liability = Taxable income

Sometimes, life throws you a curveball, and you need a little extra time to file your taxes. The good news is that you can usually get an extension. Check out the tax filing extensions for October 2024 to see if you qualify.

Tax rate

For example, if your taxable income is $50,000 and the tax rate is 10%, your tax liability would be $5,000.

Tax Filing and Payment

The IRS offers various methods for filing your taxes and paying your tax liability. You can file online, by mail, or through a tax professional.

- Online filing is often the most convenient and efficient method.

- Mail filing requires completing and sending paper forms to the IRS.

- Tax professionals can help you prepare and file your taxes accurately.

Payment options include direct debit, credit card, check, or money order.

The deadline for filing your taxes is typically April 15th of each year.

The W9 Form is an important document for businesses, and the requirements can change from year to year. Make sure you’re up-to-date on the latest information for October 2024 by checking out the W9 Form October 2024 for estates.

Outcome Summary

Navigating the complexities of tax calculations can feel daunting, but with the right tools and knowledge, it becomes manageable. Tax calculators offer a user-friendly approach to understanding your tax obligations, empowering you to make informed financial decisions. By leveraging these tools, you can gain a clearer picture of your tax liability, identify potential savings opportunities, and approach tax season with confidence.

FAQ Summary: Tax Calculator 2024: How Much Will I Owe In Taxes?

What if I use a tax calculator and it shows I owe more than I expected?

Don’t panic! Tax calculators are just estimations based on the information you provide. You may be able to adjust your withholdings or explore deductions and credits to reduce your tax liability. Consult a tax professional for personalized advice.

Are tax calculators accurate?

Tax calculators provide estimates based on the data you input. They are generally accurate, but it’s essential to remember that tax laws can be complex, and individual circumstances can vary. Always consult a tax professional for personalized advice.

Is using a tax calculator free?

Many online tax calculators are free, but some offer premium features or additional services for a fee. Be sure to review the terms and conditions before using any tax calculator.