Tax bracket thresholds for 2024 set the stage for understanding how your income is taxed, offering insights into how these thresholds might impact your financial planning. The United States tax system relies on a progressive tax structure, meaning that as your income increases, so does your tax rate.

This guide delves into the specifics of these thresholds, outlining the different tax brackets for various filing statuses and the potential impact on your overall tax liability.

Understanding the tax bracket thresholds for 2024 is crucial for both individuals and businesses. By analyzing the income ranges and corresponding tax rates, you can gain valuable insights into how your income will be taxed and strategize ways to minimize your tax burden.

This guide provides a comprehensive overview of the 2024 tax bracket thresholds, covering essential topics such as inflation’s influence on tax brackets, effective tax planning strategies, and a historical comparison to previous years.

2024 Tax Bracket Thresholds

The 2024 tax year is fast approaching, and it’s crucial to understand how the tax brackets will affect your income. This information will help you plan your finances and ensure you’re paying the correct amount of taxes.

The tax brackets are changing for 2024, so it’s essential to understand the new rates. Find out about the new tax brackets for 2024 and how they might affect you.

2024 Tax Bracket Thresholds

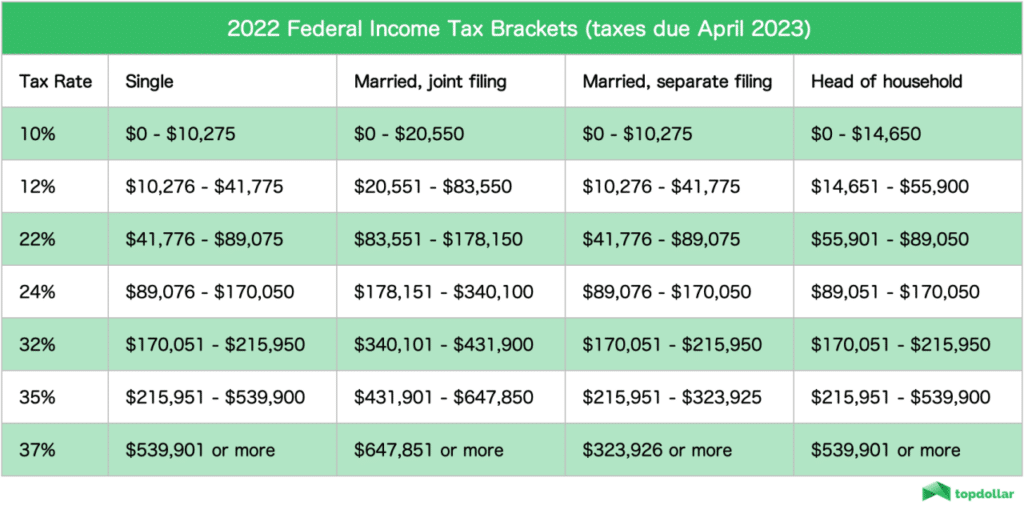

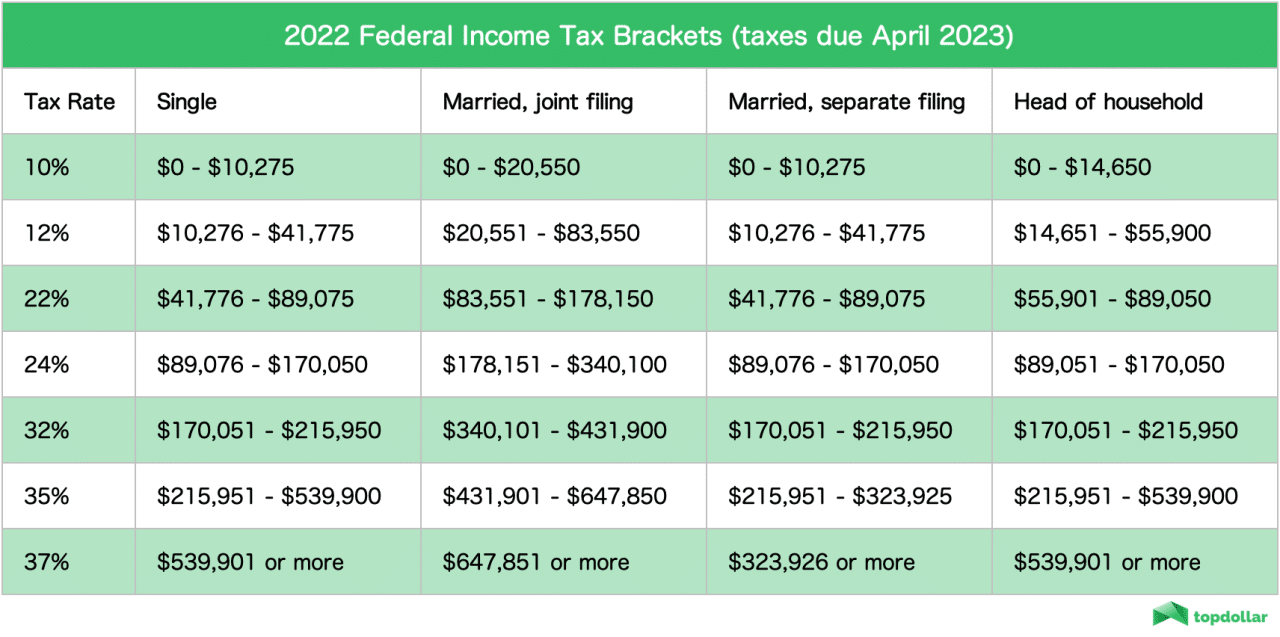

The following table Artikels the 2024 tax bracket thresholds for single filers, married filing jointly, married filing separately, and head of household.

| Filing Status | Income Range | Tax Rate | Total Tax Liability |

|---|---|---|---|

| Single | $0

|

10% | $0

The college football landscape is shifting, with Alabama falling in the rankings and Big Ten teams making their mark. See where your favorite teams landed in the latest rankings.

|

| $10,951

Southern California felt the ground shake early this morning due to an earthquake in Ontario. Get the latest details on the earthquake and its impact.

|

12% | $1,095

|

|

$46,276

|

22% | $5,553

If you’re filing as married filing separately in 2024, you’ll need to know the specific tax brackets that apply to you. Get the details on the tax brackets for married filing separately.

|

|

$101,751

|

24% | $18,397

If you’re filing as single in 2024, you’ll want to know the updated tax brackets. Get the details on the tax brackets for single filers in 2024 to plan your finances.

|

|

$192,151

|

32% | $36,913

|

|

$578,126

|

35% | $156,393

|

|

| $693,751+ | 37% | $212,543+ | |

| Married Filing Jointly | $0

|

10% | $0

|

$21,901

|

12% | $2,190

|

|

$82,551

|

22% | $9,906

The Jaguars pulled off a thrilling victory against the Colts in Week 5. Check out the game report to relive the action.

|

|

| $172,751

Ready for some NFL action? Find out how you can catch the Raiders vs. Broncos game by checking out the guide to watching the game.

|

24% | $30,106

|

|

$324,301

|

32% | $58,230

|

|

| $648,601

The tax brackets for 2024 in the United States have been adjusted. Learn about the updated tax brackets and how they might impact your taxes.

|

35% | $164,790

|

|

| $787,501+ | 37% | $235,080+ | |

| Married Filing Separately | $0

The Seahawks put up a good fight, but ultimately fell short in their Week 5 matchup. Read the rapid reactions to see what fans and analysts are saying about the game.

|

10% | $0

|

$10,951

|

12% | $1,095

|

|

$41,276

|

22% | $4,953

|

|

$86,376

|

24% | $15,053

|

|

$162,151

|

32% | $29,115

|

|

| $324,301

The Ravens and Bengals battled it out on the field, but the Bengals emerged victorious. Check out the postgame notes and quotes to see what both teams had to say about the game.

|

35% | $82,395

|

|

| $393,751+ | 37% | $117,540+ | |

| Head of Household | $0

|

10% | $0

If you’re a qualifying widow(er) in 2024, you’ll want to be aware of the specific tax brackets that apply to you. Find the information you need on the tax brackets for qualifying widow(er)s.

|

$18,551

|

12% | $1,855

|

|

$82,551

|

22% | $9,906

|

|

$172,751

|

24% | $30,106

|

|

$324,301

|

32% | $58,230

Curious about how the new tax brackets might affect your income? Find out how the changes could impact your bottom line by reading the analysis of tax bracket impacts.

|

|

$578,126

|

35% | $156,393

|

|

| $693,751+ | 37% | $212,543+ |

Tax Planning Strategies for 2024

Tax planning is an essential aspect of personal and business finance, particularly as tax laws and regulations evolve. By strategically planning your tax obligations, you can minimize your tax liability and maximize your financial well-being.

This section will explore various tax planning strategies that individuals and businesses can employ in 2024 to optimize their tax outcomes.

The Giants pulled off a victory against the Seahawks, and it wasn’t just a win, it was a dominant performance. Dive into the instant analysis to see what made the Giants so successful.

Tax Deductions and Credits

Tax deductions and credits offer valuable opportunities to reduce your tax burden. Understanding the differences between deductions and credits is crucial for effective tax planning.Deductions reduce your taxable income, while credits directly reduce your tax liability. For example, the standard deduction is a deduction that reduces your taxable income, while the Earned Income Tax Credit is a credit that directly reduces the amount of tax you owe.

“Deductions and credits are valuable tools for reducing your tax liability. It’s important to understand the difference between them to make informed decisions about your tax planning.”

Tax Planning Strategies for Individuals, Tax bracket thresholds for 2024

Individuals can implement various tax planning strategies to minimize their tax liability. These strategies often involve maximizing deductions and credits, taking advantage of tax-advantaged accounts, and strategically timing income and expenses.

The Packers secured a win over the Rams thanks to some key turnovers. Get a recap of the game and the highlights of the Packers’ victory.

Maximize Deductions and Credits

Taxpayers can leverage deductions and credits to reduce their tax liability. Some common deductions include:

- Standard Deduction:Most taxpayers choose to take the standard deduction, which is a fixed amount that varies based on filing status.

- Itemized Deductions:If you have significant expenses, you may benefit from itemizing your deductions. These include deductions for medical expenses, mortgage interest, charitable contributions, and state and local taxes.

- Homeownership Deductions:Homeowners can deduct mortgage interest and property taxes.

- Child Tax Credit:This credit is available to taxpayers with qualifying children under 17 years old.

- Education Credits:Taxpayers can claim credits for education expenses, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

Utilize Tax-Advantaged Accounts

Tax-advantaged accounts offer tax benefits for savings and investments.

- 401(k) and 403(b) Plans:These employer-sponsored retirement plans allow pre-tax contributions to grow tax-deferred.

- Individual Retirement Accounts (IRAs):IRAs are personal retirement accounts that offer tax benefits. Traditional IRAs allow pre-tax contributions, while Roth IRAs allow tax-free withdrawals in retirement.

- Health Savings Accounts (HSAs):HSAs are tax-advantaged accounts for healthcare expenses. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Strategic Timing of Income and Expenses

Timing your income and expenses can impact your tax liability.

- Income:If possible, try to spread out your income throughout the year to avoid hitting higher tax brackets.

- Expenses:Consider bunching deductible expenses, such as medical expenses, into a single tax year to maximize your deductions.

Tax Planning Strategies for Businesses

Businesses can implement various tax planning strategies to minimize their tax liability and maximize their profitability. These strategies often involve maximizing deductions and credits, taking advantage of tax-advantaged structures, and strategically timing income and expenses.

Maximize Deductions and Credits

Businesses can leverage a wide range of deductions and credits to reduce their tax liability. Some common business deductions include:

- Business Expenses:This includes expenses related to running your business, such as rent, utilities, salaries, and supplies.

- Depreciation:You can deduct the cost of depreciable assets, such as equipment and machinery, over time.

- Research and Development (R&D) Credits:Businesses engaged in R&D activities may be eligible for tax credits.

- Small Business Deductions:Small businesses may qualify for special deductions, such as the Qualified Business Income Deduction (QBI Deduction).

Utilize Tax-Advantaged Structures

Choosing the right business structure can have significant tax implications.

- Sole Proprietorship:This structure is simple to set up, but the business owner is personally liable for all debts and obligations.

- Partnership:This structure involves two or more individuals who share profits and losses.

- Limited Liability Company (LLC):This structure provides limited liability protection for the business owners.

- Corporation:This structure offers limited liability protection and can be beneficial for tax purposes.

Strategic Timing of Income and Expenses

Businesses can also strategically time their income and expenses to minimize their tax liability.

With the new year comes new tax rules, including changes to the tax brackets. Stay informed about the tax bracket changes for 2024 to ensure you’re prepared for filing season.

- Income:Consider deferring income to the next tax year if possible.

- Expenses:Accelerate deductible expenses into the current tax year.

Implications for Different Income Groups

The 2024 tax bracket thresholds will have a significant impact on taxpayers across various income levels. Understanding how these changes affect different income groups is crucial for individuals and families to plan their finances effectively.

Impact on Low-Income Earners

Low-income earners may see a slight reduction in their tax burden due to the adjusted tax brackets. The expanded standard deduction and increased personal exemptions could provide some relief, particularly for individuals with lower incomes. This could lead to a higher net income, potentially increasing disposable income for essential needs like food, housing, and healthcare.

Impact on Middle-Income Earners

Middle-income earners may experience a more pronounced impact from the 2024 tax bracket changes. While the adjustments could lead to lower tax liabilities, they may also face increased costs associated with inflation and rising interest rates. This could necessitate careful financial planning to maintain their current standard of living and meet their financial goals.

Impact on High-Income Earners

High-income earners may see a more significant increase in their tax liability due to the adjusted tax brackets and potential changes in deductions and exemptions. They may need to consider strategies for minimizing their tax burden, such as maximizing contributions to tax-advantaged retirement accounts, exploring investment opportunities with tax-efficient structures, and potentially adjusting their income streams to minimize tax implications.

Closing Notes: Tax Bracket Thresholds For 2024

Navigating the intricacies of the tax system can be daunting, but understanding the 2024 tax bracket thresholds is a fundamental step towards informed financial decision-making. By analyzing the impact of these thresholds on different income groups, individuals and businesses can make informed choices to optimize their tax planning strategies and achieve their financial goals.

This guide provides a valuable resource for understanding the intricacies of tax brackets and empowers you to navigate the complexities of the tax system with greater confidence.

FAQs

What happens if my income falls into multiple tax brackets?

You only pay the higher tax rate on the portion of your income that falls within that bracket. For example, if you earn $100,000 and the first $40,000 is taxed at 10%, the next $40,000 at 12%, and the remaining $20,000 at 22%, you’ll pay 10% on the first $40,000, 12% on the next $40,000, and 22% on the final $20,000.

Are there any deductions or credits that can help me lower my tax liability?

Yes, there are many deductions and credits available to individuals and businesses. Some common deductions include mortgage interest, charitable contributions, and state and local taxes. Credits, on the other hand, directly reduce your tax liability. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

The specific deductions and credits you qualify for will depend on your individual circumstances.

How often are tax bracket thresholds adjusted?

Tax bracket thresholds are typically adjusted annually to account for inflation. The adjustments are based on the Consumer Price Index (CPI), which measures the average change in prices paid by urban consumers for a basket of consumer goods and services.