Tax Brackets 2024: Understanding How Your Income Is Taxed – Navigating the complexities of the US tax system can feel like a daunting task, especially when it comes to understanding tax brackets. These brackets, which are based on income levels, determine the amount of taxes you owe each year.

This guide delves into the ins and outs of tax brackets for individuals and businesses in 2024, providing clear explanations and practical insights to help you make informed financial decisions.

From the basics of how tax brackets work to the various factors that influence your tax liability, this comprehensive guide covers everything you need to know. We’ll explore the different tax brackets for single filers, married couples, and heads of household, as well as the impact of deductions, credits, and exemptions on your tax burden.

We’ll also examine the tax implications of various income sources, such as wages, investments, and self-employment income.

Understanding Tax Brackets

Tax brackets are a system used by governments to determine how much income tax individuals and businesses owe. They are based on the idea that people with higher incomes should pay a larger percentage of their earnings in taxes. This system ensures fairness and helps fund public services.

How Tax Brackets Work

Tax brackets divide income into different ranges, each with a corresponding tax rate. The more income you earn, the higher the tax rate you’ll pay on a portion of your income.

For example, in 2024, if you earn $10,000, you might pay a 10% tax rate on that entire amount. However, if you earn $50,000, you might pay 10% on the first $10,000, 12% on the amount between $10,001 and $40,000, and 22% on the amount between $40,001 and $50,000.

Marginal Tax Rates

Marginal tax rates refer to the tax rate applied to the last dollarof income earned. This means that if you fall into a higher tax bracket, you only pay the higher rate on the income that exceeds the previous bracket’s limit.

Examples of Income in Different Tax Brackets

- Low-Income:A person earning $20,000 might fall into the lowest tax bracket, paying a lower tax rate on their entire income.

- Middle-Income:A person earning $60,000 might fall into a higher tax bracket, paying a higher rate on the portion of their income exceeding the previous bracket’s limit.

- High-Income:A person earning $200,000 might fall into the highest tax bracket, paying the highest rate on the portion of their income exceeding the previous bracket’s limit.

2024 Tax Brackets for Individuals

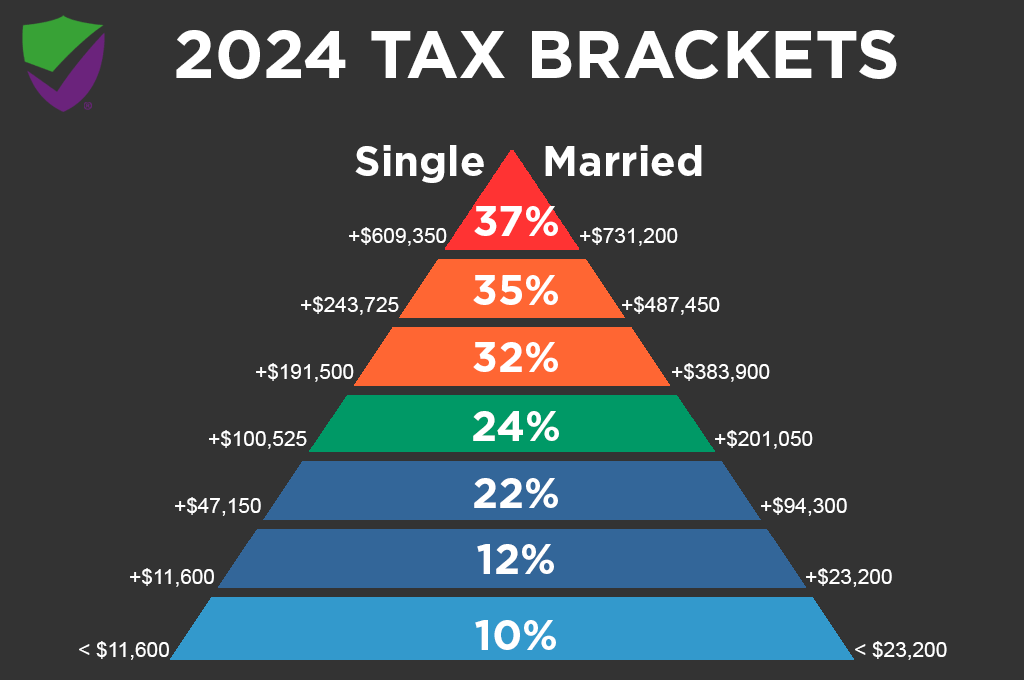

The tax brackets for individuals in 2024 are determined by their filing status, which includes single filers, married couples filing jointly, and head of household filers. These brackets dictate the tax rate applied to different income levels. Understanding these brackets is crucial for individuals to estimate their tax liability and plan their financial strategies.

Single Filers

The 2024 tax brackets for single filers are as follows:| Income Range | Tax Rate ||—|—|| $0

$10,275 | 10% |

| $10,276

$41,775 | 12% |

| $41,776

$89,075 | 22% |

| $89,076

$170,050 | 24% |

| $170,051

$215,950 | 32% |

| $215,951

$539,900 | 35% |

| $539,901+ | 37% |

Married Filing Jointly

For married couples filing jointly in 2024, the tax brackets are:| Income Range | Tax Rate ||—|—|| $0

$20,550 | 10% |

| $20,551

$83,550 | 12% |

| $83,551

$178,150 | 22% |

| $178,151

$340,100 | 24% |

| $340,101

$431,900 | 32% |

| $431,901

$647,850 | 35% |

| $647,851+ | 37% |

Head of Household

The tax brackets for head of household filers in 2024 are:| Income Range | Tax Rate ||—|—|| $0

$15,400 | 10% |

| $15,401

$62,700 | 12% |

| $62,701

$132,200 | 22% |

| $132,201

$255,350 | 24% |

| $255,351

$323,900 | 32% |

Planning for retirement? Annuity King Sarasota can help you navigate the complexities of securing your future. Learn about the different annuity options available and how to choose the best fit for your needs by visiting the Annuity King Sarasota 2024: Your Guide to Secure Retirement page.

| $323,901

$539,900 | 35% |

| $539,901+ | 37% |

Standard Deduction

The standard deduction amounts for each filing status in 2024 are:| Filing Status | Standard Deduction ||—|—|| Single | $13,850 || Married Filing Jointly | $27,700 || Head of Household | $20,800 |

Personal Exemption

There are no personal exemptions in 2024.

Tax Credits

Individuals may be eligible for various tax credits in 2024, such as the Earned Income Tax Credit (EITC). The EITC is a refundable tax credit for low- and moderate-income working individuals and families. Other notable tax credits include the Child Tax Credit and the American Opportunity Tax Credit.The key differences between the tax brackets for single filers, married filing jointly, and head of household filers in 2024 lie in the income ranges for each bracket and the corresponding tax rates.

Married couples filing jointly generally have higher income thresholds for each bracket compared to single filers. Head of household filers have income thresholds that fall between those of single filers and married couples filing jointly. The standard deduction amounts also vary based on filing status, with married couples filing jointly having the highest standard deduction and single filers having the lowest.

Tax Brackets for Businesses

Businesses, like individuals, are subject to different tax rates based on their income. The 2024 tax year sees a few changes to these brackets, impacting how corporations, partnerships, and S-corporations pay taxes.

Corporate Tax Brackets

Corporations pay federal income tax based on a progressive tax system, with higher rates applied to higher profits. Here’s a breakdown of the corporate tax brackets for 2024:

| Taxable Income | Tax Rate |

|---|---|

$0

|

15% |

$50,001

|

20% |

$75,001

|

25% |

$100,001

|

34% |

$335,001

|

35% |

| $10,000,001 and above | 39% |

For example, a corporation with a taxable income of $150,000 in 2024 would pay a tax of $34,000 (calculated as: $50,000 x 15% + $25,000 x 20% + $25,000 x 25% + $50,000 x 34%).

Tax Rates for Partnerships and S-Corporations

Partnerships and S-corporations are not taxed directly. Instead, their income and losses are passed through to their owners, who report them on their individual tax returns. This means that the tax rates for partnerships and S-corporations are determined by the individual tax brackets of their owners.

For example, if a partnership has a taxable income of $100,000 and is owned by two partners, each partner would report $50,000 of income on their individual tax return. The tax rate on this income would be determined by the individual tax brackets for that partner.

5. Tax Planning Strategies

Tax planning is an essential aspect of financial management for both individuals and businesses. By strategically planning your tax obligations, you can minimize your tax liability and maximize your financial resources. This section will explore tax planning strategies for individuals and businesses, covering various aspects like deductions, credits, tax-advantaged savings accounts, and more.

Tax Planning Strategies for Individuals

Effective tax planning for individuals involves utilizing various strategies to reduce their tax burden legally. This includes maximizing deductions, claiming relevant credits, and understanding the implications of different filing statuses.

- Deductions:Deductions reduce your taxable income, leading to lower tax liability. Some common deductions include:

- Standard Deduction or Itemized Deductions:Choose the option that benefits you most. Itemized deductions include medical expenses, mortgage interest, state and local taxes, charitable contributions, and more.

- Homeownership Expenses:Deductible expenses related to your home include mortgage interest, property taxes, and insurance premiums.

- Education Expenses:Deductions are available for student loan interest, tuition, and fees.

- Medical Expenses:If your medical expenses exceed a certain percentage of your adjusted gross income (AGI), you can deduct the excess.

- Charitable Contributions:You can deduct cash or non-cash contributions made to qualified charities.

- Credits:Credits directly reduce your tax liability. Some common credits include:

- Child Tax Credit:This credit is available for qualifying children under 17 years old.

- Earned Income Tax Credit (EITC):This credit is available for low- to moderate-income working individuals and families.

- American Opportunity Tax Credit (AOTC):This credit is available for the first four years of college.

- Lifetime Learning Credit:This credit is available for courses taken to improve job skills or to pursue a degree.

- Tax-Advantaged Savings Accounts:These accounts offer tax benefits for saving for specific purposes. Some popular options include:

- Traditional IRA:Contributions are tax-deductible, and withdrawals are taxed in retirement.

- Roth IRA:Contributions are not tax-deductible, but withdrawals in retirement are tax-free.

- 401(k) Plan:Offered by employers, contributions are pre-tax, and withdrawals are taxed in retirement.

- 529 College Savings Plan:Contributions grow tax-deferred, and withdrawals for qualified educational expenses are tax-free.

- Filing Status:Your filing status can significantly impact your tax liability. Some common filing statuses include:

- Single:For unmarried individuals.

- Married Filing Jointly:For married couples who file their taxes together.

- Married Filing Separately:For married couples who file their taxes separately.

- Head of Household:For unmarried individuals with a qualifying child.

Tax Planning Strategies for Businesses

Effective tax planning for businesses involves optimizing their business structure, maximizing deductions, and minimizing tax liabilities.

- Business Structure:Choosing the right business structure is crucial for tax purposes. Some common structures include:

- Sole Proprietorship:The business is owned and operated by one person.

- Partnership:Two or more individuals own and operate the business.

- Limited Liability Company (LLC):Provides liability protection for its owners.

- Corporation:A separate legal entity from its owners.

- Deductions:Businesses can deduct various expenses from their income to reduce their tax liability. Some common deductions include:

- Business Expenses:Costs directly related to running the business, such as rent, utilities, salaries, and supplies.

- Depreciation:Allows businesses to deduct the cost of assets over their useful life.

- Interest Expense:Interest paid on business loans.

- Home Office Deduction:Available if you use a portion of your home for business purposes.

- Charitable Contributions:Businesses can deduct contributions made to qualified charities.

- Credits:Businesses can claim various credits to reduce their tax liability. Some common credits include:

- Research and Development (R&D) Tax Credit:Available for businesses that invest in research and development activities.

- Work Opportunity Tax Credit (WOTC):Available for hiring individuals from certain disadvantaged groups.

- Small Business Health Care Tax Credit:Available for small businesses that provide health insurance to their employees.

- Energy Investment Tax Credit (ITC):Available for investments in renewable energy technologies.

- Tax-Advantaged Savings and Investment Options:Businesses can utilize various tax-advantaged savings and investment options to achieve specific goals. Some common options include:

- 401(k) Plan:Allows employees to contribute pre-tax dollars to a retirement savings plan.

- SEP IRA:A retirement plan for self-employed individuals and small business owners.

- SIMPLE IRA:A retirement plan for small businesses with 100 or fewer employees.

- Employee Stock Ownership Plan (ESOP):Allows employees to own shares of the company’s stock.

Tax-Advantaged Savings and Investment Options: A Comparison

| Option | Individuals | Businesses ||—|—|—|| Traditional IRA| Tax-deductible contributions, taxed withdrawals in retirement | Not applicable || Roth IRA| Non-deductible contributions, tax-free withdrawals in retirement | Not applicable || 401(k) Plan| Pre-tax contributions, taxed withdrawals in retirement | Pre-tax contributions for employees, tax-deductible contributions for employers || 529 College Savings Plan| Tax-deferred growth, tax-free withdrawals for qualified education expenses | Not applicable || SEP IRA| Not applicable | Tax-deductible contributions for self-employed individuals and small business owners || SIMPLE IRA| Not applicable | Tax-deductible contributions for small businesses with 100 or fewer employees || Employee Stock Ownership Plan (ESOP)| Not applicable | Allows employees to own shares of the company’s stock, tax-deductible contributions for employers |

Disclaimer:The information provided in this guide is for general knowledge and should not be considered professional tax advice. Please consult with a qualified tax professional for personalized advice.

Tax Policy Changes and Implications

Tax policy changes are a regular occurrence in most countries, including the United States. These changes can significantly impact individuals and businesses, influencing their tax liabilities and financial planning strategies. It’s crucial to stay informed about the latest tax policy developments and their potential implications.

Recent Tax Policy Changes for 2024

This section will provide a summary of recent tax policy changes for 2024, outlining their potential impact on individuals and businesses.

| Policy Change | Description | Impact on Individuals | Impact on Businesses |

|---|---|---|---|

| Increased Standard Deduction | The standard deduction for individuals and married couples filing jointly has been increased for 2024. | This change could lead to lower tax liabilities for many individuals, particularly those with lower incomes. | No direct impact on businesses. |

| Changes to Itemized Deductions | Certain itemized deductions, such as those for state and local taxes (SALT), have been modified or limited for 2024. | This could result in higher tax liabilities for individuals who previously benefited from these deductions, especially those in high-tax states. | No direct impact on businesses. |

| Increased Corporate Tax Rate | The corporate tax rate has been increased for 2024. | No direct impact on individuals. | This change could lead to higher tax liabilities for corporations, potentially affecting their profitability and investment decisions. |

| New Tax Credits for Green Energy Investments | New tax credits have been introduced for businesses investing in renewable energy technologies. | No direct impact on individuals. | This could incentivize businesses to invest in green energy, potentially leading to increased innovation and job creation in this sector. |

Implications of Proposed Tax Reforms

Proposed tax reforms can significantly impact future tax brackets and tax liabilities. It’s important to understand the potential implications of these reforms.

- Increased Tax Rates:Some proposed reforms suggest increasing tax rates for higher earners, potentially creating new tax brackets or adjusting existing ones.

- Changes to Deductions and Credits:Proposed reforms might alter the availability and amount of deductions and credits, affecting both individuals and businesses.

- New Tax Incentives:Tax reforms could introduce new tax incentives for specific industries or activities, encouraging investment and economic growth in those areas.

7. Tax Brackets and Income Inequality: Tax Brackets 2024

The relationship between tax brackets and income inequality is a complex and multifaceted issue that has been the subject of much debate. This section will delve into the intricate connections between these two concepts, examining how tax systems can influence income distribution and the arguments surrounding progressive taxation.

Whether you’re a musician, podcaster, or gamer, improving your audio quality can make a big difference. Acoustic foam is a great way to enhance your recordings and minimize unwanted noise. Find out more about the benefits of acoustic foam and how to choose the right type for your needs by visiting the Acoustic Foam Youtube 2024: Elevate Your Audio article.

Data Analysis

To understand the link between tax brackets and income inequality, it is crucial to analyze the distribution of income across different tax brackets. Data from reputable sources like the Internal Revenue Service (IRS) or the Organisation for Economic Co-operation and Development (OECD) can provide valuable insights.

- Tax Bracket Data: By examining the income ranges for each tax bracket, we can identify the average income of individuals within each bracket. This information allows us to calculate the percentage of total national income held by each tax bracket.

For instance, consider the following hypothetical data:

This table illustrates how a significant portion of national income is concentrated in the higher tax brackets. This pattern can be indicative of income inequality, as a smaller percentage of the population holds a larger share of the total income.

Income Inequality Analysis

To quantify income inequality, we can employ metrics like the Gini coefficient or the Palma ratio. The Gini coefficient measures income inequality on a scale from 0 to 1, where 0 represents perfect equality and 1 represents perfect inequality. The Palma ratio compares the income share of the top 10% of earners to the bottom 40% of earners.

- Trends in Income Inequality: By analyzing trends in income inequality over time, we can observe how the distribution of income has changed in relation to tax bracket distribution.

- Impact of Tax Brackets: Understanding the impact of tax brackets on income inequality requires examining the characteristics of different tax systems.

Progressive Tax Systems

Progressive tax systems are designed to reduce income inequality by requiring higher earners to pay a larger percentage of their income in taxes.

- Fairness and Equity: Proponents of progressive taxation argue that it promotes fairness and equity by adhering to the principle of “ability to pay.”

- Social Mobility: Progressive taxation can contribute to social mobility by funding social programs and education, which can provide opportunities for individuals from lower-income backgrounds to improve their socioeconomic status.

- Economic Stability: Progressive taxation can potentially contribute to economic stability by reducing income inequality and stimulating demand. When a larger share of income is distributed among a wider segment of the population, it can lead to increased consumer spending and economic growth.

The EV tax credit is having a significant impact on the auto industry in 2024, driving innovation and pushing automakers to produce more electric vehicles. Read about the impact of the EV tax credit on the industry and its implications for the future of transportation by checking out the EV Tax Credits Impact on the Auto Industry in 2024 article.

Regressive Tax Systems

In contrast, regressive tax systems have the opposite effect on income inequality. They impose a higher tax burden on lower earners, exacerbating income disparities.

- Impact on Income Inequality: Regressive tax systems disproportionately impact lower-income households, leading to a widening gap between the rich and the poor. This can further exacerbate existing social and economic inequalities.

- Tax Bracket Adjustments: Changes in tax bracket thresholds or rates can have significant effects on income inequality. Raising the thresholds for higher tax brackets can potentially reduce income inequality by shifting the tax burden to higher earners. Conversely, lowering thresholds or reducing tax rates for higher earners can exacerbate income disparities.

Arguments for and Against Progressive Tax Systems

The debate surrounding progressive taxation revolves around its potential benefits and drawbacks.

Pro-Progressive Taxation

Arguments in favor of progressive taxation often focus on its potential to promote fairness, social mobility, and economic stability.

- Fairness and Equity: Proponents of progressive taxation argue that it promotes fairness and equity by adhering to the principle of “ability to pay.” They believe that those who earn more should contribute a larger share of their income to support public services and social programs.

- Social Mobility: Progressive taxation can contribute to social mobility by funding social programs and education, which can provide opportunities for individuals from lower-income backgrounds to improve their socioeconomic status. By investing in education, healthcare, and other social programs, progressive taxation can help create a more equitable society where individuals have a greater chance of upward mobility.

- Economic Stability: Progressive taxation can potentially contribute to economic stability by reducing income inequality and stimulating demand. When a larger share of income is distributed among a wider segment of the population, it can lead to increased consumer spending and economic growth.

This can create a more robust and sustainable economy.

Anti-Progressive Taxation

Opponents of progressive taxation argue that it can have negative effects on economic growth, disincentivize work and entrepreneurship, and lead to inefficient government spending.

- Economic Growth: Critics of progressive taxation argue that it can stifle economic growth by discouraging investment and entrepreneurship. They believe that high tax rates on high earners can reduce their incentive to invest and create jobs, hindering economic expansion.

- Disincentivized Work: Opponents of progressive taxation argue that high tax rates can disincentivize work and entrepreneurship. They believe that individuals may be less likely to work hard or start businesses if they perceive that a significant portion of their earnings will be taxed away.

- Government Spending: Critics of progressive taxation argue that even with progressive taxation, government spending can be inefficient or ineffective. They believe that government programs may not always be well-designed or implemented, leading to waste and inefficiency. Additionally, they argue that high taxes can lead to a larger and more intrusive government, potentially reducing individual freedom and economic liberty.

Tax Brackets and Economic Growth

The relationship between tax brackets and economic growth is a complex and often debated topic. While tax brackets are designed to ensure fairness in the tax system, their impact on economic growth is not always straightforward. This section explores how tax brackets can influence investment, spending, and ultimately, the overall health of the economy.

Impact of Tax Bracket Changes on Investment and Spending

Changes in tax brackets can have significant effects on investment and spending patterns within an economy. When tax rates are lowered, individuals and businesses may have more disposable income, leading to increased spending and investment. This can stimulate economic growth by boosting demand for goods and services.

However, lowering tax rates can also lead to a decrease in government revenue, which may limit public investment in infrastructure and social programs. Conversely, raising tax rates can lead to a decrease in disposable income, potentially slowing down spending and investment.

This could result in a decrease in economic activity. The impact of tax bracket changes on investment and spending depends on several factors, including the size of the change, the overall economic climate, and the specific sectors affected. For instance, a reduction in the top marginal tax rate may encourage wealthy individuals to invest more in the stock market or real estate, leading to increased capital formation and economic growth.

However, if the reduction is too significant, it could also lead to increased income inequality and a decrease in social spending.

Arguments for and Against Using Tax Brackets as a Tool for Economic Policy

There are strong arguments both for and against using tax brackets as a tool for economic policy.

Arguments for Using Tax Brackets for Economic Policy

- Stimulating Economic Growth:Lowering tax rates, particularly for businesses and high-income earners, can lead to increased investment and spending, potentially boosting economic growth. This is often referred to as “supply-side economics.”

- Encouraging Innovation and Entrepreneurship:Reducing taxes on businesses and individuals with higher incomes can provide incentives for innovation and entrepreneurship, leading to the creation of new businesses and jobs.

- Improving Income Distribution:Progressive tax systems, where higher earners pay a larger proportion of their income in taxes, can help to reduce income inequality and ensure that everyone contributes to the public good.

Arguments Against Using Tax Brackets for Economic Policy

- Limited Effectiveness:The impact of tax bracket changes on economic growth is not always clear-cut. Other factors, such as government spending, monetary policy, and global economic conditions, also play a significant role.

- Potential for Abuse:Tax loopholes and exemptions can be exploited by high-income earners and corporations, leading to a decrease in tax revenue and an increase in income inequality.

- Negative Impact on Social Spending:Lowering tax rates can lead to a decrease in government revenue, which may limit public investment in social programs, such as education, healthcare, and infrastructure.

Tax Compliance and Reporting

Tax compliance is crucial for individuals and businesses to ensure they meet their legal obligations and avoid penalties. Understanding your tax obligations, reporting accurately, and adhering to filing deadlines are essential aspects of responsible tax management. This section provides a comprehensive overview of tax compliance and reporting, covering key aspects such as understanding your tax obligations, accurate tax reporting and filing, penalties for non-compliance, and a guide to ensure tax compliance.

Understanding Your Tax Obligations

Individuals are obligated to pay various taxes, including income tax, property tax, and sales tax. These taxes are levied by federal, state, and local governments to fund public services and infrastructure. * Income Tax:This is the most significant tax for most individuals.

It’s a tax on your earnings from various sources, such as wages, salaries, investments, and self-employment income. The amount of income tax you owe is determined by your tax bracket, which is based on your taxable income. * Property Tax:This tax is levied on real estate, such as homes, land, and commercial properties.

The property tax rate varies depending on the location and value of the property.* Sales Tax:This tax is imposed on the purchase of goods and services. The sales tax rate varies depending on the state and local jurisdiction. The tax brackets are a system used to determine the amount of income tax owed based on your taxable income.

The higher your income, the higher your tax bracket, and the greater the percentage of your income you pay in taxes.Individuals are entitled to various deductions and credits that can reduce their tax liability. These deductions and credits are designed to provide tax relief for specific expenses or situations.* Common Deductions:Some common deductions include deductions for mortgage interest, charitable contributions, medical expenses, and state and local taxes.* Common Credits:Common credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit.

| Tax Type | Filing Deadline |

|---|---|

| Federal Income Tax | April 15th |

| State Income Tax | Varies by state |

| Property Tax | Varies by jurisdiction |

| Sales Tax | Generally collected at the point of sale |

Accurate Tax Reporting and Filing

Accurate tax reporting and filing are crucial to avoid penalties and ensure compliance with tax laws. This process involves gathering necessary documentation, organizing financial records, and choosing the appropriate filing method.* Gathering Necessary Documentation:It is essential to gather all relevant documents before filing your taxes.

These documents include:

W-2 Form

This form reports your wages and withholdings from your employer.

1099 Form

This form reports income from sources other than employment, such as interest, dividends, and self-employment income.

Receipts

Keep receipts for all deductible expenses, such as medical expenses, charitable donations, and business expenses.

Other Relevant Paperwork

This may include mortgage interest statements, student loan interest statements, and investment account statements.* Organizing Financial Records:Maintaining organized financial records is essential for accurate tax reporting. This involves keeping all receipts, tax forms, and other relevant documentation in a safe and accessible place.* Methods of Tax Filing:Individuals can file their taxes using various methods:

Online Filing

This is the most convenient and efficient method, allowing you to file your taxes electronically.

Mail Filing

You can file your taxes by mail using paper forms.

Tax Preparer

Hiring a tax preparer can help you file your taxes accurately and efficiently.

Penalties for Non-Compliance and Tax Evasion

Failing to file taxes on time or accurately can result in penalties. These penalties can include:* Late Filing Penalties:This penalty is imposed if you fail to file your taxes by the deadline.

Underpayment Penalties

This penalty is imposed if you don’t pay enough taxes.

Looking for some extra cash? California residents might be eligible for a stimulus check in October 2024. Find out if you qualify and what amount you could receive by checking out this article on the California Stimulus Check October 2024: Amount and Payment Schedule.

Accuracy-Related Penalties

This penalty is imposed if you make significant errors on your tax return.Tax evasion is a serious crime involving intentionally avoiding paying taxes. It can involve hiding income, claiming false deductions, or using other fraudulent methods to reduce tax liability.

Tax evasion carries severe legal consequences, including fines, imprisonment, and other penalties.

Writing a Tax Compliance Guide, Tax Brackets 2024

Following a comprehensive guide can help individuals ensure tax compliance and avoid penalties. * Understand Your Tax Obligations:Familiarize yourself with the different types of taxes you are obligated to pay, including federal, state, and local taxes.

Gather Necessary Documentation

Collect all relevant documents, such as W-2 forms, 1099 forms, receipts, and other tax-related paperwork.

Organize Financial Records

Maintain organized financial records by keeping all receipts, tax forms, and other documentation in a safe and accessible place.

File Your Taxes on Time

File your taxes by the deadline to avoid late filing penalties.

Pay Your Taxes Accurately

Calculate your tax liability accurately and pay the correct amount of taxes to avoid underpayment penalties.

Seek Professional Advice

If you are unsure about your tax obligations or need assistance with tax filing, consult a qualified tax professional.

Keep Records for Future Reference

Retain copies of all tax-related documents for at least three years.

Stay Informed About Tax Laws

Keep yourself updated on any changes in tax laws and regulations.By following these steps, individuals can ensure tax compliance, avoid penalties, and maintain a positive relationship with the tax authorities.

Tax Assistance and Resources

Navigating the complexities of the tax system can be daunting, even for seasoned individuals. Fortunately, numerous resources and organizations are available to provide guidance and support throughout the tax season. These resources can help taxpayers understand their obligations, claim eligible deductions, and ensure accurate filing.

Reputable Tax Assistance Organizations

Tax assistance organizations play a crucial role in helping individuals and families navigate the tax system. They offer a range of services, from free tax preparation to educational workshops and advocacy.

- Volunteer Income Tax Assistance (VITA) Program:This program provides free tax preparation services to low- and moderate-income taxpayers, particularly those who are elderly, disabled, or speak limited English. VITA sites are typically located in community centers, libraries, and other accessible locations.

- Tax Counseling for the Elderly (TCE) Program:Similar to VITA, TCE provides free tax assistance specifically tailored to seniors, focusing on issues relevant to their age group, such as pensions, retirement income, and Social Security benefits.

- AARP Foundation Tax-Aide:This program offers free tax preparation services to taxpayers of all ages, with a focus on assisting low- and moderate-income taxpayers. They have a nationwide network of volunteers who can assist with tax preparation and provide guidance on tax-related matters.

Tax Preparation Software and Services

Tax preparation software and services have become increasingly popular, offering convenience and affordability for taxpayers. These platforms provide step-by-step guidance, access to tax forms, and automated calculations, simplifying the tax filing process.

- Intuit TurboTax:This popular software offers a range of options, from basic versions for simple returns to more comprehensive versions for complex tax situations. It provides personalized guidance, helps users claim eligible deductions, and offers features such as audit support and tax planning tools.

- H&R Block:H&R Block provides both online and in-person tax preparation services. Their software offers a user-friendly interface, guided assistance, and access to tax professionals for personalized support.

- TaxSlayer:TaxSlayer offers affordable tax preparation software with a focus on simplicity and ease of use. It provides a straightforward process, helpful tips, and access to tax forms, making it suitable for taxpayers of all levels of experience.

Seeking Professional Tax Advice

While tax preparation software and online resources can be helpful, complex tax situations often require the expertise of a qualified tax professional. Tax professionals can provide personalized guidance, identify potential deductions and credits, and help taxpayers navigate complex tax laws and regulations.

“Seeking professional tax advice is particularly crucial for individuals with unique circumstances, such as business owners, investors, or those with international income.”

Tax Brackets and Retirement Planning

Retirement planning involves strategically saving and investing for your future financial security. Tax brackets play a significant role in this process, influencing how much you pay in taxes on your retirement savings and withdrawals. Understanding the interplay between tax brackets and retirement planning is crucial for maximizing your retirement income and minimizing your tax burden.

Impact of Tax Brackets on Retirement Savings

Tax brackets directly affect how much you pay in taxes on your retirement contributions. Traditional IRA and 401(k) contributions are tax-deductible, meaning you deduct them from your taxable income, potentially lowering your tax bracket in the present. However, withdrawals in retirement are taxed as ordinary income, subject to your tax bracket at that time.

Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free, making them particularly advantageous for those expecting to be in a higher tax bracket during retirement.

Strategies for Optimizing Retirement Income within Different Tax Brackets

Retirement income planning involves strategically withdrawing funds to minimize your tax liability. You can use various techniques, such as Roth conversions, to shift income between tax brackets. For instance, if you anticipate a higher tax bracket in the future, converting some traditional IRA funds to a Roth IRA now may be beneficial, allowing you to withdraw funds tax-free later.

Benefits and Drawbacks of Retirement Account Options

Retirement account options offer varying tax benefits and restrictions. Traditional IRAs and 401(k)s provide tax deductions on contributions but tax withdrawals in retirement. Roth IRAs offer tax-free withdrawals in retirement but require after-tax contributions.

- Traditional IRAs and 401(k)s: These offer tax deductions on contributions, reducing your current tax liability. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRAs: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket during retirement.

- 403(b): Similar to 401(k)s but offered to employees of certain non-profit organizations, educational institutions, and religious organizations.

- 457(b): Similar to 401(k)s but offered to government employees.

- SEP IRA: A retirement plan for self-employed individuals and small business owners.

- SIMPLE IRA: A retirement plan for small businesses with 100 or fewer employees.

Choosing the right retirement account depends on your individual circumstances, tax bracket, and retirement goals. It’s advisable to consult with a financial advisor to determine the best approach for your situation.

Tax Brackets and Estate Planning

Estate planning involves preparing for the distribution of your assets after your death. Understanding how tax brackets affect estate taxes is crucial for effective estate planning. Estate taxes are levied on the value of your assets exceeding a certain threshold.

The amount of estate tax you pay is directly tied to the tax bracket your estate falls into.

Estate Tax Implications of Tax Brackets

The estate tax is a progressive tax, meaning the tax rate increases as the value of the estate grows. The current federal estate tax exemption is $12.92 million per person in 2024, which means estates worth less than that amount are not subject to federal estate tax.

For estates exceeding the exemption, the tax rate starts at 40% and can go up to 40%. The exact tax rate depends on the total value of the estate.

For example, if your estate is worth $15 million, the first $12.92 million is exempt from estate tax. The remaining $2.08 million would be subject to estate tax at the 40% rate, resulting in a tax liability of $832,000.

Strategies for Minimizing Estate Tax Liability

Several strategies can help minimize estate tax liability.

Wondering if you’re eligible for the California stimulus check? The requirements are outlined in detail in this article, so you can check your eligibility and see if you’re in line for some extra funds. Head over to the California Stimulus Check October 2024 Eligibility Requirements page for all the information.

- Gifting:Gifting assets during your lifetime allows you to transfer wealth outside of your estate, potentially reducing the size of your estate subject to estate tax. There are annual gift tax exclusions that allow you to gift a certain amount of money each year without incurring gift tax.

The 2024 annual exclusion is $17,000 per recipient.

- Charitable Giving:Donating assets to qualified charities can reduce your taxable estate. Charitable donations can be made during your lifetime or through your will.

- Trusts:Creating trusts can help minimize estate taxes by strategically distributing assets to beneficiaries. Trusts can be used to manage assets, reduce estate taxes, and protect assets from creditors.

- Revocable Living Trust:A revocable living trust allows you to retain control over your assets during your lifetime and distribute them according to your wishes after your death. This can help minimize estate taxes by transferring assets outside of your probate estate.

- Irrevocable Trust:An irrevocable trust is a trust that you cannot change or revoke after its creation. This type of trust can be used to transfer assets to beneficiaries without incurring estate tax. However, you lose control of the assets once they are transferred to the trust.

Tax Brackets and Inheritance and Gift Taxes

Inheritance and gift taxes are also influenced by tax brackets. Inheritance tax is levied on assets inherited from a deceased person, while gift tax is levied on assets gifted to someone during your lifetime. The amount of inheritance or gift tax you pay depends on the value of the asset and the tax bracket you fall into.

For example, if you inherit $1 million from a relative, you may be subject to inheritance tax depending on your state’s laws and the amount of the estate tax exemption. If you gift $1 million to a child, you may be subject to gift tax.

Epilogue

Understanding tax brackets is crucial for maximizing your financial well-being. By leveraging the information presented in this guide, you can make informed decisions about your income, expenses, and tax planning strategies. Remember, staying informed and proactive about your tax obligations can help you save money and achieve your financial goals.

Whether you’re an individual or a business owner, understanding the intricacies of tax brackets empowers you to navigate the tax landscape with confidence.

Helpful Answers

What are the tax brackets for single filers in 2024?

The tax brackets for single filers in 2024 vary depending on their income level. You can find a detailed table outlining the tax brackets and corresponding income ranges in the main guide.

How do tax credits differ from deductions?

Tax credits directly reduce the amount of taxes you owe, while deductions lower your taxable income. Tax credits are generally more beneficial than deductions because they provide a dollar-for-dollar reduction in your tax liability.

What are some examples of common tax deductions?

Some common tax deductions include mortgage interest, charitable contributions, state and local taxes, and medical expenses. The specific deductions you can claim will depend on your individual circumstances.

Are there any tax credits available for individuals in 2024?

Yes, there are several tax credits available for individuals in 2024, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. The eligibility requirements and credit amounts vary depending on the specific credit.

Where can I find more information about tax brackets and tax planning?

You can find comprehensive information on tax brackets and tax planning from reputable sources like the Internal Revenue Service (IRS) website, tax preparation software, and financial advisors.